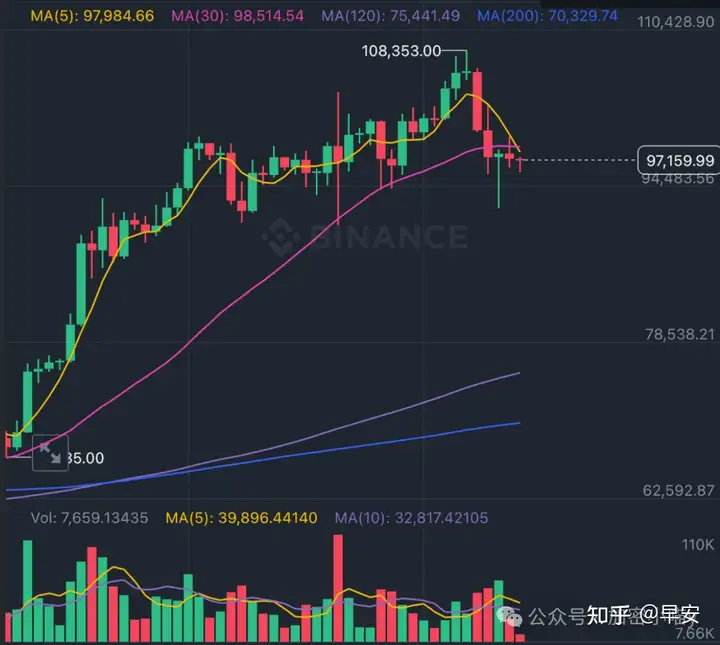

After a nearly 15% pullback, the price of Bitcoin has rebounded. The Bitcoin daily chart shows a bearish engulfing pattern, with the MA5 having crossed below the MA30, indicating a lower likelihood of short-term upside. Some believe this is similar to the performance of the previous bull market.

Comparing to the 2021 bull market:

- In 2021, Bitcoin broke through its historical high and continued to set new local highs. As market sentiment cooled, the price pulled back to the 50-day moving average and found support, before regaining momentum and breaking through new highs again.

- The current market performance is similar: Bitcoin broke through its historical high and formed a local high, and has recently retested the 50-day moving average. The last time it tested this average was in mid-October this year, when long-term and short-term holders went through a second round of turnover.

The impact on long-term holders:

Long-term holders are investors who have held Bitcoin for more than 155 days. They typically bought in at the beginning of the year and gradually take profits as the price rises. From mid-September to mid-October this year, the supply held by long-term holders reached a new peak, after which the market began to accelerate upwards. This turnover of positions became an important driving force for this round of the uptrend.

The accelerated effect in mid-October is considered a key point, supporting the possibility of Bitcoin strengthening further after the retracement.

After looking at the overall market, let's continue to look at the hot topics in the altcoin market!

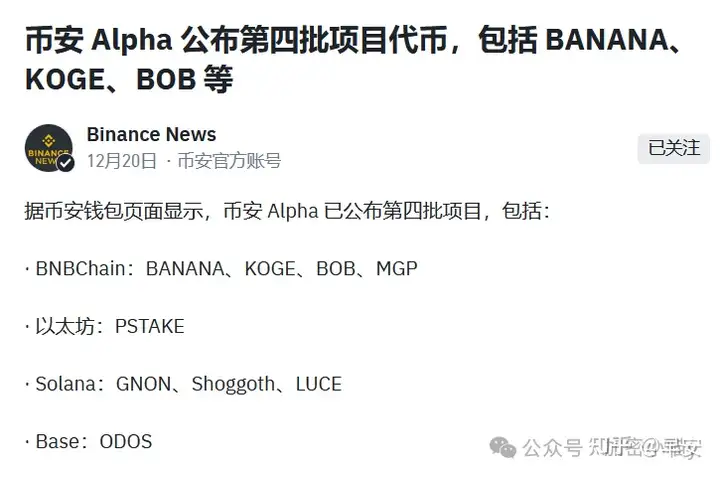

Binance recently launched Binance Alpha, similar to Coinbase's roadmap for listing coins. In the future, Binance's coin listings may be selected from this list. Among the dozens of coins currently listed, which ones have a real chance? I believe Monky has the highest probability of being listed, mainly due to its strong background.

Monky's core advantages:

Deep cooperation with DWF: Monky has transferred 200 billion tokens to DWF addresses, and these tokens have all been sold on major platforms. DWF is a multi-billion dollar giant in the industry, and its capital and influence are undeniable.

Floki's issuance background: One of the issuers of Monky is Floki, and it has airdropped 27% of the tokens to its users. DWF has also repeatedly driven Floki's significant price increase through purchases. This endorsement is obviously a plus for Monky's development.

Successful historical precedent: Floki airdropped Simon Cat (Cat) to its holders in September, and the latter successfully listed on Binance this week and doubled in price. As the second project airdropped by Floki, Monky is still deeply tied to DWF, and is now included in Binance Alpha and issued on the Binance Chain. With all these factors combined, its probability of being listed on Binance has increased significantly.

This information requires an in-depth understanding of on-chain data and industry dynamics to grasp, which reflects the "cognitive dividend". If Monky can successfully list on Binance, its potential should not be underestimated.

It needs to be reminded that although the probability of Monky being listed on Binance is high, it is not 100%. During the lurking process, it may also experience a significant correction like PNut. Even if it is ultimately successfully listed on Binance, whether it can make up for the potential decline is uncertain, which is a risk that needs to be considered. Therefore, when participating in on-chain meme projects, it is necessary to be cautious. Once the positive news triggers a sharp rise, be sure to escape the top in time.

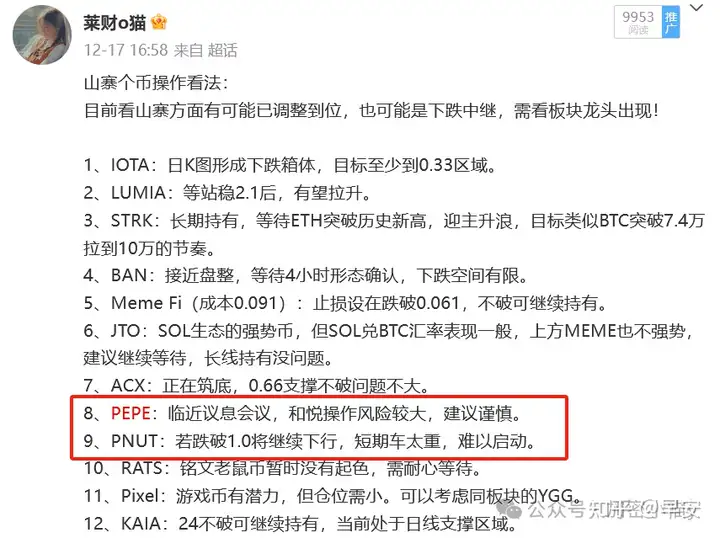

Here are a few examples:

- PNut: When it was on the Coinbase roadmap, I clearly reminded everyone to escape the top, and now it has halved.

- Neiro: When the positive news caused it to surge, I also reminded everyone to take profits in time, and now it has also halved.

- Pepe: When it surged to 0.26 and 0.27, I reminded everyone to escape the top again, and the subsequent crash proved the importance of this strategy.

The escape window is often very short, and if you miss it, you may end up deeply trapped. This time during the crash, our ETH successfully bought the dips at 3100, which is the result of timely adjusting the strategy. If you want to know more about the point analysis of other coins, welcome to follow my daily updates.

Next, let's talk about the major environmental challenges facing the crypto market.

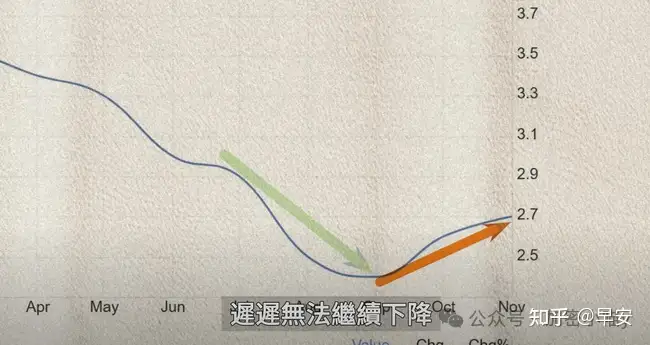

Due to the sudden change in the Federal Reserve's attitude, the probability of no rate hike in January is almost 100%, and the probability of no rate hike in March is also as high as 57%. Powell's hawkish stance has indeed delayed the easing process, reducing the original plan of 4 rate cuts by 2025 to 2 cuts. This is mainly because inflation has resurfaced and has not been able to decline significantly.

But there's no need to be too pessimistic, because these rate cut expectations are based on the current inflation data. Once inflation declines in the next few months, the Fed's rate cut expectations may still be put back on the agenda.

Why is the possibility of inflation declining still high?

- High-pressure interest rate environment: The current 4.5% interest rate is much higher than the normal 2%, and in this high-pressure environment, the rebound in inflation is more likely to be a "dead cat bounce", with a high probability of further decline afterwards.

- The role of a strong US dollar: The US dollar index has risen sharply by 8% to 108 level due to reduced rate cut expectations. The appreciation of the US dollar has enhanced purchasing power, allowing the US to purchase oil, consumer goods, etc. at a lower cost, thereby reducing the cost of living and having a significant effect on suppressing inflation. The method used by the Federal Reserve in 2022 to achieve inflation transfer through a strong US dollar is now working again.

Future outlook:

Although the timing of the rate cuts may be delayed by two to three months compared to expectations, it will not change the overall trend of global easing by 2025. The bull market in the crypto market may be slightly delayed, but the eventual explosive power will definitely exceed this year.

That's it for today's article. Currently in a bull market, with turbulent developments, we have crypto updates to share every day. If you don't know how to navigate the bull market, welcome to follow our public account, Crypto Kitty y, where we can share spot crypto strategies and layout plans for free.