BTC reached a new all-time high of $98,800 on November 25, but then experienced a more pronounced correction, dropping to as low as $90,800 on Wednesday (27).

Just as the market expected it might break below the $90,000 level before rebounding, BTC rebounded to $97,200 yesterday (28), and is currently trading at $95,482, continuing to fluctuate and holding the $95,000 level, down slightly 0.68% in the last 24 hours.

After reaching a high of $3,680 yesterday, ETH has continued to fluctuate in the $3,500-$3,600 range in the last 24 hours, currently trading at $3,564, down 1.6%.

90,000 USD or a Temporary Bottom for BTC

As November is about to end, the market's celebratory mood over Trump's victory seems to have gradually subsided. Regarding the market conditions of BTC, Cointelegraph reported on the 28th that there are currently three signs that may indicate $90,000 has formed a temporary bottom for BTC.

1. Coinbase BTC Premium

The Coinbase BTC premium refers to the premium of the BTC price denominated in USD on the US-listed exchange Coinbase compared to the BTC price on other exchanges like Binance. As BTC fell from $98,800 to $90,800, the Coinbase premium has also declined. However, the Coinbase BTC premium has now risen again, indicating that the demand for BTC (especially in the US) has increased again.

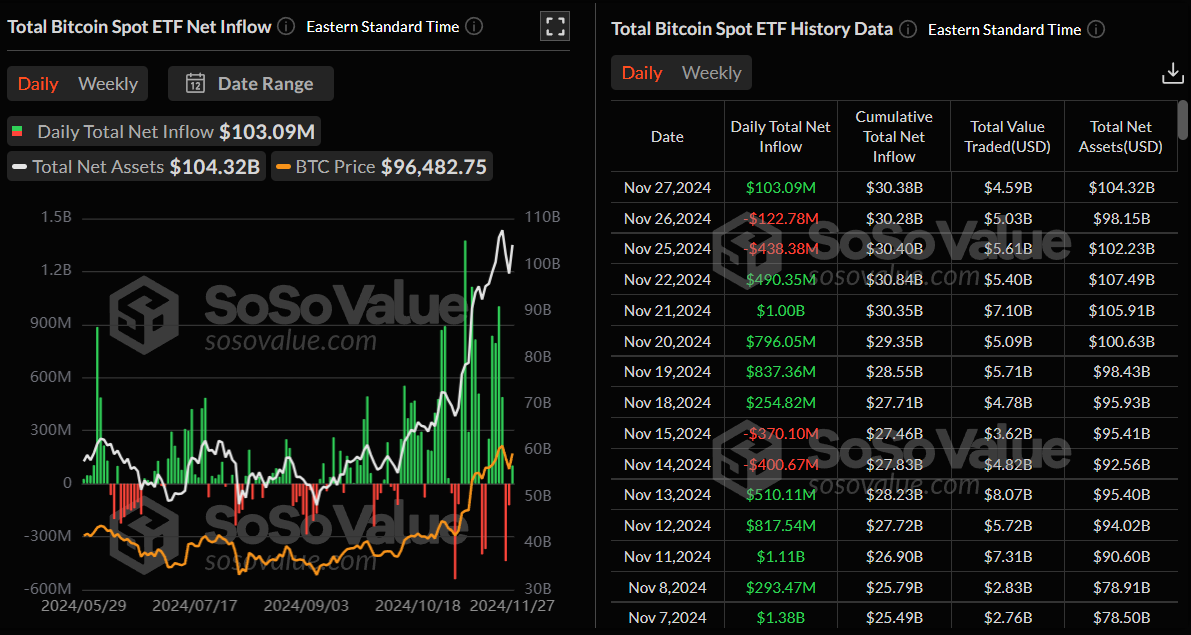

2. BTC Spot ETFs Turned to Net Inflows

According to data from Sosovalue, during the correction on the 25th and 26th, US BTC spot ETFs also showed net capital outflows, totaling as high as $560 million. However, on November 27, BTC spot ETFs saw net capital inflows again.

3. Exchange BTC Balances Hit New Lows

Finally, according to data from CryptoQuant, the BTC balances on centralized exchanges have hit new all-time lows again, and this usually means that investors are more willing to withdraw BTC to cold wallets for long-term holding, indicating a bullish sentiment in the market.

Kaiko: ETF Options Show the Latest Bullish Signal

Cryptocurrency data provider Kaiko also released a report stating that BTC ETF options are showing the latest bullish signal. Kaiko explained that several BTC ETF options were launched last week, and the Blackrock IBIT option alone reached a notional trading volume of $1.9 billion on the first day, while the first BTC ETF launched in 2021 (Bitcoin Strategy ETF, BITO) had a trading volume of only $360 million at launch, indicating a strong demand and bullish sentiment in the market for BTC and its derivatives.

Additionally, in the first day of trading for the IBIT options, 80% were call options, and Kaiko analyzed:

The launch of BTC spot ETF options will continue to accelerate institutional adoption of BTC. These tools allow investors to hedge risks and develop complex trading strategies to profit from BTC volatility, and a new wave of capital and experienced institutions will rush in.

BTC Whales Accumulated 10,000 BTC During the Correction

Finally, according to on-chain data analyst @ali_charts, during the recent correction of BTC from $99,000 to $90,000, BTC whales have again accumulated over 10,000 BTC, indicating that the whales seem to believe the current price has not yet reached a cyclical high.