The decentralized exchange (DEX) leader Uniswap announced in October the launch of "Unichain", a Layer2 network designed for DeFi, making it a part of the OP Mainnet super-chain ecosystem.

The official team tweeted the development roadmap for the mainnet early this morning, stating that the current testnet phase has already seen over 50 million test transactions and more than 4 million test contract deployments, highlighting the tremendous interest from developers in Unichain.

Unichain Roadmap

According to the official statement, the Unichain roadmap includes:

1. Sepolia Testnet (Currently Live)

The primary focus at this stage is to ensure the network's stability and user safety through rigorous testing and monitoring. The official stated that the Unichain Sepolia testnet has maintained an uptime of over 99% for all critical services, and the team has also conducted in-depth reviews of the OP infrastructure for the Sequencer, simulating extreme cases to enhance security.

2. Mainnet Launch

The mainnet is expected to launch in early 2025 and will feature Permissionless Fault Proofs on day one, allowing anyone to verify the activity on the mainnet, realizing the decentralization vision.

Permissionless Fault Proofs will be officially enabled on January 6, 2025, and the Unichain Sepolia testnet will undergo a planned upgrade to deploy this feature. The official warns users to re-verify pending withdrawals and advises avoiding initiating new withdrawals within 7 days before the upgrade, as withdrawals not completed by the upgrade day will need to be restarted.

3. Experimental Testnets: Flashblocks and Unichain Verification Network

The official stated that after the mainnet launch, new features will be continuously introduced to further enhance the system's decentralization and performance. These features will first be tested on experimental testnets, then moved to the Sepolia testnet for larger-scale verification, and finally deployed to the mainnet as official functionalities.

The first feature to be launched on the public experimental testnet will be Flashblocks, which can reduce the block generation time to 250 milliseconds, providing users with an almost instant transaction experience. Additionally, the Unichain Verification Network will also be introduced at this stage, and the community members will be invited to participate in testing the operation of the verification nodes.

For detailed technical information on Flashblocks and the verification network, please refer to the Unichain whitepaper.

Impact of Unichain Mainnet Launch

With the launch of the Unichain mainnet and the Unichain Verification Network, the value capture ability of the UNI token is expected to be significantly enhanced, while also having a significant impact on the revenue of the Ethereum mainnet.

According to an analysis by DeFi Report founder Michael Nadeau, the $368 million in fees paid by Uniswap to Ethereum validators last year will now be shared by the Unichain validators. Although the "Permissionless Fault Proofs" will be enabled on the mainnet launch day, this economic value will not be entirely attributed to Uniswap Labs, but with the introduction of the Unichain Verification Network, the transaction fee revenue and MEV (Maximum Extractable Value) are highly likely to be shared by the UNI token holders.

In comparison, Ethereum validators and ETH holders may become the biggest victims. Uniswap has been the core of decentralized trading on the Ethereum network, accounting for about 75% of the trading volume, and has facilitated over $2.4 trillion in transactions to date. However, with Uniswap launching Unichain, Ethereum validators may lose $400 million to $500 million in annual revenue. This not only will impact the Ethereum transaction fee burn volume but may also undermine the narrative of Ethereum as a "deflationary currency".

Nevertheless, the ongoing dependence between Uniswap and Ethereum, such as Ethereum's role as the security foundation for Layer2, and whether large holders are willing to migrate to Layer2 for trading, should also be considered. Additionally, the value capture ability of UNI will depend on the specific design of its verification network in the future, particularly whether the fee distribution and MEV revenue can effectively attract token holders to participate in staking.

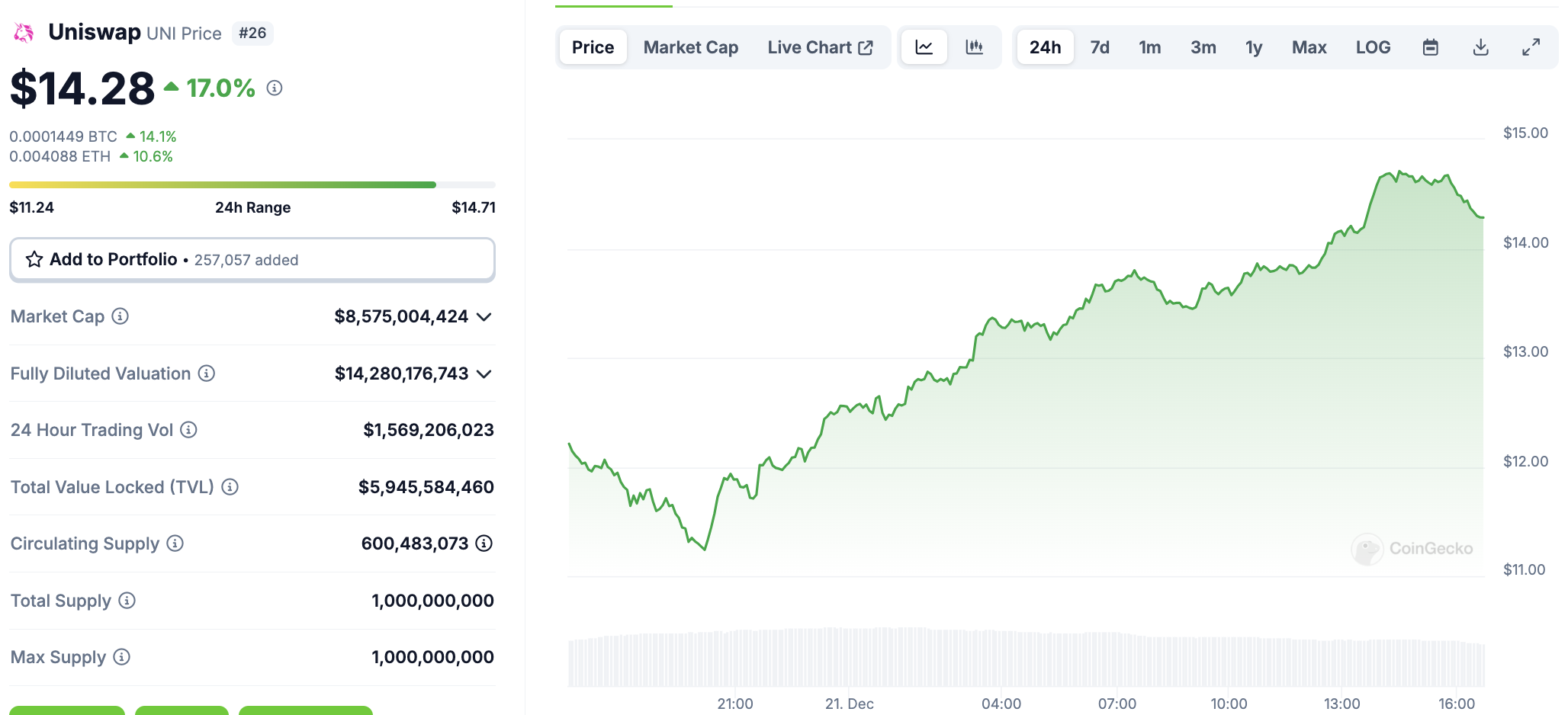

UNI Jumps 17%

Possibly influenced by this news and the broader crypto market recovery, the UNI token has shown an impressive performance. CoinGecko data shows that UNI has surged 17% in the past 24 hours, briefly spiking to $14.71, and currently slightly retreating to $14.28, making it one of the top 5 best-performing tokens among the top 30 cryptocurrencies.