Table of Contents

ToggleApplication Negotiation Progress

According to information disclosed by FOX Business reporter Eleanor Terrett, the discussions between the U.S. Securities and Exchange Commission (SEC) and the issuers who hope to launch a Solana spot ETF are making positive progress.

Eleanor Terrett tweeted that according to informed sources, the SEC is currently reviewing the S-1 filing documents submitted by multiple institutions, and the exchange representatives on behalf of the issuers may submit the 19b-4 application in the next few days.

Cboe Resubmits 19b-4 Application

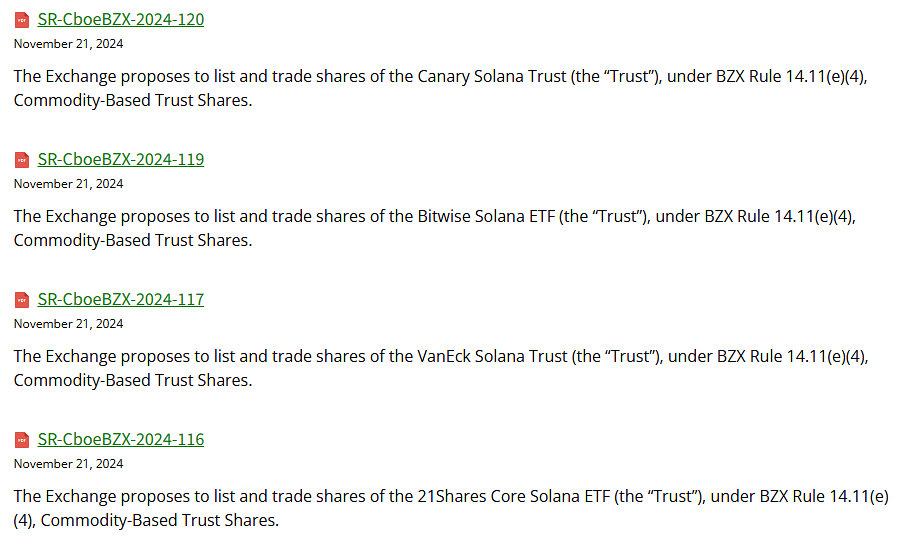

Shortly after Eleanor Terrett's tweet, the Chicago Board Options Exchange (Cboe) resubmitted the 19b-4 application for the Solana ETF to the SEC on behalf of the issuers, with the aim of requesting the SEC to allow the listing of the Solana spot ETF on its platform. According to the document shared by Bloomberg senior ETF analyst James Seyffart, these issuers include VanEck, 21Shares, Canary Capital, and Bitwise.

According to the SEC's process, after submitting the 19b-4 application, the SEC must make a final decision to approve or reject the product within 240 days of receiving the document. James Seyffart estimates that if the SEC accepts these applications, the final approval deadline will be in early August 2025.

According to a previous report by Zombit, the U.S. Securities and Exchange Commission (SEC) had previously rejected two 19b-4 application documents for Solana spot ETFs (submitted by 21Shares and VanEck respectively) submitted by Cboe BZX. The resubmission of the application may indicate that the issuers and Cboe have higher confidence in potential approval than before.