Ripple is preparing to launch its regulated stablecoin RLUSD, and approval from the New York Department of Financial Services (NYDFS) is expected soon.

According to a FOX Business report, the company is tentatively planning a December 4th launch. This will be an important step in Ripple's expansion into New York's strict digital finance market.

Ripple Stablecoin, Regulated Entry into the US Crypto Market

Ripple's entry into the stablecoin market will put it in direct competition with existing US issuers like Circle, Paxos, and Gemini.

Once approved, Ripple will be able to offer RLUSD as a stable and regulated digital currency alternative to XRP. This may be attractive to customers seeking to avoid the volatility and regulatory issues associated with other cryptocurrencies.

Meanwhile, New York remains an important market for stablecoin issuers. The state maintains a regulatory framework for such assets. The NYDFS imposes strict requirements including transparency, security, and consumer protection standards.

"XRP is 1,000 times faster and 1,000 times cheaper than Bitcoin. Combined with Ripple's soon-to-be-launched RLUSD stablecoin, this is a tool that the US Treasury Department has recently considered an important liquidity product backed by US Treasuries. The US and the world can avoid economic turmoil and destruction." – Rob Cunningham wrote on X (formerly Twitter).

Companies like Ripple are seeking limited-purpose trust charters to provide digital asset services without the broad oversight faced by traditional banks. Other companies like Coinbase and Robinhood operate cryptocurrency trading and custody services under New York's BitLicense.

Ripple's stablecoin launch will also involve partnerships with payment providers like Bitstamp, Moonpay, and Uphold. This will ensure wide accessibility for users once the product is launched.

"RLUSD only exists on the XRP Ledger and is not multi-chain. It is designed for institutional settlements at bank branches, and will compete with USDT/USDC in cross-border payments." – Influencer Martin Polvora wrote on X (formerly Twitter).

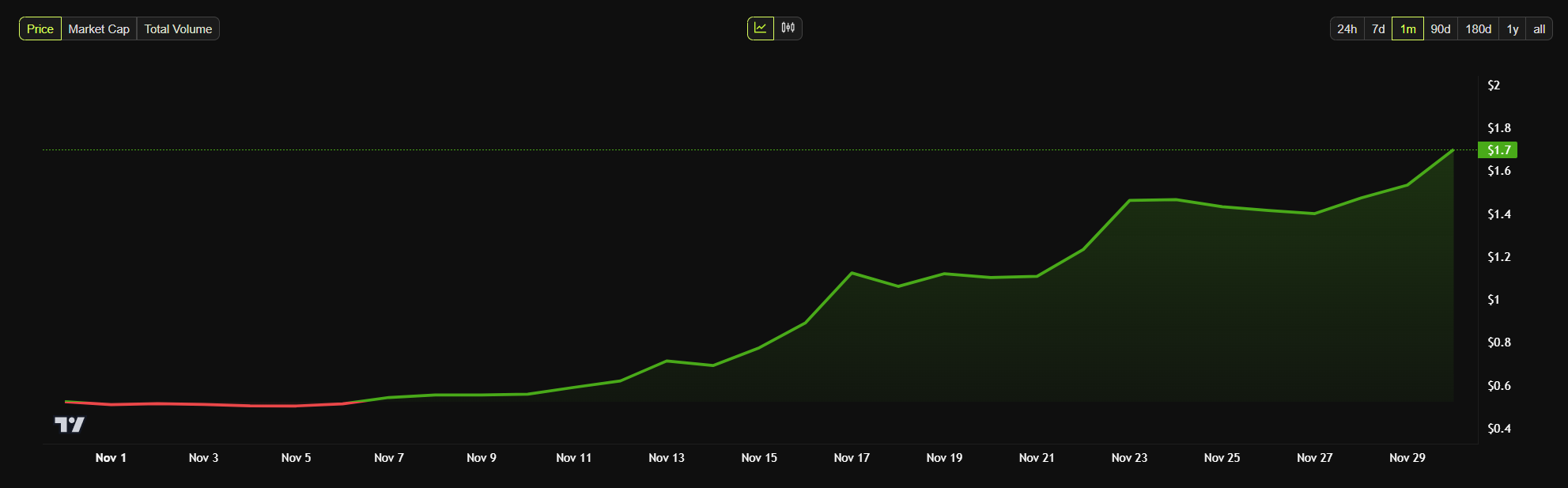

XRP Market Surge, Reflecting Optimistic Sentiment

Ripple's XRP token has recently become the fifth-largest cryptocurrency by market capitalization, overtaking BNB. Earlier today, this altcoin crossed the $100 billion mark for the first time in 3 years.

Overall, the value of XRP has risen by over 230% during November. This has been primarily driven by increased investor confidence and broader bullish momentum in the market.

The recent resignation of SEC Chair Gary Gensler has further bolstered the bullish sentiment around Ripple. Gensler's departure has sparked speculation that Ripple may face reduced regulatory pressure from the SEC, which has historically targeted the company.

Institutional interest in XRP is also on the rise. Last week, WisdomTree filed for an XRP ETF in Delaware, the third such application following similar filings by Bitwise and Canary Capital in October.