The leading on-chain analysis company, the cryptocurrency on-chain platform CryptoQuant, has issued a warning to investors who expect the Bitcoin (BTC) price to continue to exceed $94,000 recently. The company warns that the peak of Bitcoin's price in this cycle may be near.

Their analysis highlights key indicators that BTC's upward momentum may potentially be exhausted. This raises the question of whether these signals are truly a cause for concern, or if the rally still has room to continue.

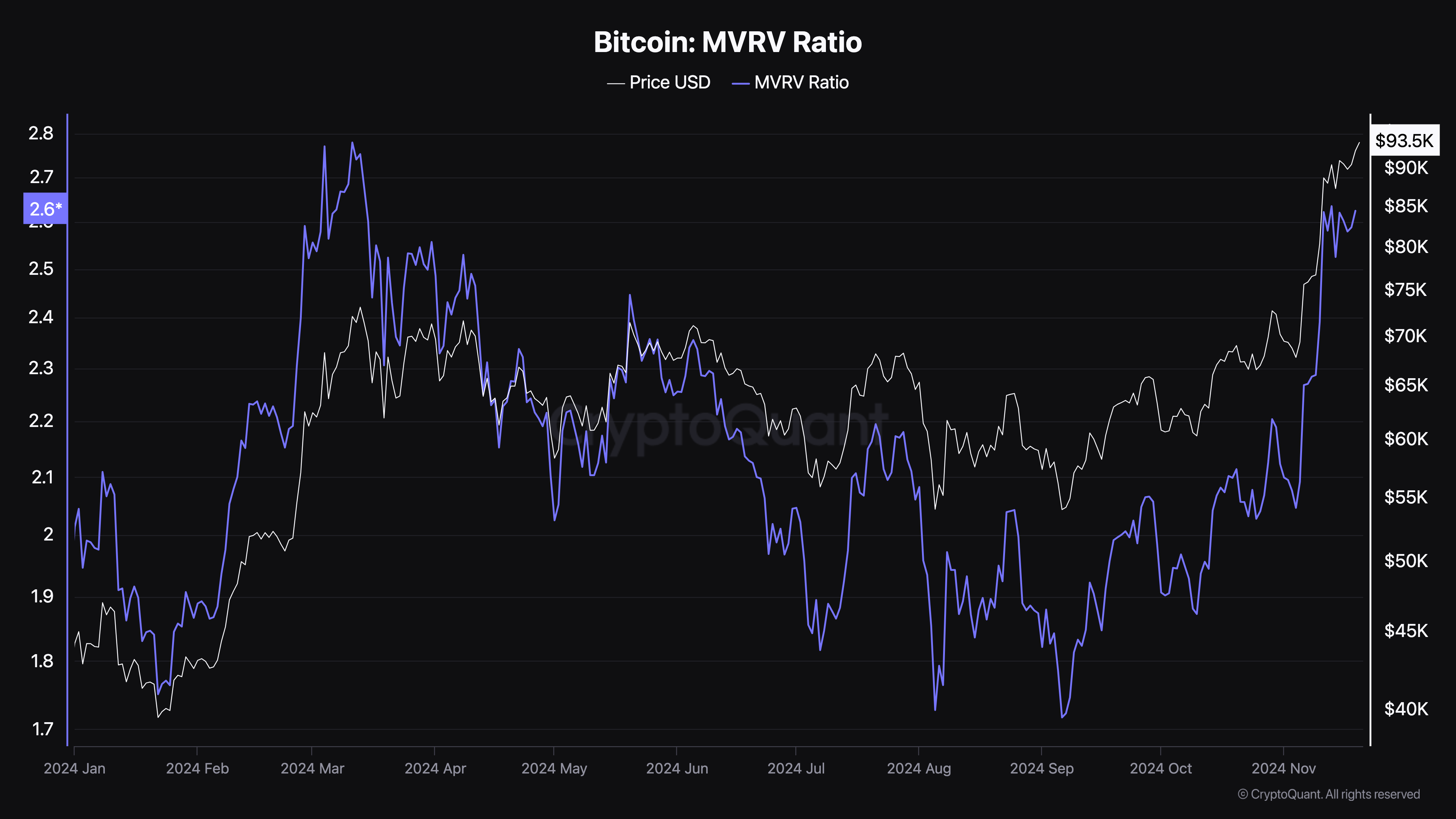

Bitcoin MVRV Soon to Enter Danger Zone

One of the indicators that the cryptocurrency on-chain platform CryptoQuant says could suggest Bitcoin's price has reached a peak is the Market Value to Realized Value (MVRV) ratio. The MVRV ratio serves as a key metric to measure whether Bitcoin's price is overvalued or undervalued.

Historically, values exceeding 3.7 indicate a price peak and overvaluation. Conversely, values falling below 1 indicate a price bottom and undervaluation. At the time of reporting, Bitcoin's MVRV ratio is 2.62.

This suggests that Bitcoin's price is no longer undervalued. While it has not yet reached the overvaluation stage, if it continues to increase, it could send BTC to that peak.

Additionally, the on-chain data provider emphasized that the Crypto Fear and Greed Index has entered the "Extreme Greed" stage. This is a strong indicator that the Bitcoin price peak may be approaching.

This observation aligns with BeInCrypto's recent analysis and the statement made by CryptoQuant CEO Ki Young Ju, who recently predicted that the market may be exhibiting potential risks as it heads towards 2025.

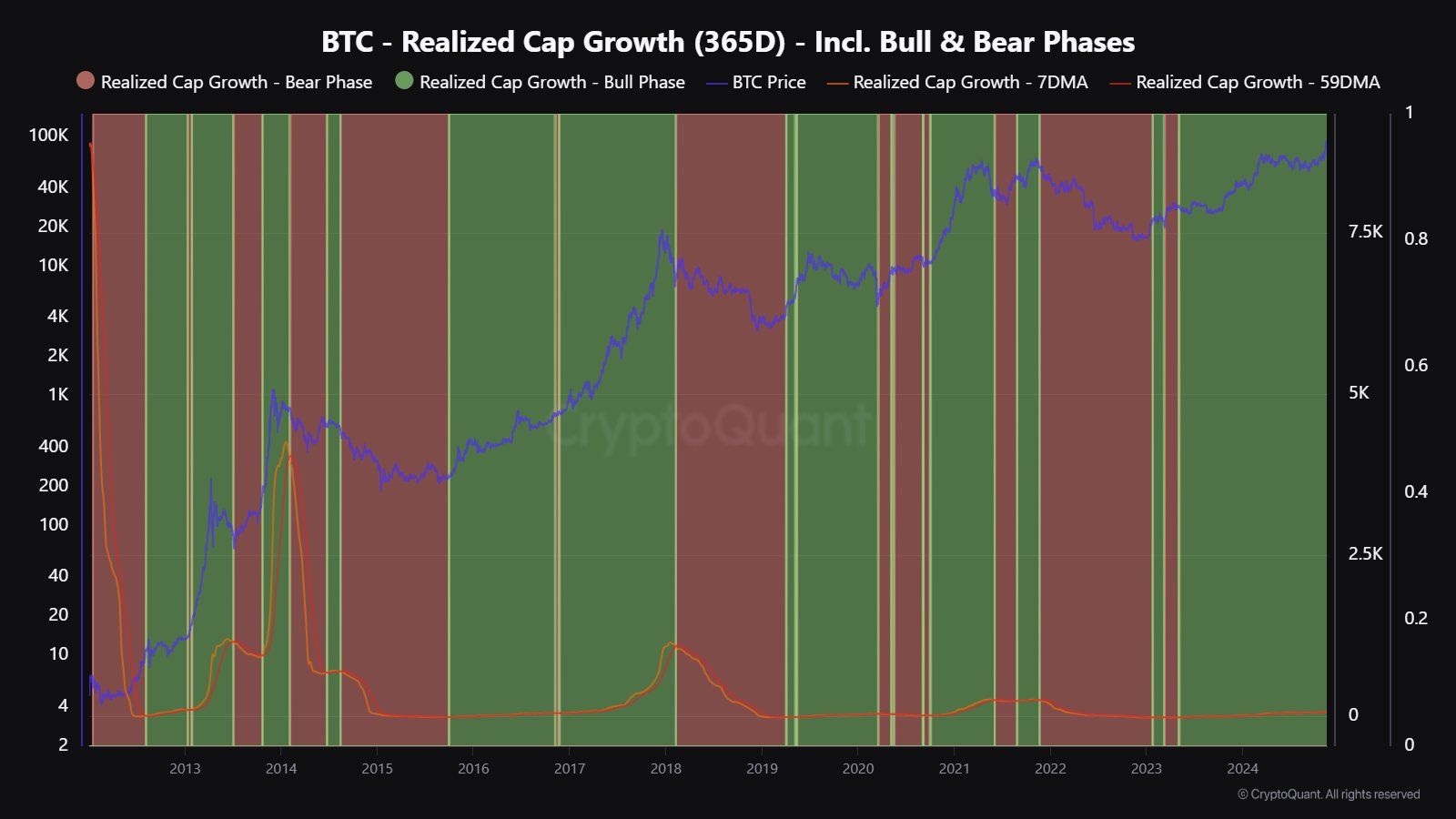

The company also highlighted that Bitcoin currently lacks new capital inflow. The 365-day Realized Cap Growth — a metric used to identify bull and bear market stages — has demonstrated this.

"For the price to maintain its bullish momentum, new money needs to flow into the market. Without sufficient inflow, the price pressure increases," the company stated on X.

As can be seen above, Bitcoin has seen capital inflows recently. However, most of the funds have come from old money, suggesting that retail investors have not yet exerted significant pressure. Meanwhile, the fact that long-term BTC holders are selling could also limit how high the asset can rise to the satisfaction of investors.

BTC Price Forecast:

At the time of reporting, the Bitcoin price is $94,248 and is trading within an ascending channel. The Bull Bear Power (BBP), which measures the strength of buyers and sellers, is also in positive territory.

An increase in BBP indicates that buyers are in control, and the price can rise. Conversely, a reading falling into negative territory suggests that sellers are in control. Therefore, the current reading suggests that the Bitcoin price peak is not here yet.

Therefore, BTC could reach $100,000. However, if the MVRV ratio rises to 3.7 and the cryptocurrency continues to lack new capital inflows, it could correct to $80,795.