On-chain data shows that the selling pressure on Bitcoin's price mainly comes from long-term holders, not ETF fund flows.

Although there was initially speculation that institutional investors might be the main cause of this price drop, Bitcoin's recent price correction is actually attributed to long-term holders, not institutional investors.

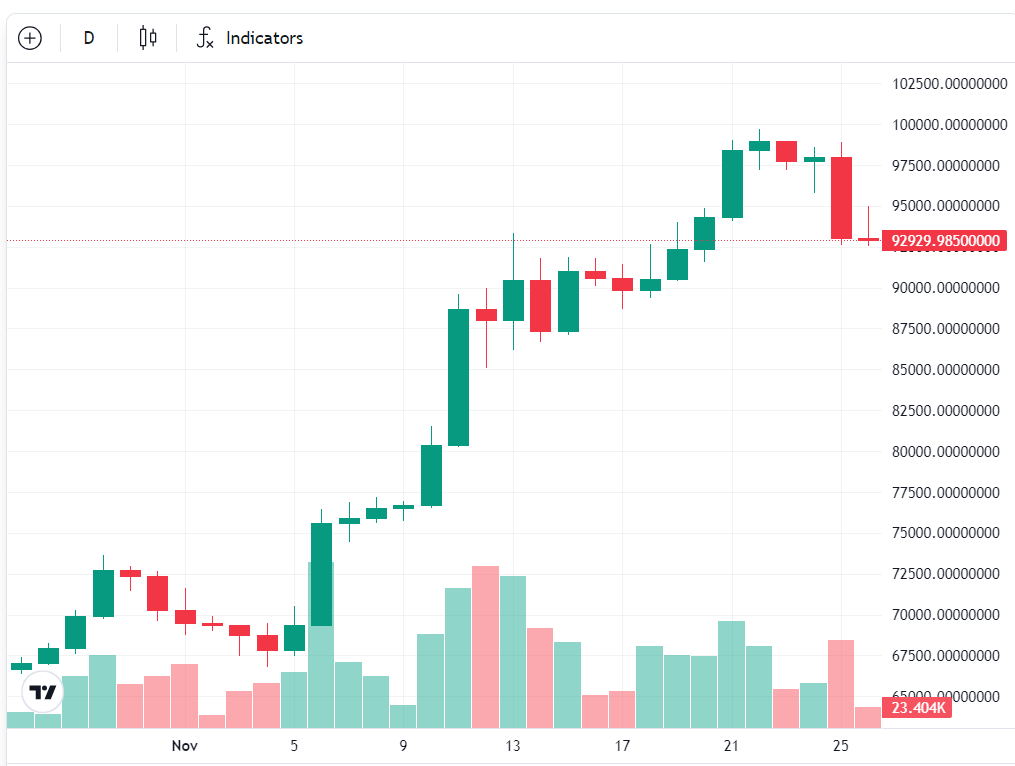

According to Cointelegraph data, as of 8:52 am UTC on November 26, Bitcoin's price has fallen more than 5.6% in the past 24 hours, trading at $92,774.

BTC/USD, 1 month trend chart. Source: Cointelegraph

However, according to Bloomberg senior ETF analyst Eric Balchunas, the decline in Bitcoin's price was not driven by institutional investors or exchange-traded funds (ETFs). In a post on X (formerly Twitter) on November 25, he pointed out that on-chain data shows that the selling pressure mainly comes from long-term holders, also known as "hodlers".

The analyst wrote, "I see a lot of crypto community members confused and frustrated that Saylor (Michael Saylor) bought $5 billion worth of Bitcoin but the price didn't go up - this is the same question I sometimes hear about ETF massive inflows. The data shows the 'call is coming from inside the house', it's the behavior of long-term holders."

This correction occurred shortly after Bitcoin created its largest monthly candle in history, with the price first breaking above $99,000 on November 22. Some analysts still expect Bitcoin to break its all-time high of $100,000 by the end of this month.

Data shows: Long-term holders drive Bitcoin's correction to $92,000

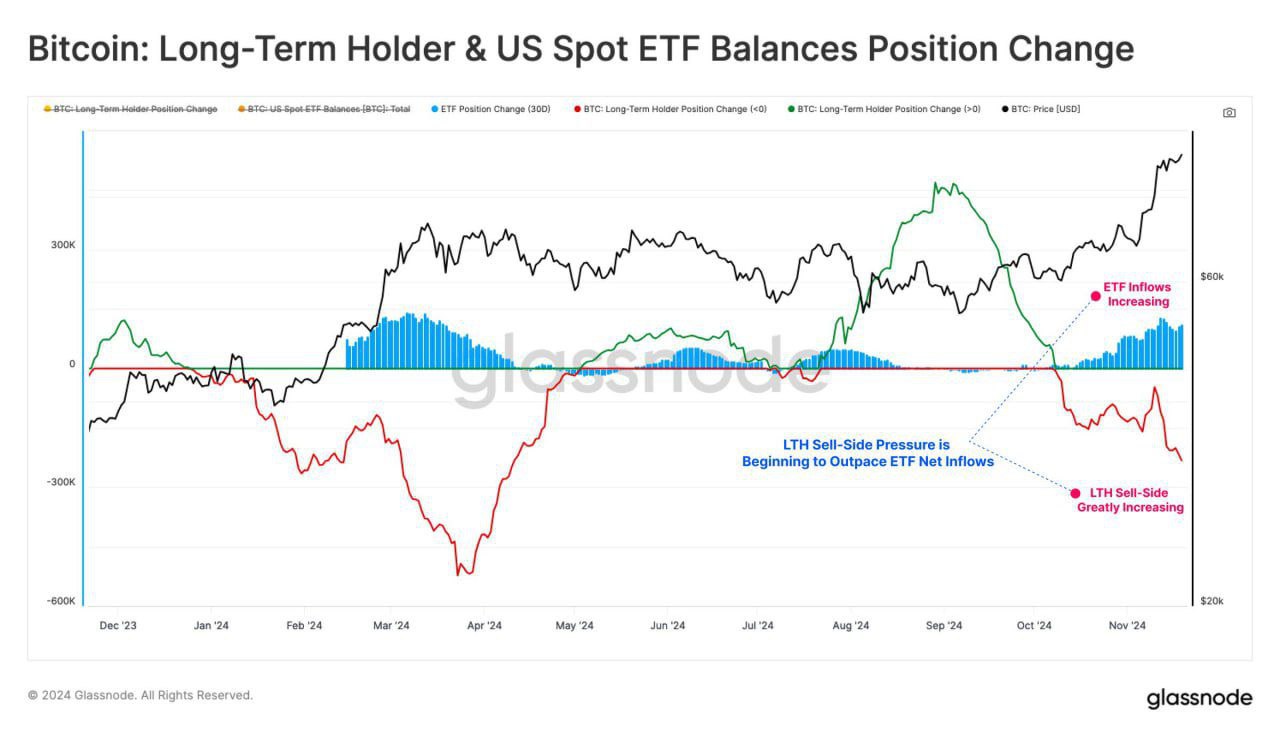

On-chain data shows that ETF fund flows are not the main factor driving the selling pressure on Bitcoin.

Furthermore, according to a post by cryptocurrency trader and technical analyst Kyle du Plessis on the X platform on November 24, the US spot ETF absorbed most of the selling pressure from long-term holders:

"Long-term Bitcoin holders sold 128,000 BTC, but the US spot ETF absorbed 90% of the selling pressure. Strong institutional demand has driven Bitcoin's rise, bringing it closer to the $100,000 milestone."

Bitcoin: Changes in balances of long-term holders and US spot ETF. Source: Kyledoops

Given the growing leverage in the crypto market, this correction may help the sustainability of the current Bitcoin uptrend.

On November 12, Crypto.com co-founder and CEO Kris Marszalek warned that the crypto market needs to deleverage before Bitcoin breaks above $100,000.

Bitcoin: Estimated leverage across all crypto exchanges. Source: CryptoQuant

This correction did not immediately trigger deleveraging. According to CryptoQuant data, the estimated leverage of Bitcoin across all crypto exchanges is 0.24, the highest level since August 2023.