Stablecoins play a crucial role in the trading, payment, and savings of the crypto industry. As of now, the market capitalization of stablecoins is around $200 billion, with the leading stablecoin Tether (USDT) accounting for $138 billion. Over the past year, the market has seen the emergence of several prominent stablecoin protocols that provide yield to stablecoin holders through real-world assets like US Treasuries or hedging strategies.

Previously, Beosin has analyzed mainstream centralized stablecoins and launched Stablecoin Monitoring in August this year to help stablecoin issuers and regulators monitor the stablecoin ecosystem. This article will use case studies of relevant stablecoin protocols to help users understand their operating mechanisms, audit focus points, and compliance challenges.

Ethena - USDe

Ethena is currently the fastest-growing stablecoin protocol, with its issued USDe having a market capitalization of $5.5 billion, surpassing DAI to become the third-largest stablecoin. Users holding sUSDe (staked USDe) can currently earn an annualized yield of around 30%, attracting significant market attention.

Protocol Principle

Ethena issues a stablecoin that represents the value of a delta-neutral position, tokenizing the arbitrage trading of mainstream assets like ETH on centralized exchanges.

Taking ETH as an example, if Ethena holds 1 ETH spot, it will 'short' a perpetual contract with a position of 1 ETH to hedge, earning funding rate yield from the cash-and-carry arbitrage. Additionally, Ethena actually uses stETH as the margin for its ETHUSD and ETHUSDT perpetual positions on centralized exchanges.

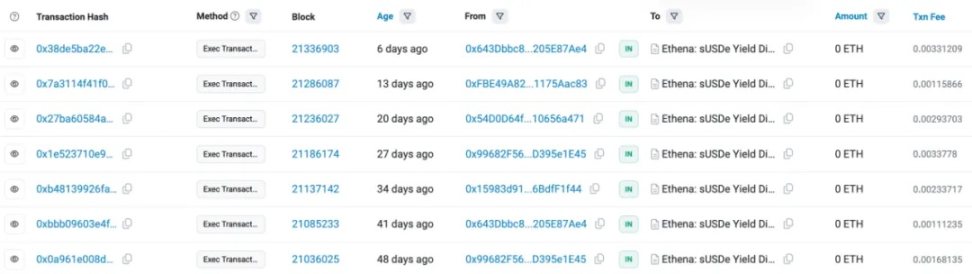

Therefore, the yield of USDe comes from two parts: the staking yield of mainstream assets (such as ETH) and the funding rate yield from the cash-and-carry arbitrage. Every week, Ethena sends the earnings to the StakingRewardsDistributor contract (0xf2fa332bD83149c66b09B45670bCe64746C6b439) through the sUSDe Yield Distributions (0x71E4f98e8f20C88112489de3DDEd4489802a3A87):

https://etherscan.io/address/0x71e4f98e8f20c88112489de3dded4489802a3a87

The StakingRewardsDistributor is the core contract of the Ethena protocol, with two roles: Owner and Operator. The Owner has the authority to update the contract configuration and modify the Operator, who is authorized by the Owner to mint USDe and send USDe rewards to the staking contract.

Currently, the Owner address of this contract is 0x3B0AAf6e6fCd4a7cEEf8c92C32DFeA9E64dC1862, controlled by a 4/8 multi-sig wallet.

Security Risks

1. Centralization Risk

Ethena's main security issue stems from the centralized exchanges used for cash-and-carry arbitrage and the custodial method for off-chain settlement. Currently, Ethena uses companies like Cobo, Ceffu, and Fireblocks as custodians and off-chain trading service providers, with about 98% of the collateral concentrated on three major exchanges: Binance, OKX, and Bybit. If the custodians or exchanges cannot operate normally (due to operational or technical issues), the stability of USDe could be jeopardized.

Although Ethena has implemented a fund verification service (similar to Proof of Reserve) to verify all the collateral in the protocol, this service is not yet open to regular users.

2. Market Risk

The yield mechanism of USDe may encounter persistently negative funding rates, which could lead to negative returns from the cash-and-carry arbitrage. Although historical data shows that such negative yield periods are relatively short (less than two weeks), future adverse conditions must be considered. Therefore, Ethena should prepare sufficient reserve funds to cope with this difficult period.

Additionally, as Ethena uses stETH as collateral, although stETH has sufficient liquidity and the price difference with ETH is less than 0.3% after the Ethereum Shanghai upgrade when stETH can be redeemed for ETH, the potential negative premium of stETH in extreme cases may cause the collateral value of Ethena's futures hedging positions to decrease, potentially leading to their liquidation.

In addition to Ethena, there are currently several similar stablecoin protocols in the market, such as USDX Money on BNB Chain and Avant Protocol on Avalanche, whose operating mechanisms and security risks are very similar to Ethena and will not be elaborated further.

Usual Money - USD0

USD0, issued by Usual Money, is a stablecoin backed 1:1 by real-world assets (US Treasuries), with the innovation being the integration of RWA and token economics.

Protocol Principle

Prior to Usual Money, there have been several stablecoin protocols collateralized by US Treasuries, with the largest being Ondo Finance and its stablecoin USDY. The underlying assets of USDY are short-term US Treasuries and bank deposits, managed by Ankura Trust Company, providing a yield of around 5% for USDY holders.

Unlike Ondo and similar protocols, Usual Money has 3 tokens: USD0, a stablecoin issued 1:1 backed by RWA assets; USD0++, a bond certificate designed by the protocol; and $USUAL, the governance token. Holding USD0 does not generate any yield. Users can only capture the yield by converting USD0 to USD0++.

The yield can be obtained in one of two ways:

1. $USUAL rewards per block: USD0++ holders receive their yield in the form of $USUAL tokens on a per-block basis.

2. 6-month locked yield: Guaranteeing USD0++ holders a yield at least equivalent to the yield of the underlying collateral (the risk-free yield of US Treasuries). Users must lock their USD0++ for a specified period (currently designed as a 6-month cycle). At the end of the 6 months, users can choose to receive the yield in the form of $USUAL tokens or USD0.

The Treasury yield earned by USD0++ will all go into the protocol treasury, linking the value of the $USUAL token to the protocol's revenue. From the two yield payout methods, we can see that the yield obtained by USD0++ holders is actually related to the $USUAL token. Furthermore, protocol governance requires $USUAL token voting, and yield-related proposals will attract more token holders, providing room for $USUAL token price appreciation.

Usual Money has the following key contracts:

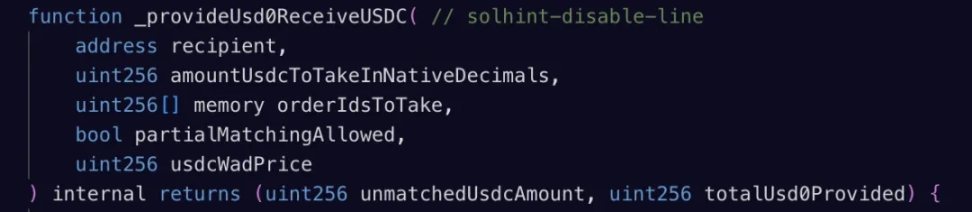

1. SwapperEngine

Used to convert USDC to USD0. Users deposit USDC to create an order, and USD0 providers match these orders to convert the user's USDC to USD0.

https://etherscan.io/address/0x9a46646c3974aa0004f4844b5fcd9c41b2337a7f#code

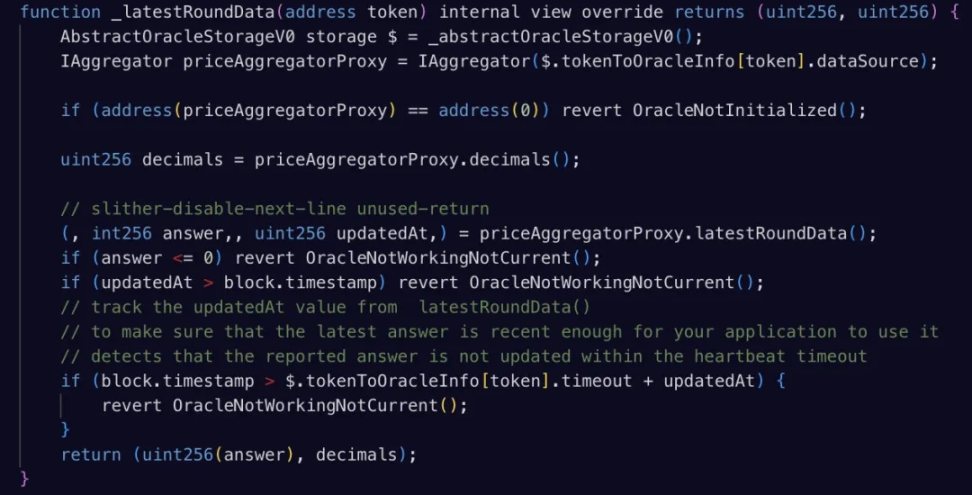

2. Classical Oracle

Aggregates existing oracle price feeds, with the core function being _latestRoundData(), responsible for fetching the latest token prices and verifying the price data:

https://etherscan.io/address/0xdec568b8b19ba18af4f48863ef096a383c0ed8fd#code

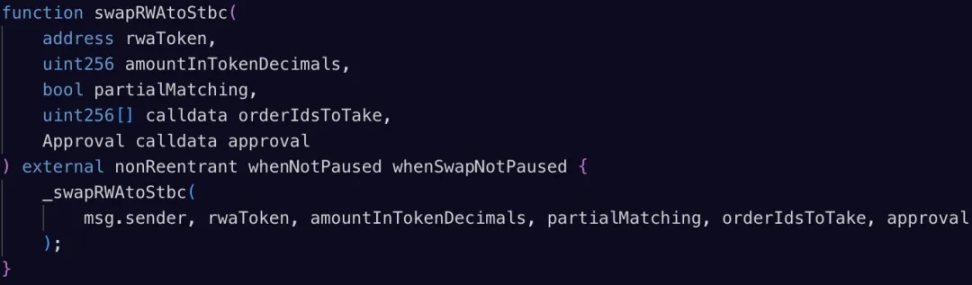

3. DaoCollateral

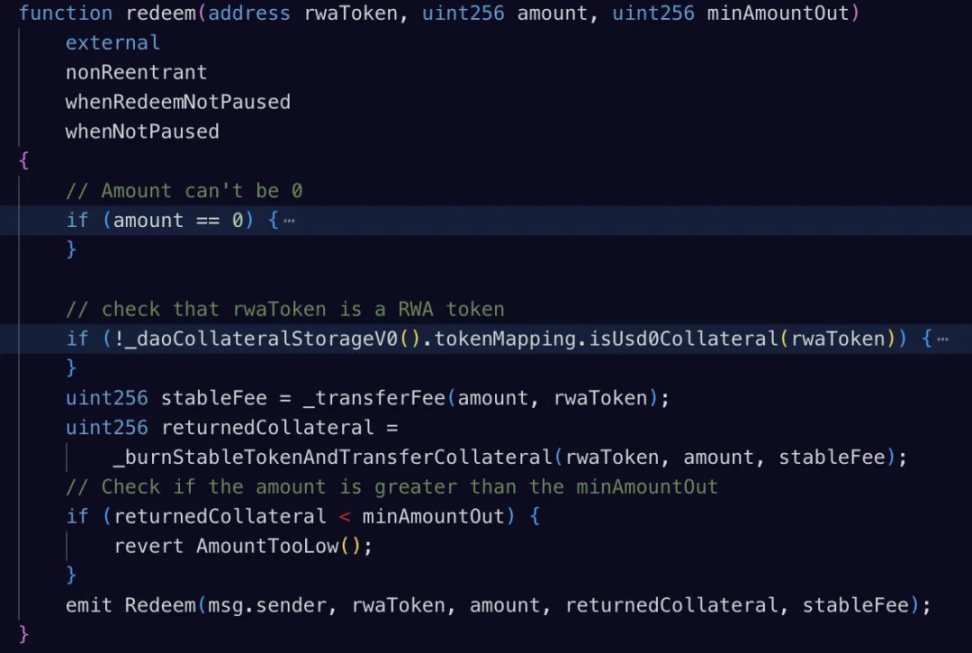

This contract is mainly responsible for the conversion between USD0 and RWA Token (currently USYC, a yield-bearing stablecoin collateralized by US Treasuries that is compliant with US regulations), and has set up a Counter Bank Run (CBR) mechanism to address liquidity risks, which is currently in a closed state.

Converting RWA Token to USD0

Converting USD0 to RWA Token

Security Risks

In the bond market, the longer the maturity, the higher the yield required to compensate. However, the potential yield of USD0++ is only at the level of short-term US Treasuries, and the risk-reward ratio is not balanced. Currently, the US has entered a rate-cutting cycle, and the yield of USD0++ will only get lower, resulting in low capital efficiency for its holders.

There is currently over $700 million in USD0++ in the market, but the liquidity on Curve's USD0-USD0++ pool is only $140 million, with only about 20% of the USD0++ available for withdrawal. In the event of a bank run, this could lead to the de-pegging of USD0++.

Regulatory Compliance

Accompanying the rapid expansion of the stablecoin market is the increasingly severe regulatory pressure globally, especially in the areas of anti-money laundering (AML) and counter-terrorist financing (CFT). The challenges faced by stablecoin issuers are becoming more complex, and how to ensure the liquidity security of stablecoins and comply with the compliance requirements of various regions around the world has become a key challenge for the industry.

Taking Hong Kong as an example, on December 6, the Hong Kong government announced the highly anticipated "Stablecoin Ordinance (Draft)". This legislation provides a detailed regulatory framework for the issuers of fiat-referenced stablecoins (FRS), and the following are some key requirements for stablecoin issuers:

Reserve Assets

a. A separate reserve asset portfolio must be established for each stablecoin to ensure that its market value is equal to or greater than the face value of the outstanding stablecoins.

b. Reserve assets must be managed separately from the assets of other institutions.

c. Investments should prioritize high-quality, highly liquid, and low-risk projects.

d. Robust risk management and audit procedures must be established.

e. Disclosure of reserve asset management, risk control, and audit results is required.

Stablecoin Redemption Mechanism

a. Licensed institutions must guarantee the unconditional redemption of stablecoins and must not impose unreasonable restrictions.

b. Redemption requests must be processed promptly and paid in the agreed form of assets after deducting reasonable fees.

c. In the event of bankruptcy, stablecoin holders should have the right to redeem proportionately.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT)

a. Licensed institutions must implement anti-money laundering and counter-terrorist financing measures involving stablecoins.

b. Compliance with the "Anti-Money Laundering and Counter-Terrorist Financing Ordinance" and related measures is mandatory.

No-Interest Policy

a. Licensed institutions are prohibited from paying interest on stablecoins or assisting in any form of interest payment.

As for non-fiat-linked interest-bearing stablecoin protocols, Hong Kong currently does not have specific regulatory provisions.

The current regulatory framework in Hong Kong aims to ensure the stability, security, and transparency of the fiat-linked stablecoin ecosystem, while protecting the rights and interests of relevant stakeholders. The "Ordinance (Draft)" is scheduled for its first reading in the Legislative Council on December 18.

In the United States, the stablecoins USDY and USYC supported by the U.S. Treasury Department are interest-bearing stablecoins, providing returns to holders through the tokenization of U.S. government debt. USYC is regulated by the U.S. Commodity Futures Trading Commission, and the collateral of the Usual Money protocol mentioned in the text is USYC.

However, for interest-bearing stablecoins based on DeFi or centralized exchange trading strategies, the market risks they face are more complex, and how to protect the rights and interests of the corresponding stablecoin holders is still a challenge for regulatory authorities in various regions.

Summary

In this article, we analyzed the principles, core contract code, and risk points of interest-bearing stablecoin protocols. Project parties still need to pay attention to the security of the project operation level and the contract business logic level, especially in the aspect of permission management. At the same time, stablecoin protocols need to use good risk management and sufficient fund reserves to cope with extreme market conditions and ensure that the value of their stablecoins is not affected.