BTC has experienced the largest "small correction" in the past half month. BTC fell to $92,601.6 this morning, and is currently reported at $93,000, a 24-hour decline of 2.91%.

VX: TTZS6308

The reason why it is emphasized as a "small correction" is that although BTC has fallen by more than $6,000 from yesterday's high (98,876), the maximum decline is less than 5% based on the current $90,000 price benchmark, which is somewhat different from our previous cognitive inertia.

The most intuitive difference in this correction is that altcoins have not "immediately collapsed" as they usually do when BTC retreats, and the sustained bullish trend of most Alt-coins has been slowed down, but the overall decline is not obvious, and some even maintain a small increase.

ETH, which is in a state of catch-up, has "become tough" for once, and although there is a correction, it is not much, currently at $3,340, along with projects such as LDO, ENS, and EIGEN in the ecosystem, maintaining a strong performance for the time being.

In addition, affected by the DEXX hacker starting to sell, the meme sector of the Solana ecosystem has encountered a general decline, with MOODENG, SLERF, and BONK all falling by more than 10%.

On the US stock market, MicroStrategy (MSTR) closed at $403.45, down 4.37%; Coinbase (COIN) closed at $312.22, up 2.49%; and MARA Holdings (MARA) closed at $26.42, up 1.5%.

The total crypto market capitalization has now fallen back to $3.41 trillion, a 2.8% drop in 24 hours. The trading enthusiasm of crypto users has also risen significantly, with the Fear and Greed Index reported at 79 today, although still in the "Extreme Greed" range, it has clearly declined from the average of 90 last week.

Over the past 24 hours, $526 million in positions have been liquidated across the network, with long positions still accounting for the majority, but short positions have also reached $141 million. In terms of currencies, $146 million in BTC and $86.93 million in ETH have been liquidated.

Market Outlook: More Optimistic for ETH?

Relatively speaking, the subsequent trend of ETH, which has begun to enter the catch-up stage, seems more optimistic.

On the one hand, while the BTC spot ETF has begun to turn into a net outflow, ending the net inflow trend that lasted for a week, the ETH spot ETF has continued to see net inflows for two days, also ending the net outflow trend that lasted for a week.

In the previous bull market, the ETH/BTC exchange rate reached its bottom 220 days after the halving, and today is exactly the 220th day after the current halving...

Considering that ETH has recently shown a counter-trend upward trend, a similar script may be played out again.

The key resistance level of $3,600 may determine whether ETH can continue to rise to $4,000. This will be the first time since December 2021. If it reverses, it may lead to a significant adjustment, with strong support at $3,000, and if the downward pressure increases, it may fall to $2,350.

ETH 7D MVRV Shows an Important Threshold

Currently, the 7-day MVRV of Ethereum is 3.8%, indicating a neutral to slightly optimistic short-term profit sentiment. The 7-day MVRV index compares the market value to the actual value of the coins moved in the past 7 days, providing in-depth insights into the recent trader profits.

When the 7-day MVRV is low, it indicates that traders are holding at a loss or minimal profit, reducing the selling pressure, while higher values indicate an increased risk of profit-taking.

Historically, when the 7-day MVRV is around 5-7%, ETH usually struggles to maintain its uptrend and typically triggers an adjustment. The recent decline from 13% to 10% suggests that breaking through this range may drive a sustained uptrend.

If the 7-day MVRV exceeds 7% again, the ETH price may experience a significant rise, potentially exceeding 10%, as optimism increases and traders are less likely to take profits and wait for further upside.

Ethereum Whales Reappear

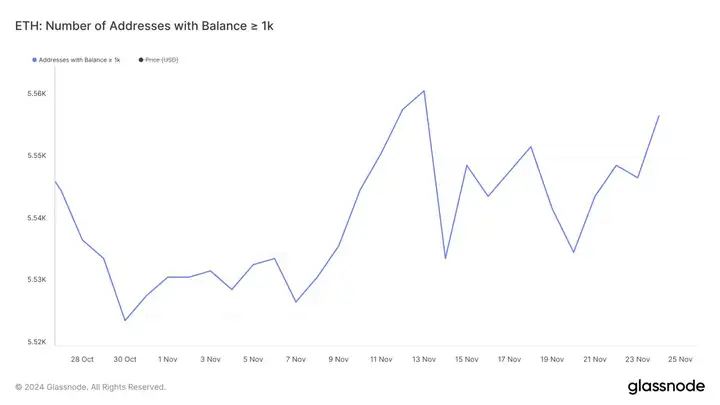

The number of Ethereum whales holding at least 1,000 ETH is approaching the monthly high of 5,561, currently at 5,557. Monitoring the activities of these large holders is crucial, as their buying and selling behavior can have a significant impact on market trends.

An increase in the number of whales usually indicates growing confidence in the asset, supporting price stability or appreciation, while a decrease may indicate reduced interest and potential selling pressure.

After increasing from 5,527 to 5,561 in 6 days, the number of whales decreased to 5,535 on November 20, indicating short-term profit-taking or reduction. The recent rebound to 5,557 reflects the new emerging interest and accumulation of large investors.

This recovery reflects the increasingly optimistic sentiment in the market, which may support the stability of Ethereum prices, and if this trend continues, it may pave the way for further growth.

Can it Return to $4,000?

If Ethereum maintains its current uptrend, it may soon test the key resistance level of $3,600. This is an important level to maintain the uptrend. Breaking through this resistance level would put Ethereum only 11% away, which could further boost optimism, attract buying interest, and consolidate the uptrend.

If the uptrend slows down and reverses, ETH prices will find strong support at $3,000, which is a key level to prevent a significant decline. If this support level is breached, the price may fall to $2,350, indicating a potential 31% adjustment from the current level.