As the price of BTC approaches the $100,000 threshold, it is poised to reach a historic milestone. This significant price increase has fueled investor optimism and confirmed BTC's dominance in the cryptocurrency market.

VX: TTZS6308

However, despite the positive outlook, BTC is not entirely immune to potential downward pressure. The factors maintaining BTC's price stability - long-term holders (LTH) - are showing signs of volatility, raising concerns about the possibility of a short-term price decline.

Wavering Confidence of Long-Term Investors

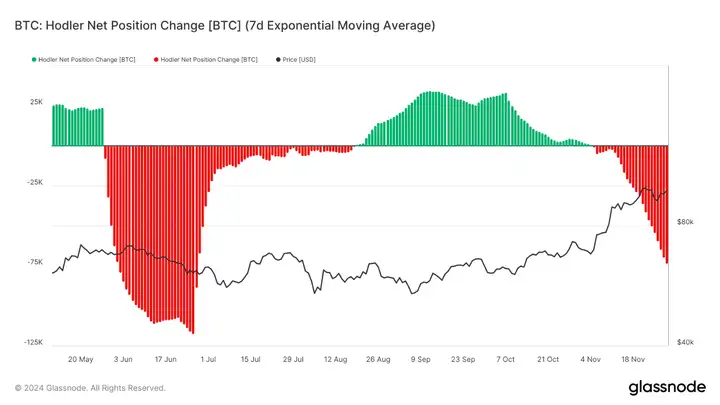

Recently, long-term BTC investors have shown signs of pessimism. The HODLer Net Position Change indicator, which tracks LTH behavior, has turned negative.

This change indicates that a large number of long-term investors are taking profits. Negative values in this indicator typically suggest a decline in confidence, which could put downward pressure on BTC.

Since LTH are considered the pillars of BTC's price, their selling could disrupt market momentum. These investors often hold assets during market volatility, helping to maintain price stability.

When they start selling, this could lead to increased price fluctuations. If this trend continues, it could result in a price adjustment, especially as BTC approaches the $100,000 threshold.

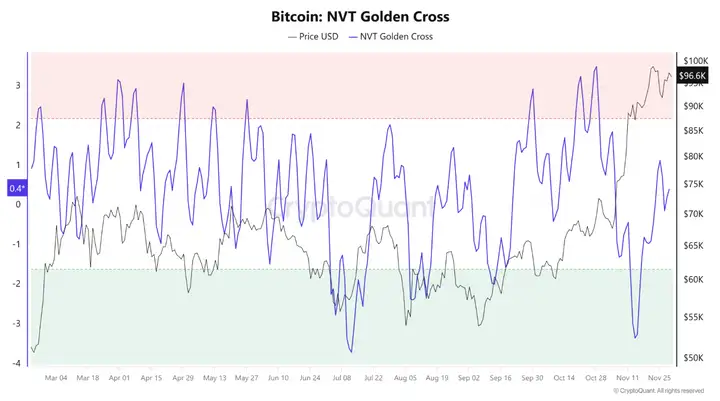

Although LTH are temporarily pessimistic, BTC's macroeconomic momentum remains strong. An important indicator to watch is the BTC Network Value to Transactions (NVT) Golden Cross, which is currently in the neutral zone.

Although it has not yet entered the bullish zone (below -1.6), the NVT Golden Cross indicator is still an important signal for BTC's future price trend. History shows that when the NVT indicator crosses the pessimistic zone (above 2.2), the market often views this as a sell signal.

Currently, BTC has not reached this pessimistic zone, indicating that there is still room for growth. The NVT Golden Cross indicator continues to provide positive signals, confirming that BTC has enough momentum to continue its upward trend before facing any significant downward pressure.

As long as the NVT indicator remains firmly in the neutral zone, BTC still has a chance to conquer the $100,000 mark without facing immediate downward pressure.

BTC Price Reaches Historic Levels

The BTC price is currently fluctuating around $96,572, approaching the historic $100,000 threshold. Due to institutional interest and growing adoption, the token has recorded strong momentum in recent weeks. If the current trend continues, BTC may break through this psychological barrier and reach a new high of $99,595.

If the $100,000 threshold is exceeded, the next target could be $120,000. Successfully conquering the $100,000 mark could trigger a stronger wave of buying from retail and institutional investors. However, the risk of profit-taking by LTH remains a concern, as any significant sell-off could lead to a temporary adjustment.

Despite short-term concerns, the overall trend for BTC remains optimistic. The recent NVT Golden Cross indicator suggests that the $100,000 target is still achievable. As long as BTC remains above key support levels, its long-term prospects remain positive.

While the selling activity of LTH may cause some volatility, unless there is a major disruption in the market, BTC is likely to continue its growth trend in the coming months.

On weekends, when U.S. institutional players are not in the market, the trading volume of ETH and XRP, which are second and fifth on the volume leaderboard, respectively, has exceeded that of BTC, indicating a certain FOMO sentiment in the market and a relatively obvious seesaw effect, where BTC is weak and others are strong. This is a typical bull market money-making effect, and as long as BTC holds its ground, the chaos will continue.

The main issue at the moment is that if BTC continues to push above $100,000 in December, the probability of a short-term top will increase. From the sentiment outside the market, a large number of potential external investors are starting to become curious about BTC, and it seems that everyone is discussing BTC. Based on past cycles, this is often a relatively high position, and it cannot be ruled out that after the external capital comes in, there will be another crazy surge, and then a top. Another scenario is that it starts to correct from this position, enters a consolidation in December, and then reopens the bull market after Trump takes office in January, in which case the high will be even higher. As for how the market chooses, we need to further observe and confirm.

But there is no doubt that regardless of the trajectory, the cost-effectiveness of getting on board BTC at this level is relatively low. How long the Altcoins can continue to fluctuate depends on the performance of the top few big guys. As long as the capital can withstand it, the smaller coins can continue to fluctuate, after all, their market caps are not high, and a surge is not excessive. Another detail to note is that the MEME coins in the leading group have started to cool down recently, and the adjustment of the leading sector often precedes other sectors, while the catch-up of the rear often belongs to the end of an upward cycle. There may still be a surge later, but everyone should be careful about the risks that may come at any time. Don't forget that the crypto market does not just fall, but each time it falls, it is a crash. Getting through it once means you can make a lot more money than others. Don't worry about the last few cents, and it is more solid to move forward steadily.