Author: bitcoinist

Compiled by: Blockchain Knight

BlackRock, a major player in the Crypto asset market, has seen some changes after experiencing the largest capital outflow in several months.

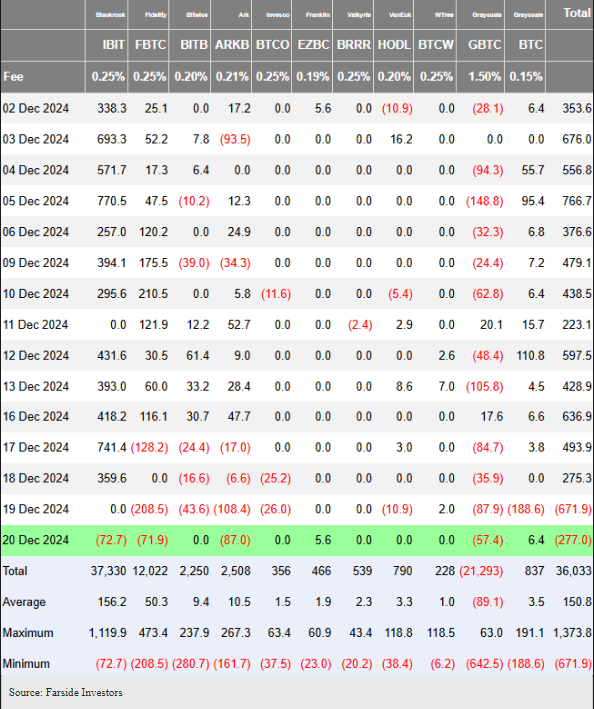

BlackRock recorded a $727 million outflow on December 20th, ending its consecutive inflows into its BTC ETF.

Data shows that BlackRock's BTC ETF (IBIT) has seen its largest outflow since its launch in January this year.

Farside Investors said that the global asset management company's BTC ETF saw $727 million in outflows in December, setting a new record high for IBIT.

Farside Investors added: "This happened on the second day of IBIT registering zero flows, which made investors anxious about the ETF."

The day before IBIT faced the same predicament, Fidelity's BTC fund (FBTC), another ETF issuer, also set a record high of $208.5 million in outflows on December 19th.

Analysts said that on December 20th, FBTC recorded another outflow of about $719 million, resulting in two consecutive days of capital outflows for the ETF.

IBIT and FBTC are among the best-performing ETFs in the US.

A month after their launch, these two ETF issuers ranked 1st and 2nd among the top 25 ETFs by assets.

Market observers say that the record-high capital outflows from the US spot BTC ETF market for two consecutive days have played a role in fueling the outflows from BlackRock and Fidelity.

Data shows that the ETF market lost $671.9 million on December 19th, and another $277 million flowed out the next day.

The massive capital outflows experienced by the two largest ETF issuers in the US have raised concerns among Crypto asset investors about the prospects of ETFs in the coming months.

However, analysts believe that the predicament faced by BlackRock and Fidelity should not come as a surprise to traders, as these two global asset management companies were largely responsible for the massive inflows.

Some investors are concerned that the recent developments in ETFs may become a turning point, leading to a significant decline in institutional investors' interest in BTC exposure.

Market observers believe that the capital outflow may not be sustained, and added that this alpha Crypto asset has rebounded and risen again after BTC earlier plunged to $92,710.

Trading analysts said that BTC's trading volume has dropped to $59.5 billion, a 52% decline in total trading volume, which is contrary to the bullish trend of Crypto assets after former President Trump's victory in the US election.

During the Crypto asset bull market, BTC reached a historic high of $108,000 per coin in November.

In the same month, the US spot BTC ETF also benefited from the Crypto asset bull market, with a record net inflow of $6.2 billion.