Author: Socra, Jinse Finance

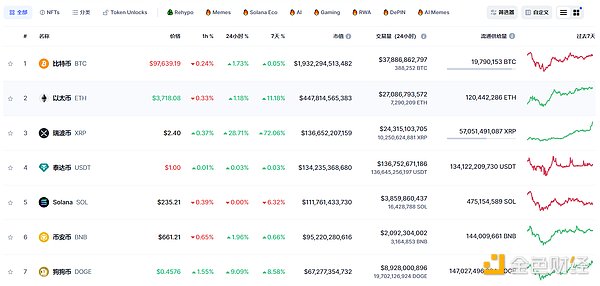

On December 2, the market capitalization of XRP surpassed USDT and Solana, ranking third in the cryptocurrency market capitalization list, and even surpassed Pinduoduo, rising to the 138th position among global mainstream assets.

With the surge of XRP breaking through $2, it has also successfully set a new high since April 2021. Just before the takeoff of XRP, the CEO of Ripple had stated that the Trump administration would bring new hope to the crypto industry, and XRP might usher in a turning point. The surprising thing for many investors is that this turning point came quickly and fiercely, with XRP's price surging by 400% in the past month. However, with such a high increase, can one still get on board with XRP?

I. XRP's Old Tree Blossoms

In early November this year, the price of XRP had been hovering around $0.5. But after the Ripple CEO's statement on November 10 that Trump might bring a turning point for XRP, the price of XRP really took off.

According to CoinMarketCap data, as of the time of writing, XRP has risen from around $0.5 to around $2.5, with a surge of nearly 400% in the past month.

After reaching a peak of $1.966 in the April 2021 bull market, XRP had been in a continuous decline until now, a span of more than 3.5 years, with the lowest point reaching $0.287.

The surge in XRP's price has also led to a surge in its market capitalization, not only surpassing USDT and Solana with a market capitalization of nearly $140 billion to rank third in the cryptocurrency market capitalization, but also surpassing traditional companies like Pinduoduo and Mitsubishi UFJ Financial Group, rising to the 136th position among global mainstream assets.

In addition, data shows that XRP is actively traded on major exchanges. The 24-hour spot trading volume of XRP/KRW on the Korean exchange Upbit reached $3.8 billion, 11 times its BTC trading volume, exceeding the spot trading volume of XRP on Binance; the 24-hour spot trading volume of XRP/KRW on Bithumb reached $1.2 billion, accounting for 32% of its total trading volume.

And xrpscan data also shows that the number of active XRP accounts increased by 100% in November, with on-chain indicators showing positive signs of recovery. The number of active accounts or unique senders on the XRP network increased from 15,592 on November 1 to 47,044 on November 16. The total number of active accounts in November doubled on average (up 100%) from around 12,000 to 25,000 this month, and the number of newly activated accounts on the XRP ledger also increased significantly, indicating a large influx of new users on the network.

Regarding the above performance of XRP, the CEO of Ripple seems to have foreseen it. As early as early November, he stated that the Trump administration might bring new hope to the crypto industry, and XRP might usher in a turning point.

He explained that the Trump administration's takeover might change the regulation of cryptocurrencies and resolve Ripple's legal disputes that have lasted for years. He mentioned that since the SEC sued Ripple, XRP has experienced many setbacks, but with the disappearance of adverse market factors, the situation is changing, and the future prospects of XRP are becoming more promising.

II. Multiple Positive Factors

1. Expectations of Policy Relaxation

The expectation of positive crypto policies under the Trump administration has continued to bring optimism to the crypto industry, and the Ripple CEO also mentioned that Trump has the hope of resolving Ripple's legal disputes that have lasted for years.

Subsequently, there were reports that Trump might meet with the Ripple CEO and other crypto industry representatives to participate in the formulation of US crypto policies.

Companies like Ripple are competing for seats on the crypto committee promised by Trump, seeking to have a voice in the planned US policy reforms.

The former CFTC chairman also predicted that the SEC would abandon the lawsuit against Ripple, indicating that the regulatory change might trigger a significant rise in XRP.

2. Expectations of XRP ETF Launch and Financial Product Listings

The Ripple CEO stated that the launch of the XRP ETF is destined to happen.

Bloomberg ETF analyst pointed out that Altcoin ETFs like XRP may need to be approved by the end of 2025, and the new SEC leadership in 2025 may be more crypto-friendly, which may then allow ETF products to include staking functions.

Ripple is expected to be approved by the New York Department of Financial Services to issue the stablecoin RLUSD, which may be launched on December 4. If approved, Ripple will be able to legally offer RLUSD to the public, making it a major participant in the regulated digital financial market and the broader stablecoin ecosystem in New York, and will also put Ripple in direct competition with other well-known US stablecoin issuers like Circle, Paxos, and Gemini.

WisdomTree will launch an XRP ETP on European exchanges, with the product 100% backed by physical XRP stored in cold wallets and using a dual custody model with a regulated custodian.

In addition, WisdomTree has registered an XRP ETF in the US state of Delaware, and 21Shares has also filed an S-1 form with the SEC to apply for the launch of an XRP ETF, while Bitwise has filed an XRP ETF application in Delaware.

Grayscale has opened up private placement of trust funds including XRP and 17 other tokens to qualified investors. Robinhood US platform has re-listed SOL, ADA and XRP, and also added PEPE to its listing.

3. Whale Support

The trading volumes of XRP/KRW on the Korean exchanges Upbit and Bithumb reached $3.8 billion and $1.2 billion respectively, and the analysis firm Scopescan believes that Korean investors may be the main driving force behind the rise in XRP prices.

In early November, 400 million XRP were unlocked from an unknown custody wallet, equivalent to about $203 million.

At the end of September, Ripple whales bought over 470 million XRP within 10 consecutive days.

However, despite the huge gains in XRP and the multiple positive factors, some analysts have issued warnings:

CryptoQuant analyst: XRP's open interest contracts have risen by 37%, which may lead to a decline, similar to a previous event that caused a 17% drop.

Another analysis suggests that the current target price for XRP may be between $1.95 and $2.05, but it needs to be noted that since November 16, the price and trading volume of XRP have shown an inverse correlation, indicating that XRP is experiencing a distribution phase, and market participants may be seeking to sell.

Summary

As an established project, it is not easy for XRP to explode again. And recently there are multiple positive factors surrounding it, whether in terms of policy and regulation or the expected launch of ETFs and other financial products, which have given investors high expectations. However, the crypto market has always had the investment tradition of chasing new projects rather than old ones, and whether XRP can continue to grow stronger and regain its glory remains to be seen over time.