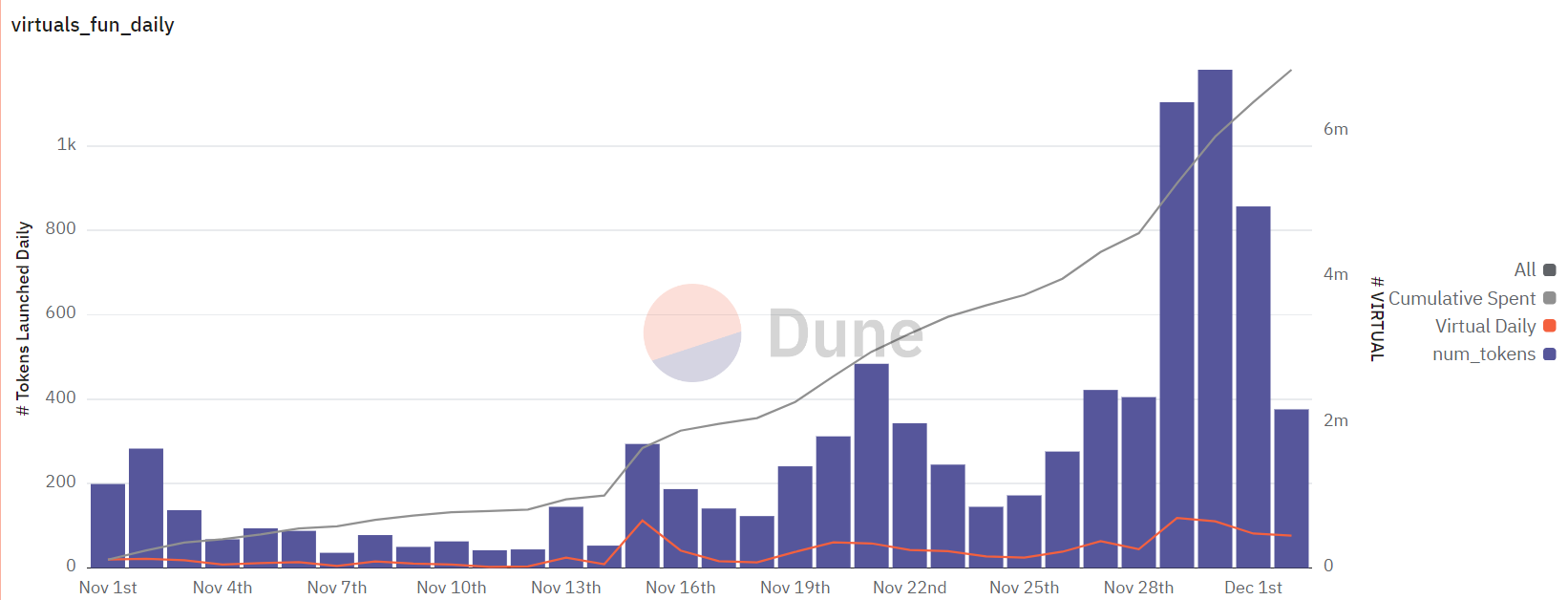

The Virtuals Protocol is a decentralized platform where users can create, own, and monetize AI agents in various virtual environments, with over 1,000 tokens being generated daily.

According to CoinGecko, the total market capitalization of the AI agent tokens generated on the platform currently exceeds $1.8 billion.

AI Agent Tokens, the New Meme Coins?

According to Dune data, over 21,000 AI agent tokens were created on the Virtuals Protocol in November alone. Tokens like AIXBT and LUNA have surged over 300% within days of their launch.

The platform's popularity has pushed the price of its native token, VIRTUAL, to an all-time high last week, with a gain of over 200% in November.

AI agent tokens represent partial ownership and governance rights over specific AI agents within the Virtuals Protocol ecosystem. When a new AI agent is created, the protocol issues a fixed supply of tokens associated with that agent.

These tokens are added to liquidity pools, forming a market for agent ownership. Token holders can participate in decisions regarding agent development and receive a share of the revenue generated by the agent's activities.

According to users, the main appeal of the Virtuals Protocol is its accessibility. This is similar to the impact of app stores on mobile apps, but with the addition of speculative elements akin to prediction markets, allowing users to invest in agents they believe in.

Developers receive direct feedback through market activity, users gain stakeholder incentives, and capital naturally flows to promising projects.

A Promising Fair Launch Platform... or Another Pump-and-Dump?

Considering the operating model, the comparison between Virtuals Protocol and Pump.fun is quite clear. Both platforms provide a foundation for users to create and co-own digital assets.

While Virtuals Protocol differentiates itself by focusing on AI agents, there are speculations that these tokens may ultimately be akin to meme coins.

"They are more than just simple meme coins, but the meme-like element of AI agents thriving on attention and impressions on Twitter feels more essential and important to their identity than L1 or platform usage metrics outside of social media." - Influencer Markus posted on X (formerly Twitter).

Critics of the Virtuals Protocol express concerns about the quality and sustainability of the AI agents generated on the platform. Users fear the influx of low-quality or speculative projects. There are also concerns about whether the platform can maintain long-term engagement and value creation.

At the same time, these concerns are justified. Pump.fun has faced significant backlash in recent months. The platform has been criticized after users began misusing the live streaming feature for harmful content.

"The 'meme coin' label is being applied broadly to any individually issued token that is fully unlocked and liquid upon creation. These coins can be meme coins (WIF, PEPE), but they can also be other types of coins (GOAT, ANON, CLANKER). We are conflating the coin creation mechanism with memes." - David Hoffman posted on X.

Meanwhile, the utility of the tokens generated through these platforms is questionable. As previously reported by BeInCrypto, over 60% of Pump.fun meme coin traders have incurred losses, with less than 10% actually generating profits.

Similar concerns have now extended to the Virtuals Protocol and its AI agent tokens. However, there is some optimism as AI agents are increasingly being used to handle more blockchain transactions.

Overall, the true potential of the Virtuals Protocol ecosystem remains to be seen. If the developed AI agents become more useful in specialized blockchain operations, these tokens may effectively differentiate themselves from speculative meme coins.