Author: Revc, Jinse Finance

The bull market liquidity begins to nourish the dried-up riverbed of the NFT sector

Recently, TheBlock co-founder Mike Dudas revealed on social media that OpenSea has registered a foundation in the Cayman Islands, and Azuki NFT series anonymous researcher Waleswoosh also posted a screenshot of OpenSea's registration in the Cayman Islands. Typically, Web3 projects register a foundation to prepare for token issuance, which has sparked speculation about the imminent launch of tokens and user airdrops. However, OpenSea still faces regulatory enforcement from the SEC, making its token issuance prospects highly uncertain. In addition, OpenSea has previously adopted a traditional financing model, which has also to some extent limited its token issuance process. But facing the incentive competition from platforms like Blur and Rarible, without a point system, it is difficult to gather liquidity, and it is expected that OpenSea will adopt a relatively compromised scheme to benefit users.

The listing of Magic Eden has injected some confidence into the NFT market. However, the current NFT trading market has already moved away from the core narrative of the crypto industry, and although its token price once reached a high of $10, it has now fallen back to $3.68. Recently, a large batch of "zombie projects" in the crypto industry have rushed to go public, and the negative impact on the industry is still borne by users.

According to SosoValue data, the launch of MOCA on Upbit has caused its price to soar by 380%, boosting the short-term sentiment recovery of the NFT market. The logic chain of the token's three-level jump is further strengthened, which is worth investors' attention. Most MEME and Token market capitalizations follow the following path:

Solana & Base chain fermentation - Binance & Bitget listing - Coinbase & Upbit listing

The former king OpenSea

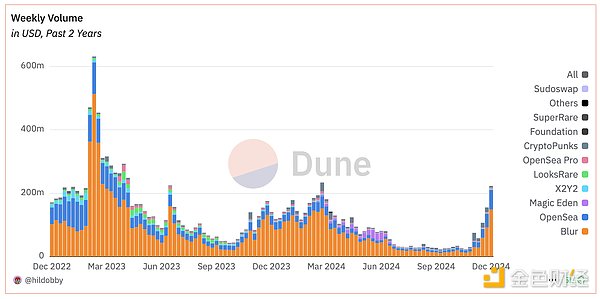

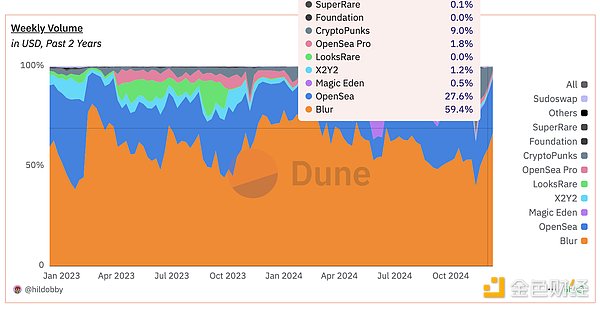

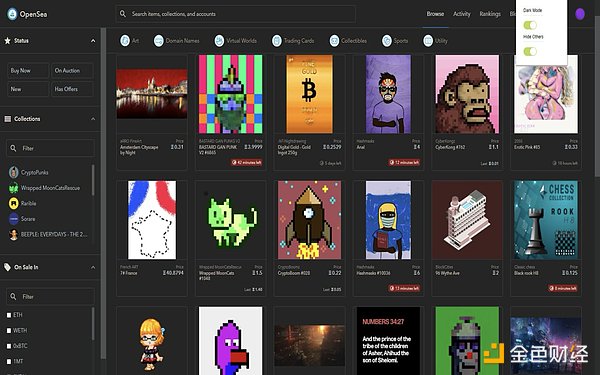

NFT has always been seen as the cornerstone of the creator economy and the SocialFi track, and at the peak of its trading volume, OpenSea accounted for 90% of the entire sector, but now it only has an average market share of less than 20%. Relying on its unique culture and product positioning, which is different from the transaction-driven Blur platform, OpenSea's excellent user experience and UI design have attracted the creator and artist community, and even their first stop in entering Web3. If the NFT market recovers with the crypto industry, OpenSea is expected to re-establish its core strategic position.

OpenSea was founded in 2017 by Stanford graduates Finzer and Atallah, initially as a Wi-Fi sharing startup. After being exposed to the concept of NFT, they quickly pivoted to the NFT market and received their first round of funding in 2018. With the explosion of the NFT market in 2021, especially the popularity of works like Beeple, OpenSea quickly became the industry leader, occupying more than 90% of the market share. The platform's valuation once reached $13.3 billion.

However, OpenSea's success did not last. The platform has been plagued by internal problems, including insider trading scandals and platform crashes. At the same time, external competition has also become increasingly fierce, with the rise of new trading platforms like Blur diverting a large number of users. With the overall decline in NFT trading volume and the bear market in the crypto currency market, OpenSea's revenue and valuation have also shrunk significantly.

To address the challenges, OpenSea has launched a series of measures, such as layoffs and the launch of version 2.0. But the market's confidence in OpenSea has diminished. In addition to market and internal challenges, OpenSea also faces close scrutiny from regulatory authorities. The U.S. Securities and Exchange Commission (SEC) has launched an investigation into OpenSea and demanded a large number of documents. The SEC's investigation is mainly focused on whether OpenSea has treated NFTs as securities for sale. If deemed a security, OpenSea could face serious legal consequences. In addition, tax authorities in multiple countries around the world have also investigated OpenSea's tax issues. OpenSea's legal team is actively addressing these challenges, but regulatory risk remains the Sword of Damocles hanging over the company.

OpenSea 2.0

Previously, OpenSea co-founder and CEO Devin Finzer announced that the NFT market is planning a comeback. Although Finzer revealed limited details, he promised that the new version of OpenSea will be launched in December.

In addition to the regular user interface upgrades, the new version of OpenSea is more focused on optimizing the trading interface to cater to the habits of professional NFT investors and attract a large amount of liquidity into the market.

From the preview of the point system, the OpenSea V2 version aims to encourage users to provide NFT liquidity through collection and trading. In addition, the platform has designed a point bonus for guiding the liquidity of specific projects. But for now, the mechanism seems rather conventional.

Review of Blur's airdrop rules

Blur has used multi-stage airdrops (called "Seasons") to increase platform participation and introduced differentiated token distribution rules. It is expected that OpenSea will refer to Blur's mechanism and combine the current market trends and incentive goals.

Season 1 airdrop

First wave: Targeting traders active on any Ethereum NFT market in the first 6 months after Blur's launch. Users need to list at least 1 NFT on the Blur platform within 14 days of the announcement to be eligible for the airdrop.

Second wave: Rewarding users who actively list NFTs on Blur. The listing score is based on the likelihood of sale and collection activity, and listings with full royalties can earn double points. In addition, users can earn additional incentives through trading activities (5% reward for completing 3 sweeps, 50% reward for 6 sweeps).

Third wave: Mainly rewarding users who bid on NFTs on Blur, aiming to improve platform liquidity and participation.

Season 2 airdrop

Blur introduced a loyalty scoring system to encourage users to exclusively use Blur for transactions. The allocation of rewards is determined by the user's loyalty and the volume of NFTs listed. A total of 300 million $BLUR tokens, worth about $146 million, were distributed in this airdrop.

Season 3 airdrop

Supported by the Layer2 network Blast, users can accumulate points through NFT listing, bidding and lending activities. In addition, holders of $BLUR can also receive point rewards.

Referring to Blur's airdrop experience, users can prepare from the following aspects to obtain potential token airdrops from OpenSea:

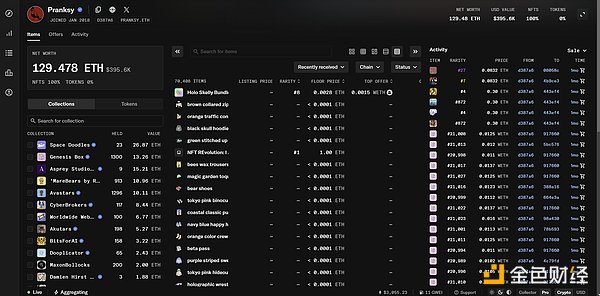

Provide liquidity for NFT projects with stable floor prices and active trading volumes, and pay attention to the expected returns of potential token issuance projects.

List NFTs, even at prices far above the market, to minimize the situation of NFTs being stuck in wallets for a long time.

Focus on NFT projects that interact frequently with OpenSea, especially those with higher royalties, as OpenSea intends to attract more creators through this.

Actively participate in the use scenarios of OpenSea's points or tokens to promote token circulation and ecosystem applications.

Non-Fungible Token (NFT) Project Token Issuance Surge

With the rise in NFT floor prices, the transaction threshold is also constantly increasing, and token issuance has become an effective tool to expand the community audience and increase market liquidity. By combining NFTs and tokens, project parties use token incentive mechanisms to form a closed-loop ecosystem, attracting user participation and enhancing liquidity. Data shows that the token market capitalization and trading volume of projects are usually higher than the NFTs themselves, reflecting the high demand and liquidity advantages of tokens in the market.

Note: Due to the complexity of the NFT ecosystem and IP rights, the rights and interests of NFTs and tokens are not completely matched. The above data is for reference only, and participation in such projects requires a full assessment of potential risks.

Summary

The activity of the current NFT market is recovering, with recent trading volume exceeding $200 million, but there is still a large gap to the peak trading volume of the previous cycle. If blue-chip NFT projects are viewed as undiscovered Alpha assets at this time, the new version of OpenSea and its point-based incentive plan are expected to inject new capital flows and user vitality into the NFT market.