Introduction

Ethereum (ETH) has shown a strong upward trend in recent months, not only successfully breaking through the key price level of $4,000, but also attracting the attention of more and more institutional investors. According to the latest data, the net inflow of ETH spot ETFs has set a new record, and the market's confidence in its future potential is constantly increasing. At the same time, there are a large number of whale transactions and bullish technical indicators in the market, indicating that Ethereum may be at the starting point of a new round of upward trend.

Latest price trend of Ethereum ETH

Record inflow of spot ETFs: Institutional attention continues to rise

According to SoSoValue data, ETH spot ETFs have shown a net inflow for 10 consecutive days since the 22nd, with a total amount of $1.41 billion. During this period, ETH's market capitalization has risen to 2.74% of the entire cryptocurrency market. The president of The ETF Store, Nate Geraci, said that this phenomenon indicates that advisors and institutional investors have just begun to show interest in the Ethereum field.

This wave of ETF inflows also reflects investors' optimism about ETH, especially against the backdrop of the overall market environment gradually warming up recently. Geraci emphasized that the inflow volume on some days has set the best record since its launch in July, proving that Ethereum is becoming the focus of attention for institutional and whale investors.

Whale buying activities show market confidence

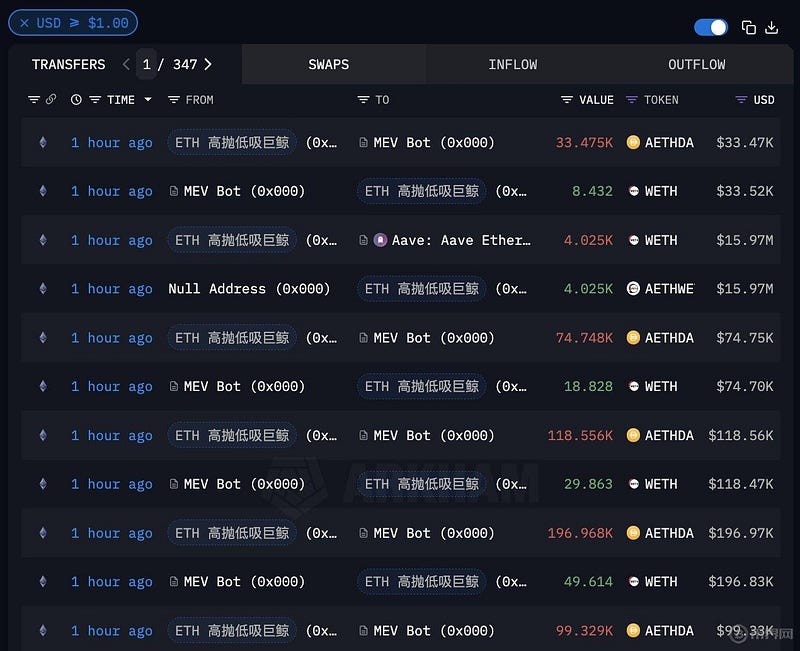

In addition to the inflow of spot ETFs, large transactions in the market also indicate strong demand for Ethereum. On-chain analyst Ai Yi monitored that this morning, a whale with a high hit rate of 84.2% in swing trading made another move, launching the 20th ETH swing trading operation. According to the data, this whale bought a total of 4,005 ETH through two addresses at prices of $3,979 and $3,965, worth about $15.91 million. This indicates that this whale is optimistic about ETH breaking through the $4,000 price and continuing to rise.

Analysts believe that this trading activity shows that more and more whales and investors in the market are optimistic about the long-term prospects of Ethereum, and expect ETH to further break through the recent highs.

Technical indicators suggest Ethereum is entering a new round of uptrend

According to the analysis of CryptoQuant analyst Crypto Sunmoon, Ethereum's second bull market has already begun. The analyst pointed out that ETH has been showing strong bullish signals since October, especially in the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) indicators, which have shown continued upward momentum. In addition, Ethereum's historical data shows that the first quarter is usually the strongest performance period for ETH, and in the past few years, Ethereum's gains have generally exceeded Bitcoin in the first quarter.

Currently, Ethereum's price is approaching $4,000, and some analysts predict that with the rise of the ETH/BTC ratio, Ethereum may reach the range of $5,000 to $6,200 in the first quarter of 2025. This forecast is also consistent with multiple technical indicators, indicating that Ethereum's performance is expected to be strong in the coming months.

Ethereum may reach a new all-time high

Currently, Ethereum is facing a "structural change" stage, and some commentators believe it may soon retest the historical high of $4,878, which was the highest price since November 2021. Ryan Adams, the host of the Bankless podcast, said that based on the current technical trend, ETH may reach a new all-time high in the next few days. Anonymous trader Pentoshi also agrees with this view, believing that the resistance for Ethereum to break through the all-time high is very small, and the ATH (all-time high) is like a magnet attracting the market to break through upwards.

In addition, the continuous growth in trading volume and the increase in whale transactions also indicate that market confidence in Ethereum is strengthening. Pentoshi also pointed out that Ethereum is currently in a critical upward trend, and its future price fluctuations may significantly exceed expectations.

Conclusion

Comprehensive analysis from various perspectives, the current Ethereum market is in a critical upward stage. The large-scale inflow of ETFs, the attention of institutional investors, and the support of technical indicators have laid the foundation for the long-term rise of ETH. At the same time, large transactions and whale activities in the market also indicate that investor confidence is gradually recovering, and it is expected that by 2025, the price of ETH may reach a new historical high.

However, experts also remind that the market may experience short-term adjustments or corrections, especially when technical indicators such as RSI approach the overbought area. Therefore, investors should remain vigilant, pay attention to key support levels such as $3,800 and $3,500, as well as potential resistance levels of $4,100.

The current market dynamics of Ethereum show strong bullish signals. With the large-scale inflow of spot ETFs, the active trading of whales, and the support of technical indicators, the future price of ETH may break through the historical high and usher in a new round of upward cycle. Although there may still be short-term adjustments or corrections in the market, the overall trend remains optimistic. Investors should continue to pay attention to key technical support and resistance levels, maintain sensitivity to market dynamics, and prepare for the potential long-term profits that Ethereum may bring. With the participation of more institutions, ETH may reach a higher price range in 2025 and become a leading force in the cryptocurrency market.

Overall, the market outlook for Ethereum remains optimistic, and it is expected that ETH will continue to strengthen in the coming months and may achieve new historical breakthroughs.