Author: Maggie

From a certain perspective, the 21 trillion US dollar volume of Bitcoin (latest CoinGecko data as of December 18, 2024) is the largest "dormant capital pool" in the crypto world.

Unfortunately, most of the time it has neither brought returns to its holders nor injected vitality into the on-chain financial ecosystem. Although there have been many attempts to release the liquidity of Bitcoin assets since the start of the DeFi Summer in 2020, most of them are just reinventing the wheel, and the overall inflow of BTC funds is very limited, and have never really leveraged the BTCFi market.

Against this backdrop, the newly launched Stacks mainnet sBTC, as a 1:1 Bitcoin-backed asset on the Stacks L2, is committed to leveraging the security (100% Bitcoin finality) and fast transactions of Bitcoin to unlock BTC capital and open up new use cases, thereby fully revitalizing the Bitcoin economy.

Currently, sBTC is operated by a large-scale signer network composed of institutions such as BitGo, Asymmetric and Ankr, and is expected to become one of the most decentralized L2 Bitcoin assets, bringing unprecedented opportunities to areas such as DeFi and dApps. This article will further explore the specific operating mechanism and relative advantages of sBTC.

How does sBTC work?

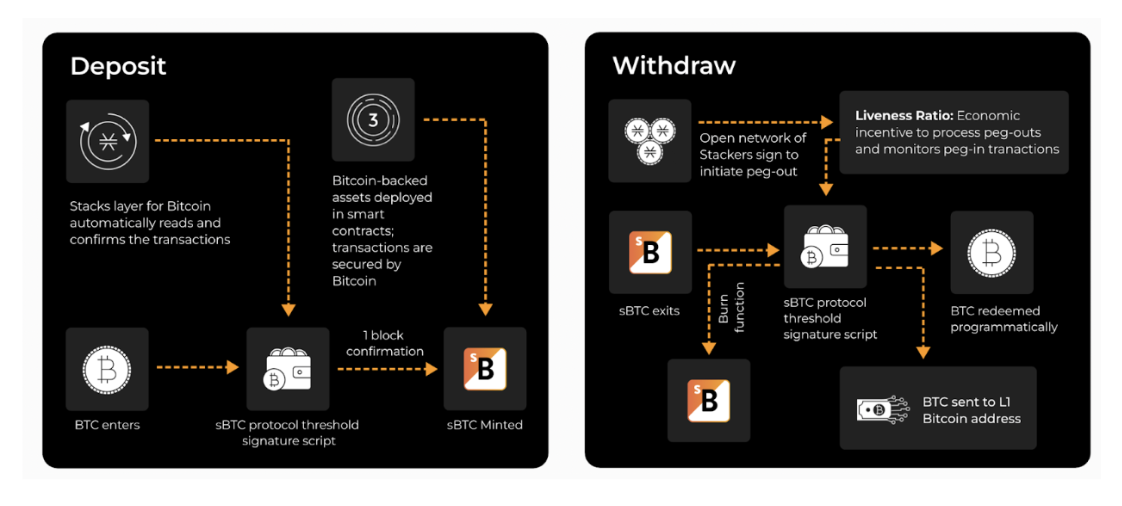

Users first deposit BTC into a multi-signature protocol monitored by a decentralized signer group on the Stacks network through Bitcoin mainnet transactions.

After the BTC is deposited, sBTC is minted on Stacks, and users can then interact with DeFi dApps.

Users can use Bitcoin DeFi seamlessly, for example, Zest Protocol will support the deposit of mainnet BTC and automatically convert it to sBTC. In the future, sBTC is expected to become the fee token on Stacks, further enhancing the user experience.

Will sBTC have a deposit limit?

At the current stage, the deposit limit is 1,000 BTC, in order to conduct controlled testing and gradually strengthen security.

In the early stage, only deposits are supported, and withdrawals are temporarily unavailable.

Will sBTC generate yield?

Imagine being able to earn Bitcoin rewards just by holding BTC.

No staking, no points, no complex procedures, just hold BTC to get rewards. Early sBTC users can connect their wallets to https://bitcoinismore.org/ (launched at 10:00 pm Beijing time on December 17) to receive a 5% annualized Bitcoin reward.

Now, through the sBTC reward program, this becomes possible. Early users can earn BTC rewards simply by holding sBTC, and the rewards will be distributed in the form of sBTC.

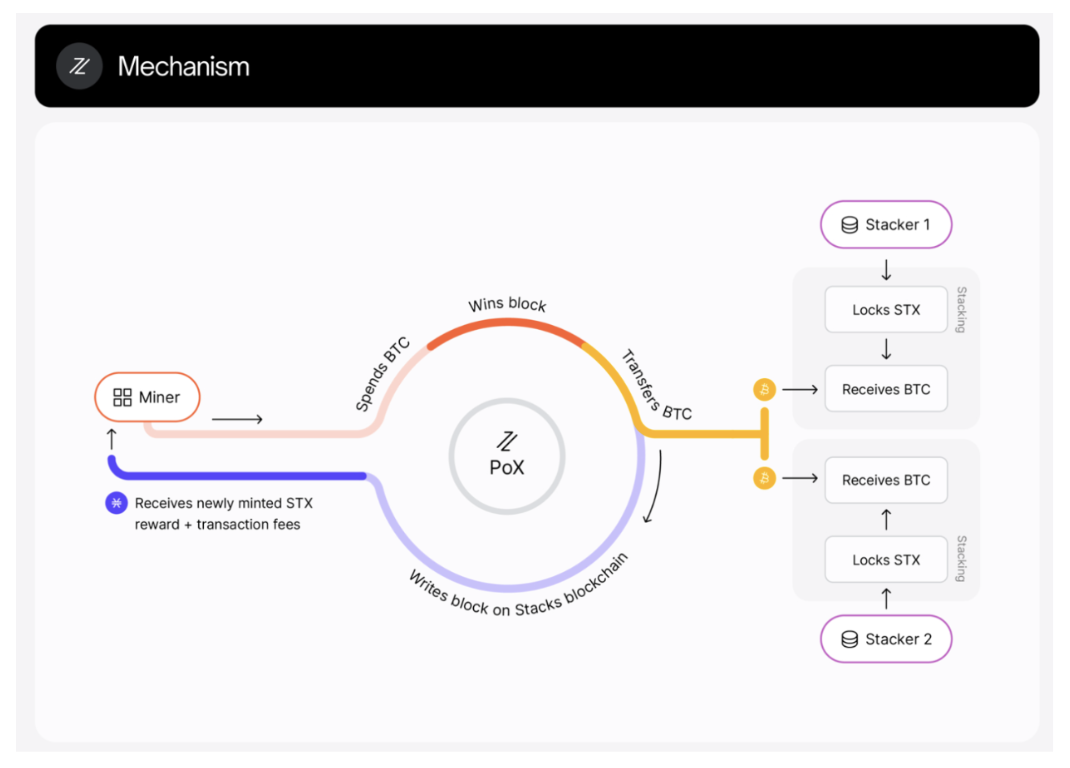

The sBTC reward program is supported by the "Stacking" STX stackers.

When staking STX, stackers receive BTC through the Stacks consensus mechanism. To enable the sBTC reward program, these stackers will contribute the corresponding proof-of-transfer BTC rewards to the sBTC reward pool.

The BTC from the reward pool will be directly deposited into a smart contract, which will deposit the BTC into sBTC and distribute the rewards proportionally to sBTC holders. The protocol will take a snapshot of users' sBTC holdings daily and distribute the rewards every two weeks - the length of a PoX cycle.

The current estimated annual BTC reward is 5%, and the rewards will be distributed every two weeks.

Key features of sBTC:

Where can sBTC be used?

Multiple DeFi protocols will support sBTC, allowing users to earn additional rewards on top of the 5% APY:

Liquidity pools: Users can deposit sBTC into Bitflow's liquidity pools to facilitate trading and earn a share of the transaction fees.

Yield farming: Liquidity providers can stake their LP (liquidity provider) tokens in yield farming projects to earn additional rewards, which typically come from trading activity or platform incentives.

Early estimates suggest an additional 10%-30% annualized yield from deploying sBTC.

Bitflow Runes AMM

Bitflow has launched a Runes AMM (Automated Market Maker) on the Stacks L2, allowing users to bring Runes to L2 and enjoy a better user experience.

sBTC will be available on the Zest Protocol's lending market on the first day of launch.

Zest Protocol will launch an enhanced yield activity on the first day of launch, offering up to 10% BTC yield on provided sBTC.

Zest will also unlock more DeFi strategies related to sBTC, such as:

Deposit sBTC to earn up to 10% annualized BTC yield;

Use BTC (or other stablecoins) as collateral to borrow USDh stablecoin, and then swap it for USDh;

Stake the USDh on Hermetica to earn up to 25% annualized yield.

Note: Hermetica's DeFi protocol provides USDh, the first yield-bearing stablecoin backed by Bitcoin. This yield is sustainably generated from the funding fee payments on centralized exchange perpetual contracts and paid out daily.

stSTXbtc is a new liquid staking token, which users can apply in the Stacks DeFi ecosystem. Holders of this token will earn up to 10% annualized yield through staking rewards, which will be paid in sBTC directly to their wallets.

Liquidity provision: Users can provide sBTC to Velar's liquidity pools to facilitate trading and earn a share of the platform's transaction fees.

Yield farming: By participating in yield farming projects, users can stake the liquidity provider (LP) tokens they received for providing sBTC liquidity to earn Velar's native tokens or other incentive rewards.

Staking: If Velar provides staking options for sBTC, users can lock their sBTC in the staking contract to earn rewards, such as additional tokens or a percentage of the revenue supporting the network operations.

Velar will launch its own incentive program, allowing users to earn Velar's native token VELAR by deploying sBTC to its DEX pools.

Arkadiko- USDA Stablecoin

Arkadiko will, through governance voting, allow sBTC to be used as collateral in its protocol, enabling users to use their Bitcoin holdings as collateral to borrow USDA or other assets.

ALEXDEX

Users can deposit sBTC into ALEX's liquidity pools and pair it with other assets (such as STX or stablecoins). In this way, they provide liquidity for the platform's trading and earn a share of the pool's transaction fees.

ALEX will provide additional reward yields through its native token ALEX as part of a Surge program. This means that in addition to the 5% annualized sBTC reward program, users can also earn extra ALEX token rewards by providing sBTC liquidity.

Granite- Lending Protocol (not yet launched)

Borrowers can obtain stablecoin loans by using Bitcoin as collateral, while liquidity providers can earn yields by supplying stablecoins to the protocol.

Borrowing: Users can use sBTC as collateral to borrow stablecoins, and then use them for various DeFi strategies to earn yields.

Liquidation participation: Users can act as liquidators, earning rewards by repaying part of the undercollateralized loans and receiving the collateral, thereby earning yields through the liquidation process.

Granite currently has a waitlist that allows early registered users to access the platform in advance. Ultimately, the system will introduce a points system that will bring additional benefits, and early registered users will have a significant advantage.

Granite Waitlist

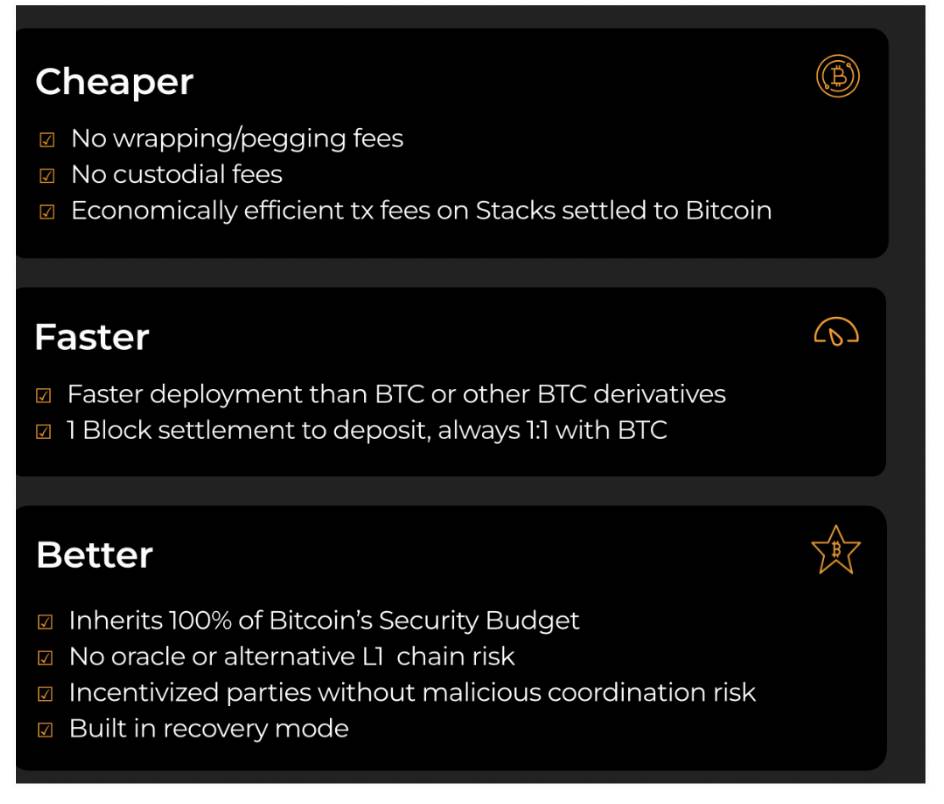

What is the difference between sBTC and other BTC assets?

These BTC assets usually require sending BTC to an intermediary, or rely on a trusted signer consortium/small multi-sig institution.

sBTC will initially rely on 15 signers, including enterprise-level institutions like BlockDaemon, Figment, Luganodes, and Kiln, responsible for handling the asset's pegging and unlocking. Over time, this responsibility will gradually shift to all Stacks signers, allowing anyone to participate in the network's security and decentralization, with institutions like BitGo and the Aptos Foundation expected to join this process.

Additionally, thanks to Stacks' design, sBTC will achieve 100% Bitcoin finality, meaning that transactions on the Stacks layer will be irreversible like Bitcoin.

Note: Signers are responsible for verifying and approving each produced block; anyone can become an independent signer by staking enough STX, similar to the concept of a validator.

Additional Information:

1) sBTC Resources:

sBTC Website: https://www.stacks.co/sbtc

sBTC Documentation: https://docs.stacks.co/concepts/sbtc

sBTC Presentation: https://www.stacks.co/sbtc-deck

2) Nakamoto Upgrade Information:

Nakamoto Website: https://www.nakamoto.run/

Documentation: https://docs.stacks.co/nakamoto-upgrade/nakamoto-upgrade-start-here

The Nakamoto Upgrade is crucial because it brings:

- Fast Blocks (from the current 10 minutes to less than 1 minute, with optimization still ongoing)

- 100% Bitcoin Finality

Fast Blocks: Fast blocks provide a Solana-like transaction experience and Bitcoin DeFi interactions, greatly improving the overall user experience when interacting with the Stacks L2.

Stacks' DeFi ecosystem has grown rapidly this year, and now deploying DeFi strategies takes just seconds, facilitating user onboarding and retention.

Before the Nakamoto hard fork, Stacks' blocks were synchronized with Bitcoin blocks (average 10 minutes), which made the chain too slow to meet the needs of DeFi activities. This limitation no longer exists. Instead, Stacks' blocks can now be finalized in just seconds, and performance improvements are made regularly. At the same time, once the Bitcoin blocks are settled, Stacks still relies on Bitcoin's security.

100% Bitcoin Finality: With the Nakamoto Upgrade, transactions occurring on the Stacks L2 will leverage Bitcoin's 100% security budget, meaning that once the subsequent Bitcoin blocks are settled, Stacks' transactions will be irreversible like Bitcoin.

Unlike the previous model where a single Stacks block was tied to a single Bitcoin block, now Bitcoin blocks are tied to miner terms, during which they will mine multiple Stacks blocks, which are settled in seconds.

There are currently 50 signers, including enterprise-level institutions like BitGo, Aptos, Luganodes, and Kiln, responsible for verifying and approving the blocks produced during each miner term.

Fast block times and Bitcoin finality make Stacks the most secure and scalable Bitcoin L2, with operations supported by a decentralized signer network, and future plans to achieve decentralized Bitcoin liquidity through the upcoming sBTC upgrade.

3) Stacks Data Analysis Platforms:

Signal 21: https://signal21.io/

DefiLlama: https://defillama.com/chain/Stacks

Stacks Block Explorer: https://explorer.hiro.so/