The Bitcoin price increase to a historic high of $100,000 has brought investor holdings to an extremely high profit level, leading to a strong redistribution of the supply. Some risk indicators are rising and showing cautious signals, while actual profits and financing rates are starting to cool, suggesting an upcoming accumulation phase.

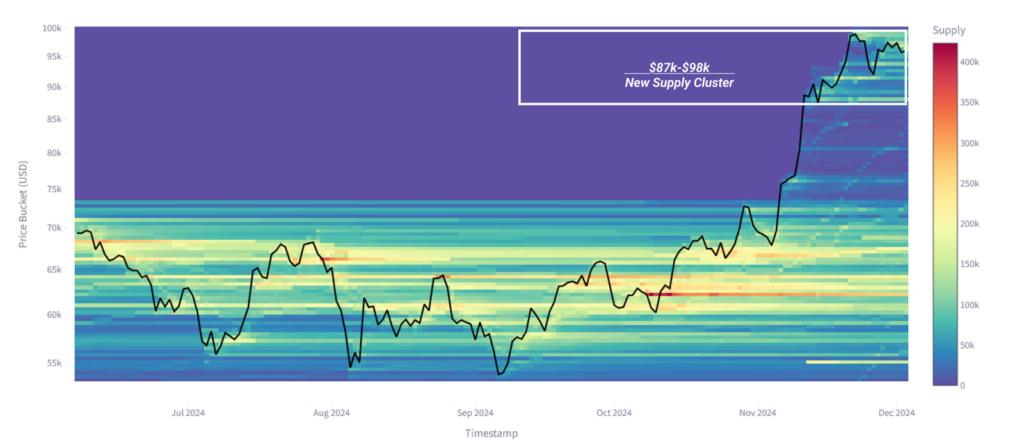

Bitcoin: Cost Basis Distribution

Bit CBD helps identify demand zones and investor interest by tracking the redistribution of the supply. This is particularly important as the market enters the early stages of price discovery, where the upper and lower price bands are not yet fully formed.

- A significant supply cluster is forming in the $87k to $98k range, indicating concentrated interest and trading activity at these price levels.

- However, very little trading activity occurred during the price increase up to $87k, creating a "gap".

Currently, the market is seeking a balance point between buyers and sellers within the current trading range. However, there is still significant risk if the price drops into the "gap" below $87k, where there is little support from the supply.

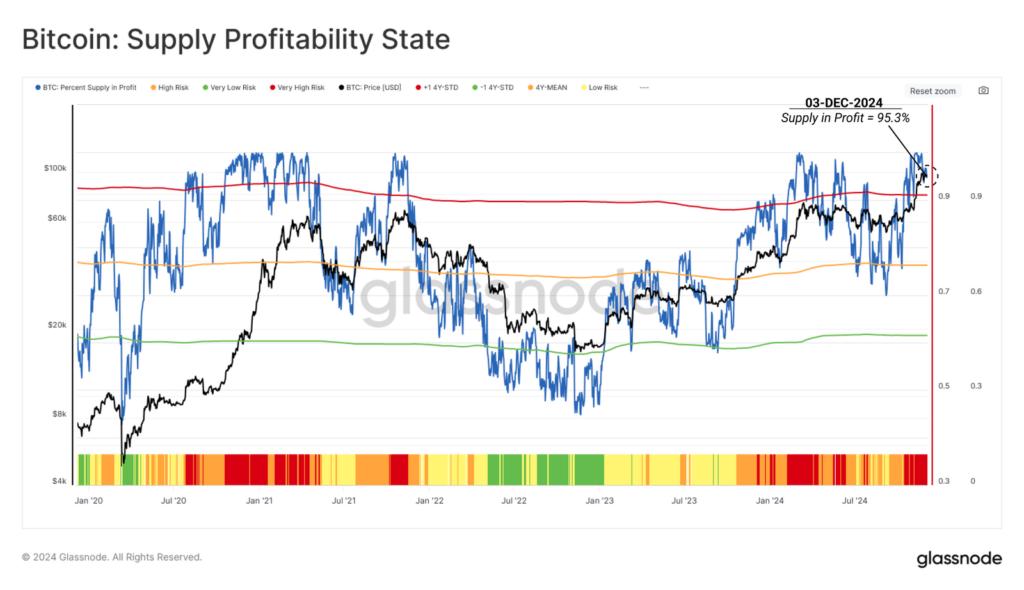

Bitcoin: Percent of Supply in Profit

The Percent of Supply in Profit (PSIP) metric helps us analyze the market cycle, based on the percentage of the supply holding unrealized profits. This provides insights into potential sell-pressure risks, as investors with unrealized profits often have an incentive to take profits.

The PSIP is divided into four risk levels:

The PSIP is divided into four risk levels:

Very High Risk: PSIP > 90%, more than one standard deviation above the historical medium.

Very High Risk: PSIP > 90%, more than one standard deviation above the historical medium. High Risk: 75% < PSIP < 90%, slightly above the historical medium.

High Risk: 75% < PSIP < 90%, slightly above the historical medium. Low Risk: 58% < PSIP < 75%, below the medium but still above the lower band.

Low Risk: 58% < PSIP < 75%, below the medium but still above the lower band. Very Low Risk: PSIP < 58%, more than one standard deviation below the historical medium.

Very Low Risk: PSIP < 58%, more than one standard deviation below the historical medium.

When PSIP crosses into the higher bands, this often coincides with the euphoric phase of a Bull market. The recent price increase has pushed PSIP into the Euphoric Phase, meaning the market is in the Very High Risk ( ) zone.

) zone.

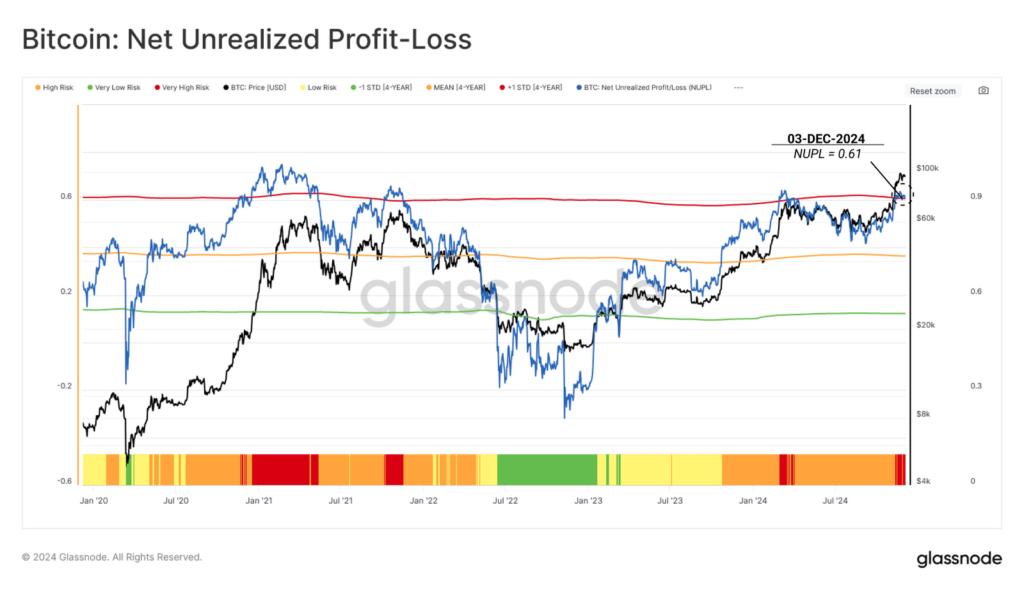

Bitcoin: Net Unrealized Profit-Loss

The Net Unrealized Profit/Loss (NUPL) metric measures the total unrealized profits or losses of the market as a percentage of market capitalization. This is a tool that provides insights into the market's psychological state, based on the level of unrealized profits or losses.

Compared to the Percent of Supply in Profit (PSIP) metric, NUPL provides a deeper view of the scale of unrealized profits. This metric reflects investor sentiment, from optimism to euphoria and fear.

When the price crossed $88k, the NUPL entered the Very High Risk  zone. This indicates that the market is holding an extremely high level of unrealized profits, a sign of euphoria and increased risk as investors are more likely to sell to realize their gains, leading to heightened sell pressure.

zone. This indicates that the market is holding an extremely high level of unrealized profits, a sign of euphoria and increased risk as investors are more likely to sell to realize their gains, leading to heightened sell pressure.

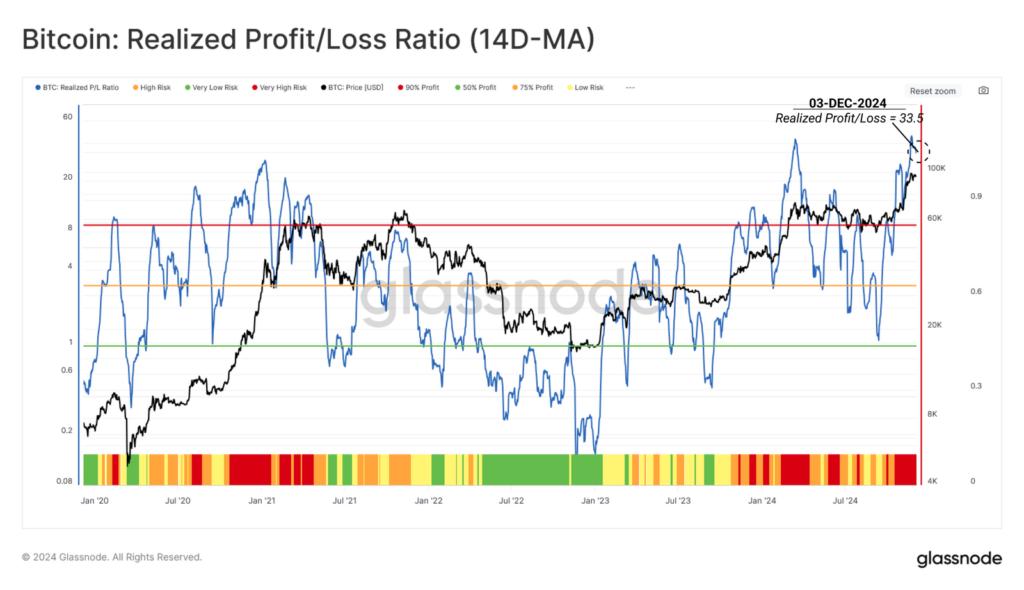

Bitcoin: Realized Profit-Loss Ratio

The Realized Profit and Loss Ratio (RPLR) metric measures the ratio between realized profit and loss events on the chain. This is an important tool to assess the changing behavior of investors as Bitcoin reaches the $100k milestone.

The RPLR has now entered the Very High Risk  zone, indicating that profit-taking activity is dominating with significant intensity. The majority of coins are being sold at a profit during the current price discovery phase, creating a large supply overhang in the market. This could put pressure on the price as new demand needs to absorb this supply to maintain the uptrend.

zone, indicating that profit-taking activity is dominating with significant intensity. The majority of coins are being sold at a profit during the current price discovery phase, creating a large supply overhang in the market. This could put pressure on the price as new demand needs to absorb this supply to maintain the uptrend.

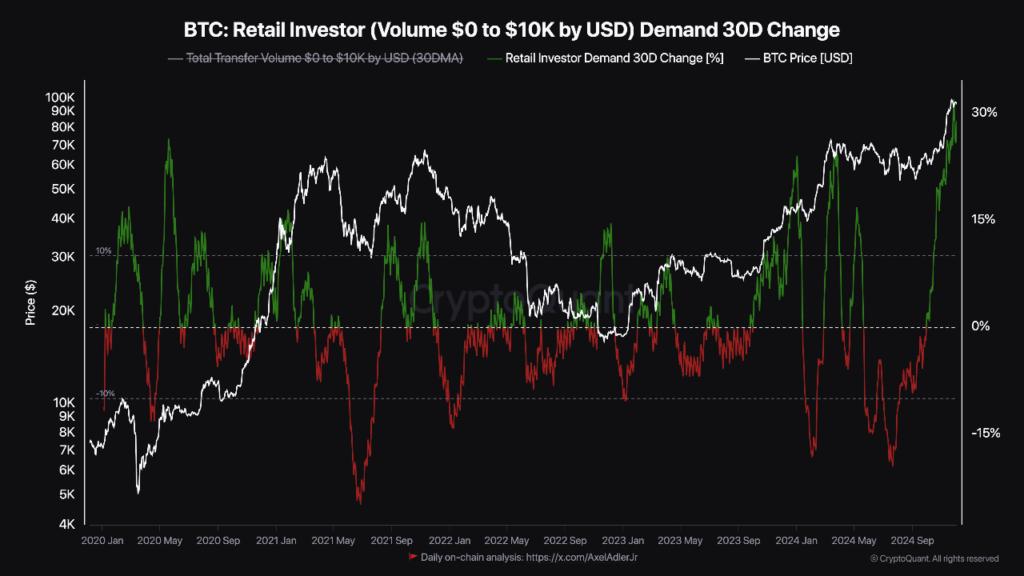

Bitcoin: Retail Investor (Volume $0 to $10K by USD) Demand 30D Change

The 30-day change in retail investor demand has reached its highest level since 2020, as retail investors are becoming increasingly interested in Bit.

This sudden surge in retail investor interest may partly explain the strong demand currently underway, even as long-term investors begin to take profits.

History shows that high participation from retail investors often signals a local top. However, it also highlights the increasing market participation, which, when combined with institutional interest, can create a sustained positive momentum.

As Bit enters a consolidation phase, retail investor demand may gradually decrease over time.

Bitcoin may continue to fluctuate for a period of time, with small adjustments, before the next price increase to break through the important psychological threshold of $100k. Breaking through this price level could stimulate renewed demand from retail investors, potentially driving the market into an exuberant phase.

Monitoring the interaction between retail and institutional investor activity during this period will be crucial, as strong participation from retail investors often reflects a high degree of market optimism, while institutional interest provides a foundation for sustainable momentum.

Summary

The fact that profitability/risk indicators have reached very high-risk zones means that the market is facing the risk of significant selling pressure from investors realizing their profits. In this context, market participants need to be cautious about the possibility of short-term corrections, especially as large supplies continue to be brought to the market.

The Bitcoin market is trying to regain its balance, with the $88k level identified as the foundation of the current supply density cluster.

What do you think the market will be like going forward? See you in Onchain issue 50/2024 on the Coinmoi website to see how the indicators have changed over this period.

The article Bitcoin Onchain Week 49/2024: Trend after setting a new ATH first appeared on CoinMoi.