BlockBeats will organize the key industry news content of the week (12.16-12.22) in this article, and recommend in-depth articles to help readers better understand the market and learn about industry trends.

Important News Review

The hawkish Fed cuts interest rates by 25 basis points; the crypto market cools down, and Bitcoin has fallen below $95,000 several times this week

On December 19, the Federal Reserve concluded its 2024 annual interest rate decision, lowering the benchmark interest rate by 25 basis points to a range of 4.25%-4.50%, the third consecutive rate cut, in line with expectations. When asked about Bitcoin reserves, Fed Chairman Powell replied, "We are not allowed to have Bitcoin, and we do not want to change the law." At the same time, the Fed added the wording "magnitude and timing" to its policy statement, suggesting that the pace of interest rate cuts will be slowed to modify potential adjustments. The crypto market fell in response, with Bitcoin falling below $95,000, Ethereum falling below $3,200, and multiple Altcoin falling by more than 30%.

Binance Wallet launches new platform Binance Alpha, and has announced the first four batches of projects

On December 17, Binance Wallet announced the launch of Binance Alpha, a new platform in Binance Wallet that focuses on early crypto projects with growth potential. On December 18, Binance Alpha announced the first and second batches of projects. The first batch of projects includes: KOMA, Cheems, APX, ai16z and AIXBT. The second batch of projects includes: CKP, GEAR, SD, SYRUP, FARTCOIN. On December 19, Binance Alpha announced the third batch of projects, including: FROG, AICell, CGPT, MONKY, TERMINUS, GRIFFAIN, RIF, URO, CLANKER, LUNAI. On December 20, Binance Alpha announced the fourth batch of projects, including: BANANA, KOGE, BOB, MGP, PSTAKE, GNON, Shoggoth, LUCE, ODOS. On the day of the project announcement, all currencies rose and fell. Related reading: "Binance Wallet Space Review: Alpha is not the same as the main site" , "Solana ecosystem briefly shut down, is Binance Alpha really Alpha? | What is meme hyping today? "

In the falling market, HYPE rose to $35, a record high; Hyperliquid's market value ranked among the top 20 cryptocurrencies

On December 21, HYPE rose to $35, with a 24-hour increase of 39.62%, setting a new record high. According to official data, Hyperliquid's 24-hour trading volume exceeded $15 billion, setting a new record high. On the same day, Hyperliquid (HYPE) had a market value of $11.13 billion, ranking 19th on the cryptocurrency market value list. Related reading: "$6 billion poured into the "New Cycle FTX", the most complete guide to Hyperliquid's bull market gold rush" , "The strong will always be strong, everything you need to know about the Hyperliquid ecosystem"

Pudgy Penguins has airdropped about 25% of PENGU tokens to the Solana ecosystem, and about 7 million wallets are eligible to claim

On December 17, the NFT project Pudgy Penguins airdropped approximately 25% of the PENGU token supply to the Solana ecosystem. Active users of the Solana ecosystem, using decentralized applications such as the Phantom wallet and Jupiter, have the opportunity to obtain PENGU tokens even if they do not hold Pudgy. On the same day, Pudgy Penguins issued an announcement in its official Discord community stating that approximately 7 million wallets outside the Pudgy Penguins community are eligible to apply for PENGU tokens, including users who interact with various protocols and members of different communities. Currently, Binance and OKX have launched PENGU spot trading. Related reading: "Fat Penguin's coin issuance drives the recovery of NFT. How do PENGU, Abstract, and OpenSea kill three birds with one stone?"

Trump's crypto project WLFI reaches cooperation with Ethena Labs

On December 19, the Trump family DeFi project World Liberty Financial announced a partnership with Ethena Labs. The two parties are seeking "long-term cooperation" and the cooperation will start with Ethena's revenue token sUSDe. If sUSDe is not approved as a collateral asset, WLFI and Ethena will continue to explore cooperation opportunities and strive to find integration points. Perhaps affected by this news, ENA rose by about 8% in a short period of time.

The total assets of users of the top five CEXs in South Korea exceeded a record high of US$86.5 billion, with a monthly increase of approximately US$34.8 billion

On December 16, according to Korean media reports, as of the end of November 2024, the total user assets of South Korea's five major cryptocurrency CEXs (Upbit, Bithumb, Coinone, Korbit, and GoPax) exceeded 115.7 trillion won (about 86.5 billion US dollars) for the first time, an increase of about 50 trillion won from the previous month, setting a record high. In November, the monthly trading volume of stablecoins reached 16 trillion won, an increase of more than 6 times from the beginning of the year, showing a trend of large amounts of funds shifting to overseas markets. South Korea's financial regulators have stepped up supervision of abnormal transactions and issued warnings for tokens with large price spreads between exchanges. Related reading: "Unveiling the Korean Crypto Market: A Cryptocurrency Powerhouse Where 70-Year-Old Aunts Queue Up to Open Accounts"

The AI Agent track remains hot: This week, VIRTUAL's market value exceeded US$3.1 billion, setting a new record high

On December 16, the market value of VIRTUAL, the AI agent token on the Base chain, exceeded 3.1 billion US dollars, setting a record high, with a 24-hour increase of 26.8%. On the same day, Virtuals Protocol ecosystem tokens generally rose, and currencies such as SAINT, NFTXBT, and GUAN rose by more than 40% in 24 hours. Related reading: "VIRTUAL's market value hit 3 billion US dollars this week. What stories are the AI projects in the ecosystem telling?" , "A comprehensive review of the development history of the AI Agent track. How to seize the next 100 times in the evolving hype logic?" , "A comprehensive comparison of the 8 strongest AI Agent frameworks. Who is the real leader in the track?"

The NFT market has rebounded significantly, with transaction volume reaching US$302.2 million this week, a month-on-month increase of 32.93%.

On December 22, according to relevant reports, the recent NFT market has rebounded significantly. This week, the total NFT transaction volume reached US$302.2 million, a month-on-month increase of 32.93% compared with US$224 million last week. The number of NFT buyers increased by 92.39% to 349,972, and the number of NFT sellers increased significantly by 77.18% to 207,672. The NFT transaction volume of the Ethereum network soared to US$199.9 million. It has increased by 73.56% in the past seven days. Bitcoin network NFT ranked second, with a transaction volume of 23% to US$39.7 million, but the number of user participation grew well, with the number of buyers reaching 38,987. The Solana network consolidated its third position with a transaction volume of US$29.9 million, a month-on-month increase of 5.14%, and a total of 104,958 buyers, a month-on-month increase of 108.45%. Related reading: "8 new NFT projects worth paying attention to recently"

BIO Protocol Co-creation: BIO tokens will be listed on Solana; BIO Protocol's new proposal "Enabling transferability of BIO tokens" has been opened for voting

On December 18, Paul Kohlhaas, co-founder and CEO of BIO Protocol, said on social media that in addition to being listed on Ethereum, BIO tokens will also be listed on Solana within a few days. At the same time, Paul Kohlhaas also said that he would propose airdrops to communities such as Big Pharmai (DRUGS). On December 20, BIO Protocol's new proposal "Enabling transferability of BIO tokens" has been put to vote for 3 days (until December 23). If passed, BIO will become a liquid asset within 14 days, with initial liquidity on the ETH mainnet, and more chains will be supported in the future.

Coinbase has suspended wBTC trading

On December 19, U.S. federal judge Araceli Martínez-Olguín ruled to dismiss the request for a temporary restraining order filed by Hong Kong company BiT Global, allowing Coinbase to continue its plan to remove Wrapped Bitcoin (WBTC) from its platform. The judge believed that BiT Global failed to prove that Coinbase's move would cause it "imminent and irreparable harm." The next day, Coinbase announced that it had suspended wBTC trading. wBTC trading on Coinbase Exchange and Coinbase Prime was suspended, and users can still withdraw funds at any time.

PNUT Origin Event: The breeder claimed that he had sued Binance for intellectual property infringement and shill for a new token

On December 16, Peanut Origin Event keeper Mark Longo said in a post that his legal team has filed a lawsuit against Binance, accusing Binance of unauthorized use of his intellectual property, including images and stories featuring his beloved animals. He and his team will continue to work hard to ask Binance to stop the infringement.

However, Mark Longo also shill another squirrel meme, JUSTICE FOR PEANUT (JFT), which caused (or) the price of JFP to rise rapidly. It is worth noting that as a new meme coin born on December 8, JFP had previously gone through a trend of falling "to zero" after going online, and then falling "to zero" again after soaring. Several investors have accused Mark Longo of only bringing in new memes to "cut leeks" in response to his remarks.

China's Beijing Procuratorate cracked the virtual currency mixing path and recovered more than 89 million yuan in stolen money

On December 20, the Workers' Daily reported that in a case of occupational embezzlement, the defendant defrauded the company of more than 140 million yuan, and the procuratorate tracked virtual currency to recover the stolen money. From 2020 to 2021, Feng used his position to conspire with Tang and Yang to defraud the company's service provider bonuses totaling more than 140 million yuan. Subsequently, Feng directed Tang and Yang to use 8 overseas virtual currency trading platforms to convert the money involved from RMB to virtual currency, and confuse the source and nature of the funds through overseas "mixed currency" platforms. Transferred through multiple levels in the form of virtual currency, part of the money involved in the case flowed into accounts controlled by Feng and others in the form of RMB, and part of the money involved in the case was concealed by Feng and others in the form of virtual currency.

In response to the defendants’ use of virtual currency to divide the spoils and confuse the flow of funds through overseas “mixing currency” platforms, the procuratorate compared virtual currency and legal currency one by one, conducted two-way reviews, and accurately identified the flow of funds, which eventually prompted Feng to return 92 bitcoins and recover a total of more than 89 million yuan in stolen money, minimizing the economic losses of the victim unit. On September 14, 2024, the Beijing No. 1 Intermediate People’s Court ruled that the defendant Feng and seven others were guilty of embezzlement and were sentenced to fixed-term imprisonment ranging from 14 years and 6 months to 3 years, and fined accordingly. The judgment has come into effect.

The Siping City police in China cracked down on a money laundering gang using USDT, and the case is under further investigation

On December 18, according to the information from China National Radio, the Economic Investigation Brigade of the Tiedong District Public Security Bureau of Siping City, Jilin Province, China, successfully uncovered a money laundering case in which a group used the virtual currency USDT (referred to as "U Coin") to help financial fraud criminals transfer stolen money during the investigation of a financial fraud crime. After investigation, the criminal suspect Liu Mou, together with Zhao Mou and Wang Mou, helped the financial fraud criminal group to launder money and profit from it by buying low and selling high "U Coin" on a centralized trading platform. The group has accumulated a profit of more than 100,000 yuan from money laundering. At present, the members of the money laundering criminal group have been taken criminal compulsory measures by the public security organs, and the case is under further investigation.

GoPlus released a post hinting at an upcoming TGE

On December 20, Web3 user security network GoPlus released three emoji animals on the social platform, corresponding to "tiger goat eagle" respectively, which may imply that it will soon TGE.

This week's hot articles

"HYPE's bulldozer-like rise, how does its "crowdfunding" platform Hypurr Fun work?"

Last Saturday, Farm, a token born from Hypurr Fun, was listed on the Hyperliquid spot market, and its market value soared to 20 million US dollars. While HYPE maintained a "bulldozer"-like rise, the success of Farm attracted many users to the Hypurr Fun ecosystem. As an order book DEX, Hyperliquid's listing is different from the permissionless form of Raydium. How does Hypurr, a platform similar to pump.fun, combine with it? What are the specific rules and transaction processes behind it?

On December 17, HYPE broke through $28. Since opening at $6 on November 29, HYPE has been on a major uptrend with almost no pullback, and has smoothly surpassed Layer1 such as Fantom and Aptos, reaching a circulating market value of about $9 billion and a FDV of $27 billion, directly breaking into the top 30 of crypto asset market value. HYPE's epic airdrop is the biggest turning point in the Hyperliquid ecosystem. Before TGE, although Hyperliquid also had a strong wealth-creating effect, there was little discussion about the Hyper ecosystem in the Chinese area. After the airdrop, the market was attracted by the rise of HYPE's "stand-alone coin", and Hyperliquid realized the transformation from PerpDEX to a high-performance trading public chain in the public eye.

"EVM is not online yet, how to evaluate the future of Hyperliquid?"

Hyperliquid attracts users through low fees and strong incentives. It is expected that the incentives in the first year will be close to 1 billion US dollars, and the inflation rate will be 11.65%. After the launch of EVM, it may become an important platform for the new DeFi protocol to drive the growth of HYPE demand. The platform makes profits through transaction fees and token auctions, and the fee distribution is automatically executed, supporting staking rewards, platform operations and token destruction. Increased capital inflows, especially through Kucoin, will drive HYPE prices if more market funds can be attracted. However, centralization and EVM transition risks may affect user experience, and investors need to be cautious and do research.

This conversation mainly tells how LucaNetz and his team experienced difficult challenges in the early days of Pudgy Penguins, including financial difficulties, investor rejection, and community distrust, and discusses Pudgy Penguins' ecosystem, tokens, and its future development. It also touches on the reasons why Pudgy Penguins chose Solana instead of other chains, and stated that it will change the Solana ecosystem by promoting cultural phenomena.

《Binance HODLer 5th Airdrop PENGU Token Economics Overview》

On December 16, Binance announced that the Binance HODLer Airdrop has launched the fifth project Pudgy Penguins (PENGU), an NFT (non-fungible token) collectible built on Ethereum. This article will introduce the details of the PENGU HODLer Airdrop, what is PENGU, the Pudgy Penguins token, and the uniqueness of the token.

On December 17, as the PENGU coin issuance approached, the floor price of Pudgy Penguins NFT also rose all the way. At the same time, the L2 network Abstract Chain under Pudgy Penguins' parent company Igloo also officially announced that it will launch the mainnet in January next year, and there is also market expectation of issuing coins separately; OpenSea was also recently exposed to the news that the OpenSea Foundation was registered in the Cayman Islands. Therefore, through the issue of the fat penguin coin issuance, whether the three projects of PENGU, Abstract, and OpenSea can achieve "three kills with one fish" has become the focus of market attention.

Top 10 AI+Crypto Trends Worth Watching in 2025

This article discusses several innovative areas of crypto and AI in 2025, including agent-to-agent interaction, decentralized agent organizations, AI-driven entertainment, generative content marketing, data markets, decentralized computing, etc. The article explores how to use blockchain and AI technologies to create new opportunities in multiple industries, promote privacy protection, AI hardware development, and the application of decentralized technologies, and pay more attention to how intelligent agents can bring breakthroughs in areas such as transactions and artistic creation.

In the fierce fluctuations of the crypto bull market, opportunities and risks coexist. As the market adjusts, it is those projects that stand at the forefront of technology and have strong innovation that demonstrate their unique value. This article will reveal eight of the most exciting and promising tokens in the current market trough: AI16z, ZEREBRO, ARC, AIXBT, GRIFFAIN, GRIFT, ZODS and ALCH. These projects not only create new possibilities in their respective fields, but also have unique advantages across cycles, and are accumulating strength for future market waves.

Since the birth of AI meme coin GOAT, Crypto+AI seems to have ushered in its own "ChatGPT moment". From the industry leader Coinbase to Silicon Valley's top brother A16Z, and then to the academic benchmark Stanford, the whole world has gradually fallen into the rabbit hole of imagination with the endless AI Bots on social media. Even Marc Anderson did not expect that the $50,000 he funded Truth Terminal at the beginning of the year would ignite a $10 billion market in less than a year. From AI meme to AI Agent issuance platform to AI Agent framework, what surprised investors is the ultra-high innovation space and acceleration shown by Crypto+AI Agent. This field seems to be evolving in units of days. No matter from which dimension, it is very similar to DeFi and the metaverse at the end of 2020.

On December 17, the Virtuals Protocol token VIRTUAL broke through $3, with a market value of $3 billion. This article analyzes the token data and the project business behind the tokens in the Virtuals ecosystem with a market value of $10 million to $100 million.

This article discusses the growth potential of the Virtuals ecosystem, focusing on the revolutionary role of the GAME framework. Through buybacks, destruction and activation royalties, Virtuals is expected to significantly increase token demand and prices. The article also mentioned that Virtuals is building an "agent society" with AI agents at its core, constantly evolving itself. Although facing risks such as team fatigue, competition from Eliza Framework, and market saturation, Virtuals' future remains promising, especially with the potential for listing on Binance and Coinbase.

"Ethereum returns to $4,000. Has the ecosystem fundamentals really changed?"

After the bull market correction phase in the past few days, on December 16, the price of ETH once again reached $3,900. Looking back on the development of Ethereum over the past year, there are many complex factors and emotions. On the one hand, the Cancun upgrade was successfully completed, the spot ETF was officially approved, and the technology and fundamentals ushered in a new bull market; but on the other hand, as Bitcoin, SOL, and BNB broke through historical highs one after another, the price of ETH still hovered around the $4,000 mark.

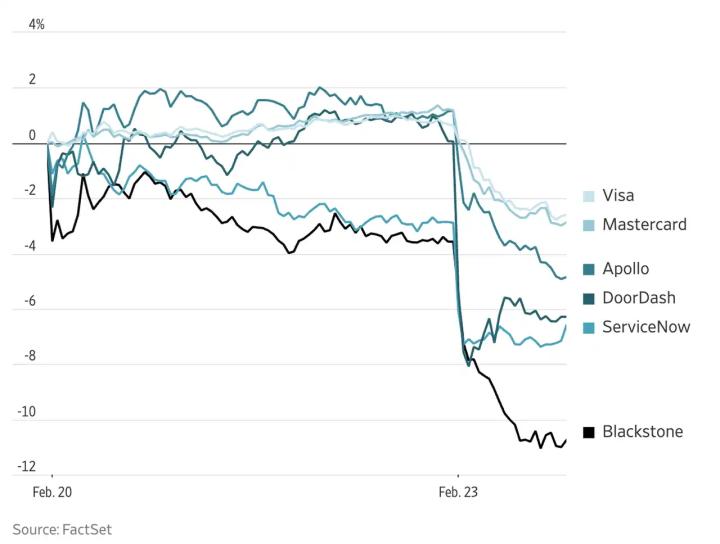

On December 18, at the latest interest rate meeting of the Federal Reserve, the benchmark policy rate was lowered by 25 basis points to a range of 4.25%-4.5%. Although this result was in line with market expectations, the hawkish wording in the statement and the adjustment of economic forecasts had a profound impact on market sentiment, and the cryptocurrency market as a whole suffered a sharp correction. The prices of mainstream and Altcoin such as Bitcoin, Ethereum, Dogecoin, and Solana have all fallen significantly.

"From the timestamp of on-chain data, how to judge when this bull market cycle will reach its peak?"

There are two core concepts in the on-chain data analysis of BTC, namely "timestamp" and "price stamp". The transparency of the blockchain allows us to observe each on-chain transaction and identify two key details: 1. The time when the chip movement occurs: timestamp; 2. The price when the transaction occurs: price stamp. When we analyze the transition of stage trends, the data used, such as turnover cost, profit realization, demand inflow, and hot supply, are mainly based on "price stamp". If we want to observe and analyze the timeliness of the BTC large cycle, we need to use "timestamp" more.

Cryptocurrency is a maturing asset class: new spot Bitcoin and Ethereum ETFs broaden market access, and the incoming Trump administration could bring greater regulatory clarity to the crypto industry. For these reasons, cryptocurrency market valuations could break new all-time highs. Grayscale Research believes that the current market is in the middle of a new crypto cycle. As long as the fundamentals are solid, the bull market is likely to continue until 2025 and beyond. Bitcoin price action shows the characteristics of statistical momentum: gains tend to follow gains, and losses tend to follow losses. Although Bitcoin can rise or fall in the short term, its price shows a significant upward cyclical trend in the long term.

After the Fat Penguin airdrop, Fuel also opened its airdrop query window. 20% of the total supply of Fuel will be allocated to the Fuel community, of which 10% will be used for the Genesis Drop; 5% will be allocated to the community cooperation platform; and 5% will be used for unannounced incentives, programs, activities and activations. The Fuel Genesis Drop allocated 1 billion FUEL (10% of the total supply) to more than 200,000 unique addresses and will be open for claiming at the launch on December 19, 2024 until January 19, 2025.

"DRUGS's 500-fold wealth creation myth sets off a wave of new listings on daos.fun"

DeSci project Big Pharmai (DRUGS) continues the myth of daos.fun. Based on the limit of 420 SOL (about 92,000 US dollars) in the fundraising stage (an additional 42 SOL was raised to build initial liquidity), DRUGS has increased by nearly 500 times since it was sold out of the "internal market", becoming the most outstanding daos.fun token after ai16z.

"Spending $45 million to buy coins: Who is the manipulator behind Trump's project WLFI?"

Trump's DeFi project World Liberty Financial (WLFI) purchased a large number of crypto assets in December, with a cumulative expenditure of nearly US$45 million, including ETH, cbBTC, LINK, AAVE, ENA and the latest ONDO. Since its launch in September, the project has claimed to be a decentralized finance (DeFi) platform. On December 13, the World Liberty Financial community passed the first proposal to deploy an Aave v3 instance. Although the project has made initial progress, from the current situation, the leadership team is mostly new faces, and there is still some uncertainty about the practicality and innovation of the project.

"Rising more than 40% against the trend, how to understand the logic of USUAL's rise?"

More and more competitors are emerging in the stablecoin market. From the beginning of December to now, from listing on Binance to the official announcement of cooperation with BlackRock, Usual has performed well in the market with its innovative economic model and high return potential. On December 19, USUAL broke through $1.2, setting a new record high. This article deeply analyzes the token economics, profit mechanism and potential risks of $USUAL, aiming to provide readers with a comprehensive understanding and help everyone make wise decisions in the rapidly developing crypto market. Whether considering investment or observing market trends, understanding its core mechanism is key.

VanEck's top 10 predictions for 2025 include: the crypto bull market will reach a mid-term high in the first quarter and hit a new high by the end of the year; the United States will further embrace Bitcoin through strategic reserves and policy support; the total value of tokenized securities will exceed $50 billion; the daily transaction settlement volume of stablecoins will reach $300 billion; the on-chain activity of AI agents will exceed 1 million; the total locked value (TVL) of the second-layer Bitcoin network will reach 100,000 BTC; Ethereum Blob space fee income will reach $1 billion; DeFi transaction volume will hit a new high of $4 trillion, and the total locked value will reach $200 billion; the NFT market will recover, with annual transaction volume reaching $30 billion; the performance of decentralized application (DApp) tokens will gradually catch up with mainstream public chain tokens. Next, we will delve into the background and logic of some of these key predictions.

On December 17, the Bitcoin Policy Institute drafted an executive order proposing to establish a strategic Bitcoin reserve under the Trump administration’s U.S. Treasury Exchange Stabilization Fund (ESF). The order needs to be signed after Trump takes office to take effect.

As an important promoter of multi-chain interoperability, zero-knowledge proof applications, and DeFi and NFT ecosystems, Polygon once shined in the last bull market cycle. However, in the past year, many public chain projects such as Polygon have failed to achieve new breakthroughs, but have gradually been submerged in the light of new competitors such as Solana, Sui or Base. When Polygon returned to the discussion on social media again, it was not because of any major updates, but because of the withdrawal of ecological partners such as AAVE and Lido.

Ethena (ENA) may be one of the most outstanding tokens in the past period of time. The market shows that since hitting the bottom at 0.194 USDT in early September, until yesterday's rebound to 1.33 USDT, ENA has achieved a nearly 600% increase in the past two months. Ethereal officials held a community conference call, at which Ethereal's roadmap, functions, advantages and airdrops were outlined. It is worth mentioning that the developers of Ethereal have obviously noticed the amazing performance of another strong project Hyperliquid in recent times, and mentioned that Ethereal hopes to build a "one-stop trading service" similar to Hyperliquid.

Recently, with the surge in "antique coins" such as XRP, the news of "Korean aunts rushing into the crypto market" has spread in the community again. At the same time, the trading volume of related tokens such as XRP and APT on Korean trading platforms such as Upbit and Bithumb even exceeded Binance at one point. In other words, for these tokens, the trading volume of the Korean regional market alone is enough to match the total trading volume of the rest of the world. For a long time, the crypto community has regarded listing on Upbit as a great benefit to the project. After a token is listed on these Korean exchanges, the price can often soar rapidly in a short period of time. This strong purchasing power makes the world curious about the "Kimchi Premium". How does the Korean cryptocurrency market work? What kind of hype logic do investors here have?

A look at 12 Solana AI hackathon ideas

On December 11, Solana announced the launch of the first Solana AI Hackathon, which aims to build AI agents and tools on Solana. The prizes range from $5,000 to $30,000, and are intended to encourage serious Crypto x AI projects that can attract venture capital or launch their own tokens. This article is a list of twelve AI startups proposed by SEND AI, an AI project in the Solana ecosystem.

Welcome to BlockBeats the BlockBeats official community:

Telegram subscription group: https://t.me/theblockbeats

Telegram group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia