The price of XRP has experienced a strong rally, rising 51.33% in the last 7 days and 109.09% last month. This strong momentum has driven XRP upwards, with key indicators such as the EMA lines supporting the uptrend.

However, the declining RSI and negative signals from the CMF suggest caution is warranted. Whether XRP continues to rise or undergoes a sharp correction depends on how the market reacts to these changes.

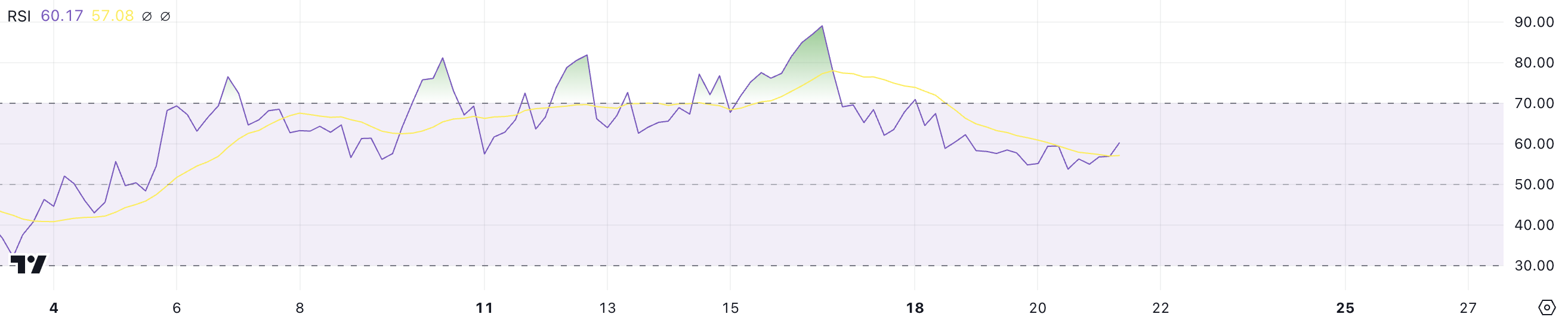

XRP RSI Drops Below Overbought Territory

XRP's RSI reached nearly 90 on November 16th before dropping to 60, maintaining above 70 from November 15th to November 17th.

This decline indicates that XRP has moved out of the overbought zone, with the previous strong buying pressure driving the price higher. The pullback suggests the market is calming down and traders may be taking profits after the strong rally.

The RSI measures the speed and magnitude of price changes, with readings above 70 indicating overbought conditions and below 30 indicating oversold conditions. At 60, XRP's RSI still reflects positive momentum, but shows a more balanced psychology compared to the previous sharp rise.

The uptrend remains intact, but the lower RSI suggests the pace of gains may slow, and the market may be entering a corrective phase as it stabilizes. If buying pressure returns, XRP's price can continue its upward trajectory, but if the RSI declines further, the upward momentum may weaken.

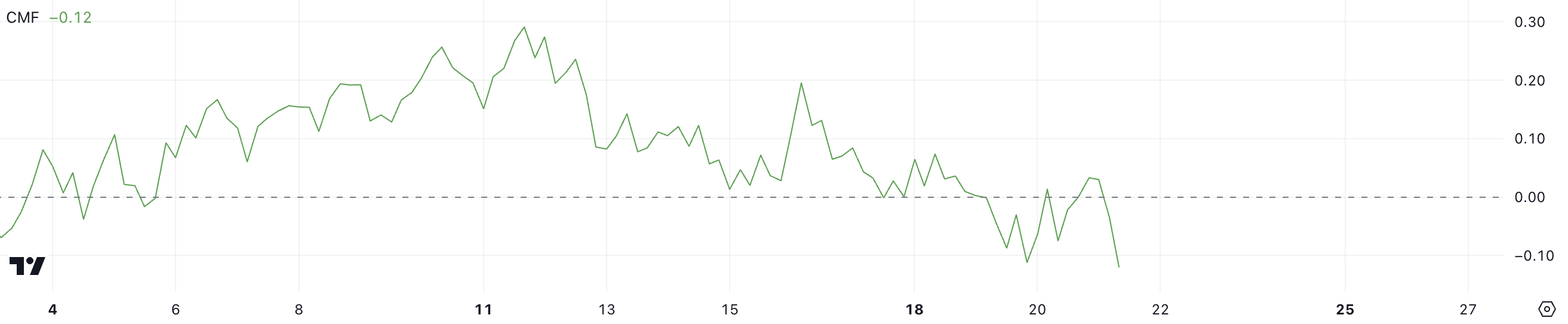

Ripple CMF Turns Negative After 14 Days of Positive Readings

XRP's Chaikin Money Flow (CMF) is currently at -0.12, having been in positive territory from November 5th to November 19th, the lowest level since October 31st. This transition into negative territory reflects capital outflows and increased selling pressure on the asset.

The shift from positive CMF values earlier this month suggests the upward momentum is weakening as more market participants reduce their exposure to Ripple.

The CMF measures the flow of capital into or out of an asset, with positive values indicating capital inflows (uptrend) and negative values indicating capital outflows (downtrend).

XRP's CMF at -0.12 suggests bearish sentiment is starting to emerge, and this could put pressure on the price despite the recent gains. If the CMF remains negative or declines further, it may indicate sustained selling pressure and challenge Ripple's ability to sustain its upward momentum.

Ripple Price Forecast: Upward Momentum Slowing... Market Sentiment is Key

XRP's EMA lines currently show the short-term line above the long-term line, with the price trading above both, indicating an uptrend.

However, the narrowing gap between the price and some of the lines suggests a potential slowdown in the upward momentum. This could signal that the uptrend is weakening, and XRP's price may become more vulnerable to changes in market sentiment.

If a bearish trend emerges, in line with the weakening RSI and negative CMF signals, Ripple's price could face significant pressure and potentially decline to the $0.49 support level, representing a substantial 56% correction.

Conversely, if the uptrend regains strength, XRP could test the $1.27 level and potentially break above $1.30, which would be the highest price since May 2021.