Master Ye Talks About Hot Topics:

First, let's talk about how Microsoft shareholders rejected proposals related to cryptocurrencies. Master Ye believes this is not surprising, as the market had already expected it. Although this result has had some impact on sentiment, the overall impact is limited. As the old saying goes: "The great river flows, but there is always a place to turn; the world is ever-changing, yet it has its own logic."

However, the BTC spot ETF has attracted a large influx of funds since Trump's election as president - it has surpassed $10 billion in a short period of time, reflecting institutions' expectations and confidence in the possibility of policies favorable to the crypto industry being introduced by the former president.

At the same time, the Ethereum ETF is not to be outdone, with a net inflow of $837 million in a single week, setting a new record. The flow of funds fully demonstrates that, in the face of the global economic fog, mainstream institutions are re-positioning themselves in the crypto market, grasping the new trend.

However, this optimistic sentiment does not cover up the recent market volatility. The consecutive declines a few days ago have triggered some analysts' "divine predictions", with figures like $80K and $70K flying around.

However, after Master Ye's analysis, it is not difficult to find that these statements are mostly subjective guesses without any basis. The market, like life, is most afraid of being distracted by the outside noise. For short-term traders, focusing on the daily rhythm rather than the final direction is the way to stand firm.

Over the past period, BTC has been able to quickly recover to the 96K-99K range after repeatedly breaking below 95K, and the bullish rebound trend is still continuing. This shows that the market still has resilience. For short-term operations, the most important thing is to take profits in time and trade quickly, and never chase the highs and lows.

Chasing shorts when the price drops, the rebound may catch you off guard; chasing longs when the price rises, the overnight pullback may leave you helpless. Therefore, instead of being swayed by the ups and downs of the market, it is better to focus on the present and grasp the profit of each trade. As the ancient saying goes: "Do not be greedy for small profits, do not be burdened by small worries, and you can step up step by step."

In addition, the release of tonight's CPI data is undoubtedly the focus of the market, and many friends have already started guessing how BTC will react. Master Ye is personally optimistic about a pullback, with the logic still the same as last Friday night's non-farm payrolls. The current expectation is that inflation will rise, but even if the inflation data rises slightly, this will not affect the Fed's predetermined path of rate cuts in December.

A consecutive 72-hour decline is also rare in history, so the possibility of a short-term rebound is still relatively high. Just as the bowstring is pulled taut, it must be accompanied by a powerful rebound force.

For tonight's market, it is suggested that everyone can deal with it with the logic of technical rebound. Near the important support line, you can grasp the opportunity to enter the market after a proper adjustment, and don't let the short-term volatility affect your own rhythm.

Remember the market in the past few days, each time BTC broke through 95K, it was able to strongly recover, and this trend has proven that the market still has the strength.

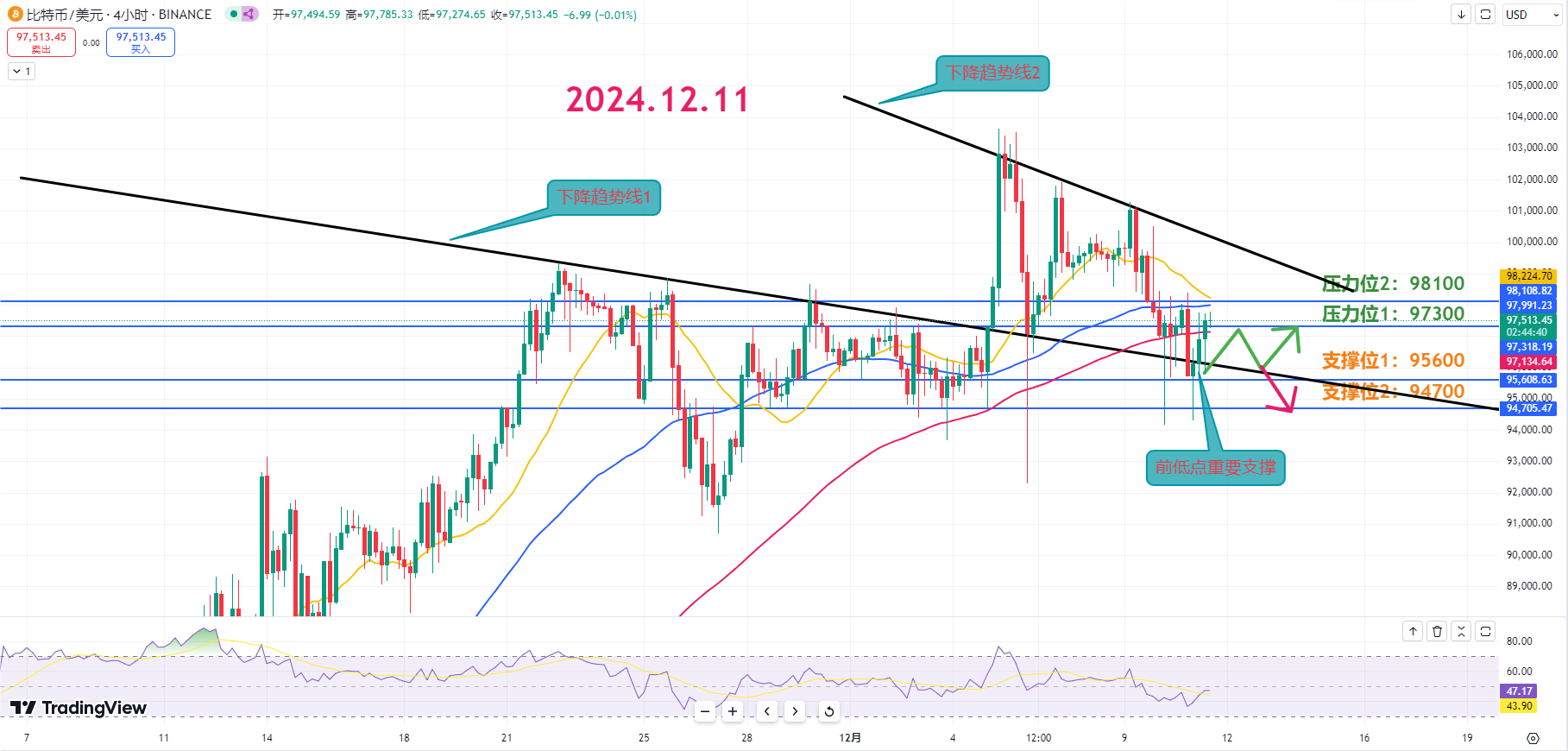

Master Ye's Trend Outlook:

BTC is still in an adjustment trend, but has now returned to an upward trend. The K-line above clearly shows the action of washing out retail investors, so even if there is a short-term rebound, do not easily think it is the bottom.

Resistance Levels:

First Resistance: 97300

Second Resistance: 98100

Support Levels:

First Support: 95600

Second Support: 94700

Suggestions for Today:

In the short-term, the first support can be set as the bottom formation area, which is also an important short-term support. It is suggested that in today's short-term trading, this can be used as a reference. Currently, the first support has rebounded, and if there is another adjustment, this area needs to be defended.

If there is another adjustment, and the first downward trend line can be defended, it can be judged as an opportunity to enter the market. If it falls below the first support, attention should be paid to the possibility of an N-shaped decline.

If there is a proper adjustment, it can be judged as an opportunity to enter the market and take corresponding position operations. If the adjustment has low trading volume and forms a small K-line gradually declining while defending the low point, it is a suitable adjustment interval.

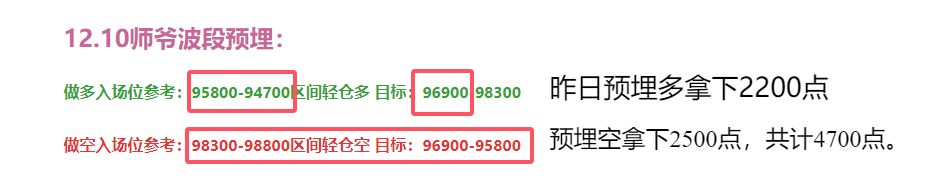

Master Ye's Wave Forecast on 12.11:

Long Entry: 93300-94150 with light position, Target: 95600-97300-98000

Short Entry: 97500-98550 with light position, Target: 95600-94700

The content of this article is exclusively planned and published by Master Ye Chen (public account: Coin God Master Ye Chen), who is the same name across all platforms. If you want to learn more about real-time investment strategies, unwinding, spot, short, medium and long-term contract trading techniques, operation skills and K-line knowledge, you can join Master Ye Chen's learning and exchange group, which has already opened a free experience group for fans and community live broadcasts and other high-quality experience projects!

Warm Reminder: The only public account (as shown in the image above) that this article is written by is Master Ye Chen. All other advertisements at the end of the article and in the comments are not related to the author! Please be careful to distinguish the true and false, and thank you for reading.