Speculation is growing that MicroStrategy (MSTR) may suspend its Bitcoin (BTC) purchases in January. This is due to a rumored blackout period for stock or convertible bond issuance.

A corporate blackout period is a temporary period when a publicly traded company restricts certain activities related to its securities. Such restrictions are typically imposed voluntarily.

Possibility of Slowdown in MSTR's Bitcoin Purchases in Q1 2025

Prominent venture investor Vance Spencer, co-founder of Hyperfine, has argued that Michael Saylor, the chairman, may find it difficult to make additional Bitcoin purchases through a new convertible bond issuance in January next year.

However, this could disappoint many MSTR investors who have been closely watching the company's aggressive Bitcoin acquisition strategy.

"Saylor will be in a blackout period throughout January and unable to issue new convertible bonds to buy BTC. He'll try to do it by December 31st, and then alt season begins." - Vance Spencer wrote on X (formerly Twitter).

Some observers have suggested that the rumored restriction may have originated from insider trading regulations. While the SEC does not prohibit insiders from trading after the end of an accounting quarter, many companies adopt blackout periods to avoid the appearance of impropriety.

These periods often last two weeks to a month, ending a few days after the quarterly earnings announcement. Others have speculated that the restriction may only apply to "at-the-market" (ATM) stock sales, not convertible bond issuances.

"I don't think the MSTR blackout is as dramatic as portrayed. I'm not confident that MicroStrategy will halt Bitcoin purchases or suspend their ATM for the period from quarter-end to earnings release (~40 days). I understand their regular 8K filings and press releases satisfy all fair disclosure requirements, and they've established norms for market activity so far." - Another analyst wrote.

Another theory is that it may be related to MicroStrategy's inclusion in the Nasdaq-100 index on December 23rd. Recommendations from an internal committee may have led to a temporary suspension.

MicroStrategy's next earnings report is expected between February 3-5, 2025. Analysts believe the blackout period may last the entire month of January or start in mid-January on the 14th.

"MSTR's financial operations have achieved a 46.4% return on BTC so far. This equates to a net profit of approximately 116,940 BTC. Calculated at $105,000 per BTC, this amounts to approximately $12.28 billion for the quarter." - Michael Saylor wrote on X (formerly Twitter).

MicroStrategy currently holds $4.62 billion worth of Bitcoin, recording over $1.89 billion in unrealized gains. The company purchased more than $3 billion in BTC in December alone, demonstrating Michael Saylor's company's strong optimism about the largest cryptocurrency.

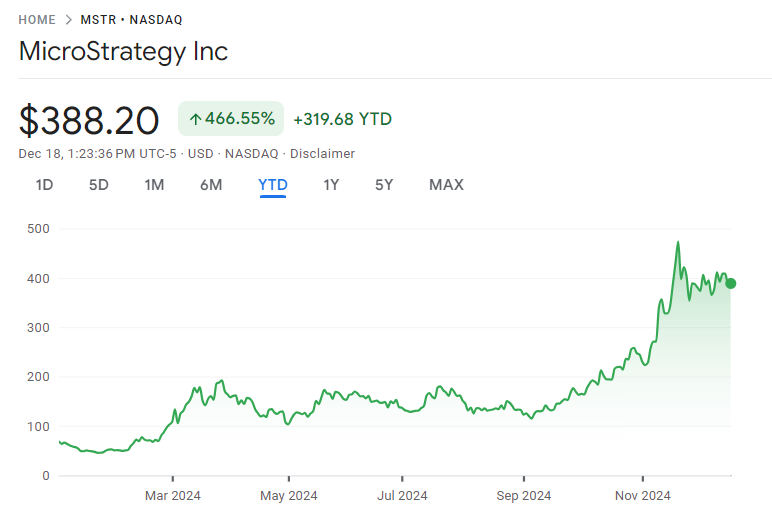

The Bitcoin bull run this year has been reflected in MicroStrategy's stock market performance. MSTR's share price has surged over 460% since the beginning of the year.

This rally has propelled the company into the top 100 publicly traded companies in the US. The stock has recently been added to the Nasdaq-100 and may potentially join the S&P 500 next year.