Author: JoyChen, EvanLu Source: Waterdrip Capital

As the global financial regulatory environment becomes clearer, the cryptocurrency market has gradually moved from the original "niche circle" to the mainstream financial system. Since the US election, Trump's election as president has had a positive impact on the cryptocurrency industry, promising to adopt more friendly regulatory policies, including establishing a national Bitcoin reserve and encouraging the United States to expand Bitcoin mining activities. These promises have boosted market confidence. In the next few days, the capital market began to be generally transmitted. Against this background, many blockchain concept stocks rose generally.

At present, more and more listed companies have realized the huge potential of blockchain technology and actively incorporated it into the company's strategic layout. Many blockchain concept stocks have a strong development momentum and have received significant attention and investment in the market. These companies have promoted the digital transformation and value creation of their businesses by introducing blockchain technology, and have gradually become important players in the industry. We have closely followed many stocks in this field and have seen that their performance in the capital market is getting better and better. In the future, they are expected to usher in greater development opportunities driven by blockchain:

In recent years, especially the regulatory dividends brought by the launch of cryptocurrency-related ETFs (such as Bitcoin spot ETFs) in the United States, it indicates that cryptocurrencies are no longer limited to the closed digital currency market, but are deeply integrated with the traditional capital market. Grayscale, as a pioneer, has become a bridge for traditional investors to enter the crypto market with its Bitcoin Trust (GBTC). Data shows that as of November 20, BlackRock's Bitcoin Spot ETF (IBIT) had an asset management scale of nearly US$45 billion, and has been in a net inflow state almost since the beginning of the year. The Grayscale Bitcoin Spot ETF (GBTC) manages assets of about US$20.3 billion, showing investors' interest and confidence in this emerging asset class.

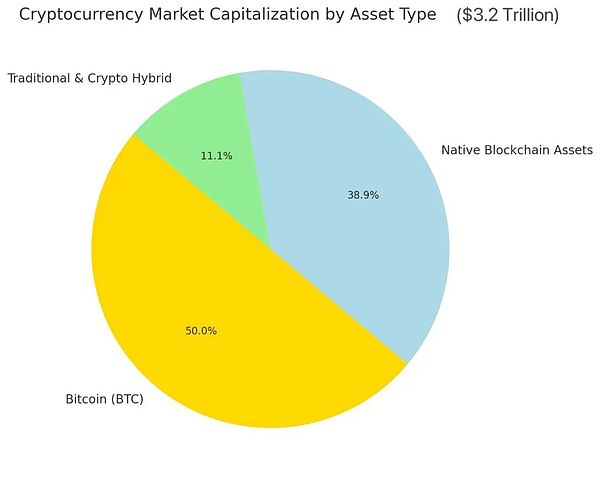

The total market capitalization of the current cryptocurrency market is approximately $3.2 trillion, which can be divided into three main parts by asset class:

In recent years, especially the regulatory dividends brought by the launch of cryptocurrency-related ETFs (such as Bitcoin spot ETFs) in the United States, it indicates that cryptocurrencies are no longer limited to the closed digital currency market, but are deeply integrated with the traditional capital market. Grayscale, as a pioneer, has become a bridge for traditional investors to enter the crypto market with its Bitcoin Trust (GBTC). Data shows that as of November 20, BlackRock's Bitcoin Spot ETF (IBIT) had an asset management scale of nearly US$45 billion, and has been in a net inflow state almost since the beginning of the year. The Grayscale Bitcoin Spot ETF (GBTC) manages assets of about US$20.3 billion, showing investors' interest and confidence in this emerging asset class.

The total market capitalization of the current cryptocurrency market is approximately $3.2 trillion, which can be divided into three main parts by asset class:

1. Bitcoin (BTC)

As the core asset of the entire crypto market, Bitcoin currently has a market value of approximately $1.9 trillion, accounting for more than 50% of the total market value of cryptocurrencies. It is not only a value storage tool recognized by traditional finance and native crypto, but also the first choice of institutional investors due to its anti-inflation characteristics and limited supply. It is known as "digital gold". Bitcoin plays a key hub role in the crypto market. While stabilizing the market, it also provides a bridge for the interconnection between traditional assets and native chain assets.

2. Native on-chain assets

Including public chain tokens (such as Ethereum ETH), decentralized finance (DeFi) related tokens, and functional tokens in on-chain applications. This field is diverse and highly volatile, and its market performance is driven by technological updates and user demand. The current market value is about 1.4 trillion US dollars, which is actually far lower than the high growth expected by the market.

3. Combination of traditional assets and crypto technology

This field covers emerging projects such as on-chain real-world asset (RWA) tokenization and blockchain-based securitized assets. Its current market value is only a few hundred billion US dollars, but with the popularization of blockchain technology and the deep integration of traditional finance, this field is developing rapidly. Improving liquidity by tokenizing traditional assets is also one of the main driving forces for the growth of the crypto market in the future. We are confident in this part and believe that it will promote the transformation of traditional finance to a more efficient and transparent digital direction and release huge market potential.

Why are we so optimistic about the growth potential of traditional assets?

Over the past six months, Bitcoin's asset attributes have undergone a new evolution, and the dominant force in the capital market has also completed the transition from old forces to new capital pools.

In 2024, the position of cryptocurrencies in the traditional financial sector was further consolidated. Financial giants including BlackRock and Grayscale launched exchange-traded products for Bitcoin and Ethereum, providing institutional and retail investors with more convenient channels for digital asset investment, which further confirmed the connection with traditional securities.

At the same time, the tokenization trend of real-world assets (RWA) is also accelerating, further improving the liquidity and coverage of financial markets. For example, Germany's state-owned development bank KfW issued two digital bonds totaling 150 million euros through blockchain technology in 2024. These bonds are settled through distributed ledger technology (DLT). French computer equipment manufacturer Metavisio issued corporate bonds and used tokenization to provide capital support for its new manufacturing facilities in India. This also shows that traditional financial institutions are using blockchain technology to optimize operational efficiency. Many financial institutions have introduced encryption technology into their business models.

Today, a capital circulation model with Bitcoin as the core asset, ETFs and stock markets as the main channels for capital inflows, and US-listed companies such as MSTR as the carrier platform is continuously absorbing US dollar liquidity and is unfolding in an all-round way.

The combination of traditional finance and blockchain will bring more investment opportunities than native on-chain assets. Behind this trend, it reflects the market's emphasis on stability and practical application scenarios. The traditional financial market has a deep infrastructure and mature market mechanism. After combining with blockchain technology, it will release greater potential. In this regard, Waterdrip Capital, especially its Pacific Waterdrip Digital Asset Fund, will also focus on the innovative combination of traditional financial markets and the crypto industry in the future to find investment opportunities in the field of integration.

This research report will briefly analyze the growth model of blockchain concept stocks, especially the way they are combined with on-chain assets, to explore more innovative investment opportunities. For example, MSTR's additional issuance model shows a typical path of exchanging US dollar assets for on-chain assets through convertible bonds and stock issuance. Recently, MSTR's stock price has risen rapidly with the rise in Bitcoin prices, and its convertible bond income due in 2027 has hit a three-year high. This strategy has made its stock performance far outperform traditional technology stocks.

From these perspectives, we can see that the future development of the crypto market is not just about the incremental growth of digital currency itself, but also about the huge potential for integration with traditional finance. From regulatory dividends to changes in market structure, blockchain concept stocks are at the key node of this major trend and have become the focus of global investors.

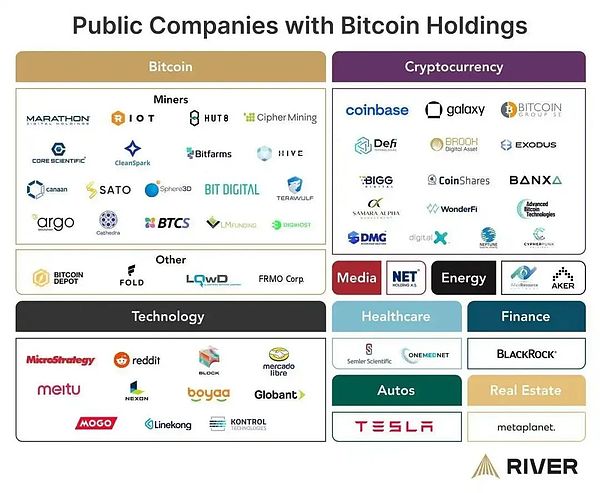

We roughly divide the current blockchain concept stocks into the following categories:

1. Asset-driven concept:

Regarding the concept of asset allocation for blockchain stocks, the company's strategy is to use Bitcoin as the main reserve asset. This strategy was first implemented by MicroStrategy in 2020 and quickly attracted market attention. This year, other companies such as Japanese investment company MetaPlanet and Hong Kong-listed company Boyaa Interactive have also joined in, and the acquisition of Bitcoin has continued to increase. MetaPlanet announced the introduction of the key performance indicator "Bitcoin Yield" developed by MicroStrategy. Its BTC Yield in the third quarter was 41.7%, and in the fourth quarter (as of October 25) it was as high as 116.4%.

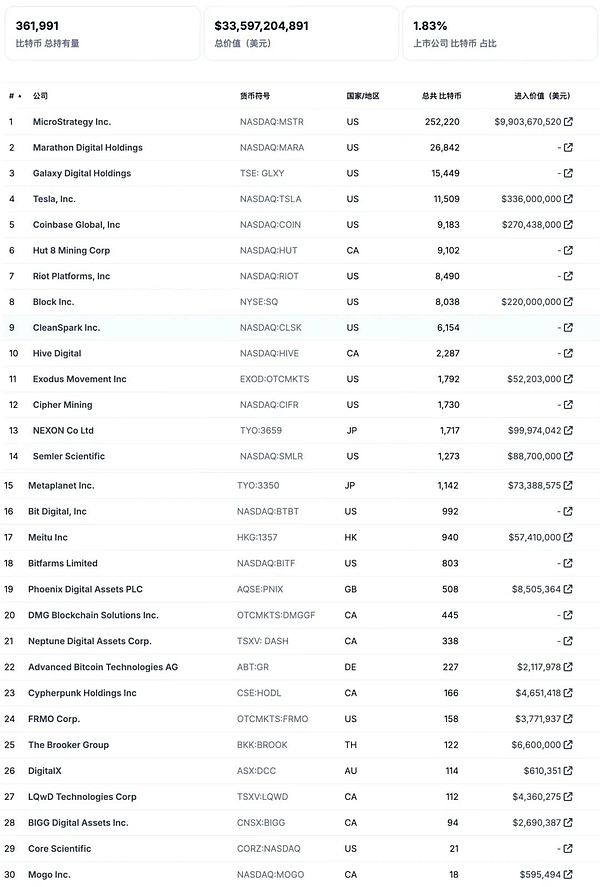

TOP30 listed companies worldwide that use Bitcoin as a company reserve asset*Data source: coingecko

Specifically, the strategy of companies such as MicroStrategy is to provide investors with a new perspective to evaluate the company's value and investment decisions by introducing the key performance indicator of "Bitcoin yield". This indicator is based on the diluted number of outstanding shares, calculates the number of Bitcoins held per share, and does not take into account Bitcoin price fluctuations. It aims to help investors better understand the company's behavior of purchasing Bitcoin by issuing additional common shares or convertible instruments, focusing on measuring the balance between the growth of Bitcoin holdings and the dilution of equity. So far, MicroStrategy's Bitcoin investment yield has reached 41.8%, which shows that the company has successfully avoided excessive dilution of shareholder interests while continuously increasing its holdings.

However, despite MicroStrategy's remarkable achievements in Bitcoin investment, the company's debt structure still arouses market concern. MicroStrategy's current outstanding debt totals $4.25 billion, according to reports. During this period, the company raised funds through multiple rounds of convertible bonds, some of which also came with interest payments. Market analysts worry that if the price of Bitcoin falls sharply, MicroStrategy may need to sell some Bitcoin to repay its debts. However, there is also a view that because MicroStrategy relies on its stable traditional software business and low interest rate environment, its operating cash flow is sufficient to cover debt interest, so even if the price of Bitcoin plummets, it is unlikely to force the company to sell its Bitcoin assets. In addition, MicroStrategy's stock market value is currently as high as $43 billion, and debt accounts for a small proportion of its capital structure, which further reduces the risk of liquidation.

Although many investors are optimistic about the company's firm Bitcoin investment strategy and believe that it will bring considerable returns to shareholders, some investors have expressed concerns about its high leverage and potential market risks. Due to the high volatility of the cryptocurrency market, any adverse market changes may have a significant impact on the asset value of such companies, and their stock prices are significantly premium to their net asset value. Whether this state can continue is the focus of market attention. If the stock price falls back, it may affect the company's financing ability, and in turn affect its future Bitcoin purchase plans.

1. Microstrategy (MSTR)

Business Intelligence Software Company

MicroStrategy was founded in 1989 and initially focused on business intelligence and enterprise solutions. However, starting in 2020, the company transformed itself into the world's first listed company to use Bitcoin (BTC) as a reserve asset, a strategy that completely changed its business model and market position. Founder Michael Saylor played a key role in driving this transformation, transforming from an early Bitcoin skeptic to a staunch supporter of the cryptocurrency.

Since 2020, MicroStrategy has continued to purchase Bitcoin through its own funds and bond financing. As of now, the company has accumulated approximately 279,420 Bitcoins, with a current market value of nearly US$23 billion, accounting for approximately 1% of the total supply of Bitcoin. Among them, the most recent purchase occurred between October 31 and November 10, 2023, when 27,200 Bitcoins were acquired at an average price of US$74,463. The average holding price of these Bitcoins is US$39,266, and the current price of Bitcoin has reached approximately US$90,000, and MicroStrategy's book profit is close to 2.5 times.

Although MicroStrategy's Bitcoin investment faced a paper loss of about $1 billion during the bear market in 2022, the company never sold Bitcoin, but chose to continue to increase its holdings. Since 2023, the strong rise of Bitcoin has driven a significant increase in MicroStrategy's stock price, with a return on investment of 26.4% from the beginning of the year to date, and a cumulative return on investment of more than 100%.

MicroStrategy's current business model can be seen as a "circular leverage model based on BTC", which raises funds to purchase Bitcoin by issuing bonds. Although this model brings high returns, it also hides certain risks, especially when the price of Bitcoin fluctuates violently. According to analysis, the price of Bitcoin needs to fall below $15,000 before the company may face liquidation risks, and this risk is extremely small in the context of the current Bitcoin price of nearly $90,000. In addition, the company's low leverage ratio and strong demand in the bond market further enhance MicroStrategy's financial robustness.

For investors, MicroStrategy can be seen as a leveraged investment tool in the Bitcoin market. With the expectation of a steady rise in Bitcoin prices, the company's stock has great potential. However, it is necessary to be wary of the medium- and long-term risks that debt expansion may bring. In the next 1 to 2 years, MicroStrategy's investment value is still worthy of attention, especially for investors who are optimistic about the prospects of the Bitcoin market. This is a high-risk, high-return target.

2. Semler Scientific (SMLR)

Semler Scientific is a company focused on medical technology, and one of its innovative strategies is to use Bitcoin as its main reserve asset. In November 2024, the company disclosed that it had recently purchased 47 Bitcoins, increasing its total holdings to 1,058 Bitcoins, with a total investment of approximately $71 million. These acquisitions were partly funded by operating cash flow, indicating that Semler is trying to strengthen its asset structure through Bitcoin holdings and become a representative of asset management innovation.

However, Semler's core business remains focused on its QuantaFlo device, which is primarily used to diagnose cardiovascular disease. However, Semler's Bitcoin strategy is more than just a financial reserve. In the third quarter of 2024, the company realized $1.1 million in unrealized gains from its Bitcoin holdings, which provided Semler with a financial hedge against economic fluctuations despite a 17% year-over-year revenue decline in the quarter.

Although Semler's current market value is only US$345 million, far lower than MicroStrategy, its strategy of using Bitcoin as a reserve asset has made it regarded by investors as a "mini MicroStrategy."

3. Boyaa Interactive

Boyaa Interactive is a Hong Kong-listed company whose main business is games. It is a developer and operator ranked among the top in China's board game industry. It began to test the crypto market in the second half of last year, aiming to fully transform into a Web3 listed company. The company has purchased large amounts of crypto assets such as Bitcoin and Ethereum, invested in multiple Web3 ecological projects, and signed a subscription agreement with Pacific Waterdrip Digital Asset Fund SPC under Waterdrip Capital to carry out strategic cooperation in Web3 game development and Bitcoin ecology. The company once said: "Purchasing and holding cryptocurrencies is an important measure for the Group to develop and layout its Web3 business, and is also an important part of the Group's asset allocation strategy." As of the latest announcement, Boyaa Interactive holds 2,641 Bitcoins and 15,445 Ethereums, with a total cost of approximately US$143 million and US$42.578 million, respectively.

It is worth mentioning that due to the recent active cryptocurrency market, both Bitcoin and cryptocurrencies have seen a sharp rise. If calculated based on the closing price of cryptocurrencies on the 12th, Boyaa Interactive made a floating profit of nearly $90.22 million on Bitcoin and about $7.95 million on Ethereum, with a total floating profit of nearly $100 million.

The continuous rise in the price of cryptocurrencies has aroused the market's high attention to related concept stocks. Taking the Hong Kong stock market as an example, as of November 12, Linekong Interactive rose 41.18%, Xinhuo Technology Holdings rose 27.40%, and OKEx Cloud Chain rose 11.65%, showing the strong performance of blockchain-related companies. The Hong Kong stock blockchain market is still in its early stages of development, but the policy environment is continuously being optimized. The recent policies supporting the development of blockchain encourage open innovation and create a good growth space for enterprises. Some companies rely on the asset-driven effect brought about by the fluctuations in cryptocurrency prices, and are also actively exploring the practical application of blockchain technology in games, finance, metaverse and other fields. The further growth of the market in the future will depend on the effectiveness of technology implementation and the improvement of the ecological system, providing investors with clearer direction and confidence.

The value of the cryptocurrency held by Boyaa Interactive has reached approximately HK$2.2 billion. This means that the total value of the cryptocurrency currently held by Boyaa Interactive exceeds the current market value of the company. In the second quarter of 2024, the company recorded revenue of approximately 104.8 million yuan, a year-on-year increase of 5.8%. Among them, the revenue from web games and mobile games was 29 million yuan and 69 million yuan respectively, and the digital asset appreciation income was 6.74 million yuan. As for the reason for the increase in revenue, Boyaa stated in the announcement: "It is mainly due to the digital asset appreciation income obtained from the cryptocurrencies held by the Group."

At the same time, the company plans to increase its holdings of cryptocurrencies by up to $100 million in the next 12 months. In addition, Boyaa Interactive has formed a team focused on Web3 game development and related infrastructure research and development. Benefiting from the significant growth of cryptocurrency assets, its first-quarter earnings increased by 1130% year-on-year, pushing the company's stock price up nearly 3.6 times since the beginning of the year, becoming a typical asset-driven blockchain concept stock in the market. For this stock, Boyaa Interactive's performance depends on the volatility of the cryptocurrency market, and its stock price may continue to be driven by the growth of asset value.

2. Mining Concept

Blockchain mining stocks have received great attention from the market in recent years, especially with the fluctuations in the prices of cryptocurrencies such as Bitcoin. Mining companies not only benefit from the direct benefits of digital currencies, but also participate in the layout of other high-growth industries to a certain extent, especially artificial intelligence (AI) and high-performance computing (HPC) businesses. With the vigorous development of AI technology, the demand for AI computing power is rapidly increasing, which has brought new support to the valuation of mining stocks. In particular, with the gradual shortage of electricity contracts, data centers and their supporting facilities, mining companies can obtain additional benefits by providing computing power infrastructure for AI needs.

However, we generally believe that not all mining companies can fully meet the needs of AI data centers. Mining operations prioritize cheap electricity supply and often choose locations with low prices and short-term unstable electricity to maximize profits. In contrast, AI data centers pay more attention to the stability of electricity, so they are less sensitive to changes in electricity prices and prefer long-term stable electricity supply. Therefore, not all mining companies' existing power equipment and data centers are suitable for direct transformation into AI data centers.

Mining concept stocks can be divided into the following categories:

1. Mining companies with mature AI/HPC businesses: These companies not only have a presence in the mining field, but also have mature AI or HPC businesses and are supported by technology giants such as NVIDIA. For example, companies such as Wulf, APLD, and CIFR not only participate in cryptocurrency mining, but also integrate mining and AI computing power requirements to a certain extent by building AI computing power platforms and participating in AI reasoning and other businesses, thus gaining more market attention.

2. Focus on mining and hoard a large amount of coins: These companies mainly focus on mining business and hold a large amount of digital currencies such as Bitcoin. CleanSpark (CLSK) is one of the representatives of this type of company, and its hoarding accounts for 17.5% of the unit market value. In addition, Riot Platforms (RIOT) is also a similar company, and its hoarding accounts for 21% of the unit market value. These companies accumulate cryptocurrencies such as Bitcoin in the hope of making profits when the market price rises in the future.

3. Diversified business complex: This type of company not only mines and hoards cryptocurrencies, but also dabbles in AI reasoning, AI data center construction, etc. Marathon Digital (MARA) is a representative of this type of company, with its hoarded coins accounting for 33% of the unit market value. These companies usually reduce the risk of a single field through a diversified business layout, while improving overall profitability.

As the demand for AI increases, AI computing power and high-performance computing businesses will be increasingly combined with blockchain mining businesses, which may further increase the valuation of mining companies. In the future, mining companies will not only be "miners" of digital currencies, but may also become important infrastructure providers behind the development of AI technology. Although this road is full of challenges, in order to meet this trend, many mining companies have accelerated the layout of AI computing power and data center construction, and are committed to occupying a place in this emerging field.

1. MARA Holdings (MARA)

One of the largest enterprise Bitcoin self-mining companies in North America, founded in 2010 and listed in 2011. The company is dedicated to mining cryptocurrencies, focusing on the blockchain ecosystem and the generation of digital assets. The company provides managed mining solutions based on its proprietary infrastructure and smart mining software, mainly mining Bitcoin. Marathon, similar to Riot, also experienced a 12.6% drop in share price, followed by further declines. However, Marathon's share price has risen rapidly in the past year.

According to the latest data in October, MARA (Marathon Digital) has achieved a computing power of 32.43 EH/s, becoming the first listed mining company to reach this scale. It is expected that the computing power will increase by about 10 EH/s after its new 152 MW power capacity is put into use. MARA recently acquired two data centers in Ohio and built a third new site, adding 152 MW of mining power capacity, which is planned to be fully operational by the end of 2025. Salman Khan, MARA's chief financial officer, said that the cost of the asset acquisition was about $270,000 per MW, and it is expected that these deployments will help the company achieve its computing power goal of 50 EH/s in 2024.

In addition, MARA announced on November 18 that it would issue $700 million worth of convertible senior notes, which will mature in 2030. The funds raised will be mainly used to purchase Bitcoin, repurchase notes due in 2026, and support the expansion of existing businesses. MARA expects to use the net proceeds from these notes, of which up to $200 million will be used to repurchase some convertible notes due in 2026, and the rest will be used to purchase more Bitcoin and general corporate purposes, including working capital, strategic acquisitions, expansion of existing assets, and repayment of additional debt. This move further demonstrates MARA's long-term bullish attitude towards Bitcoin.

2. Core Scientific (CORZ)

Blockchain infrastructure and cryptocurrency mining services

Core Scientific Inc., founded in 2017, has two main business segments: equipment sales and hosting services, as well as self-built mining farms for Bitcoin mining. The company generates revenue by selling consumption-based contracts and providing hosting services, while the digital asset mining segment generates revenue from computing devices operated by the company that process transactions on the blockchain network and participate as part of the user pool in return for digital currency assets.

Recently, Microsoft (MSFT.US) announced that it will spend nearly $10 billion between 2023 and 2030 to rent servers from artificial intelligence startup CoreWeave. CoreWeave has signed an agreement with Bitcoin mining giant Core Scientific to host an additional 120 megawatts (MW) of high-performance computing power. Through several rounds of expansion, CoreWeave currently hosts a total of 502 MW of GPU capacity in Core Scientific's data centers. Since signing the multi-billion dollar contract with CoreWeave, Core Scientific's stock price has risen sharply, with a cumulative increase of nearly 300%. The company also plans to transform some of its data centers to host CoreWeave's more than 200 megawatts of GPUs.

The 12-year hosting contract is expected to generate $8.7 billion in total revenue for Core Scientific. Meanwhile, while its bitcoin mining hashrate remained stable, its market share declined, from 3.27% in January to 2.54% in September.

Overall, Core has perfectly digested the combination of the two hot topics of AI and Bitcoin. Especially in the field of AI data centers, Core Scientific has won large contracts and actively expanded new customers, showing strong development potential. Although the market share of Bitcoin mining business has declined, the company's progress in AI data centers has provided strong support for its long-term stable growth, and future growth is still expected.

3. Riot Platforms (RIOT)

Riot Platforms, headquartered in Colorado, USA, focuses on blockchain technology construction, support and digital currency mining. Previously, the company has invested in several blockchain startups, including Canadian Bitcoin exchange Coinsquare, but has now completely shifted its focus to cryptocurrency mining.

Riot’s stock price has experienced significant volatility, particularly when the price of Bitcoin fell, with the company’s stock price falling 15.8% at one point. However, despite this, the company’s stock is still up more than 130% in the past year.

Although the latest market positives have pushed the stock price up 66% in just one week, Riot's operating conditions are not ideal. According to its third-quarter 2024 financial report, the company's total revenue was US$84.8 million, of which Bitcoin mining revenue accounted for US$67.5 million, and the net loss reached US$154.4 million, with a loss of US$0.54 per share, far exceeding the market's expected loss of US$0.18 per share. In addition, Riot's loss in the second quarter was US$84.4 million, while the net loss in the same period last year was only US$27.4 million. Overall, Riot's losses continue to expand. Although the stock price has risen in the short term, the short-term stock price increase is only accompanied by the overall market. Whether long-term stock price growth can be achieved is still a question mark.

4. CleanSpark (CLSK)

Green Energy Cryptocurrency Mining

CleanSpark is a company focused on bitcoin mining using renewable energy. The company's revenue grew to $104.1 million in the second quarter of 2024, up $58.6 million, or 129%, from $45.5 million in the same period last year. However, in the three months ended June 30, 2024, the net loss was $236.2 million, or $1.03 per share, compared with a loss of $14.1 million, or $0.12 per share, in the same period last year. It is worth mentioning that despite a wave of gains in the market in early November, CleanSpark (CLSK) did not benefit from it because the company was suspended during this period. The company's founder explained that the reason for the suspension was due to a recent error in the calculation of the equity subscription ratio during the acquisition process. The company also announced the completion of its acquisition of GRIID, with the goal of increasing the total computing power of the mine to 400 megawatts (MW) in the next few years. At the same time, CleanSpark holds a large amount of digital currencies such as Bitcoin. The hoard accounts for 17.5% of the unit’s market cap, meaning a significant portion of its market cap is backed by the Bitcoin it holds.

From the perspective of stock trends, CleanSpark is one of the representative Bitcoin miners with renewable energy as its core, with long-term development potential thanks to its green mining strategy and relatively low energy costs. The company's acquisition of GRIID and expansion of mining farm computing power indicate that it has a positive strategic layout in expanding market share and enhancing competitiveness. However, although the company's revenue growth is significant, due to the large loss margin, investors' attention to its profitability and cash flow will be an important factor affecting future stock price trends. With the impact of Bitcoin price fluctuations and energy cost fluctuations, CleanSpark's stock price may fluctuate greatly.

5.TereWulf(WULF)

Cryptocurrency mining using green energy

Energy companies are becoming a major force in the cryptocurrency industry as operational risks are reduced and profit margins are increased. TeraWulf, a cryptocurrency subsidiary of Beowulf Mining Plc, recently revealed in a regulatory filing that it expects to reach 800 megawatts of mining capacity by 2025, accounting for 10% of the current computing power of the Bitcoin network. TeraWulf focuses on providing sustainable cryptocurrency mining solutions, especially focusing on utilizing renewable energy such as hydropower and solar power, and is developing AI data centers.

TeraWulf recently announced that it would increase the total size of its 2.75% convertible bonds to $425 million, of which $118 million would be used for stock repurchases. The financing also includes an option to issue additional bonds, allowing the initial purchaser to add an additional $75 million within 13 days of issuance. The newly issued bonds will mature in 2030, and part of the funds will be used for stock repurchases, while the remaining funds will be used for general corporate expenses.

TeraWulf said it would prioritize share buybacks and continue to advance its organic growth and potential strategic acquisitions in high-performance computing and AI. After the announcement, TeraWulf's stock price has risen by nearly 30% since last Friday, surpassing the performance of Bitcoin and other mining companies. Mining companies have recently raised funds through convertible bonds and Bitcoin-backed loans to cope with the decline in computing power prices after the Bitcoin halving.

Overall, TeraWulf's layout in clean energy and AI mining shows strong growth potential. In the short term, the company may benefit from the market's high attention to green energy and AI mining. However, considering the volatility of the mining industry and the overall market environment, long-term performance still needs to be continuously monitored and evaluated. Under the current situation, TeraWulf's stock price rise has a certain hype factor, but it is also expected to further drive growth through its sustainable development strategy.

6. Cipher Mining (CIFR)

Bitcoin Mining Companies

Cipher Mining is primarily focused on developing and operating Bitcoin mining data centers in the United States, with the goal of enhancing the infrastructure of the Bitcoin network.

Recently, Cipher Mining announced that it has further expanded its credit cooperation with Coinbase and established a term loan of $35 million. According to the financial report disclosed on November 1, the company increased its original $10 million credit line to $15 million and added a $35 million term loan.

In addition, as the demand for artificial intelligence technology in the crypto market grows, the valuation of Cipher Mining's AI business has also risen. However, compared with peer companies such as CORZ, APLD and WUFL, Cipher Mining's stock price increase has lagged behind. Although the company's infrastructure investment in the field of Bitcoin mining has achieved certain results, its progress in the layout of AI technology has been relatively slow, which may affect its stock price performance in the short term.

7. Iris Energy (IREN)

Bitcoin mining with renewable energy

Focusing on Bitcoin mining through green energy (especially hydropower) worldwide. Focusing on clean energy-driven Bitcoin mining business, environmental sustainability is its core competitiveness, which is also an important factor that distinguishes it from other mining companies. Compared with traditional coal and oil energy, IREN uses clean energy mining to reduce carbon emissions and lower operating costs. IREN currently has multiple clean energy-driven mining facilities, especially in clean energy-rich regions such as Canada and the United States, where a lot of infrastructure has been invested.

In addition, IREN is also trying to make arrangements in the field of cloud computing, but the prospects of this part of the business are not as clear as its clean energy mining business. Although cloud computing as a business model can reduce the demand for mining hardware to a certain extent and provide investors with a more flexible way to make profits, its revenue model and market acceptance are still in the early stages, and compared with traditional Bitcoin mining, it is difficult to show significant profitability. Therefore, IREN's exploration of cloud computing can be regarded as more of a test project, which is far from mature and its valuation is difficult to overestimate.

In terms of monetizing energy assets, IREN's progress and potential are not as good as some other competitors, such as CIFR (Cipher Mining) and WULF (Stronghold Digital Mining). These companies have made some progress in the effective integration of traditional energy assets and clean energy applications, and have stronger market competitiveness. Although IREN's unique advantages in the field of green energy mining cannot be ignored, compared with CIFR and WULF, its monetization process is still lagging behind, and it is difficult to form sufficient capital return in the short term.

8. Hut 8 (HUT)

Hut 8, headquartered in Canada, is a company that conducts cryptocurrency mining operations mainly in North America and is one of the largest innovative digital asset miners in North America. The company operates large-scale energy infrastructure and always adheres to environmentally friendly operations.

In 2023, Hut 8's annual revenue reached $121.21 million, a year-on-year increase of 47.53%. In the quarter ending September 30, 2024, revenue further increased to $43.74 million, a year-on-year increase of 101.52%. This increase brings the total revenue for the past 12 months to $194.02 million, an annual growth rate of 209.07%.

According to the third quarter report, Hut 8 has accelerated the pace of building its digital infrastructure platform and promoting its commercialization process in the past few months. The company's various data show strong growth momentum and are constantly strengthening its business development.

9. Bitfarms (BITF)

Canada-based Bitfarms focuses on the development and operation of Bitcoin mines and continues to expand the scale of mining. The company recently announced plans to upgrade the 18,853 Antminer T21 Bitcoin miners originally planned to be purchased from Bitmain to S21 Pro models with an additional investment of US$33.2 million. According to the third-quarter financial report, Bitfarms has modified its purchase agreement with Bitmain, and the upgraded miners are expected to be delivered between December 2024 and January 2025. According to TheMinerMag's analysis, thanks to the adoption of the latest generation of miners, Bitfarms' mining machine costs have been significantly reduced: from US$40.6 per PH/s in the first quarter to US$35.5 in the second quarter, and further to US$29.3 in the latest quarter.

Overall, Bitfarms has shown strong growth potential by updating its mining equipment and optimizing its procurement strategy, while reducing costs and improving mining efficiency. This strategy will not only improve the company's profitability, but also enhance its position in the highly competitive cryptocurrency market. As the cost of mining machines continues to decrease, Bitfarms is expected to continue to gain an advantage in the field of Bitcoin mining, especially if the price of Bitcoin rebounds or market demand grows.

10. HIVE Digital Technologies (HIVE)

Cryptocurrency mining company, hpc business.

Hive Digital recently announced the acquisition of 6,500 Canaan Avalon A1566 Bitcoin miners and plans to increase the total computing power to 1.2 EH/s, a move that shows the company's continued investment in cryptocurrency mining. However, since the end of last year, Hive Digital has made it clear that it will shift more resources and focus to high-performance computing (HPC) in the future. The company believes that the HPC business has higher profit margins than Bitcoin mining and has certain technical barriers, which can bring more sustainable revenue growth to the company. To this end, Hive transformed 38,000 Nvidia data center GPU cards originally used for Ethereum and other cryptocurrency mining into on-demand GPU cloud services, opening a new chapter in its AI and HPC fields.

This strategic transformation is in line with the trend of industry development. Similar to other mining companies such as Hut 8, Hive quickly turned its attention to HPC and AI businesses after Ethereum switched from POW to POS. Today, Hive's HPC and AI businesses are able to generate 15 times more revenue than Bitcoin mining, and the demand for GPU computing is growing rapidly. According to a report by Goldman Sachs, the GPU cloud service market has broad prospects. Fortune Business Insights predicts that by 2030, the GPU service market in North America will grow at a compound annual growth rate of 34%. Especially with the increasing demand for AI projects, the large language model technology behind ChatGPT has just started, and almost all companies need a lot of GPU computing power to support the operation and development of these technologies.

From an investment perspective, Hive Digital's transformation strategy has laid a solid foundation for its future growth. Although the company still has some layout in the field of cryptocurrency mining, with the rapid development of HPC and AI businesses, Hive has gradually gotten rid of its over-reliance on traditional Bitcoin mining and opened up more diversified and high-profit revenue channels.

3. Infrastructure and Solution Providers

Mining machine manufacturing/blockchain infrastructure concept stocks refer to stocks of companies that focus on Bitcoin mining hardware, blockchain infrastructure construction and related technical services. These companies mainly make profits by designing, manufacturing and selling specialized mining equipment (such as ASIC mining machines), providing cloud mining services, and operating the hardware infrastructure required for blockchain networks. Mining machine manufacturers are at the core of blockchain infrastructure because they provide hardware equipment for mining cryptocurrencies such as Bitcoin. ASIC (application-specific integrated circuit) mining machines are the most common type of mining machines, which are specifically used for mining cryptocurrencies. Mining machine manufacturers' revenue mainly comes from two sources: mining machine sales and mining machine hosting and cloud mining services.

Generally speaking, the price of mining machines is affected by many factors, including the volatility of the Bitcoin market, the cost of mining machine production, the stability of the supply chain, etc. For example, when the price of Bitcoin rises, the income of miners also increases, and the demand for mining machines usually rises accordingly, thereby driving the revenue growth of mining machine manufacturers. In addition to mining machine production, blockchain infrastructure also includes mining pools, data centers and other cloud service platforms that provide computing power support.

For investors, mining machine manufacturers and blockchain infrastructure companies may provide higher growth opportunities, especially when the cryptocurrency market is in an upswing. The demand for mining machines is positively correlated with the price of Bitcoin. However, such companies also face high volatility risks, which are affected by multiple factors such as market sentiment, technological innovation and policy supervision. Therefore, when investing in such concept stocks, in addition to having a positive view on the prospects of the cryptocurrency market, it is also necessary to consider the potential risks brought about by market uncertainty.

1. Canaan Technology (CAN)

Research and development of blockchain hardware products

Canaan Technology was founded in 2013. In the same year, it released the world's first blockchain computing device based on ASIC chips, leading the industry into the ASIC era. Since then, it has gradually accumulated rich experience in chip mass production. In 2016, the mass production of 16nm products marked Canaan Technology as the first company in the advanced process camp in mainland China. From 2018 to date, Canaan Technology has successively achieved the world's first mass production of self-developed 7nm chips, as well as mass production of the self-developed commercial edge intelligent computing chip K210 based on RISC-V.

Since its establishment, Canaan Technology has become an important player in the field of blockchain hardware with its leading ASIC mining machine technology and self-developed chips. Compared with other mining machine manufacturers, CAN and BTDR, which can increase mining profits with self-produced mining machines, have more potential benefits. In the past year, despite the bear market, Canaan Technology's mining machine sales have remained at a high level, especially against the backdrop of the rebound in Bitcoin prices, and future sales are expected to increase significantly.

The biggest potential positive factor is the change in the price of mining machines. If the price of mining machines rises, for example due to unexpected demand or limited supply, the increase in the price of mining machines may lead to an increase in the valuation multiples of mining companies, thus forming a "Davis double-click" effect and increasing the overall valuation of the company. CAN recently signed two important institutional orders, among which HIVE purchased 6,500 Avalon A1566 mining machines, which will further promote its sales and revenue growth, and also demonstrate the market's recognition and demand for its mining machines.

Judging from Canaan's fundamentals and market expectations, the current stock price does not fully reflect its future potential. Assuming the Bitcoin market picks up and the price of mining machines remains stable or rises, Canaan's sales revenue and profits will see a significant increase, further driving its valuation upward.

2. Bitdeer (BTDR)

Provide cloud mining services and mining machine manufacturing

Bitdeer provides global cryptocurrency mining computing power, allowing users to rent computing resources for Bitcoin mining. The company provides computing power sharing solutions, including cloud computing power and computing power market, and provides one-stop mining machine hosting services, covering deployment, maintenance and management to support efficient cryptocurrency mining.

Recently, Bitdeer released its new generation of water-cooled mining machine SEALMINER A2 as the second-generation product of the SEALMINER series. The SEALMINER A2 mining machine is equipped with the second-generation chip SEAL02 independently developed by Bitdeer. Compared with the A1 series, A2 has achieved significant improvements in energy efficiency, technical performance and stability. The A2 series includes two models, air-cooled SEALMINER A2 and water-cooled SEALMINER A2 Hydro, designed to meet the mining needs in different environments. Both mining machines use advanced heat dissipation technology to optimize power consumption control and computing power performance to ensure stable operation under high load. According to test data, the energy efficiency of A2 is 16.5 J/TH, and the computing power reaches 226 TH/s, which is slightly lower than the 13.5 J/TH of mainstream mining machines on the market such as Bitmain and MicroBT. The company also stated that A2 has entered the mass production stage and is expected to increase the computing power by 3.4 EH/s in early 2025. Bitdeer also plans to complete the tape-out design of the SEAL03 chip in the fourth quarter, with a target energy efficiency of 10 J/TH.

Overall, Bitdeer is in a critical period of innovation and growth, especially in the field of water-cooled mining machines and computing power sharing. It is worth noting that as a cloud mining platform, it provides computing power leasing and hosting services, not just traditional mining machine sales. Unlike traditional mining machine manufacturing companies, cloud mining and hosting companies are more flexible in capital and resource allocation, and can expand market share and adapt to investment needs of different sizes by providing users with on-demand computing resources. Therefore, although the overall trend of the cryptocurrency market has an impact on Bitdeer's performance, the diversity and innovation of its business model may enable it to remain relatively stable in market fluctuations.

3. BitFuFu(FUFU)

Cloud mining services and digital asset management services

BitFuFu is a Bitcoin mining and cloud mining company supported by Bitmain, dedicated to providing cloud mining services to users around the world, allowing users to participate in Bitcoin mining without purchasing hardware. According to the latest third-quarter financial report, BitFuFu holds about $104 million in digital assets, equivalent to 1,600 Bitcoins. 340 Bitcoins belong to the company, and the rest belong to customers of cloud mining and hosting services. BitFuFu is not only a service provider in the field of Bitcoin mining, but also an important Bitcoin asset manager.

In addition, BitFuFu has reached a two-year credit agreement with Antpool, a subsidiary of Bitmain, with a maximum loan amount of US$100 million. This credit agreement further consolidates the partnership between BitFuFu and Antpool and enhances its flexibility in capital operations. With the volatility of the Bitcoin market, more and more Bitcoin mining companies (such as MARA and CleanSpark) have also begun to adopt financing methods such as Bitcoin mortgages, flexibly using their Bitcoin assets to support business development and capital expansion.

From an investment perspective, BitFuFu has the support of Bitmain and Ant Pool, which gives it unique advantages in hardware supply and computing resources, and can provide BitFuFu with efficient and stable mining equipment, and help it optimize mine operations and mining pool support. Therefore, BitFuFu has obvious technical and resource advantages in the field of cloud mining, which can attract more users and capital.

Overall, as the Bitcoin market gradually recovers and the demand for cloud mining increases, BitFuFu will likely benefit from this trend. Compared with traditional mining companies, cloud mining allows investors to participate in Bitcoin mining at a lower cost, especially for users who do not have hardware resources.

4. Exchange Concept:

1. Coinbase (COIN)

Cryptocurrency trading platform, digital currency trading and storage services

Founded in 2012 and listed on Nasdaq in 2021, Coinbase is the first and only legally compliant listed cryptocurrency exchange in the United States. This status makes it the largest cryptocurrency exchange in the United States by trading volume, and it also attracts many institutions to choose it as the preferred platform for custody of crypto assets.

Coinbase and Circle jointly issued the USDC stablecoin pegged to the US dollar, and expanded diversified businesses such as pledge custody. In addition, Coinbase is also the core holding of ARK Invest fund manager Cathie Wood Wood, who has publicly expressed her optimism about it many times.

Coinbase's stock price trend is highly correlated with Bitcoin. For example, its historical high occurred on November 8, 2021, which almost coincided with Bitcoin's historical high (November 10, 2021). At the recent low (November 21, 2022), the stock price bottomed out simultaneously with the Bitcoin price. From the high of $368.9 in 2021 to the low of $40.61, the stock price fell by as much as 89%, and the fluctuation range even exceeded the 78% drop in Bitcoin during the same period, reflecting the amplified leverage effect of Coinbase in the crypto market.

In the past six months, the fluctuations in Coinbase's stock price have been mainly affected by regulatory pressure and the approval process of the Bitcoin ETF. In 2023, the approval of the Bitcoin ETF was initially considered a major positive, but the market subsequently worried that such products might have a diversion effect on Coinbase's traditional business model, causing the stock price to fall back. Nevertheless, the market dynamics after the election have brought benefits to Coinbase.

As Trump won the election, his cryptocurrency-friendly policy expectations boosted market confidence and pushed Coinbase's stock price up rapidly. The stock price briefly dropped to $185 at the beginning of the election, but eventually soared to around $329. It can be expected that in the relatively closed and compliant crypto market in the United States, the demand for Bitcoin investment by ordinary investors will continue to benefit Coinbase. As the leading company of legal exchanges in the United States, Coinbase has relatively solid fundamentals, and its highly compliant identity gives it a greater advantage when policies are favorable. In the future, as more ordinary investors enter the market, Coinbase may attract large-scale traffic.

2. Bakkt Holdings (BKKT)

Bakkt is a leading cryptocurrency platform dedicated to providing compliant crypto asset custody and trading services to institutional investors. The company holds a crypto asset custody license issued by the New York State Department of Financial Services (NYDFS). Due to security incidents on multiple crypto asset custody platforms in recent years, Bakkt has won trust, especially among institutional clients, with its compliance and strong regulatory background.

Bakkt was originally founded by Intercontinental Exchange Group (ICE), and later spun off into an independent listed company, demonstrating the combination of traditional finance and the crypto economy. Recently, Bakkt's stock price has experienced a significant rise, mainly due to Trump's Media and Technology Group (DJT) plan to acquire Bakkt in full. According to the Financial Times, Trump's company DJT is in in-depth acquisition negotiations with Bakkt. If the acquisition plan is successful, it will further advance Trump's layout in the cryptocurrency market and provide Bakkt with financial support and more development opportunities.

Bakkt's stock price soared 162% on the day the news was released, and continued to rise by more than 15% in after-hours trading. DJT's stock price also rose by about 16.7%. In addition, Bakkt's market value before the acquisition was slightly over $150 million, a valuation based on the company's financial performance over the past period and the volatility of the crypto market. Although Bakkt's revenue did not meet expectations (in the three months ending September 30, the company had revenue of $328,000 and an operating loss of $27,000).

From an investment perspective, Bakkt is a company with great potential but still faces challenges. First, Bakkt has unique advantages in compliance and institutional services, especially as institutional investors gradually join the market. Second, Bakkt's stock price has risen sharply recently, mainly benefiting from the Trump Group's acquisition intention. This acquisition will provide Bakkt with more funds and resources, and it is possible to accelerate its development in the field of cryptocurrency trading. However, Bakkt's past profitability has not been good, and its main income comes from crypto asset custody and trading services, and the growth potential of these businesses remains uncertain. Therefore, when investing in Bakkt, it is necessary to consider the sustainability of its profit model and the intensity of market competition.

5. Payment concept:

Block (SQ)

A payment service provider founded in 2009, formerly known as Square. As early as 2014, Square began to accept Bitcoin as a payment method, and Square has been active in the Bitcoin field since 2018. Since 2020, Block has purchased a large amount of Bitcoin for payment services and as a company asset reserve. Financial report for the third quarter of fiscal year 2024. This quarter, Block's total net revenue reached US$5.976 billion, a steady increase of 6% compared with US$5.617 billion in the same period last year. Excluding Bitcoin-related revenue, total net revenue increased to US$3.55 billion, an increase of 11% year-on-year. Net profit turned from a net loss of US$93.5 million in the same period last year to a profit of US$281 million, a year-on-year increase of 402.1%;

Square's business has strong application support, good asset reserves, and stable cash flow, making it one of the more stable concept stocks. On this basis, influenced by the certainty of Trump's election that is favorable to Bitcoin, Square has achieved a 24% increase in the past half month.

As a payment concept stock, if you pay attention to Block, you can also pay attention to PayPal. As we all know, PayPal, as a global payment giant, provides digital payment services to merchants and consumers around the world. They have also shown a strong interest in the field of blockchain technology in recent years, and their representative initiatives include the stablecoin PayPal USD (PYUSD) launched in 2023. This is an Ethereum-based, dollar-backed stablecoin, which is one of PayPal's core strategies in integrating digital payments with blockchain. PayPal also used PYUSD for the first time to invest in blockchain, supporting Mesh, a company focused on digital asset transfer and embedded financial platforms.

In contrast, Block’s focus in the blockchain space is more focused on Bitcoin, integrating it into payment services and company asset reserves.

VI. Summary :

The demand for blockchain concept stocks is growing rapidly, and may even surpass the demand for traditional technology stocks and cryptocurrencies themselves. As blockchain gradually expands from the initial cryptocurrency applications to a wider range of industry solutions, the market demand for related technologies and infrastructure has also increased significantly. Compared with traditional technology stocks, blockchain concept stocks have more prominent growth potential because they not only rely on continuous technological innovation, but are also closely related to the digital transformation and decentralization trend of the global financial market.

With the maturity of blockchain technology and the optimization of the policy environment, the market prospects of blockchain concept stocks will become clearer. Especially in the context of the gradual clarification of the regulatory policies of governments around the world on crypto assets, blockchain companies are expected to usher in explosive growth on the basis of compliance. We expect more traditional industries to begin to adopt blockchain technology, promoting technological innovation and market demand in this field. Waterdrip Capital will also continue to be optimistic about the long-term development potential of the blockchain field, closely follow related companies and their technological progress, and actively invest in it. In the next few years, blockchain concept stocks are expected to become one of the most attractive investment directions in the global capital market.