The price of Dogecoin (DOGE) reached its highest level since 2021 on November 23, but has since entered a correction, declining 12% in the past 24 hours. The Ichimoku Cloud, DMI, and EMA indicators all indicate that the downtrend is strengthening, and DOGE is trading below critical levels, with upward pressure weakening.

If the downtrend continues, DOGE could test support at $0.34, and if selling pressure intensifies, it could drop to $0.14. However, if a recovery occurs, DOGE could challenge resistance at $0.43 and $0.48, and potentially target the important milestone of $0.50, which it has not reached since March 2021.

DOGE, Investor Sentiment Change Seen in Ichimoku Cloud

The Ichimoku Cloud chart for DOGE shows a downtrend. The price is trading below the Tenkan-sen (blue line) and Kijun-sen (orange line), indicating a bearish trend. The price has fallen below the cloud (Senkou Span A and B), suggesting the downtrend has become firmly established.

The narrowing of the cloud to the right indicates weakening support and increases the possibility of further downward pressure.

If DOGE fails to recover the cloud and stay above the Kijun-sen, the downtrend could accelerate, leading to further price declines. However, the flat base of the Kijun-sen could act as a minor resistance, and a bounce back above the cloud could signal a potential trend reversal.

Currently, the Ichimoku Cloud suggests that Dogecoin's price is at a critical juncture, and the downtrend is likely to continue unless a strong recovery occurs.

DOGE Downtrend Could Strengthen Further

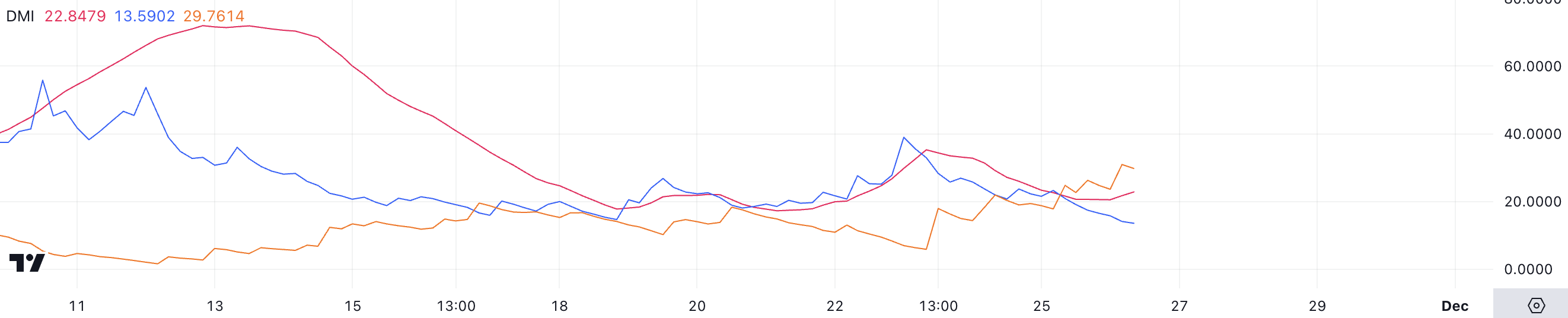

The Dogecoin DMI chart shows an ADX of 22.84, D+ of 13.5, and D- of 29.7, highlighting the potential for a change in momentum. The ADX, or Average Directional Index, measures the strength of a trend, and a value above 25 indicates a significant trend, regardless of direction.

Meanwhile, D+ represents the strength of the uptrend, and D- represents the strength of the downtrend. In this case, D- is higher than D+, confirming that the current price movement of DOGE is dominated by the downtrend.

While the ADX of 22.84 suggests the downtrend is not yet firmly established, the widening gap between D- and D+ indicates that the downtrend is strengthening.

This setup suggests that DOGE is likely to enter a downtrend, with selling pressure outweighing buying interest. If the ADX continues to rise above 25 and D- remains dominant, a stronger downtrend can be confirmed, potentially leading to further price declines.

DOGE Price Prediction: Increased Likelihood of Further Decline

The Dogecoin EMA lines suggest that market sentiment is shifting from bullish to bearish, and the current price is trading below the short-term EMA lines.

Additionally, these short-term lines are showing a downward trend, indicating that selling pressure is increasing, and upward momentum is weakening. This downtrend suggests that DOGE's price is losing its previous bullish support and opens the possibility of further price declines.

If the downtrend strengthens, the Dogecoin price could test a crucial support level at $0.34. If this level is not maintained, the price could drop to $0.14, representing a significant 61% correction.

However, if DOGE's price manages to reverse the trend and regain upward momentum, it could challenge resistance at $0.43 and $0.48. Breaching these levels could pave the way for DOGE to target $0.50, a level it has not seen since March 2021, signaling a strong recovery.