BTC continued to surge this (23rd) morning, reaching a high of $99,588, although selling pressure later emerged, causing it to retreat to around $98,500 level. Overall, the market's expectation for BTC to break through the $100,000 mark remains very strong.

As the second-largest cryptocurrency, ETH also finally awakened from its slumber on the previous (21st) day, jumping sharply from around $3,100 to a high of $3,426, but as of the time of writing, it has retreated to $3,337, up 0.63% in the past 24 hours.

Investors continue to watch whether ETH, after a long period of dormancy, is about to enter a new upward cycle. The following summarizes the views of recent analysts and the movements of whales.

Analyst: ETH has formed strong support at $3,000

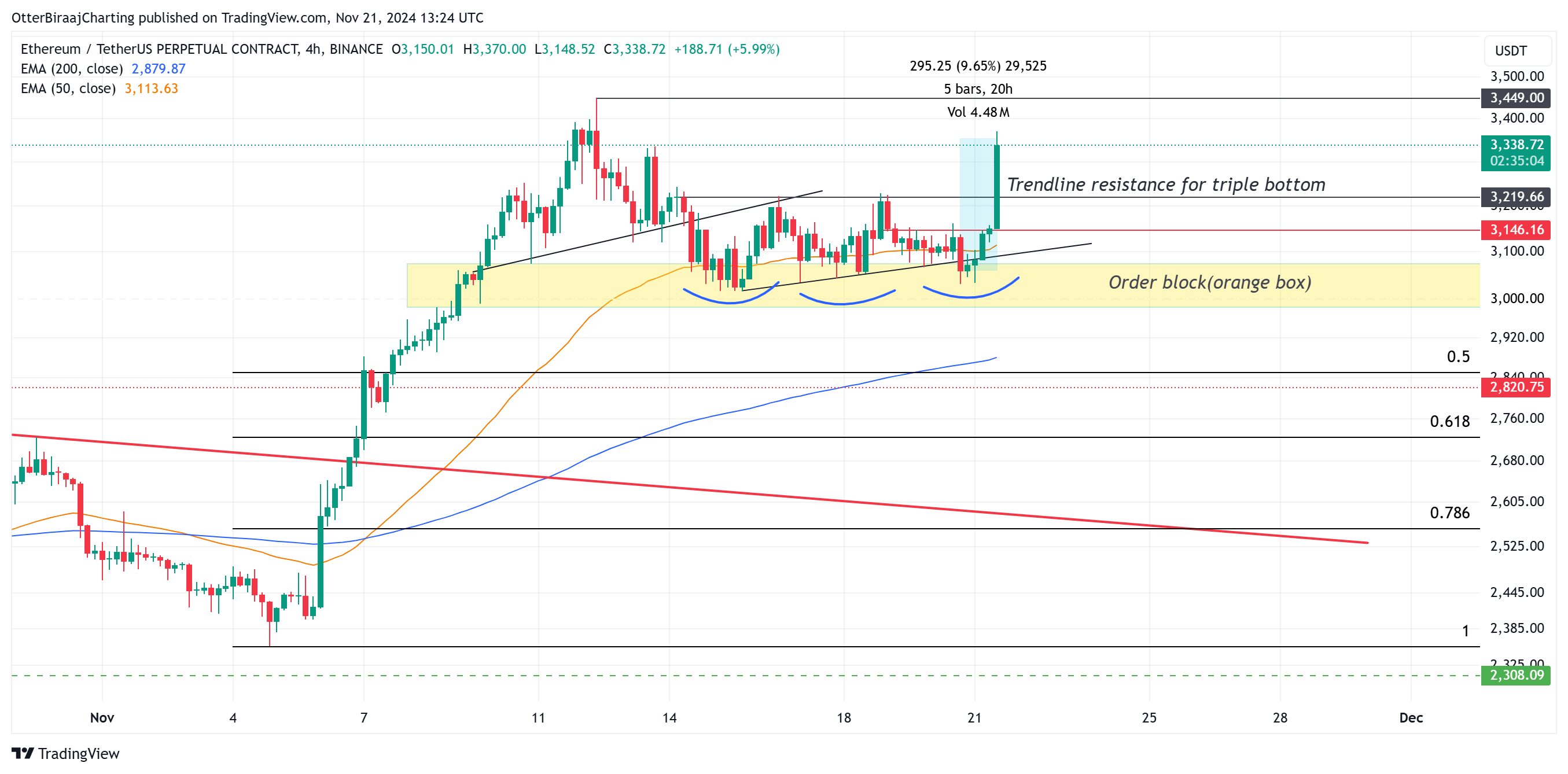

Regarding this rally, crypto analyst Biraajmaan Tamuly commented that ETH has regained its 50-day moving average on the 4-hour chart, indicating that the market has regained its bullish sentiment towards ETH.

In addition to the bullish breakout in technical analysis, ETH's price movement is also accompanied by a confirmed triple bottom pattern, which coincides with the daily order block, further strengthening the bullish trend of ETH.

Currently, after breaking through the resistance, ETH's 50-day moving average is crossing above the 200-day moving average, forming a golden cross, which usually represents a long-term bullish signal. Analyst Rekt Capital also stated:

If the breakout is confirmed, ETH will retest the $3,700 resistance level.

IntoTheBlock: If BTC consolidates at current highs, ETH will rally

Meanwhile, IntoTheBlock recently tweeted that typically, after BTC experiences a significant rally, ETH is often one of the first cryptocurrencies to benefit from the profit rotation in the bull market sector. Therefore, if BTC consolidates at the current highs, ETH is likely to see a strong rally.

Bitcoin has been the star of this rally, but what about Ethereum?

Historically, Ethereum has been one of the first assets to benefit from profit rotations after Bitcoin's move.

Currently, Ethereum's on-chain activity shows evenly spaced potential resistance levels, but in… pic.twitter.com/amkbZmtEyo

— IntoTheBlock (@intotheblock) November 21, 2024

Additionally, IntoTheBlock reminded investors to monitor five data points to track potential changes in ETH:

- Total on-chain transactions: If the transaction volume increases, it may indicate a change in market demand for ETH;

- Whale holdings: When whales buy and hold, it may suggest that ETH is about to rise;

- Number of short-term holder addresses: An increase in short-term holders may indicate rising speculative sentiment;

- Investors' holding time before trading ETH: Testing whether long-term holders will exert selling pressure;

- ETH exchange reserves: If a large amount of ETH flows into exchanges, it may indicate selling pressure in the market.

Whale transfers 6,404 ETH to Binance

However, according to on-chain data analyst Yuyin, an ETH staking whale withdrew 6,404 ETH from staking and transferred them to Binance yesterday, with a total value of $21 million.

This week, the whale has already transferred 14,268 ETH to Binance. However, the whale's average purchase price of ETH was $3,245, so if they sold these ETH before this rally, they would face losses. (But some netizens have commented that these whales need to take profits for ETH to have a healthy rally.)

This staking whale just redeemed 6,404 ETH ($21.01M) from staking and transferred them to Binance 50 minutes ago.

He has transferred 14,268 ETH ($45.39M) to Binance in the past 2 days, with an average transfer price of $3,181, which is lower than the price he withdrew from Binance 9 months ago (implying a loss).https://t.co/LrJqv8lnjy

This article is sponsored by #Bitget|@Bitget_zh https://t.co/wvXtGkvg2l pic.twitter.com/PyWDUJccPk

— Ember (@EmberCN) November 22, 2024

According to the Whale Alert alert this morning, 143,012 ETH (473,934,082 USD) were transferred from an unknown wallet to Coinbase, suggesting that whales may still not have shifted from a selling state to re-accumulating?

143,012 #ETH (473,934,082 USD) transferred from unknown wallet to #Coinbasehttps://t.co/E8inb5XDZp

— Whale Alert (@whale_alert) November 22, 2024

Ethereum's Total Open Interest Reaches $20 Billion

Additionally, it is worth noting that according to Coinglass data, Ethereum's total open interest on the network has reached $20 billion, a new all-time high. This also means that Ethereum may experience greater volatility in the near future.