Author: 0xLeoDeng, LK Venture Partner & Investment Lead

How to find the most promising targets among millions of Memecoins?

In the crypto world, Memecoins are an endless drama. They perfectly blend internet culture and cryptocurrencies, from the early $Doge to $Shiba Inu, and then to newcomers like $GOAT and $PNUT. These seemingly "unserious" projects have created billions of dollars in market value. However, behind this frenzy, there are also countless "shit coins" and scams.

The value of Memecoins comes not only from community consensus and the power of network propagation, but also from the faith of holders - the so-called "Diamond Hands" investment attitude. In the extreme market fluctuations, Diamond Hands symbolize unwavering confidence and long-term optimism about the asset. "Diamond Hands" is not just an investor label, but a manifestation of a belief. When the market fluctuates, only steadfast holders can seize the opportunity for the next outbreak.

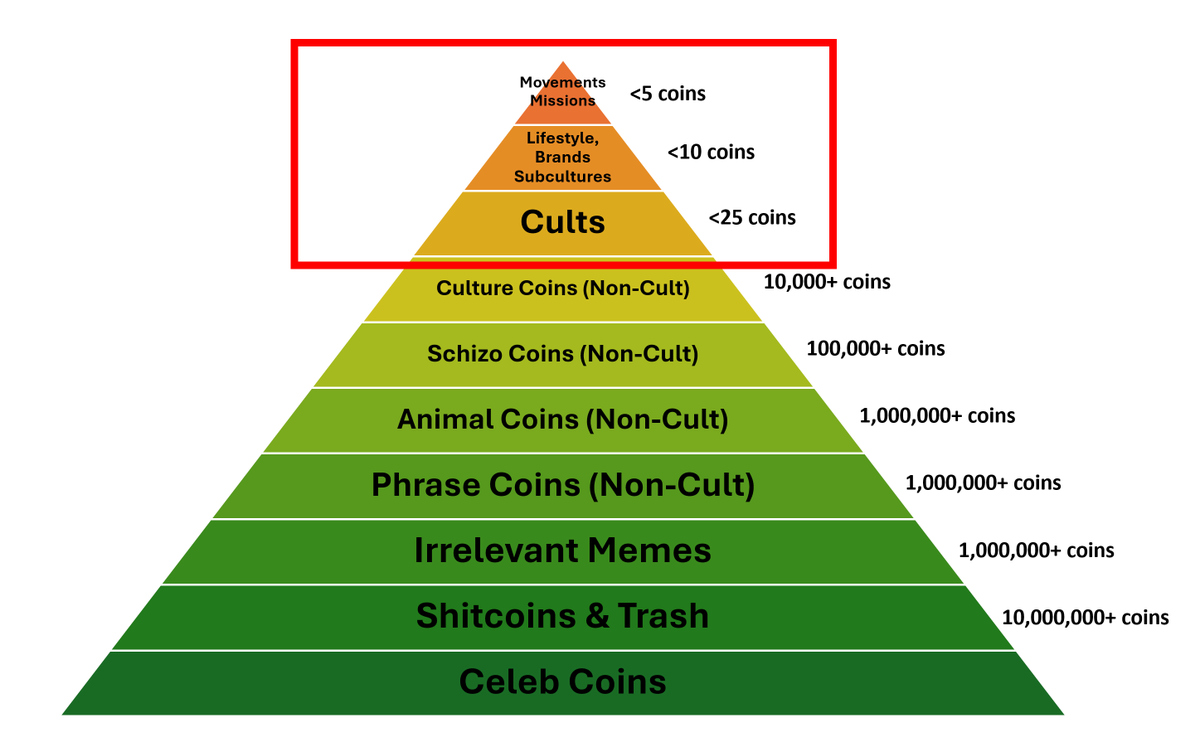

So, how do we define the value of Memecoins? How can Diamond Hands find potential targets among millions of coins? Let's start with a "pyramid chart" and gradually unravel this puzzle.

I. The Pyramid Ecology of Memecoins

Image link:

https://x.com/MustStopMurad/status/1851690032639148044

The above image is a Meme ecosystem pyramid provided by Murad, which well illustrates the different levels and value logic of Memecoins. From the bottom "shit coins" to the top "faith coins", each layer represents different narrative depth and market positioning:

1. Bottom Layer: Celeb Coins, Shit Coins & Trash

Characteristics: Purely relying on hot spots or celebrity effects to hype, with almost no technical support and no actual application scenarios, surviving only on short-term traffic.

Examples: Celeb Coins (celebrity coins), purely riding on celebrity heat; Shit Coins & Trash: no innovation, quickly launched to raise funds.

Comments: These coins are like "one-time internet celebrities", their fame fades and their value quickly drops to zero.

2. Irrelevant Memes

Characteristics: Funny themes, absurd content, but no clear narrative and community support.

Examples: GrumpyCatCoin (based on the angry cartoon cat expression); Some Pepe Forks (strong bandwagon effect, no uniqueness).

Comments: Although these coins may initially attract some interesting attention, they lack long-term value and are destined to be short-term phenomena.

3. Phrase Coins (Non-Cult)

Characteristics: Using popular crypto phrases as themes to attract attention, but only staying at the conceptual stage.

Examples: WenLamboCoin: based on the "Wen Lambo" crypto meme (when will I buy a Lamborghini); HODLToken, borrowing the "Hold On for Dear Life" crypto term.

Comments: Phrase coins are more about playing on memes, and may ignite investment enthusiasm in the short term, but have limited long-term development potential.

4. Animal Coins (Non-Cult)

Characteristics: Themed around animals, with higher entertainment value and propagation, with some community support, but lacking strong narratives.

Examples: TigerKingCoin: based on the Netflix documentary "Tiger King"; BabyDogeCoin: self-proclaimed as the "son" of Dogecoin.

Comments: Animal coins have a certain community driving force, but if there is no further innovation or branding, they are easily forgotten.

5. Schizo Coins (Non-Cult)

Characteristics: Themes often have absurd, surreal or niche cultural elements, attracting specific audiences, but with limited market scope.

Examples: FlokiCoin: derived from Musk's dog name "Floki", briefly exploded; CultDAO: tried to build a "cult" culture, but the long-term influence is limited.

Comments: Although these coins have unique niche charm, most of them are difficult to break through the circle limitations.

6. Culture Coins (Non-Cult)

Characteristics: Combining internet subcultures or specific circle cultures, with certain narratives and community support, but not yet fully formed "faith" level.

Examples: PEPE: based on the famous Pepe frog meme culture; POPCAT: the world's first Memecoin themed on the "Popcat" click game meme.

Comments: These coins are based on specific cultures, attracting a relatively stable fan base, but need deeper narratives to break through development bottlenecks.

7. Cults: Lifestyle, Brands, Subcultures (Faith Level)

(1) Lifestyle, Brands, Subcultures

Characteristics: No longer just coins, but symbols of lifestyle and brands, attracting highly loyal followers.

Example: Shiba Inu: Starting from an animal coin, it has developed into a branded Memecoin with a complete DeFi and Non-Fungible Token ecosystem.

Comments: These coins have transitioned from speculation to "brand building", and are starting to create long-term value.

(2) Movements, Missions

Characteristics: The narratives of these coins have already transcended cryptocurrencies, representing a social goal or cultural movement.

Example: Dogecoin: From a "joke coin" to an "decentralized people's currency", figures like Musk have endowed it with a strong sense of mission.

Comments: The top Memecoins are not just investment targets, but carriers of cultural beliefs. Only Memecoins with social goals or cultural movements can have the opportunity to harvest billions of dollars in consensus value.

Pyramid Summary: The Success Rules of Memecoins

Bottom-layer coins: Shit coins, meaningless Memecoins, relying only on hot spots or short-term traffic, with extremely short life cycles.

Middle-layer coins: Culture coins, animal coins, with certain community support and narratives, but lacking enough innovation.

Top-layer coins: Faith coins, with strong narratives, loyal communities, and brand potential, becoming cultural symbols.

The Core Logic Behind the Pyramid: Narrative + Community + Innovation

Narrative is the foundation: Top Memecoins all have a powerful story that makes people remember and participate, such as Dogecoin's "decentralized people's currency" story.

Community is the key: Without an active community, there is no Memecoin heat. The loyalty of the SHIBA Army is the core of Shiba Inu's success.

Traffic determines life and death: From Musk's tweets to viral spread on Reddit, traffic is the lifeline of Memecoins.

However, even knowing these core logics, it is still like finding a needle in a haystack to pick out truly promising Memecoin projects from the many. This is why we need a simple and effective screening rule.

II: M.E.M.E. Principle: How to Choose More Valuable Memecoins

When choosing more valuable Memecoins, I have summarized a memorable "M.E.M.E. Principle" to help everyone find opportunities in the chaos:

1. M - Mission (Mission and Narrative)

- Is the story interesting and easy to spread?

- Does it combine culture or emotions to form a sense of belonging?

- Is there a clear value proposition?

Memecoins with a strong sense of mission can create emotional resonance with investors and make them willing to hold them long-term.

2. E - Engagement (Community Participation)

- Can it attract users to participate in interesting activities?

- Is the community size growing?

- HODL > Transactions, a large number of "Diamond Hands"

The community is the heart of a Memecoin. Without an active community, there is no real Memecoin. People should stop trying to find the next 100x token and instead look for the next 100x growth community.

3. M - Momentum (Market Heat and Liquidity)

- Is there celebrity support or event heat?

- Is the trading volume and liquidity sufficient?

- Is there sustained topic heat, rather than a one-time surge?

Market heat is the first step to opening investors' wallets. Without media attention and capital liquidity, nothing can be discussed.

4. E - Evolution (Innovation and Ecosystem Development)

- Does it combine new industry hotspots (such as AI/DeSc)?

- Does it explore the extension and implementation of offline scenarios?

Only Memecoins that can continuously evolve can survive in the long-term competition.

Case Analysis

Based on the M.E.M.E. Principle, Memecoins with development potential can be divided into three categories according to their risk and return characteristics: 1. Low risk, stable return; 2. Medium risk, medium return; 3. High risk, high return.

The following is a list of Memecoins screened and summarized according to the M.E.M.E. Principle, with the help of Chatgpt (for model analysis reference only, not investment advice):

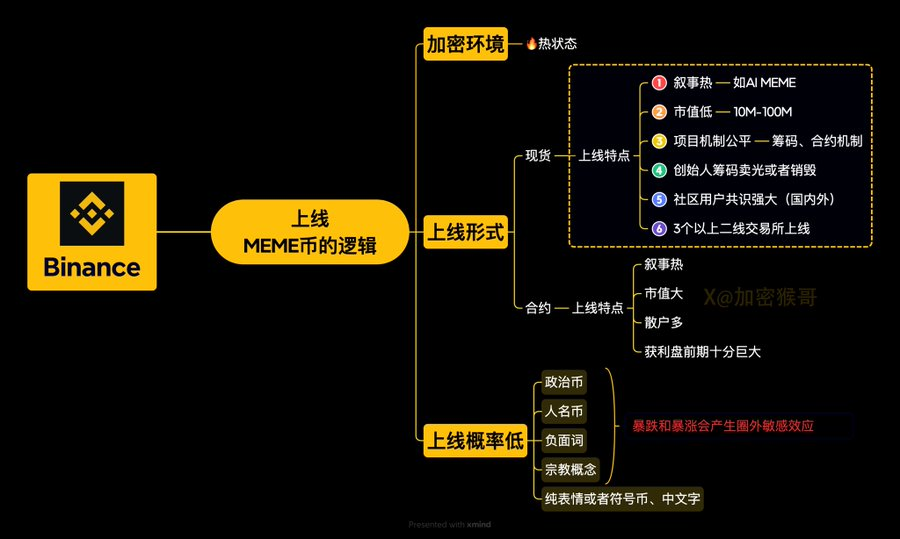

Finally, here is the "Logic of Binance Listing Memecoins" diagram compiled by Crypto Monkey, which you can also refer to.

Original link:

https://x.com/monkeyjiang/status/1856607604429963673

Choosing Memecoins, Finding Order in Chaos

The world of Memecoins is a fascinating field, from shit coins to faith coins, they reflect the diversity of crypto culture and the human pursuit of narratives.

Murad called the bull market since 2024 the "People's Bull Market", the most important wealth creation opportunity for retail investors since the early days of Bitcoin, and in this cycle we will see more than 10 Memecoin prices break through $10B.

I hope that through the hierarchical analysis of the pyramid and the M.E.M.E. Principle, I can help everyone better understand the value and risks of these Memecoins, find their own wealth code, and become "Diamond Hands" in the Meme world.