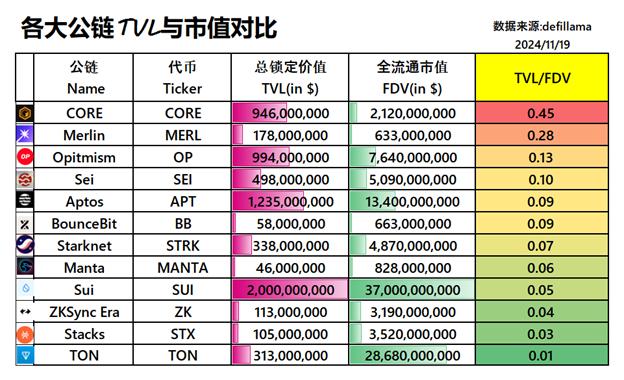

As shown in the figure, from the key indicators of TVL (Total Value Locked), FDV (Full Diluted Valuation), and the TVL/FDV ratio, we can roughly judge the "size of the pie", market expectations, and whether there is "undervalued potential" of these public chains.

In simple terms, TVL represents the amount of money that has come in, FDV is the big pie that the market has drawn for this project, and TVL/FDV is to see whether this pie is real or virtual. Let's break it down one by one.

1. TVL - The higher the locked-in amount, the more "money-attracting" the ecosystem

This is the most intuitive indicator, the more money locked up, the more "livelihood" the ecosystem has.

From the table, Sui has locked in $2 billion, which is indeed a high number, but don't be hasty, let's see the FDV.

Aptos and Optimism have both locked in close to $1 billion, and these two ecosystems seem to be very stable, with active capital.

Although Merlin only has $178 million, it is not at the bottom of the list, and its ability to attract capital is not bad.

2. FDV - Is the BTC big enough?

FDV is the "market value expectation" for the project. If the BTC is drawn too big, but the capital has not caught up, then it is in the "bubble danger zone"; if the BTC is drawn moderately, and the proportion of locked-in capital is high, then it is a "potential stock".

Let's take a look at these projects:

Sui's FDV has directly soared to $37 billion, but the $2 billion TVL cannot support it, this is definitely "drawing the BTC in the sky, the capital is underground". The risk is not small.

TRON's FDV is $2.8 billion, but the TVL is only $300 million, this ratio is ridiculously low, and it also seems to be relying on sentiment and hype to support it.

In contrast, Merlin's FDV is only $633 million, but its TVL is $178 million, indicating that the market's expectation for it is not too outrageous, and there is still a lot of upside potential.

3. TVL/FDV - Is it real strength or a BTC master?

This ratio is to see the proportion of locked-in capital to market value expectation, the higher the more efficient the capital is, and the more solid the development.

Let's take a look:

CORE (0.45): This ratio is directly godly on the list, the money comes in a lot, the BTC is drawn small, and there is basically no bubble. If the inflow of funds continues to grow, the explosive power is obvious.

Merlin (0.28): The second-ranked existence, the proportion of locked-in capital is not bad, the BTC is not drawn too big, steady and steady, quite suitable for ambush.

Optimism (0.13) and Sei (0.10): Moderate, not considered undervalued, but also no particularly surprising, just the "steady" ones among the mainstream public chains.

Sui (0.05) and TRON (0.01): These two directly pull the TVL/FDV to the bottom, the market expectation is the ceiling, but the locked-in capital is poor, it looks more like a bubble, not very suitable for chasing highs.

The higher the TVL/FDV ratio, the smaller the bubble, and the more potential; the lower the ratio, the bigger the bubble, and the more cautious.

Combining the above data:

High potential players: CORE and Merlin, both are real high capital utilization rate, the BTC is not drawn too outrageous, the ecosystem is healthy, especially suitable for medium-term ambush.

Steady and progressive old hands: Optimism and Aptos, the locked-in capital is large enough, although the BTC is drawn a little too big, but the ecosystem is still expanding, definitely the blue-chip stocks.

Bubble suspect players: Sui and TRON, these two are too "poor", relying solely on FDV to draw a big BTC, without more TVL support, the future is likely to be cool or the valuation will shrink.