Author: BitpushNews

On Wednesday, the latest October core PCE price index in the US rose 2.8% year-on-year, in line with expectations, but still higher than the Federal Reserve's 2% target. This data further exacerbated market concerns about persistently high inflation and raised questions about the effectiveness of the Federal Reserve's monetary policy tightening.

Tavi Costa, macro strategist at Crescat Capital, said the Federal Reserve is facing a tricky policy dilemma. He warned that the risk of a second wave of inflation appears to be brewing. If this materializes, the Federal Reserve will face a difficult choice: further rate hikes could exacerbate the government's debt burden, while slowing the pace of rate hikes could lead to uncontrolled inflation.

US stocks fell in response, while the crypto market bucked the trend

Faced with inflationary pressures and uncertainty over Federal Reserve policy, traditional financial markets have been cautious. The three major US stock indexes all fell. At the close, the S&P 500 index, Dow Jones index and Nasdaq index fell 0.42%, 0.30% and 0.66% respectively.

However, the crypto market has shown strong resilience. The price of BTC rose sharply on Wednesday, breaking through the $97,000 mark, and ETH rose more than 10%, hitting a new high in months. ETH (ETH) rose 10%, reaching a high of $3,687.01 during the day, the highest since June.

The top 200 tokens by market cap generally rose. Among them, Kadena (KDA) led the gains with 25.3%, followed by Uniswap (UNI) with 23.7% and PancakeSwap (CAKE) with 22%.

The total market cap of cryptocurrencies is currently $3.34 trillion, with BTC accounting for 57.1% of the market.

Capital rotation, has the altcoin season arrived?

Coinglass data shows that the ETH ETF has recorded positive net inflows for three consecutive days, with a net inflow of $406 million on Tuesday. This trend is in stark contrast to the continued net outflows from the BTC ETF. QCP Capital analysts point out that the market is shifting capital from BTC to ETH and altcoins. In addition to investors' expectations of an altcoin season, this phenomenon is also closely related to the strong performance of ETH's own ecosystem development and the derivatives market.

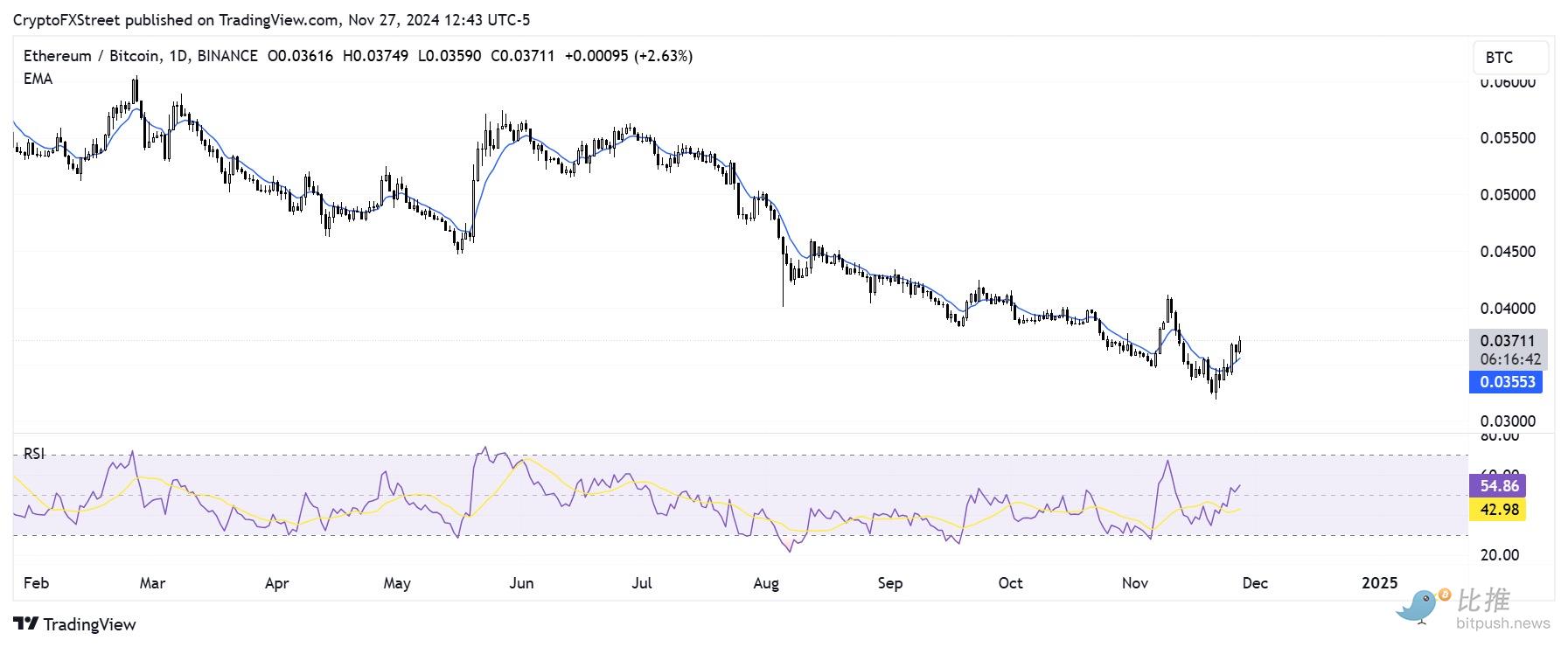

Analysts said: "After the BTC decline, ETH is making a comeback, and there are signs that the market is shifting capital to ETH and altcoins." Since hitting a low of $0.3204 on November 21, the ETH/BTC ratio (a measure of ETH's performance relative to BTC) has soared by more than 15%.

The rise in ETH is accompanied by a strong bullish sentiment in its derivatives market. According to Coinglass data, ETH's open interest (OI) hit a record high of 6.55 million ETH on Wednesday, worth $23.34 billion, continuing the growth trend of the past two weeks. In addition, Velo's data shows that the three-month premium of ETH (the difference between its futures price and spot price) on crypto exchanges Binance, OKX and Deribit has soared to 16%.

While the market is generally optimistic about the arrival of the altcoin season, CryptoQuant founder and CEO Ki Young Ju believes that the altcoin season may be delayed due to a lack of new retail capital. Ki Young Ju said: "For altcoins to reach new all-time highs in market cap, a large influx of new capital into crypto exchanges is needed. The fact that altcoin market cap is below previous all-time highs indicates a decrease in liquidity from new exchange users."

The analyst concluded that altcoins should focus on developing independent strategies to attract new capital, rather than relying on the momentum of BTC, but he remains "optimistic" about altcoins.