Messari's 2025 Crypto Thesis provides a comprehensive analysis of the current state and future of the cryptocurrency industry.

The report highlights key trends, major players, and transformative technologies that are shaping this space at a critical juncture.

Outlook for Next Year

The report starts by emphasizing resilience. Despite headwinds such as high-profile bankruptcies, increased regulatory pressure, and major company layoffs, the cryptocurrency industry remains robust. The 2022 FTX collapse and subsequent regulatory crackdown created uncertainty, but this crisis served as a catalyst to remove unsustainable models.

Layer 1 blockchains like Ethereum and Solana have continued to build on their strengths, with adoption and scaling solutions. Meanwhile, Bitcoin's market capitalization dominance has rebounded, solidifying its position as a store of value and institutional asset.

Another key theme Messari identified for 2025 is a return to fundamentals. The industry is shifting back towards decentralization, permissionless systems, and user-centric innovation, moving away from the speculative and centralized ventures that led to recent collapses.

The rise of decentralized finance (DeFi) protocols like Aave and MakerDAO reinforces this change. These platforms continue to grow without relying on intermediaries. The focus on decentralization is also reflected in protocols aiming to improve governance and increase on-chain activity.

Bitcoin Dominance, Real-World Assets (RWA)...DeFi

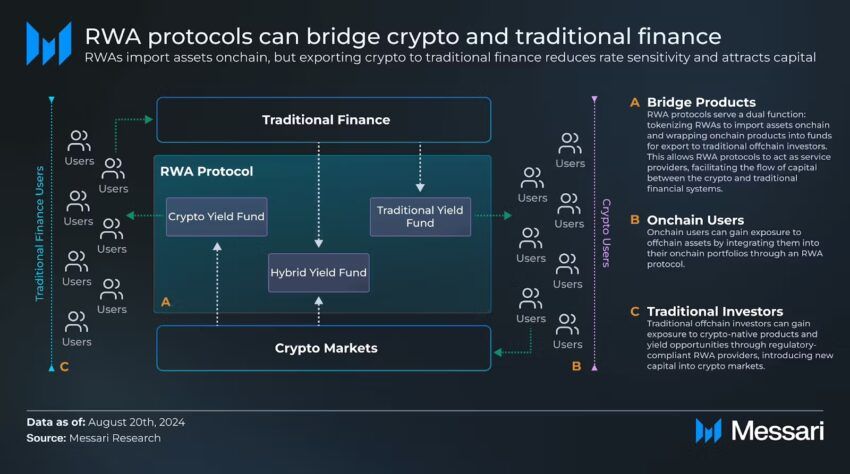

Messari highlights the investment themes expected to dominate in 2025. Bitcoin and tokenized real-world assets (RWA) stand out. Bitcoin's success in 2024 is underpinned by strong institutional trust, such as Bitcoin ETFs.

Meanwhile, tokenized RWAs are poised to reshape the market by bringing traditional assets like real estate, bonds, and equities onto blockchain networks. Projects like Centrifuge and Tempus Finance have emerged as key players connecting traditional finance and blockchain technology.

Influential individuals and companies are also identified as drivers of innovation. Individuals like Vitalik Buterin are at the forefront of Ethereum's rollups and Layer 2 networks like Optimism and Arbitrum.

Firms like Coinbase and Robinhood Crypto are adapting to regulatory changes and strengthening their global presence. In Europe, the Crypto Asset Markets (MiCA) regulation provides a favorable framework for growth.

Crypto Regulation...Europe Leads, US Uncertain

The report also discusses the importance of policy developments. MiCA has laid the groundwork for increased adoption by providing regulatory clarity in regions like the European Union, while uncertainty still exists in the US.

Messari points to ongoing legal disputes with companies like Coinbase as a key area to watch in 2025. The outcomes of these events will shape how crypto assets are classified and traded in one of the world's largest financial markets.

Finally, technological breakthroughs are poised to redefine the cryptocurrency industry. Advancements in scalability and data management are addressing blockchain's most pressing limitations. Layer 2 solutions like Ethereum's rollups and Bitcoin's Lightning Network have significantly improved transaction speeds and reduced costs.

The integration of artificial intelligence and blockchain technology is also emerging as a transformative trend. AI-powered smart contracts and decentralized data solutions are expected to automate financial processes and enable new applications. By solving scalability and automation issues, they will overcome barriers that have hindered wider adoption.

"The AI x Crypto space remains one of the most attractive and unknown frontiers in the crypto world in the coming year. While sectors like DeFi have become established categories, AI x Crypto remains an emerging vertical that is benefiting from the tailwinds of the AI industry. The positive outlook for this space is that it will successfully connect two of the most explosive technology sets." – Messari Analysts

Messari's 2025 Crypto Thesis paints a picture of an industry that has weathered adversity. By focusing on decentralization, regulation, and technological advancements, this space is maturing into a more transparent ecosystem.

With Bitcoin's continued dominance, the rise of RWAs, and the regulatory framework in Europe, 2025 could be a pivotal year in the evolution of cryptocurrencies.