Self-Custodial wallets provide cryptocurrency users with sovereignty that centralization can never offer. These wallets allow users to own digital assets without relying on intermediaries. However, governments have started to push back against this.

Regulations targeting these wallets are becoming increasingly common. A recent move by Brazil to restrict Stablecoin transfers to wallets is a prime example.

Why Self-Custody Matters

This battle raises important questions. Can wallets survive under the glare of expanding regulations? Or will institutional influence force users to rely on centralized systems?

Self-Custodial wallets allow users to directly hold their cryptocurrencies. Unlike Custodial wallets that depend on third-party platforms, Self-Custody gives users complete control. This setup protects against risks like exchange failures, as seen in the FTX collapse.

These wallets are at the heart of cryptocurrency's decentralized ethos. By enabling transactions without intermediaries, they provide privacy and maximum financial freedom.

"Self-Custodial wallets are a core element in strengthening users' financial sovereignty, privacy, and security." – Hester Bruinsma, Product Manager at Metamask, Consensys

In contrast, Custodial wallets involve counterparty risk. If the provider fails or is hacked, users may lose access to their funds. Self-Custody eliminates this risk, helping users securely maintain their assets.

Despite these benefits, these wallets have been criticized as complex and risky. Recent innovations aim to change this, with Smart Contract Accounts (SCA) leading the way. SCA remove the need for a single key and provide flexible recovery methods like passphrases and multi-party computation.

"Enhanced security models leveraging machine learning and on-chain insights make it easier for users to be protected before they take action." – Bruinsma

These advancements reduce risks, allowing people to more safely explore new Web3 applications.

Other upgrades include gas fee abstraction, enabling users to pay transaction fees in any token. Session keys facilitate approvals for multiple actions. Embedded wallets make it easier for new users to manage cryptocurrencies within applications.

Regulations Tightening Around Self-Custody Wallets

Looking at the bigger regulatory picture, governments are strengthening rules around Self-Custody. Brazil's central bank recently proposed regulations to block Stablecoin transfers to wallets. Their goal? To align cryptocurrencies with traditional finance. The national currency is at an all-time low against the Dollar.

"70% of crypto transactions in Brazil are in Stablecoins. This is a clear signal that Brazilians are shifting to Dollar-based assets to escape the weakening Real! Now they want to keep your money trapped in centralized exchanges to have full control over it. Brazilians deserve financial freedom, not more surveillance." – A crypto influencer

In Europe, the Markets in Crypto-Assets (MiCA) framework is setting new standards. Transfers over $1050 from wallets must follow stricter anti-money laundering rules and undergo "customer due diligence" checks. While aimed at preventing financial crime, these regulations could limit the use of these wallets.

Hester Bruinsma points out that regulatory hostility is already slowing innovation, especially in the US.

"Regulatory antagonism has... had a meaningful negative impact on innovation among US-based technologists." – Bruinsma

In September, the US Treasury formally withdrew a 2020 proposal to impose strict regulations on these wallets. The rule sought to prohibit peer-to-peer digital asset transactions, DeFi activities, certain Non-Fungible Token platforms, and other decentralized operations. It also required wallet users to collect and report counterparty information for all their transactions.

The push for oversight clashes with the cryptocurrency community's desire for decentralization. The challenge is finding a balance that protects users while enabling growth.

Self-Custodial wallets represent more than just control - they signify financial sovereignty. These wallets allow operation outside the traditional system, making them particularly valuable in unstable economic regions like Brazil.

Privacy is another key benefit. Using these wallets avoids the data collection practices of centralized providers. This is crucial in a digital world where financial privacy is increasingly difficult to maintain.

Self-Custodial wallets empower users within peer-to-peer ecosystems. From gaming to DeFi, these wallets enable direct participation without intermediaries.

"As long as centralized options carry the same problems as traditional intermediaries, the demand for Self-Custody alternatives will persist." – Bruinsma

The Future of Self-Custody Wallets

The path ahead is challenging yet promising. Innovations like SCA are making these tools more secure and user-friendly. With more people embracing financial independence by 2025, the likelihood of wider adoption is high.

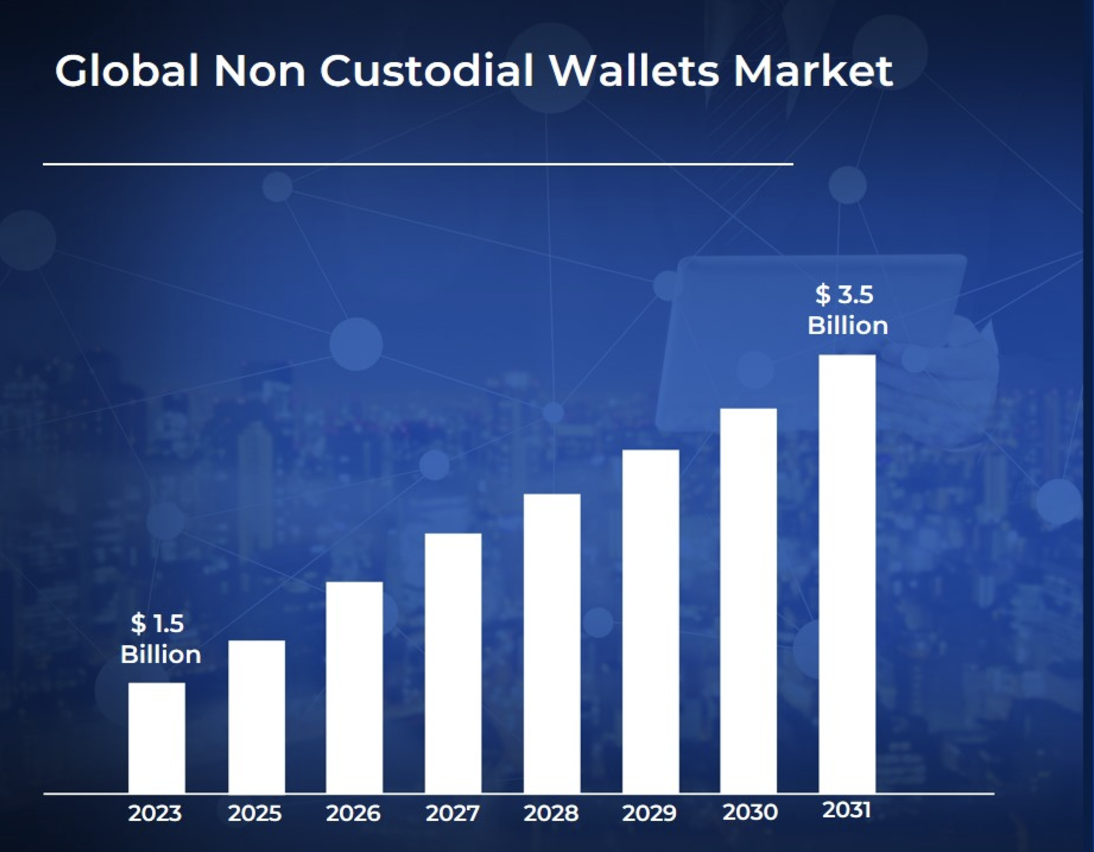

The market trend shows growth. The major non-custodial wallet, MetaMask, has seen a 55% increase in monthly active users, growing from 19 million in September to 30 million in January. The non-custodial wallet market is expected to reach $3.5 billion by 2031, growing at an average annual rate of 8% from 2024 to 2031.

However, regulatory challenges remain. Governments will continue to pursue oversight, and the cryptocurrency community must adapt. A hybrid model combining autonomy and compliance may point the way forward.

The importance of non-custodial wallets is clear. They protect user sovereignty, foster innovation, and uphold the principles of decentralization. The challenge now is to ensure these values persist in an increasingly regulated world.

Non-custodial is at the heart of cryptocurrency's promise of decentralization and financial freedom. But it is under threat. Regulations like Brazil's stablecoin rules show how governments are reshaping the industry.

The future of non-custodial lies in innovation and adaptability. Tools like SCA and gas fee abstraction are making these wallets more user-friendly and secure. The cryptocurrency community must continue to pursue solutions that balance the autonomy users demand with the oversight required.

In this battle for control, non-custodial wallets represent a crucial choice: will your cryptocurrency be held by an intermediary, or by you?