A whale with an 84.2% win rate bought the dip of 7,682 WETH worth $29.22 million in the early morning crash

The whale with an 84.2% win rate bought the dip again in the early morning crash, buying 7,682 WETH (worth $29.22 million) at an average price of $3,803. The total position has now grown to 11,687 ETH, with an average cost of $3,861, currently showing an unrealized loss of $1.63 million.

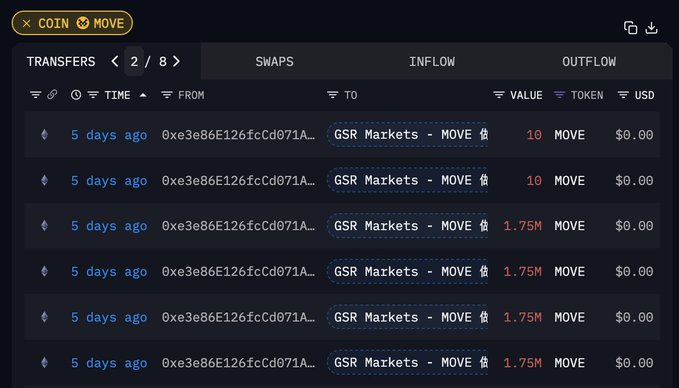

GSR Markets received 70 million MOVE tokens from Movement for market making, accounting for 3.11% of the initial circulating supply

Five days ago, the Movement project team distributed 17.5 million MOVE tokens to each of the four GSR addresses, totaling 70 million MOVE tokens (3.11% of the initial circulating supply), and these tokens have now been fully deposited into major exchanges.

According to Binance data, MOVE is currently priced around $1, with a FDV of $9.97 billion and a 24-hour trading volume of $6.516 billion, ranking 7th among all token trading volumes.

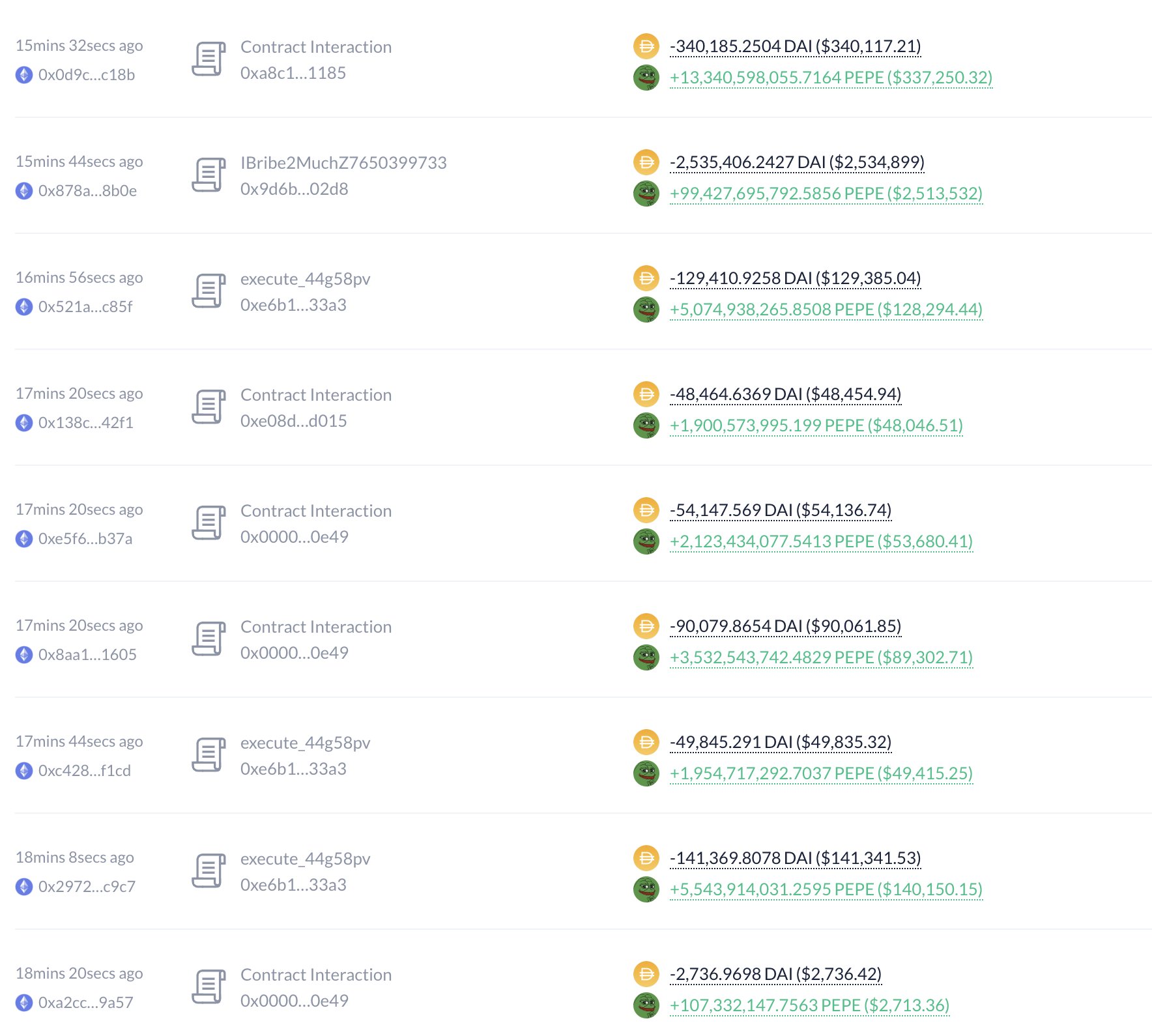

9 addresses bought 550 billion PEPE, about $13.8 million, in the past 2 hours

9 wallets (possibly belonging to the same whale) spent $13.8 million in DAI to purchase 550 billion PEPE in the past 2 hours, at an average price of $0.000025.

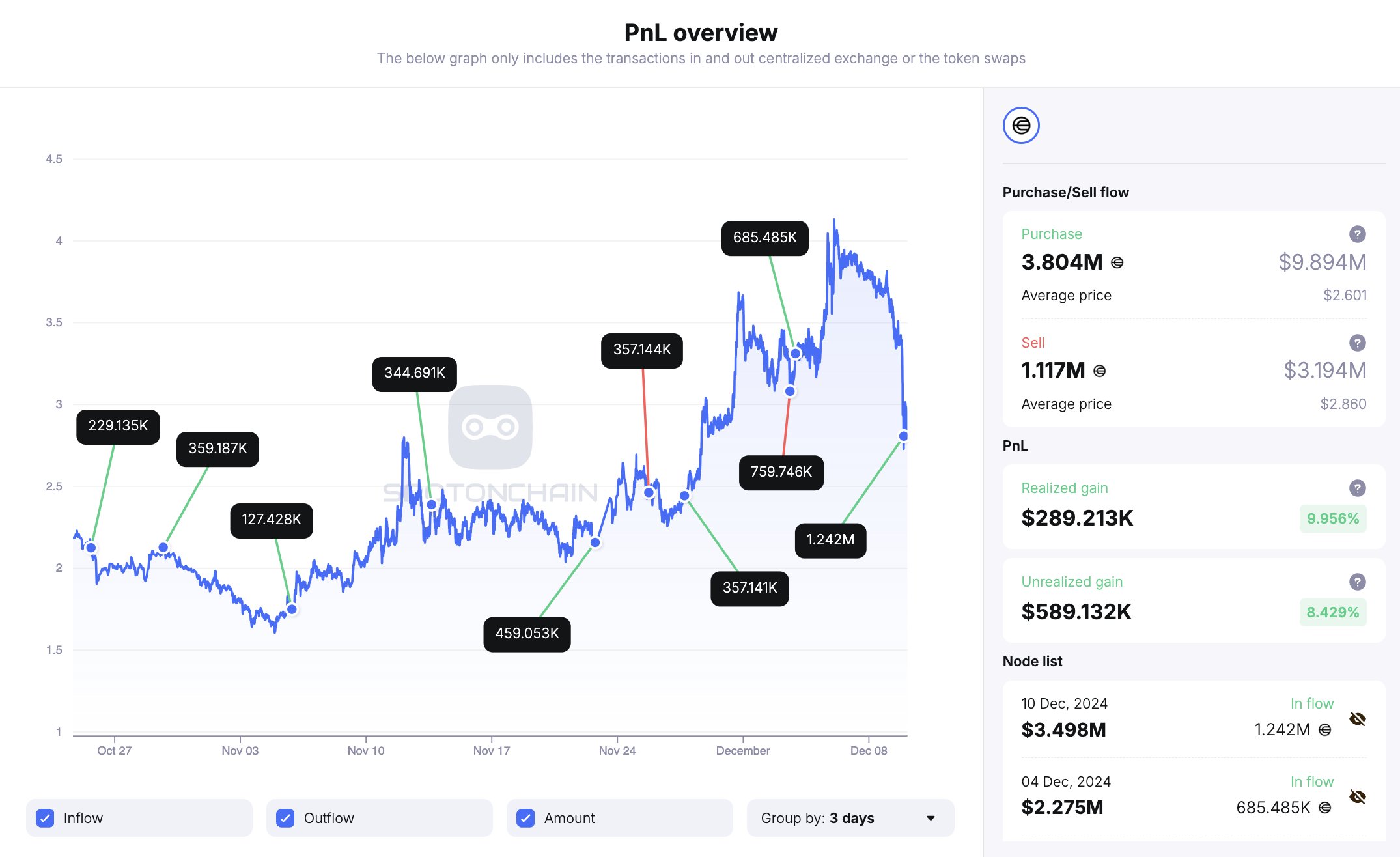

A whale withdrew 1.242 million WLD, about $3.48 million, from OKX 10 hours ago

10 hours ago, a whale withdrew 1.242 million WLD (worth $3.48 million) from OKX. This increased the whale's WLD holdings to 2.69 million (worth $7.52 million). In less than 2 months of WLD trading, it is estimated to have made a profit of $878,000 (+9%), including $289,000 in realized gains.

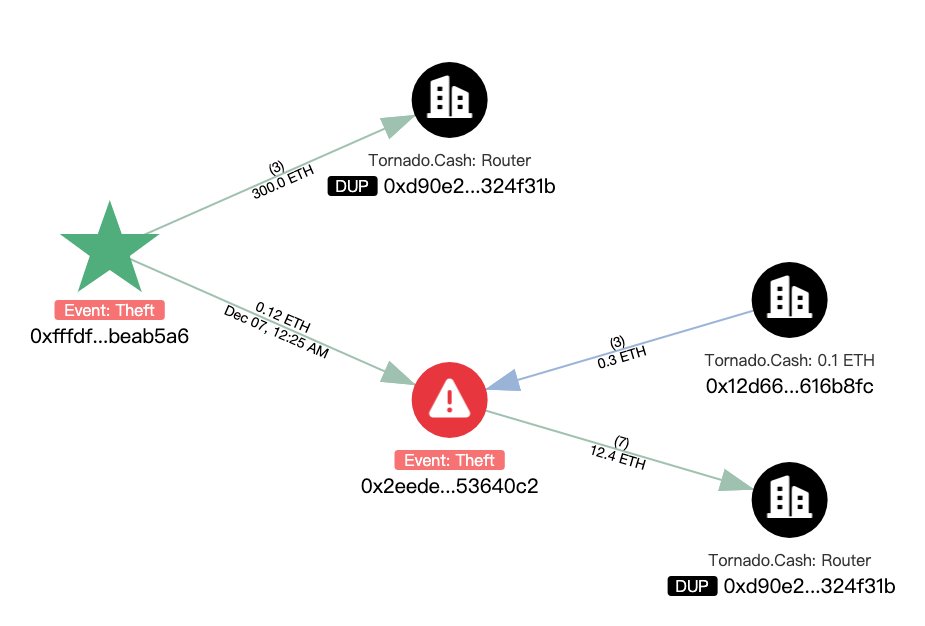

The DEXX hacker has transferred over 1,500 ETH to Tornado Cash

Slow Mist, a Web3 security tool, has released an update on the DEXX security incident:

- The DEXX hacker has transferred 1,512.4 ETH to Tornado Cash;

- There are still a total of 3,149.55 ETH in some Ethereum addresses;

- The main EVM aggregation address (starting with 0xFFB9) currently has a balance of 1,253.83 ETH and other tokens worth $130,000;

- The Solana address (starting with 4smi8T) has a balance of $96,417, and the Solana address (starting with GPuNX8) has a balance of $2,200.

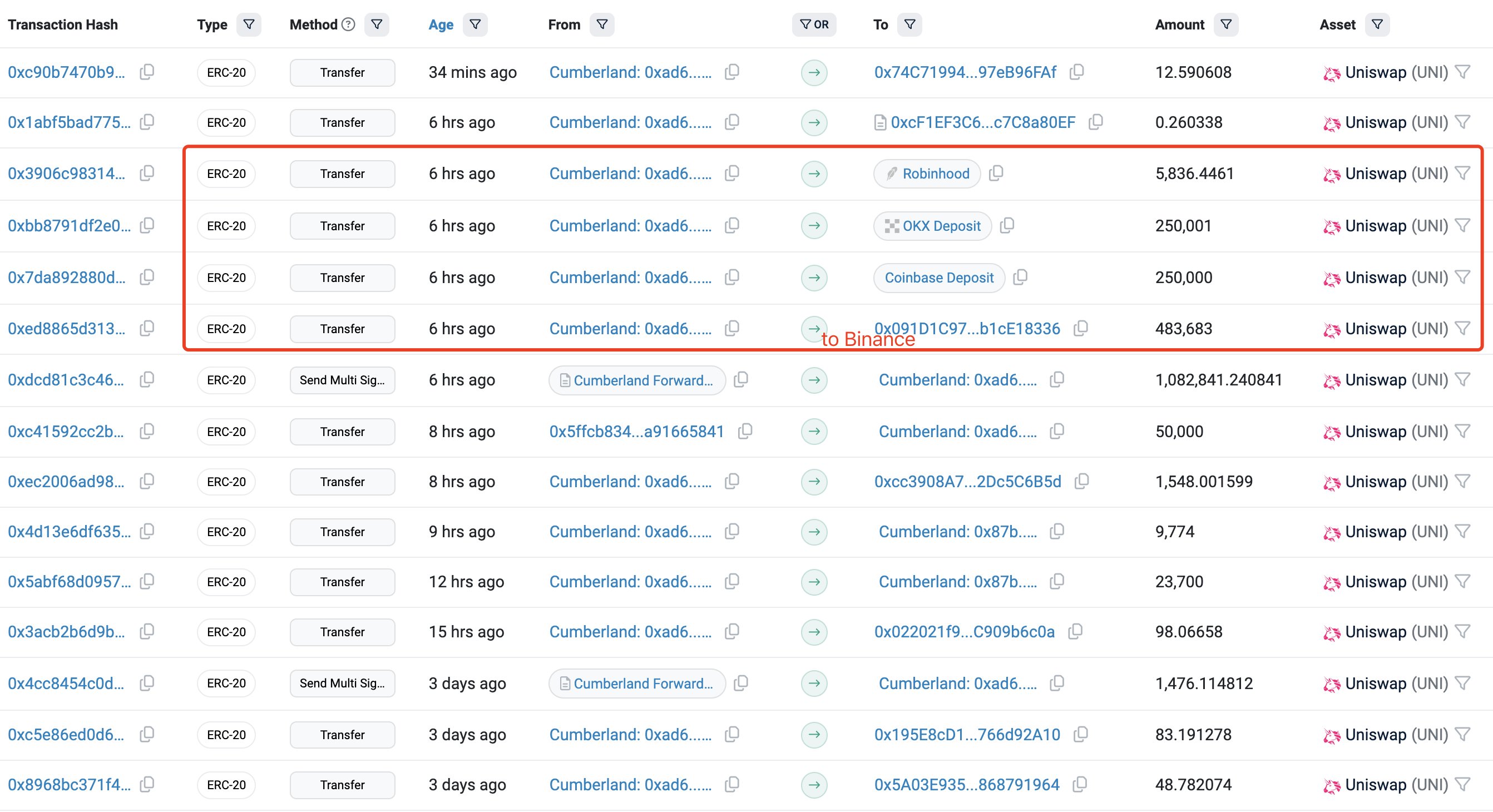

Cumberland deposited 989,520 UNI, about $16.73 million, into multiple CEXs in the early morning

13 hours ago, Cumberland deposited 989,520 UNI (about $16.73 million) into Binance, Coinbase, OKX, and Robinhood. Shortly after, the price of UNI dropped 10%.

Additionally, these UNI transfers were made by a Uniswap investor through Cumberland, with the data showing 1.08 million UNI (about $18.26 million). This address transferred 1.08 million UNI to the Cumberland address, and Cumberland then transferred 983,000 UNI of that to Binance, Coinbase, OKX, and other exchanges.

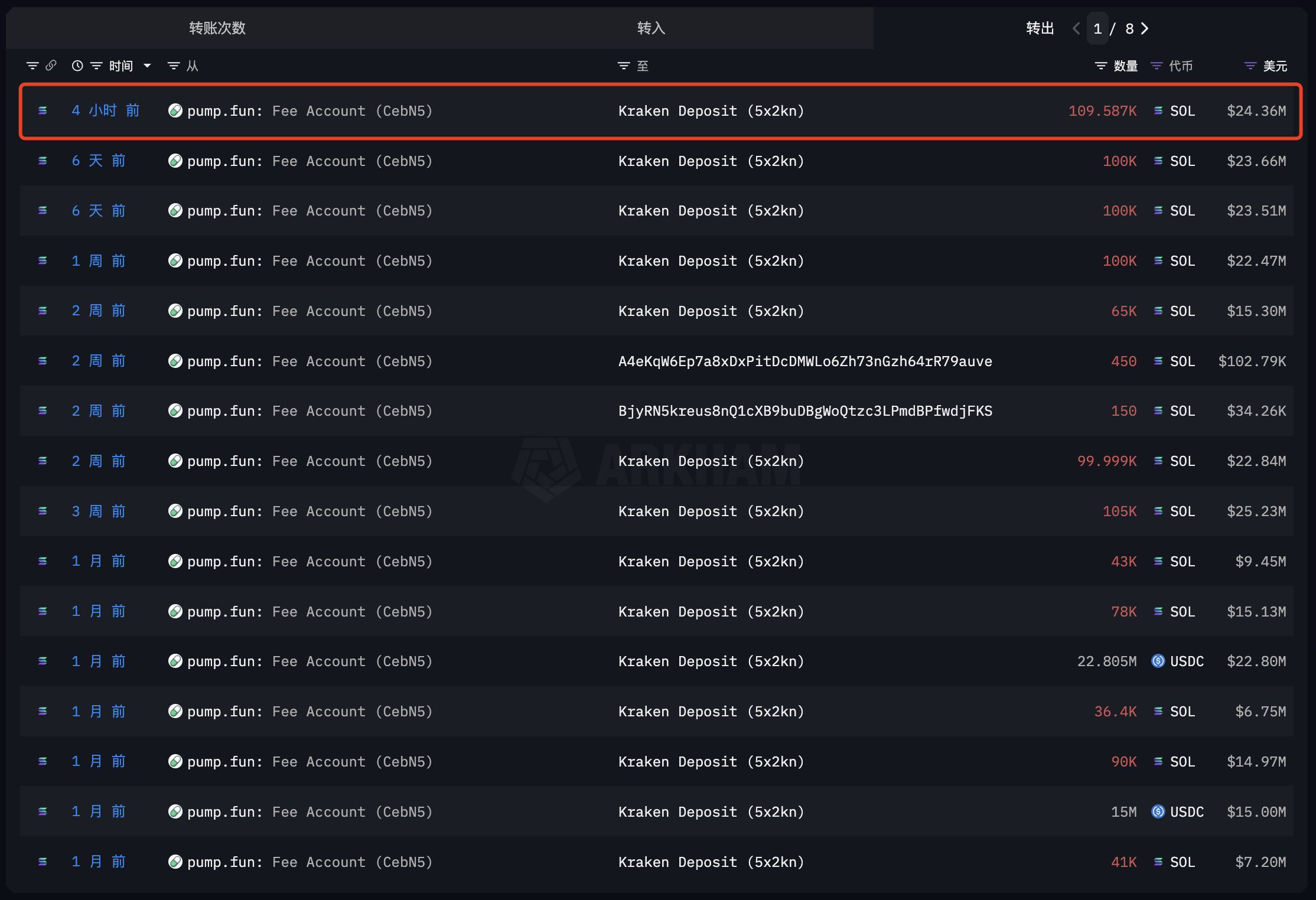

pump.fun deposited 109,587 SOL, about $24.36 million, into Kraken 13 hours ago

13 hours ago, pump.fun transferred 109,587 SOL ($24.36 million) into Kraken.

The analysis suggests that the frequency or amount of SOL sold by pump in the future may not be as high as this period, because:

1. They have already sold most of the SOL in their address, with only about 100,000 JITOSOL (worth $25.85 million) left;

2. The trading enthusiasm for SOL-based memes has declined, and pump's fee income has decreased significantly. In November, they had around 15,000-20,000 SOL in daily fee income, but in December, it has been steadily declining to around 10,000 SOL (which is still substantial).

pump.fun has accumulated a total of approximately 1.655 million SOL in fee income so far, and their total sales volume is around 1.546 million SOL ($300.76 million), with an average price of around $195.

Data sources:

1.https://x.com/lookonchain

2.https://x.com/ai_9684xtpa

3.https://x.com/EmberCN

4.https://x.com/OnchainLens

5.https://x.com/spotonchain