XRP of Ripple reached an annual high of $1.63 on November 23. However, as the upward momentum weakens, future traders are questioning the sustainability of the rally. More and more people are opening Short positions, expecting a short-term price correction.

XRP, currently trading at $1.44, has declined by 6% in the last 24 hours. This analysis explores the recent activity in the token's futures market and assesses the likelihood of continued XRP price decline.

XRP Traders Bet on Price Decline

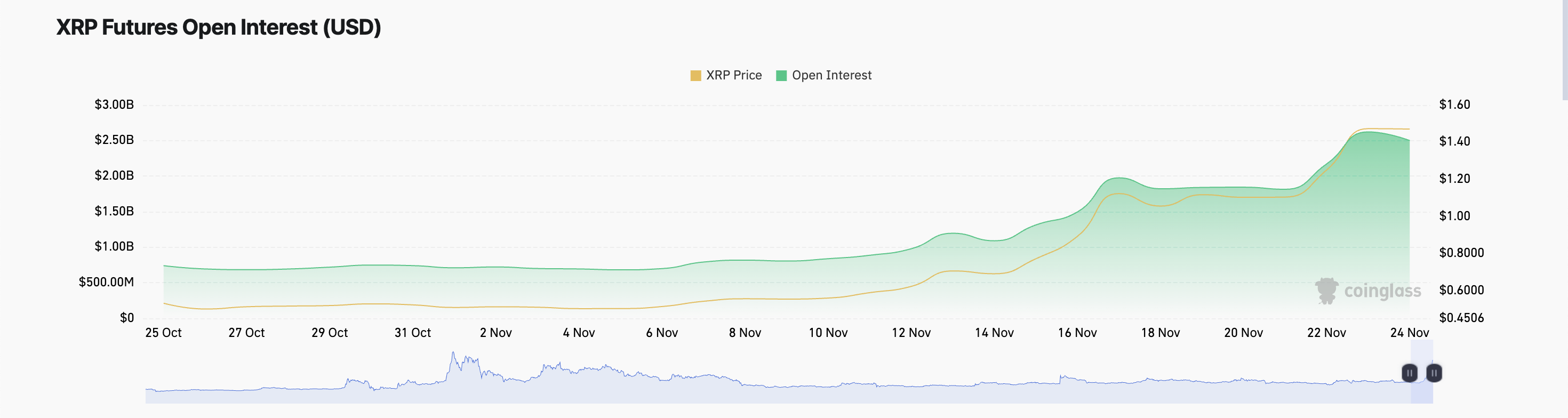

The decrease in open interest has accompanied the price decline of XRP over the last 24 hours. According to Coinglass data, it has decreased by 9% to $2.52 billion during that period.

Open interest refers to the total number of outstanding contracts in the derivatives market, such as futures or options. When the price of an asset declines, a decrease in open interest indicates that traders are closing their positions to lock in profits or minimize losses, suggesting a reduction in market participation.

In the case of XRP, this suggests a weakening of confidence in the continuation of the uptrend and implies a persistent reversal of the asset's price movement.

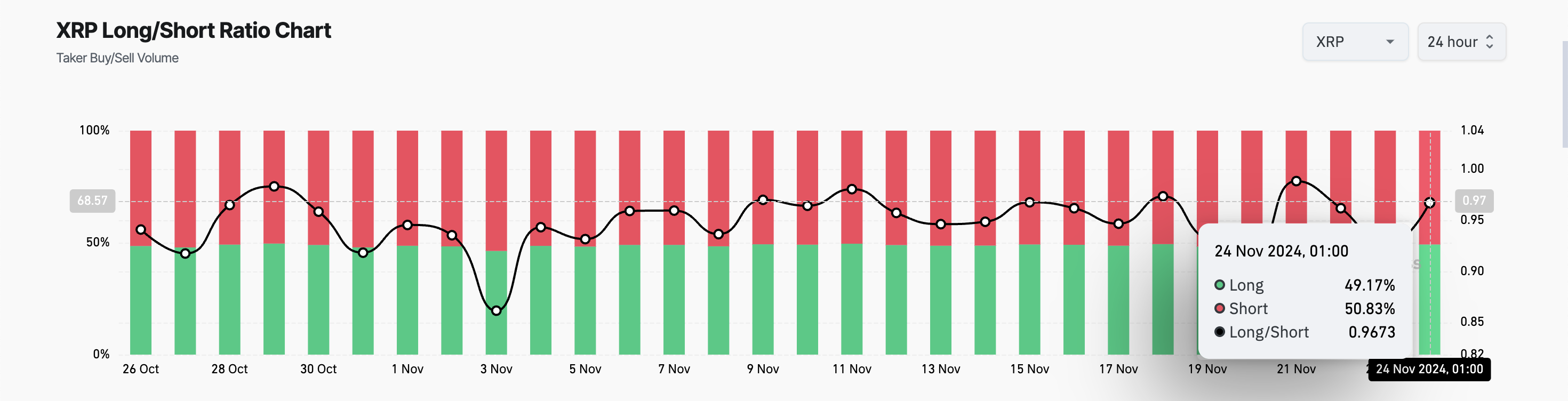

Furthermore, the Long/Short ratio of XRP confirms this bearish outlook. At the time of writing, it stands at 0.96%, indicating that 51% of all positions are Short on the altcoin.

The Long/Short ratio measures the ratio of Long positions (bets on price increase) to Short positions (bets on price decrease) in the market. A ratio below 1 suggests that Short positions outweigh Long positions, implying a bearish sentiment among traders.

This imbalance in the XRP market reflects a growing pessimism about the short-term outlook for the asset and can contribute to continued downward pressure on the price.

XRP Price Forecast: Further Decline Imminent

XRP is currently trading at $1.34, which is an important support level. If the bearish sentiment strengthens, the price could fall below this level. XRP could potentially decline to as low as $1.15.

However, if the market sentiment shifts from negative to positive, this bearish outlook would be invalidated. In such a case, the altcoin would recover and attempt to surpass its annual high of $1.63.