Moca Network (MOCA) is the native utility and governance token of the Mocaverse ecosystem, and its price surged 370% today.

Previously, a South Korean cryptocurrency exchange announced the listing of the token against the Korean Won (KRW). The MOCA Foundation stated that this marks an important milestone for MOCA. Will the sudden price surge of the token continue?

Moca Network Listed on South Korean Exchanges

Top South Korean cryptocurrency exchanges Upbit and Bithumb have announced support for Mocaverse and the listing of the MOCA token. This has sparked strong sentiment among investors, leading to a sudden 370% surge in the price of Moca Network.

According to Upbit's announcement, users can trade the token against KRW, BTC, and USDT spot pairs. Trading will commence at 2:00 PM KST on December 16th. Deposits and withdrawals of MOCA tokens are not supported through networks other than Ethereum.

"Only personal wallet addresses that have completed 'ownership verification' can make deposits and withdrawals, and even if deposits are made through associated personal wallets, refunds may be required based on the asset network."

Additionally, Bithumb has also announced the listing of Moca Network. The digital asset exchange has listed MOCA and KRW pairs on the Ethereum network.

According to the official listing announcement, trading will commence at 2:00 PM on December 16th. The base price is set at 136 Korean Won. The exchange has also listed MOODENG against the Korean Won.

Both top cryptocurrency exchanges have renamed the token to Mocabus to align with the South Korean market.

Reaction from Animoca Brands Co-founder Yat Siu

Animoca Brands co-founder Yat Siu expressed gratitude for the South Korean exchanges' support of their Mocaverse and MOCA token. He said, "Thank you Upbit, welcome Korea to the Moca network, bringing mass adoption to Web3." This statement highlights the importance of the South Korean market in driving the development of the MOCA token and the Mocaverse ecosystem. Yat Siu recently discussed the strategic direction and market potential of Mocaverse in an exclusive interview with CoinGape.

The MOCA Foundation also stated that the listing on South Korean exchanges is an important milestone, laying the foundation for the team to further expand the Moca ecosystem in the Korean market. Mocaverse specifically mentioned that the Korean market is one of its key development targets, with a core mission to attract over 28 million retail consumers. This indicates the team's deep commitment to the Korean market and their long-term vision for mass user adoption.

This expansion not only represents a growth in market size for MOCA and Mocaverse, but also enhances the global influence and appeal of the ecosystem. Coupled with the high acceptance of innovative technologies among Korean users, this strategic move could provide significant momentum for the future growth and adoption of the Moca network.

MOCA Token Surges 370%

The price of MOCA has surged significantly after the announcement of its listing on South Korean exchanges, with a gain of 370%. The current price is $0.40. Over the past 24 hours, the lowest and highest prices were $0.08 and $0.41, respectively. Trading volume has also increased by over 600%, indicating strong market interest in MOCA.

The MOCA futures market has also shown remarkable growth, with the open interest climbing nearly 1000% in 4 hours and 1250% in 24 hours. The current open interest of 13.426 million contracts is valued at approximately $33.27 million, reflecting the bullish sentiment in the market and the potential for further price appreciation.

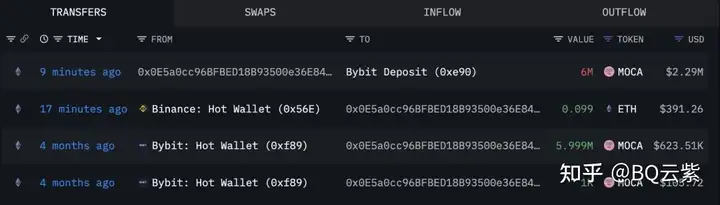

It is worth noting that on-chain data shows two wallets depositing 9.5 million MOCA tokens, worth around $3.55 million, into Bybit. These wallets are believed to be controlled by the same whale. If these tokens are fully sold, the whale could potentially realize a profit of around $2.55 million. This dynamic may impact the short-term price movement, but it also highlights the active trading activity in the MOCA market.

In this context, investors should closely monitor the whale's actions and potential market volatility, and exercise caution in their operations to prepare for possible short-term adjustments.