Author: Jian Shu

MSTR (MicroStrategy) has risen from $69 at the beginning of the year to a high of $543 last week, far exceeding the rise of BTC! What impressed me is that while BTC was being pushed down due to the election, MSTR continued to soar. This made me rethink its investment logic: it is not just riding the BTC concept, but has its own gameplay and logic.

MSTR's Core Gameplay: Issuing Convertible Bonds to Buy BTC

MSTR was originally engaged in BI (business intelligence reporting systems), but this has long been a sunset industry. Now its core gameplay is: to raise funds through the issuance of convertible bonds, to buy a large amount of BTC, and to treat it as an important part of the company's assets.

1. What is a convertible bond?

In simple terms, the company raises funds through the issuance of bonds, and investors can choose to receive the principal and interest at maturity, or convert the bonds into the company's shares at the agreed price.

If the stock price rises sharply, investors will choose to convert, and the shares will be diluted accordingly.

If the stock price does not rise, investors will choose to receive the principal and interest, and the company will have to pay a certain amount of financial cost.

2. MSTR's Operating Logic:

Use the funds raised from the issuance of convertible bonds to buy BTC.

Through this method, MSTR's BTC holdings continue to increase, and the BTC value per share also continues to grow.

For example: based on the data at the beginning of 2024, the BTC corresponding to every 100 shares increased from 0.091 to 0.107, and by November 16, it had risen to 0.12.

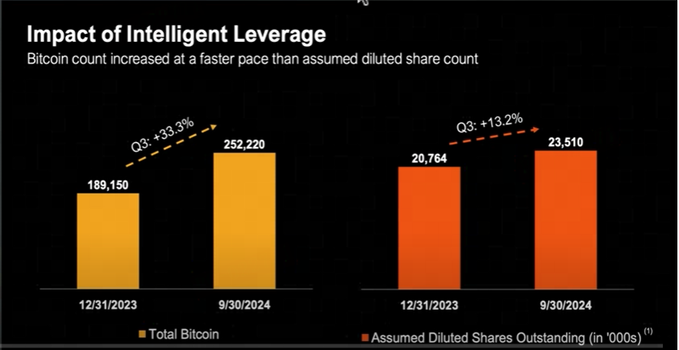

Understanding it in combination with the following figure will be clearer: the relationship between MSTR's increase in BTC holdings and the dilution of shares in the first 3 quarters of 2024.

In the first three quarters of 2024, MSTR increased its BTC holdings from 189,000 to 252,000 (an increase of 33.3%) through convertible bonds, while the total number of shares was only diluted by 13.2%.

The BTC corresponding to every 100 shares increased from 0.091 to 0.107, and the equity of BTC holdings gradually increased. We calculate based on the beginning of the year price: the price of 100 MSTR shares is ($69) $6,900, and the price of 0.091 BTC ($42,000) is $3,822, which seems very uneconomical compared to directly buying BTC (-45%). But according to this growth model, the number of BTC held per share will continue to increase through continuous debt issuance.

3. Latest Data:

On November 16, MSTR announced the acquisition of 51,780 BTC for $4.6 billion, bringing its total holdings to 331,200 BTC. According to this trend, the BTC value corresponding to every 100 shares has already approached 0.12. From the perspective of BTC, the "equity" of MSTR shareholders in BTC is constantly increasing.

MSTR is the "Gold Shovel" of BTC

From the perspective of the model, MSTR's gameplay is similar to using Wall Street leverage to mine BTC:

Continuously issue debt to buy BTC, and increase the BTC holdings per share by diluting the shares;

For investors, buying MSTR shares is equivalent to indirectly holding BTC, and they can also enjoy the leveraged gains brought by the rise in BTC prices.

By now, I believe that smart partners have already discovered that this gameplay is quite similar to a Ponzi scheme, using the newly raised funds to subsidize the equity of old shareholders, and continuing to raise funds round after round.

4. When will this model no longer be sustainable?

Increased difficulty in fundraising: If the stock price does not rise, subsequent convertible bond issuance will become more difficult, and the model will be difficult to continue.

Excessive dilution: If the speed of share issuance exceeds the speed of BTC acquisition, shareholder equity may shrink.

Model homogenization: As more and more companies begin to imitate MSTR's model, the increased competition may cause it to lose its uniqueness.

MSTR's Logic and Future Risks

Although MSTR's logic is somewhat like a Ponzi scheme, from a long-term perspective, the accumulation of BTC by large US capital has strategic significance. There are only 21 million BTC in total, and the US national strategic reserve may occupy 3 million of them. For large capital, "hoarding coins" is not only an investment behavior, but also a long-term strategic choice.

However, at present, the risks of MSTR outweigh the returns, and everyone should be cautious in their operations!

If the BTC price corrects, MSTR's stock price may suffer a larger decline due to its leverage effect;

Whether it can continue to maintain a high-growth model in the future depends on its fundraising ability and the competitive environment of the market.

Uncle's Reflection and Cognitive Upgrade

In 2020, when MSTR first hoarded BTC, I remember that BTC rebounded from $3,000 to $5,000 at the time. I thought it was too expensive and didn't buy it, while MSTR bought a large amount at $10,000. At that time, I still thought they were foolish, but the result was that BTC rose all the way to $20,000, and the fool was actually me. Missing out on MSTR this time made me realize that the operating logic and cognitive depth of the big shots in American capital are worth learning seriously. Although MSTR's model is simple, it represents a strong belief in the long-term value of BTC. Missing out is not terrible, the important thing is to learn from it and upgrade one's own cognition.