Author: CryptoAmsterdam

Compiled by: TechFlow

1.When will the Altcoin season arrive?

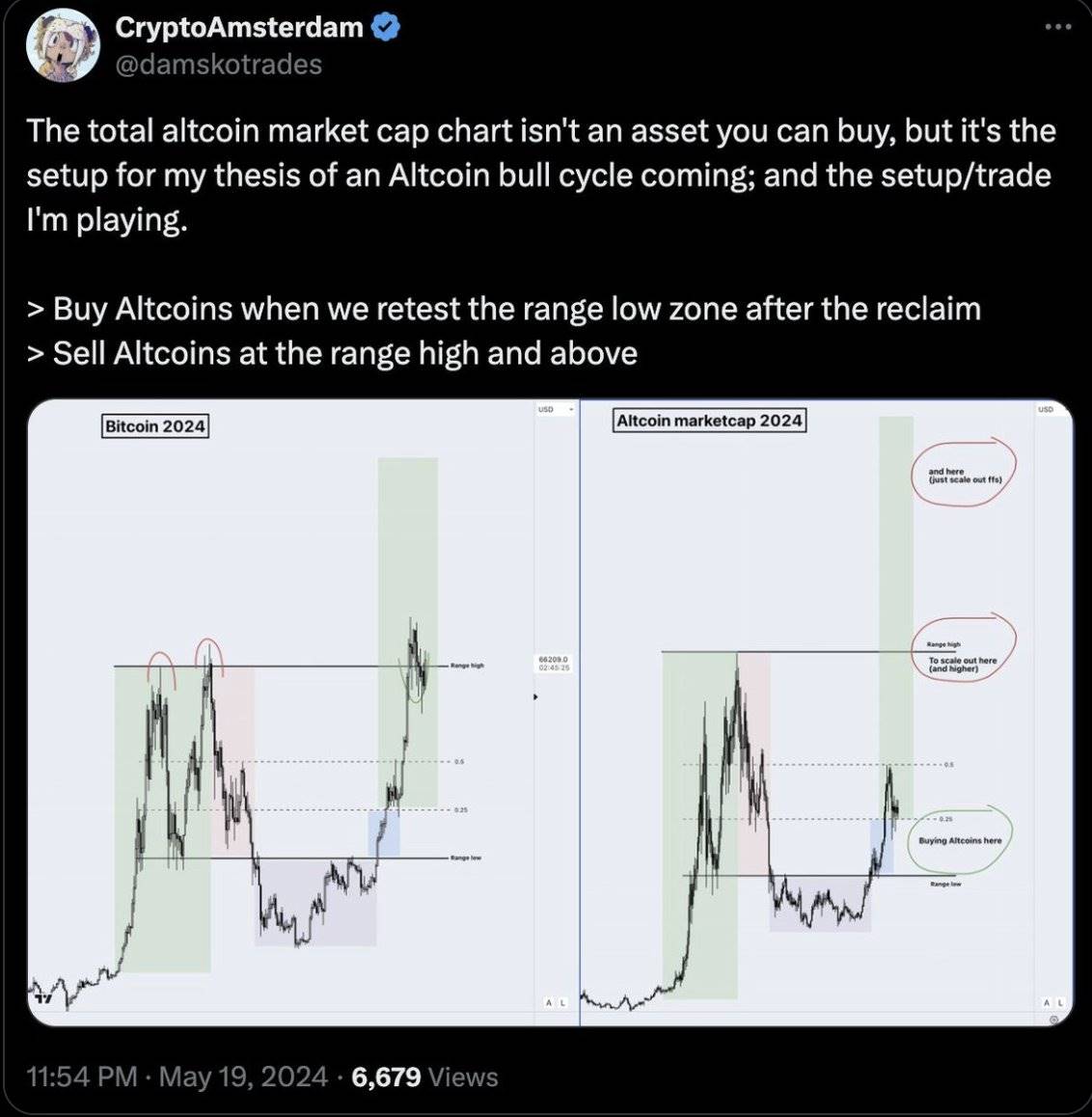

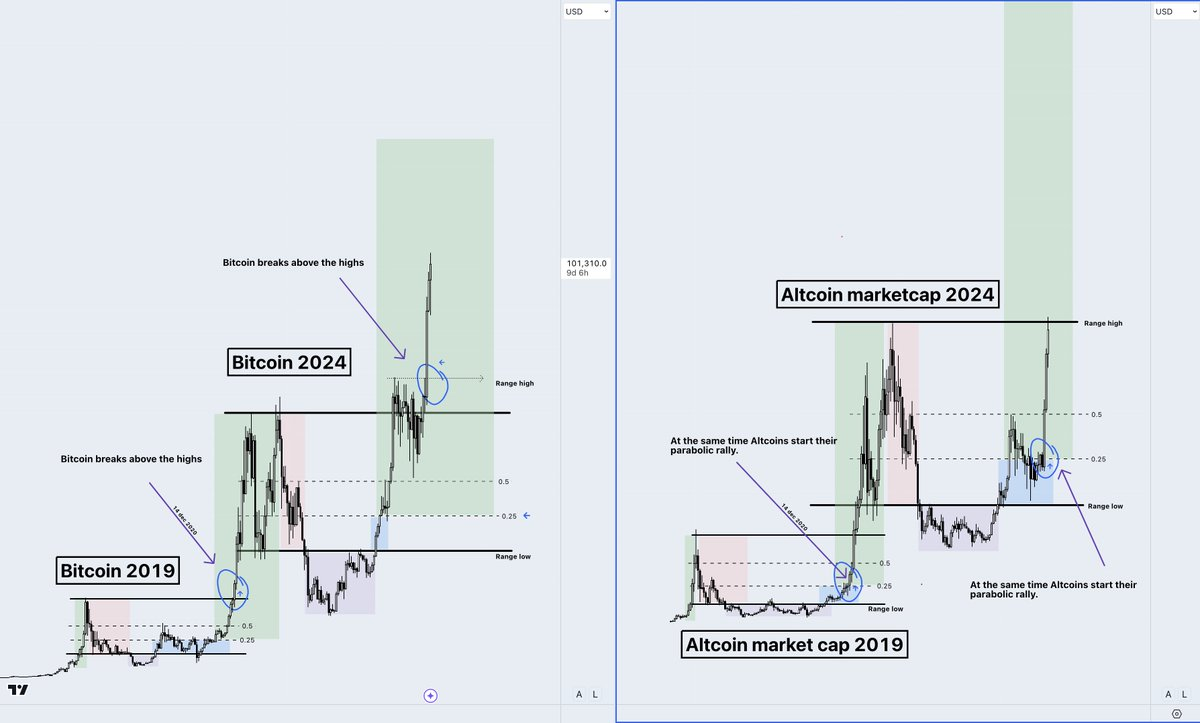

I believe the Altcoin season will arrive soon, and here are some key analysis points:

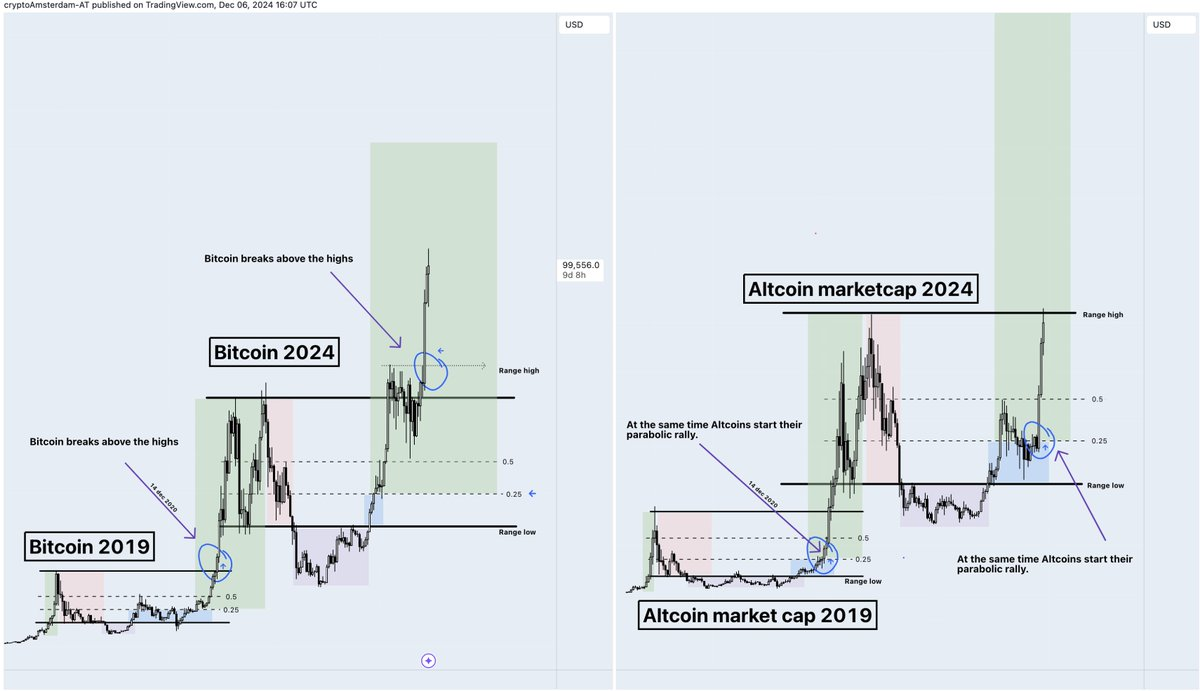

1.1 The cycle has two phases

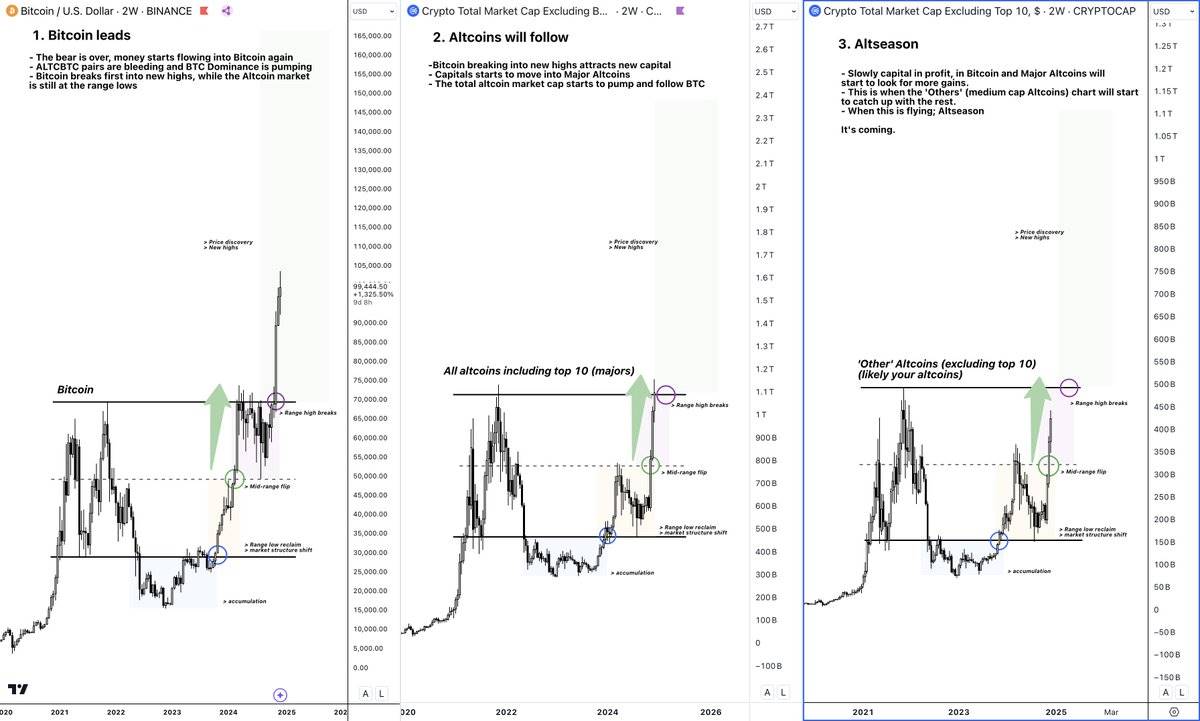

Phase 1: Bitcoin price rises, Altcoin prices fall (Bitcoin market dominance increases).

Phase 2: Bitcoin breaks a new all-time high, Altcoins start to enter a rapid upward phase.

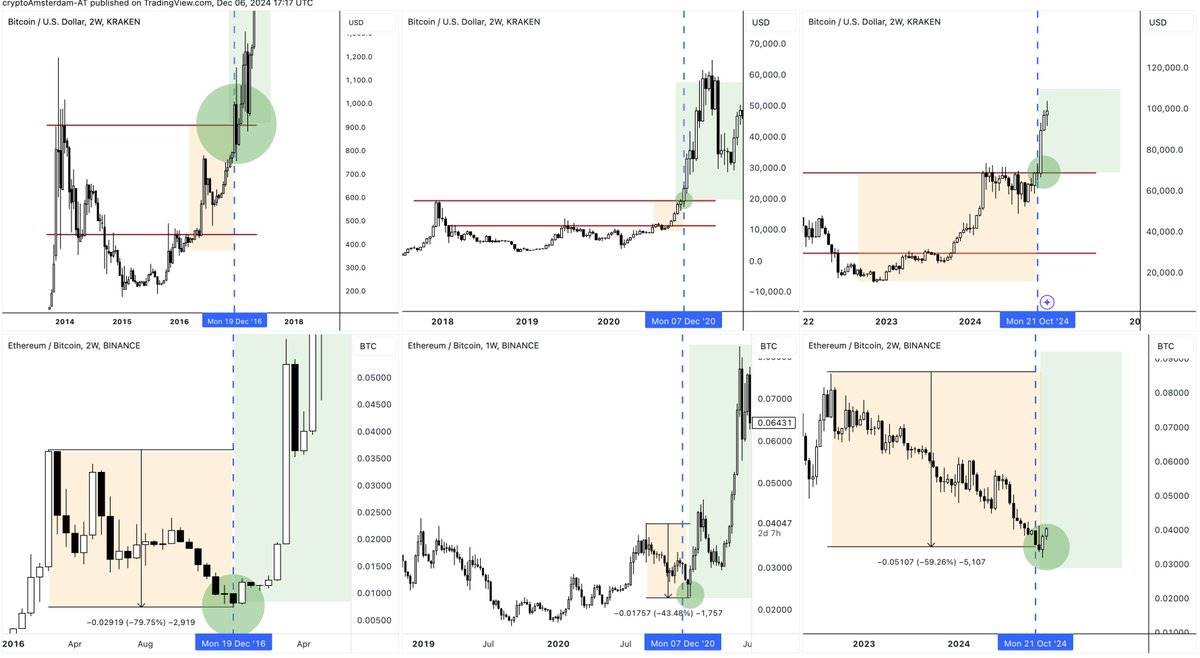

The pattern can be seen more clearly in the chart below:

In this phase, we start accumulating Altcoins when the total Altcoin market cap is at a low point. I believe Altcoin prices will break new highs like Bitcoin.

Currently, Phase 2 has already started!

For more details, please see: link.

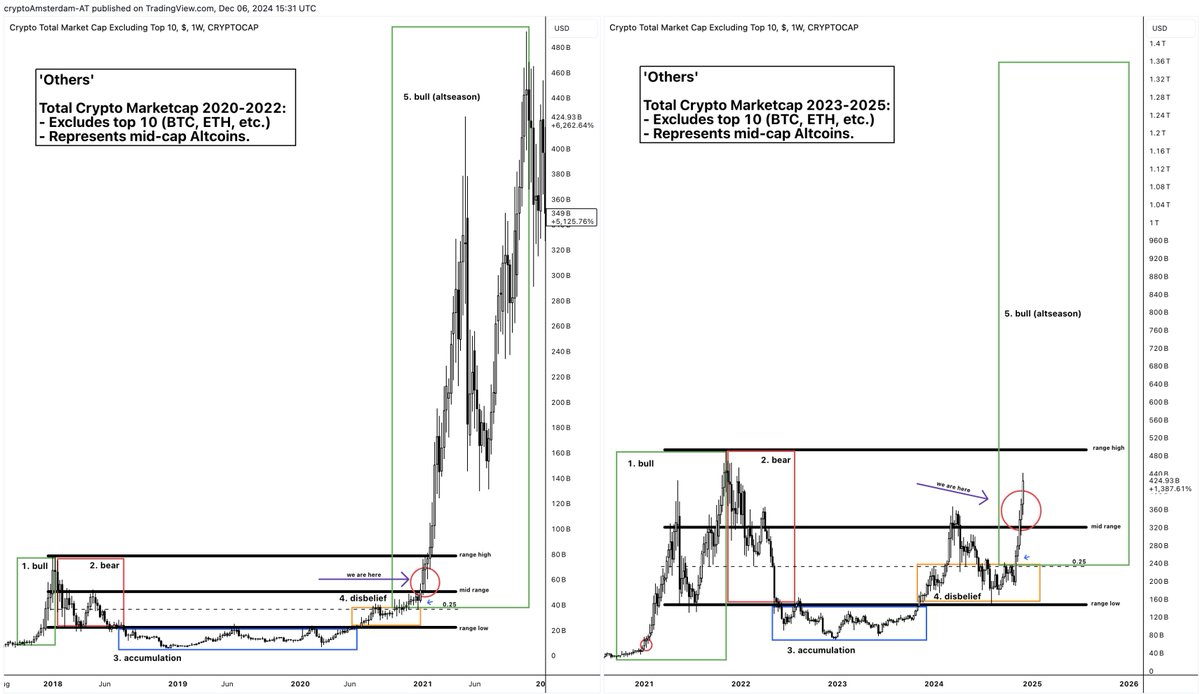

1.2 Capital flow patterns

The bull market can be traced back to the end of 2023, when Bitcoin bounced back from the bottom, returned to the range and rose to the previous high, while Altcoins depreciated against Bitcoin, and Bitcoin's market dominance increased.

When Bitcoin breaks a new all-time high (the current stage), capital begins to flow into large-cap Altcoins. From the Total 3 (total market cap of the top 100 Altcoins excluding BTC and ETH) chart, although it is currently mainly driven by large-cap coins (such as XRP), the performance of mid and small-cap coins is also catching up.

Ultimately, the capital in Bitcoin and large-cap coins will gradually flow into mid and small-cap Altcoins.

As market sentiment heats up, investors will become more greedy and start chasing mid and small-cap Altcoins. I expect the "Others" mid-cap Altcoins to reach new highs. The true Altcoin season is still ahead.

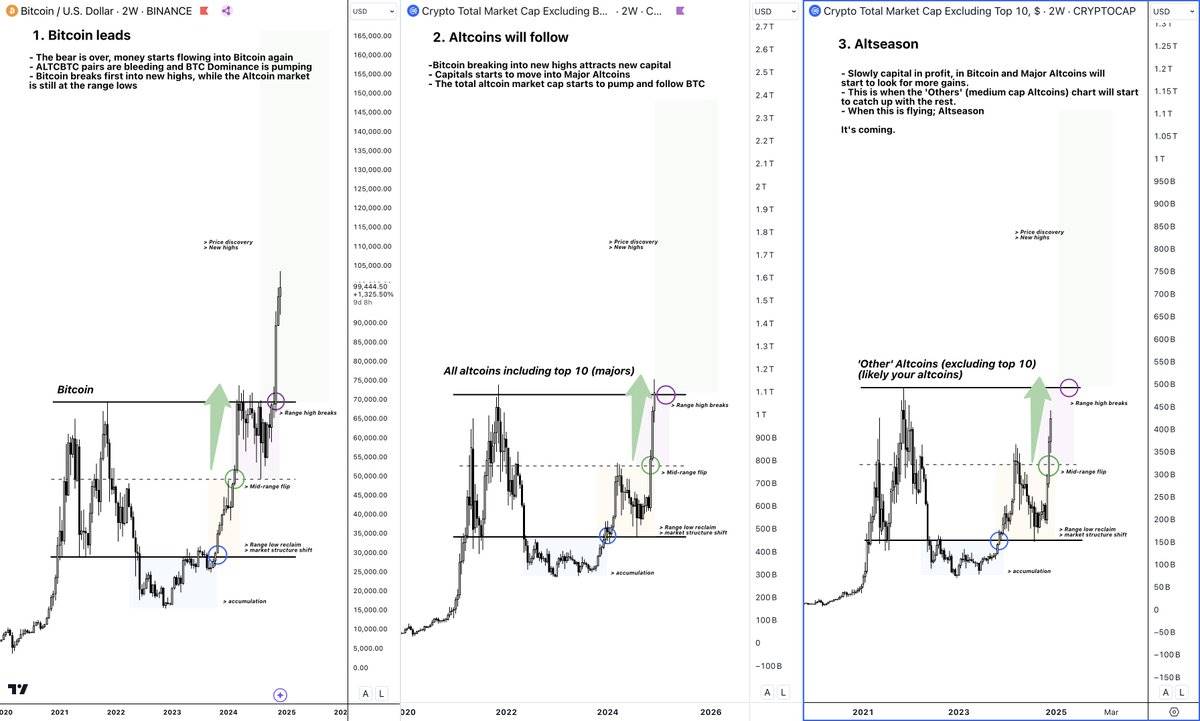

1.3 Bitcoin Dominance

There is a similar pattern in each cycle: when Bitcoin price breaks through the previous high and reaches a new high for the first time, its market dominance will start to decline.

Currently, Bitcoin Dominance has broken a rising trend that lasted for more than 800 days.

1.4 ETHBTC trend analysis

In each cycle, Ethereum tends to perform weakly in the early stage (Bitcoin rises but still below the previous high), and then starts to rebound when Bitcoin consolidates above the previous high.

The current cycle is no exception. More capital is expected to flow into Ethereum ecosystem Tokens, on-chain utility Tokens, and high-risk Tokens. Once ETHBTC truly enters an upward trend, these Tokens will perform even better.

ETHBTC chart analysis

Currently, ETHBTC has retested and regained the low end of the range.

In 2021, it failed to break through the resistance of Stage 4. In this cycle, will we see the "super uptrend" of Stage 5?

If it breaks the current downtrend line, it will end a bearish trend that has lasted for over 1100 days.

Additionally, 2024 is an important year for the launch of the Ethereum ETF (Exchange Traded Fund), and I believe the market is still underestimating Ethereum's potential.

2.Have you missed the opportunity?

As mentioned earlier, the Amsterdam team has accumulated Altcoins during the low points of the Total 3 market cap over the past 5-6 months.

At the low end of the range, it is recommended to:

Buy at key support levels;

Build positions gradually in a slowly oscillating market, rather than chasing the rally;

Set clear stop-loss levels (such as the lower end of the range);

Market volatility is lower, making it easier to hold.

But if you choose to buy after the price has risen vertically:

You may not have a clear stop-loss level. This may not have a big impact on short-term traders, but for long-term investors, the lack of a stop-loss increases the risk.

The opportunity for gains from the low to the high of the range has already disappeared, and now the bet is whether the Altcoin market cap can break new highs.

When buying during the rapid upward phase, you will face higher market volatility, and 20-30% corrections are not uncommon.

So, I don't think you're too late, because:

Bitcoin still has upside potential.

The capital rotation has not yet fully reached the mid and small-cap Altcoin stage ("Others" chart shows potential to reach new highs), so the most profitable phase is yet to come.

Bitcoin's dominance may continue to decline, while the ETHBTC ratio is likely to rise.

But please note the following:

Understand the current stage of the market cycle.

Clearly define whether you are entering a coin for short-term trading or long-term investment.

Develop a clear profit plan.

Understand this is a high-volatility phase, with the potential for 10%-30% rapid declines.

Accept that these rapid declines are difficult to predict, and trying to trade these corrections may disrupt your longer-term investment plan.

For a "risk" analysis of entering this stage (rather than the past 3-6 months of accumulation):

Please refer to this.

3.Recommendations for entry:

If you missed the accumulation period over the past 6 months, first think about why you missed it.

It's likely due to the influence of emotions:

In a bull market, prices often rise very quickly, with almost no obvious and sustainable corrections.

Many people missed the uptrend opportunity, and when they "fear missing out" and chase the highs, the market often enters a consolidation or rapid decline phase.

In the consolidation, they become pessimistic again and ultimately miss the next rapid uptrend opportunity.

The right strategy is to: build positions in batches during the consolidation orcorrection phases, maintain patience, and focus on the market structure over a longer time frame.

For more details, please refer to this.

Here are the specific recommendations!

Recommendation 1: Stick to spot trading, avoidleverage

Prioritize spot trading.

Many people are used to using leverage, but this is actually a trap. Each market fluctuation makes them feel like an "opportunity", but in reality, most of the time it is not. You don't need to rush to trade. Leveraged trading will ultimately cause most people to lose or even go to zero - don't let it ruin your bull market gains.

Stick to spot trading, so you won't be forced to liquidate your positions due to over-leveraging, and miss out on market opportunities.

Trust me, stay away from leveraged trading.

Recommendation 2: Don't chase the rally, focus on corrections

Most people trade based on emotions, only buying when the price is rising (green candles), because this makes them feel "safe".

But the market won't go up in a straight line, even in a bull market there will be corrections:

Daily fluctuations: small corrections of a few percentage points.

Every few weeks: 10%-30% panic sell-offs.

If the market falls again, you can also try to build a position at the low end of the stage 3 range.

However, for me, this token is more suitable for short-term trading rather than long-term holding.

3. $MEME

The investment cycle of Meme-themed tokens is well known even to ordinary investors. I can hardly imagine that a token called "MEME" will not attract widespread market attention after being listed on all top exchanges.

The price structure of this token is very perfect, and it is currently in stage 3. I will wait for the price to clearly break through and reclaim the key position before entering the market.

In addition, this token is also associated with a large NFT series. With the recovery of the NFT market, the implementation of the $ME incentive program, and the potential launch of the Opensea token, it may bring further upward momentum.

4. $ORAI

$ORAI is a veteran AI token. Last week, it successfully reclaimed stage 4 (orange area) in the short-cycle market structure, so I bought some positions again.

If the price falls back to this range, I will continue to add positions.

In addition, I have also set a price alert, and when it breaks through the macro low point, it will become a new entry signal.

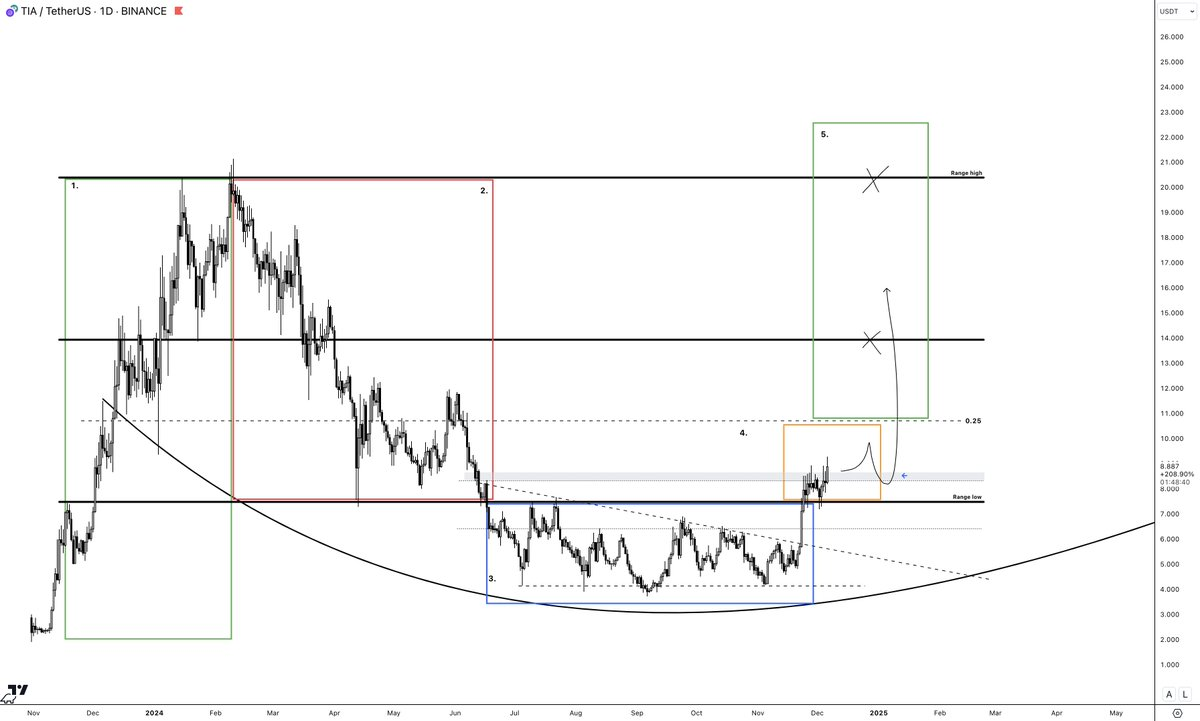

5. $TIA

I have been holding it since TIA reclaimed and retested the low end of the range.

Currently, it is trying to break through the current price structure. I think if the price forms a clear breakthrough above the gray area, the subsequent pullback will be a good opportunity to add positions.