Recently, analysts at Standard Chartered Bank have predicted that the price of Bit (BTC) will reach $200,000 by 2025. This forecast has attracted widespread attention, especially as Bit's (BTC) market performance has broken historical records for several consecutive months, approaching the six-figure mark. Is such a radical expectation credible? This question not only involves the fundamentals and market structure of Bit (BTC), but also the global macroeconomic environment, the layout of institutional investors, and the market's future demand for Bit (BTC).

Table of Contents

TogglePerspective of Standard Chartered Bank Analysts

Analysts at Standard Chartered Bank pointed out that the core factors driving the further rise in Bit (BTC) prices mainly include the influx of large institutional funds and the potential investment opportunities in digital assets for US retirement fund investors. Specifically, in 2024, institutions such as ETFs (exchange-traded funds) and MicroStrategy have purchased large amounts of Bit (BTC), and these purchases are seen as the key factors in driving Bit (BTC) prices to $60,000 or even close to $100,000.

Specifically, in 2024, Bit (BTC) ETFs and large institutions like MicroStrategy (Micro Strategy) have collectively purchased about 680,000 Bit (BTC), effectively driving up market demand and price increases. It is expected that in 2025, the inflow of institutional funds will maintain the purchase volume of 2024, or even increase, thereby continuing to support the upward trend of Bit (BTC) prices.

In addition to the influx of institutional funds, Standard Chartered Bank analysts also mentioned that MicroStrategy plans to spend $42 billion to purchase Bit (BTC), a decision that will further increase market demand for Bit (BTC). MicroStrategy's CEO Michael Saylor has always been a staunch supporter of Bit (BTC), and his company currently holds more than 700,000 Bit (BTC). It is expected that in 2025, MicroStrategy will continue to expand its Bit (BTC) position, which will have a positive driving effect on the market.

The core view of Standard Chartered Bank analysts is that with the continued influx of institutional investors, Bit (BTC) prices are expected to break through the current historical high and reach the $200,000 mark by 2025.

Potential of US Retirement Fund Investors

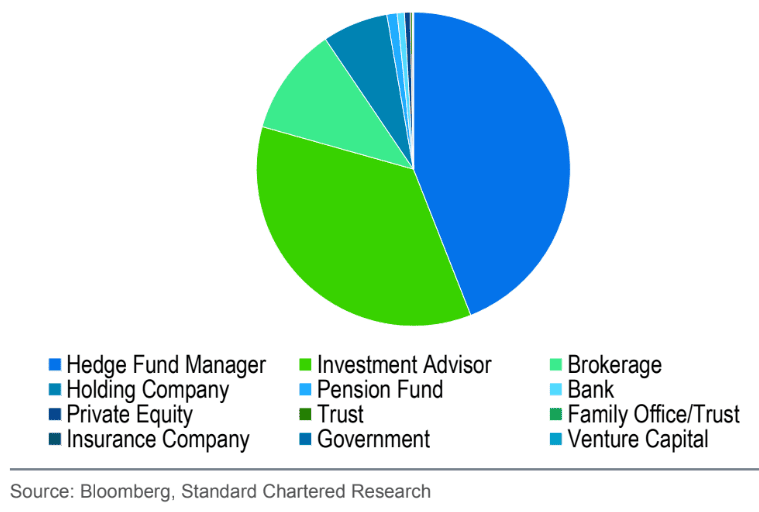

In addition to the purchasing power of institutions such as ETFs and MicroStrategy, Standard Chartered Bank analysts also pointed out that the inflow of funds from US retirement fund investors will be an important factor in driving the continued rise in Bit (BTC) prices. Currently, the proportion of US retirement funds in the holdings of 9 spot Bit (BTC) ETFs in the US is only about 1%, which is obviously low (as shown in the figure below). However, as digital assets gradually rise in the financial system, especially with changes in the US political environment, the proportion of retirement funds is expected to increase significantly by 2025.

Analysts believe that with the possibility of Trump's re-election in 2024, the policy environment for digital assets in the US may change, which will drive more institutions, especially retirement funds, to include Bit (BTC) in their investment portfolios. The influx of these funds is expected to provide strong support for Bit (BTC) prices and may become a catalyst for Bit (BTC) to break through the $200,000 mark.

Retirement funds, due to the stability of their funding sources and the need for long-term investment, usually have strong financial strength and flexibility in asset allocation. If US retirement funds truly begin to invest in Bit (BTC) on a large scale, their capital inflows will undoubtedly have a significant impact on the Bit (BTC) market. Considering the increasingly established position of Bit (BTC) as the "digital gold" in the global financial system, the investment of retirement funds in Bit (BTC) is not only reasonable, but also inevitable.

Short-term Price Pressure and Future Trend of Bit (BTC)

Although the long-term prospects for Bit (BTC) are positive and have become a market consensus, the short-term price fluctuations are still factors that cannot be ignored. Currently, the Bit (BTC) price is in a critical price range, around $100,000. This level has formed a strong psychological and technical resistance, which may lead to a period of oscillation and consolidation for Bit (BTC) prices in the short term.

Recently, the price of Bit (BTC) has approached the $100,000 mark, but with the gradual digestion of this price range by the market, there may be a certain correction or oscillation. In the short term, the price range of Bit (BTC) may fluctuate between $93,000 and $100,000. Such oscillations are often referred to as "shakeouts", the purpose of which is to clear the floating funds in the market, so that the price can break through the current resistance range after consolidation.

Here is the English translation of the text, with the content inside <> left untranslated:However, although Bit may face certain adjustment pressures in the short term, in the long run, Bit still has strong upward momentum. Investors can pay attention to market dynamics, especially the buying behavior of major institutions and changes in technical charts, to judge when Bit can break through the current price bottleneck.

The Impact of Market Funds and Market Sentiment

The price of Bit is not only affected by technical factors, but is also closely related to the global economic environment, market sentiment, and the performance of other crypto assets. Against the backdrop of uncertainty in the global financial market and loose monetary policy, Bit, as a decentralized digital asset, is increasingly seen as a tool to fight inflation and avoid the risk of currency depreciation. As the Bit market matures, its correlation with the traditional financial market is gradually strengthening, and the speed and scale of capital flows are also showing more diverse characteristics.

The continuous involvement of institutional investors, especially the deployment of large technology companies and financial institutions, is bringing greater liquidity to the Bit market. Compared to Bit, traditional market investment tools such as stocks and bonds face more severe pressure from rising interest rates and market contraction, further promoting the inflow of capital into the digital asset market, especially the leading asset Bit.

Conclusion

The optimistic outlook of Standard Chartered Bank analysts on Bit in the next few years is not without basis. Institutional funds, especially the continued purchases of ETFs, MicroStrategy, and other large funds, as well as the potential investment of US pension funds, may provide strong support for the price of Bit by 2025. However, although the long-term prospects of Bit are broad, investors need to remain vigilant about short-term price volatility. In the short term, Bit may fluctuate between $93,000 and $100,000 until the market digests these floating chips, and the price may then break through the current resistance and start a new upward cycle.

About BingX

BingX, founded in 2018, is a leading global cryptocurrency exchange that provides a diverse range of products and services, including spot, derivatives, copy trading, and asset management, to over 10 million users worldwide. It also regularly provides market analysis on mainstream currencies such as Bit price and ETH price, meeting the needs of users from beginners to professionals. BingX is committed to providing a trustworthy platform, empowering users with innovative tools and features to enhance their trading capabilities. In 2024, BingX proudly became the main partner of Chelsea Football Club, marking its exciting debut in the sports world.

This content is provided by the official source and does not represent the position or investment advice of this site. Readers must carefully evaluate it themselves.