Source: BitpushNews

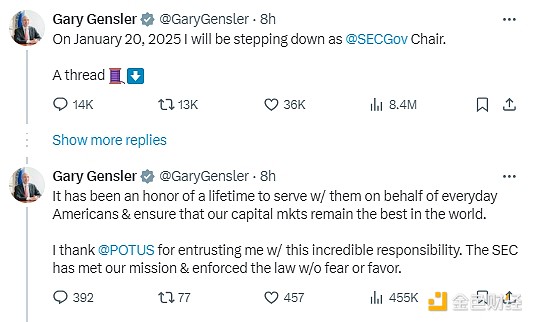

The crypto industry is overjoyed, the time for SEC Chairman Gary Gensler to "step down" has been set - January 20, 2025, the same day as the inauguration of former President Trump.

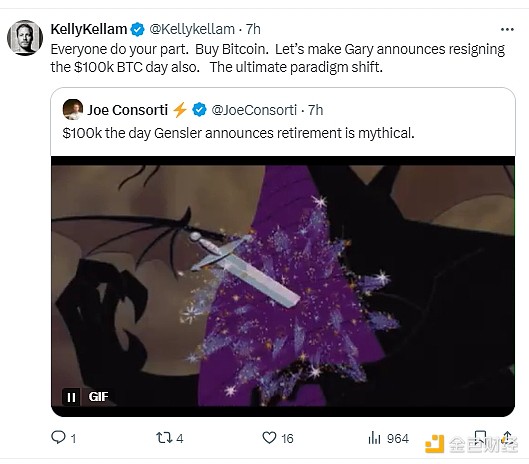

Gensler not only will resign from his leadership position, but will also no longer serve as a commissioner. After this news was released, BTC surged to $99,014.21 in the short term on the same day, and the $100,000 mark seems imminent.

In his statement, Gensler thanked President Joe Biden and his colleagues, saying the SEC is "a remarkable institution...it has been the honor of my life to serve and represent the interests of the American people in ensuring our capital markets remain the best in the world."

Shortly after the news of Gensler's departure broke, Ian Katz, managing director of Capital Alpha Partners, commented that the "crypto industry has gotten its wish, and the next SEC chairman will be more crypto-friendly than Gensler."

From Blockchain Professor to Crypto Villain

Gary Gensler, a graduate of the Wharton School of the University of Pennsylvania, has a strong academic background in the blockchain field.

Prior to joining the SEC, he was a professor at the MIT Sloan School of Management and has publicly expressed interest in blockchain technology on multiple occasions.

During his time as a professor at MIT, Gensler taught a course on "Blockchain and Money" exploring the potential applications of blockchain in the financial sector.

In 2018, he assigned his students the task of reading the Bitcoin whitepaper in his MIT classroom.

MIT has made Gensler's course available as an open course, which can be viewed for free on YouTube (https://www.youtube.com/watch?v=EH6vE97qIP4).

However, after taking office as the Chairman of the U.S. Securities and Exchange Commission (SEC) on April 17, 2021, he has become the "main villain" of the crypto industry.

So where does the industry's "hatred" of Gensler come from?

Gensler has repeatedly emphasized that many cryptocurrency projects are suspected of violating securities laws.

After the FTX collapse in 2022, Gensler led a crackdown across the entire industry, suing companies like Binance, Binance.US, Coinbase, Kraken, and Shapeshift, accusing these exchanges of being unregistered securities brokers and clearing agencies.

In 2023, the SEC's regulatory pressure on the crypto industry reached an unprecedented level. Data shows that the agency initiated 46 enforcement actions over the year, a 53% increase year-over-year. The total fines amounted to $2.89 billion, with $281 million in settlements reached that year.

According to the Blockchain Association, which represents nearly 100 industry participants including Grayscale and Paradigm, Gensler has initiated over 100 lawsuits against the digital asset industry during his tenure at the SEC. The association's members have spent approximately $429 million on litigation-related expenses.

This tough stance has made Gensler's relationship with the cryptocurrency community increasingly tense. Many industry insiders believe the SEC's regulations are too strict, and its regulatory framework is not suitable for the emerging cryptocurrency industry.

However, Gensler has also done some good things for crypto. In January this year, the SEC approved a Bitcoin spot price-tracking exchange-traded fund (ETF), and later approved an Ethereum ETF, allowing investors to more easily purchase cryptocurrencies without taking on risk, opening a window for widespread crypto adoption.

From Gensler's perspective, he is not completely rejecting cryptocurrencies, but rather hopes to bring traditional finance into the space through compliance. After the ETF approvals, Wall Street financial giants have flocked to the crypto market, with Goldman Sachs, BlackRock, and Franklin Templeton all entering the crypto market to grab a share, further accelerating the integration of crypto into the mainstream financial system.

In an interview, Gensler stated that crypto could be beneficial for economic development, but the prerequisite is that they must have robust regulation, using the example that the automotive industry only became popular after the introduction of traffic lights and speed limits.

Trump's Victory, Gensler's Successor Undecided

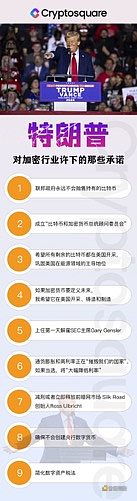

Trump, who once called Bitcoin a "scam", has now fully embraced cryptocurrencies in this election, promising to turn the US into the "global crypto capital" and launching a family crypto business, while also vowing to fire Gensler on his first day in office.

Gensler has chosen to resign voluntarily, and Trump has not yet nominated a successor. Potential candidates include former SEC member and current private practice lawyer Teresa Goody Guillén, Robinhood's Chief Legal Officer Dan Gallagher, former Acting Comptroller of the Currency Brian Brooks (who briefly managed Binance.US), and former SEC Commissioner/Token Alliance Co-Chair Paul Atkins.

The new SEC chairman may continue some of Gensler's regulatory policies, but may also introduce a new regulatory framework.

In Gensler's absence, the Commission will be composed of two members from each party, and major policy changes or enforcement decisions may take longer to implement before the Republicans gain a majority on the Commission.

SEC's major decisions (dismissals, settlements, and enforcement actions) are not solely at the discretion of the Chairman. For example, decisions involving litigation require the approval of a majority of the Commissioners, and the reversal of existing cases requires a Commission vote, which the Republicans will not have a majority in the short term.

According to Tom Krysa, a former SEC enforcement attorney and current partner at Foley & Lardner, at the federal appeals court level, the withdrawal of cases is overseen by the agency's general counsel. While this office may seek delays under the close watch of the Chairman's office, a full withdrawal of the appeal requires the approval of a majority of the Commissioners.

Krysa believes that if Trump nominates Mark Uyeda as the acting SEC Chairman, the political landscape of the Commission will shift, but there will not be an immediate "180-degree turnaround". Even as the terms of the Democratic Commissioners are about to expire, they will still have the ability to influence the policy direction in the short term.

As for the SEC's handling of pending cases, this area is likely to see more rapid changes. The new Chairman can influence the trajectory of these cases by adjusting the agency's enforcement strategy.

Trump has promised to appoint an SEC Chairman who supports the crypto industry, and how the new administration will handle the agency's various pending lawsuits against crypto companies/projects remains to be seen.

But one thing is certain, the industry is eagerly awaiting the arrival of $100,000 BTC.