Currently, BTC is trading in a narrow range between $97,000 and $99,000, as if it is gathering strength, while the Altcoin market shows no signs of waiting and has quickly taken the spotlight.

vx:TTZS6308

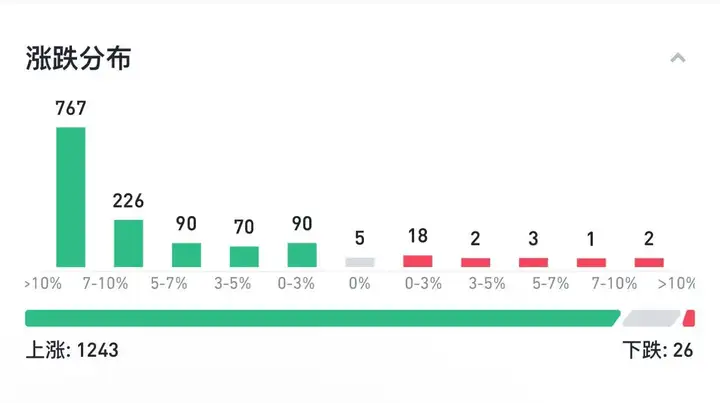

More than 1,240 tokens have seen their prices surge, with 758 of them gaining over 10%, showcasing a rare bullish frenzy in the Altcoin market. The epicenter of this rally is undoubtedly Ethereum (ETH), Dogecoin (DOGE), and XRP. Not only have they displayed strong price performance, but they have also become the benchmarks for the entire Altcoin market, delivering substantial returns to investors.

At the same time, the market has also welcomed more "pleasant surprises." The announcement of the SEC chairman's upcoming resignation has further boosted market confidence with the expectation of policy relaxation. Under this positive backdrop, the Altcoin market seems to be laying the groundwork for an even larger-scale prosperity.

However, does this mean that the "Altcoin season" is officially underway? Reviewing past bull market cycles, when Bitcoin's market dominance reaches a high point and gradually declines, Altcoins often take over and dominate the market. Currently, Bitcoin's market dominance is at a relatively high level, and some funds have flowed into star assets like ETH and DOGE, suggesting that the Altcoin market may have quietly opened its curtain.

Bitcoin's market dominance peaks, the Altcoin season has begun

Bitcoin's market dominance may have reached a peak at 62%, and the Altcoin season is about to begin. The recent market performance seems to confirm this view. After reaching a high of 62%, Bitcoin's market dominance has quickly declined, and as of the time of writing, it has dropped to 58.5%.

The current market trend indicates that Bitcoin's dominance may have reached its peak, and the Altcoin era is quietly arriving. As the "leader" of Altcoins, Ethereum not only exhibits a strong medium-to-long-term uptrend driven by both technical upgrades and market sentiment, but it is also seen as the key force that will lead the full-blown Altcoin season. As funds gradually flow from Bitcoin to more innovative projects and investors' attention to technology-based assets intensifies, Ethereum is at the forefront of the new market prosperity and is likely to become the core engine driving the Altcoin market into a comprehensive boom cycle.

Ethereum (ETH)

As of the time of writing, the price of Ethereum (ETH) is $3,400, having risen more than 46% in the past month, with an outstanding performance. The market generally believes that Ethereum will see a more sustained uptrend by 2025, becoming an undeniable force in the bull market.

The technical chart shows that Ethereum is forming a three-year ascending triangle pattern, a typical bullish signal that suggests a potential target price of $16,000. The optimistic technical analysis expectations are supported by the fundamental market conditions.

Ethereum is still the most widely used smart contract platform in terms of transaction volume, and the continuous improvement of its functionality and efficiency, as well as the upcoming Ethereum upgrades, will lay the foundation for its price to break through the historical high.

ETH/BTC Quarterly Returns

The flow of market funds has also created a favorable environment for Ethereum. After Bitcoin entered a high-level consolidation phase, a large amount of capital has gradually rotated from Bitcoin to Ethereum. This trend has led analysts to generally expect that ETH may return to its historical high before the end of the year.

Based on historical data, during the early stages after a Bitcoin halving, Ethereum typically exhibits a positive quarterly return relative to Bitcoin. This pattern may provide further bullish signals for Ethereum's price in early 2025.

Dogecoin (DOGE)

As of the time of writing, Dogecoin (DOGE) is priced at $0.43, with a gain of over 16% in the past 24 hours. Binance data shows that DOGE's spot trading volume reached $3.5 billion, surpassing Bitcoin's $3.3 billion and Ethereum's $1.95 billion, indicating its high popularity in the market.

This rally may be driven by news related to Musk. According to DogeDesigner, a Dogecoin UI designer who frequently interacts with Musk, "Musk's Boring Company has started accepting Dogecoin payments, and users can use DOGE tokens to book ride services." Stimulated by this news, DOGE quickly surged 7.6% within an hour, stabilizing around $0.46. CNN also reported that the Boring Company has launched a service supporting DOGE payments, allowing customers to use Dogecoin to pay for rides on the Las Vegas transportation system Loop, further strengthening DOGE's practical application as a payment tool.

From a technical perspective, Dogecoin has recently broken through the key resistance level of $0.43, and the target price range may expand to $0.65 to $1. Analysts believe that if DOGE price breaks through $0.73, it may challenge higher targets in the first quarter of 2025.

On the monthly chart, DOGE's trend follows a repeatable target trend based on Fibonacci lines. According to historical data, DOGE's gain in 2021 exceeded 732% compared to 2018. Based on the Fibonacci expansion model, the expected target range for 2025-2028 is $2.90 to $3.60.

This strong upward expectation is highly consistent with DOGE's performance in previous bull markets. As a representative asset of the MEME culture, Dogecoin, with its high popularity and the continued expansion of its practical applications, remains one of the most attractive investment targets in the current market.

XRP: The Full-Fledged Revival of an Old Coin

Over the past month, XRP has performed remarkably, becoming the best-performing asset among the top 10 cryptocurrencies by market capitalization, with a cumulative gain of over 210%.

This strong performance is closely related to important developments in the regulatory field. On Thursday, SEC Chairman Gary Gensler announced that he will step down on January 20, 2025, which is the date of Trump's inauguration. This news was seen by the market as a signal that Ripple's four-year legal battle with the SEC is nearing its end. Although the two parties seemed to be close to a settlement in the summer of 2024, the SEC's appeal of the 2023 ruling has further prolonged the litigation. The market generally speculates that the long-standing controversy can only be truly resolved after Gensler and the current SEC leadership leave office.

Gensler's resignation announcement quickly triggered a significant rebound in the XRP price. On Thursday evening, XRP was still hovering below $1.2, but after the news was released, it quickly surged, breaking through $1.4 on Friday and exceeding $1.6 earlier today, a gain of 35% in just a few days.

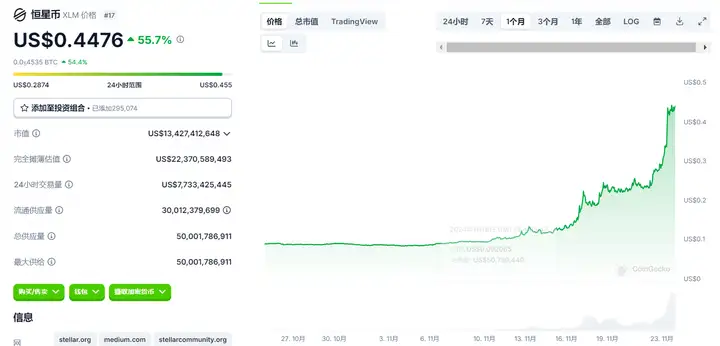

The strong performance of XRP has also driven a comprehensive revival of other old-school coins. Stellar (XLM) has gained nearly 400% in the past two weeks, while assets like Litecoin (LTC) have also seen significant increases. The collective rebound of these old-school coins not only reflects the high market sentiment but also highlights investors' re-evaluation of the value of technically sound assets in the bull market.

As the Ripple-SEC dispute nears its conclusion, XRP has not only consolidated its market position as a veteran cryptocurrency, but has also become a representative asset for the restoration of confidence in the crypto market. Accompanied by the recovery of other veteran cryptocurrencies, the strong performance of XRP may indicate that more crypto assets will usher in a new round of glory in the upcoming bull market.

The curtain of the bull market is about to rise, and a new era is about to begin

Bitcoin is steadily advancing towards the $100,000 mark, the Altcoin market is experiencing a comprehensive recovery, and the favorable policies and influx of institutional capital are injecting sustained momentum into this market frenzy. From the technological wave led by Ethereum, to the payment revolution sparked by Dogecoin, and the regulatory breakthrough of Ripple, each positive development is paving new tracks for the future of the entire crypto market.

More excitingly, the shift in the US regulatory environment has released greater room for imagination in the market. The inflow of funds into the spot Bitcoin ETF has hit a new high, with an asset management scale exceeding $100 billion, which attests to the recognition of institutional investors towards the prospects of the crypto market. The open exchange strategy has also opened the door for more quality projects to enter the mainstream market.

The resonance of policy relaxation, technological breakthroughs, and capital inflows, as all the positive factors gradually converge, the curtain of the bull market is about to rise, and a new era belonging to the crypto market is quietly arriving.