Introduction

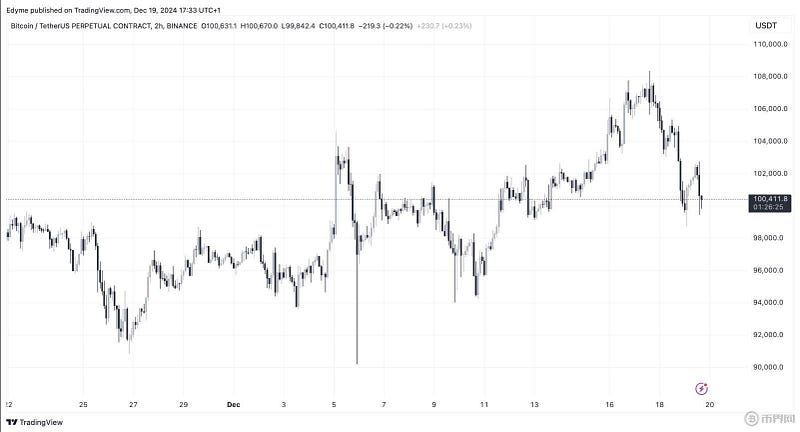

Bit' Bitcoin price has experienced significant fluctuations recently, attracting market attention. From the recent price correction, Bit' Bitcoin fell to a low of $95,682 and then rebounded to $97,278, currently stabilizing in the $97,000 range, with a decline of 3.85% in the past 24 hours. Although there has been a significant pullback in the short term, Bit' Bitcoin's long-term upward trend has not been fundamentally changed. This article will analyze the key factors in Bit' current Bitcoin market and discuss its future price trend.

Federal Reserve Policy and Market Sentiment: The Root Cause of Bit' Bitcoin's Volatility

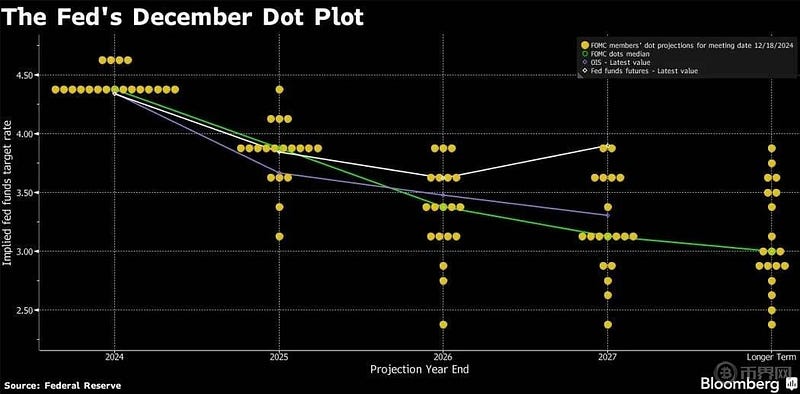

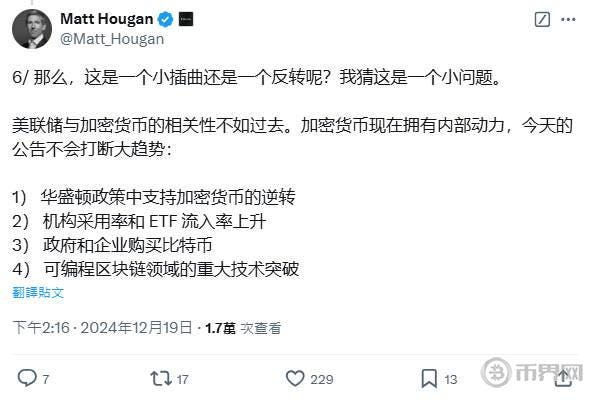

Bit' Bitcoin's latest decline is closely related to the recent policy changes of the Federal Reserve (Fed) in the United States. On the 19th, the Fed announced a 1-code rate cut as scheduled and hinted at slowing the pace of rate cuts, which triggered a cautious sentiment towards risk assets in the market. Although the US stock market and Bit' Bitcoin have experienced a short-term decline, Bit' Bitcoin's downward trend has not hindered the release of its upside potential. Matt Hougan, Chief Information Officer of Bitwise, tweeted that although the Fed's policy has had a short-term negative impact on risk assets such as Bit' Bitcoin, Bit' Bitcoin's intrinsic momentum remains strong.

Hougan believes that the relationship between the Fed's policy and Bit' Bitcoin is weakening, and the current correction is more seen as a "minor incident" in Bit' Bitcoin's upward process. In addition, he pointed out that Bit' Bitcoin's long-term upside potential still comes from several key factors: the policy environment is gradually supporting cryptocurrencies, the participation of institutional investors is increasing, the continuous breakthroughs in Bit' blockchain technology, and the gradual purchase of Bit' Bitcoin by governments and enterprises.

Liquidation in Crypto Market and Capital Flows

The violent fluctuations in the cryptocurrency market have also led to large-scale liquidation events. According to data from Coinglass, the total liquidation amount in the cryptocurrency market over the past 24 hours reached $1.003 Bit', with long positions accounting for the majority at $859 Bit', while short positions were $169 Bit'. The number of investors liquidated exceeded 300,000, reflecting the high degree of uncertainty in the market sentiment.

Such large-scale liquidation phenomena usually occur in the context of violent price fluctuations. Investors were unable to adjust their positions in time, leading to a large-scale withdrawal of market funds. Although there may be further adjustments in the short term, in the long run, this market "reshuffle" will help to promote healthier capital flows and improve the market structure.

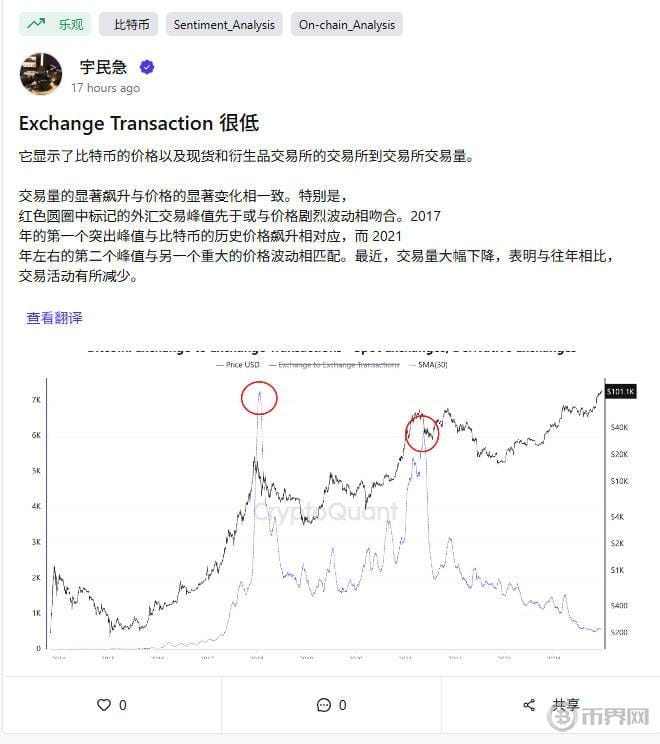

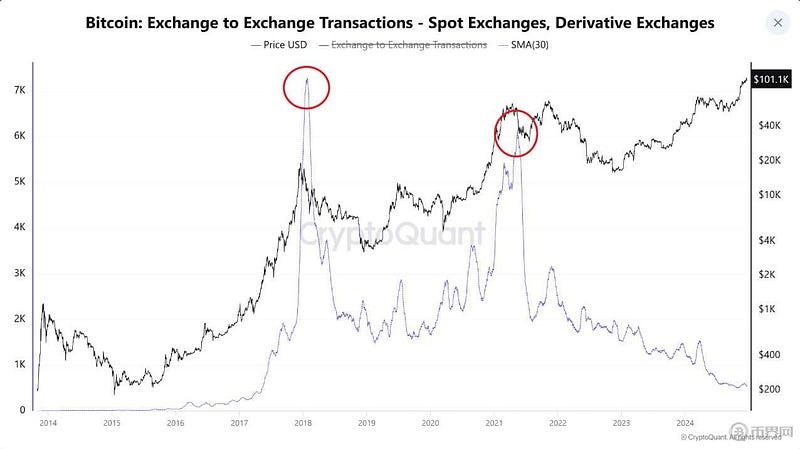

Declining Trading Volume: Changes in Market Participation

Compared to previous periods of Bit' Bitcoin price fluctuations, the trading volume in the current cryptocurrency market has shown a significant decline. According to research by CryptoQuant analyst Woominkyu, historical data shows that large fluctuations in Bit' Bitcoin prices are usually accompanied by a surge in trading volume. However, recent data shows that Bit' Bitcoin's trading volume has decreased significantly in both the spot and derivatives markets. This may indicate that market participation is declining, and investors are becoming more cautious, which could lead to a reduction in short-term market volatility.

Woominkyu's analysis suggests that the reduction in market participation may lead to a period of consolidation in the short term, and investors should pay attention to changes in trading volume and further developments in market signals. This phenomenon indicates that although Bit' Bitcoin still has growth potential, there may be some adjustments in the short term, and investors need to remain vigilant.

Technical Analysis: Support Levels and Future Trends

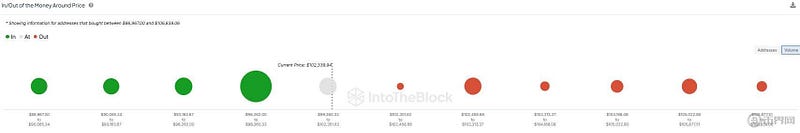

From a technical analysis perspective, Bit' Bitcoin is currently at a critical support area. According to data from the market intelligence platform IntoTheBlock, the $100,000 area is an important support region, especially at the $97,500 level, where a large accumulation of Bit' Bitcoin provides strong support. The existence of this support area means that Bit' Bitcoin may see a rebound in the short term. If the price can hold above this level, a rebound to the $104,000 resistance level is possible.

In addition, market analyst Satoshi Wolf also pointed out that Bit' Bitcoin's price has recently been in line with the 100-day exponential moving average (EMA), which provides a strong signal to the market. Although the current moving average convergence divergence (MACD) shows a bearish trend, the relative strength index (RSI) is approaching the oversold area, indicating that the market may see a reversal. Wolf suggests that traders closely monitor the $100,000 support level, and if it breaks through $104,000, it may mean that Bit' Bitcoin's recovery will be further strengthened.

Long-term Trend: Bit' Bitcoin's Intrinsic Upward Momentum

Although Bit' Bitcoin faces short-term adjustment pressure, its upward trend remains strong in the long run. Bit' Bitcoin's long-term growth momentum comes not only from the support of the macroeconomic environment, but also from technological innovation, the improvement of market acceptance, and the growing demand for Bit' Bitcoin as a digital asset.

First, the US government's policy towards cryptocurrencies is gradually shifting towards support, promoting the legalization of digital assets and the improvement of market acceptance. Secondly, the influx of institutional investors and ETF products is continuously increasing, driving the liquidity and demand in the Bit' Bitcoin market. At the same time, with the continuous breakthroughs in Bit' blockchain technology, the actual application scenarios of Bit' Bitcoin are also constantly expanding, further enhancing its value as "digital gold".

Conclusion

Bit' Bitcoin's short-term price fluctuations may continue, but its long-term upward trend still has strong intrinsic momentum. From a technical analysis perspective, Bit' Bitcoin is testing a key support level, and if it can stabilize above the current price range, it may see a rebound in the future. In addition, the macroeconomic environment, policy support, and the gradual participation of institutions all provide positive support for Bit' Bitcoin's future. Investors should pay attention to short-term market fluctuations, but also look to the long term and do a good job in risk management and investment decision-making.

By focusing on key support levels, market participation, and policy dynamics, investors can better grasp Bit' Bitcoin's future trends and seize opportunities in market volatility.