Author: Revc, Jinse Finance

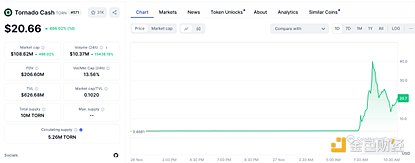

On November 26, the ruling of the U.S. Fifth Circuit Court of Appeals overturned the sanctions against Tornado Cash. Affected by this news, the price of the Tornado Cash token TORN soared 486.02% in the past 24 hours, with a trading volume of nearly $10 million and a 24-hour increase of 15438.18%.

In recent years, with the rapid development of blockchain technology and cryptocurrencies, the contradiction between privacy and regulation has become increasingly prominent. In this game, the cryptocurrency mixer Tornado Cash has become one of the important targets of the U.S. government's crackdown on illegal activities. However, the controversy over the sanctions against Tornado Cash not only concerns privacy protection, but also involves the boundaries of executive power and legal interpretation.

Cryptocurrency Mixers and Privacy Challenges

Cryptocurrencies are known for their open and transparent transaction characteristics, and anyone with technical knowledge can track fund flows through the blockchain. However, this openness also brings privacy risks. Violent crimes, hacker attacks, and malicious acts targeting sensitive transactions are commonplace, making users' demand for privacy increasingly urgent. To this end, cryptocurrency mixers have emerged.

Tornado Cash is an Ethereum blockchain-based mixing service that anonymizes transactions through smart contract technology. However, this privacy protection tool has not only attracted legitimate users, but also become a tool for criminals and hackers to launder funds. According to the U.S. Treasury Department's Office of Foreign Assets Control (OFAC), since Tornado Cash was established in 2019, about $7 billion in cryptocurrency has circulated through the platform, some of which is related to criminal activities.

Legal Controversy over OFAC Sanctions

In 2022, OFAC announced sanctions against Tornado Cash, prohibiting U.S. citizens from participating in its transactions. This sanction has sparked important legal controversies over whether the executive power has overstepped its bounds. According to the International Emergency Economic Powers Act (IEEPA), the President and his authorized agencies can freeze the property and property interests of foreign entities. However, whether the nature of Tornado Cash meets this definition has become the core of the case.

In multiple lawsuits, the plaintiffs argue that the core technology of Tornado Cash - the immutable smart contract - is open-source software code, not an entity or individual, and therefore does not constitute "property" that can be sanctioned. In addition, the lawsuits also argue that OFAC's expansive interpretation may lead to unchecked expansion of executive power, posing a threat to individual privacy, open-source development, and legitimate transactions.

Milestone Significance of the Court Ruling

The Fifth Circuit Court of Appeals ruling found that Tornado Cash's smart contracts are not "property of a foreign national or entity," and their immutable nature makes them not subject to IEEPA jurisdiction. This ruling marks a clear delineation of the limits of government power in addressing new technologies by the judicial system.

The court pointed out that while smart contract technology may have adverse consequences, legislation should be led by Congress, not through the expansive interpretation of administrative agencies to solve technological problems. After the ruling, the native token TORN of Tornado Cash soared in the market, showing the positive response of the crypto community to this decision.

Future Balance between Regulation and Privacy

Although the court ruling has temporarily won a victory for Tornado Cash, this case has not ended. The government may still pursue the platform's liability through other legal channels, and its developers still face legal challenges. Recently, Tornado Cash developer Alexey Pertsev was charged with money laundering, facing up to 5 years in prison, further highlighting the tense relationship between regulatory agencies and open-source developers.

The significance of this ruling lies not only in its direct impact on Tornado Cash, but also in its far-reaching implications for the entire cryptocurrency industry, the open-source technology community, and privacy protection. As a landmark case in the DeFi (Decentralized Finance) field, the Tornado Cash case will become an important reference in the future development of regulation and privacy technology.

Summary

The Tornado Cash case reveals the complexity faced by regulatory agencies in addressing emerging technologies. The balance between privacy protection and national security requires a more detailed and clear legal framework, rather than relying on the expansion of executive power. Congress should play a more active role in formulating regulations that adapt to technological changes, avoiding over-enforcement or privacy infringement due to regulatory vacuums.

For the cryptocurrency industry, this ruling reinforces the importance of privacy protection, while also reminding practitioners to pay attention to the integration of technology and law. However, Tornado Cash still faces legal challenges such as money laundering and financial stability, and investors should be aware of the relevant risks.

Privacy is a right, not a crime. In an era of continuous technological innovation, the challenge of balancing privacy and regulation has just begun.