Source: Galaxy; Compiled by: Baishui, Jinse Finance

summary

Bitcoin miners with large-scale land, cooling water, dark fiber, reliable electricity, skilled labor, power approvals, and critical long-lead-time infrastructure components are well-positioned to increase the value of their assets by meeting the needs of the rapidly growing AI/HPC data center market.

Goldman Sachs Research predicts that U.S. data center demand will reach 45 GW by 2030, with power demand growing at a compound annual growth rate of 15% between 2023 and 2030, driven by AI.

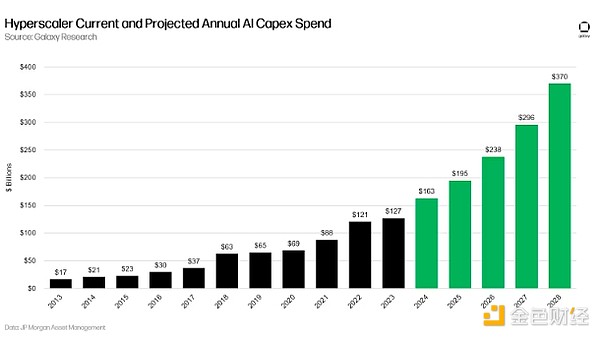

JPMorgan Chase expects hyperscale AI capital expenditures to reach $370 billion by 2038, a 127% increase from projected AI capital expenditures in 2024.

A sharp increase in connection requests for facilities ranging from 300 MW to 1,000 MW or more has put a strain on the ability of local grids to deliver power at such a rapid rate, resulting in an increase of 2-4 years in interconnection and construction time.

Traditional data centers do not have the high power capacity to support high-density computing operations. Server racks once maxed out at 40 kW per rack, but now need to support more than 132 kW per rack, which is required for cutting-edge systems such as the GB200 NVL72.

Cash flow predictability, an active financing market, and significant valuation upside for AI/HPC operations make this opportunity highly attractive and potentially accretive to miners with the right assets.

Miners can unlock significant value by transitioning to the AI/HPC market, by arbitrage their 6-12x EV/EBITDA valuations against the typical 20-25x multiples currently seen by leading data center operators.

Preface

The rise of artificial intelligence (AI) is creating unprecedented demand for high-capacity computing (HPC) facilities. This surge has led to massive investments in new data center capacity by hyperscalers. However, traditional data centers struggle to meet these demands due to limited power capacity and extended construction times for new facilities of 2-4 years.

Bitcoin miners are uniquely positioned to capitalize on this market opportunity, having already acquired critical components required for large-scale power infrastructure and data center operations. While not all mining facilities can be converted to AI data centers due to specific requirements for cooling, networking, and redundant systems, those with the right assets and expertise will benefit from the high cash flow margins and significant valuation potential of AI/HPC operations. The report examines the current landscape of traditional data centers and highlights specific barriers to meeting AI computing needs. The report then analyzes why certain types of Bitcoin miners are well-positioned to fill this gap and explores future trends at the intersection of Bitcoin mining and AI infrastructure.

What are the opportunities for AI data centers?

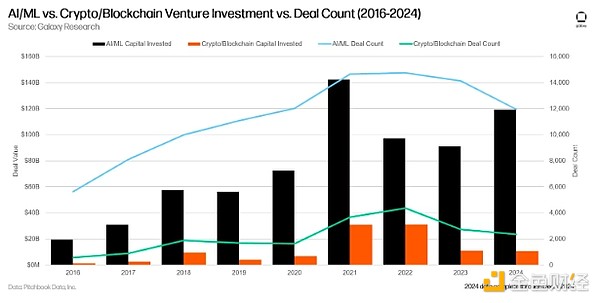

AI is booming in 2024, fueled by widespread adoption of generative AI (GenAI) technology. According to Pitchbook, more than $680 billion has been invested in AI and machine learning startups across more than 100,000 deals since 2016, with $120 billion invested in 2024 alone.

The surge in AI and high-performance computing (HPC) is creating a huge demand for data center capacity. Data centers are critical to AI/HPC operations, providing the infrastructure and power required for GPU-intensive computing. New AI applications such as large language models (LLMs) are particularly power-hungry. According to the International Energy Agency, a single ChatGPT query requires 2.9 watt-hours of electricity, while a Google search requires only 0.3 watt-hours of electricity.

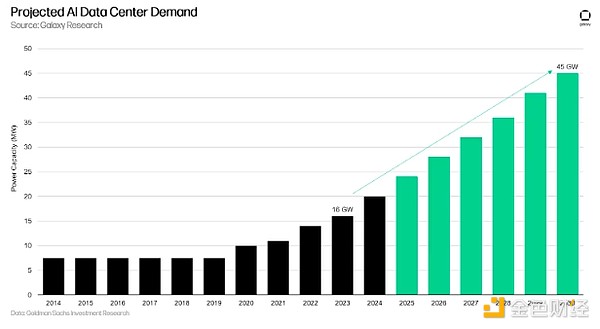

The emergence of new energy-intensive AI/HPC businesses in the United States has driven the growth in demand for data centers. Goldman Sachs Research estimates that by 2024, U.S. data center demand will reach 21 GW (a 31% year-over-year increase). For reference, the U.S. data center demand growth from 2022 to 2033 is estimated to be 15.8% CAGR. Based on the significant year-over-year growth in data center demand in 2024, Goldman Sachs Research expects U.S. data center demand to increase to 45 GW by 2030. By 2030, U.S. data centers will consume 45 GW of electricity, accounting for 8% of the total U.S. electricity capacity.

The market opportunity for U.S. data centers will be supported by increased investment in AI infrastructure by hyperscalers, which are large data center companies such as Google Cloud and AWS that can quickly expand data center capacity to serve other enterprise customers. These hyperscalers have committed to investing more than $100 billion in AI data centers over the next 10 years to meet growing data center demand. JPMorgan Asset Management estimates that by the end of 2024, $163 billion will be invested in expanding the hyperscale business, a year-over-year increase of 28%. The report predicts that by 2038, AI capital expenditures by hyperscalers will reach $370 billion, an increase of 127% over the 2024 AI capital expenditure estimate.

The current and expected growth of AI and HPC technologies is changing the data center landscape. As processing demands increase, hyperscalers and data centers are gradually evolving from traditional computing facilities to advanced AI infrastructure centers. These facilities are becoming the foundational infrastructure that drives breakthrough technologies such as self-driving cars, advanced medical research, and next-generation AI applications. The future of digital innovation will depend largely on the continued development and expansion of these critical computing facilities, marking a new era in technology infrastructure.

Overview of the current data center market

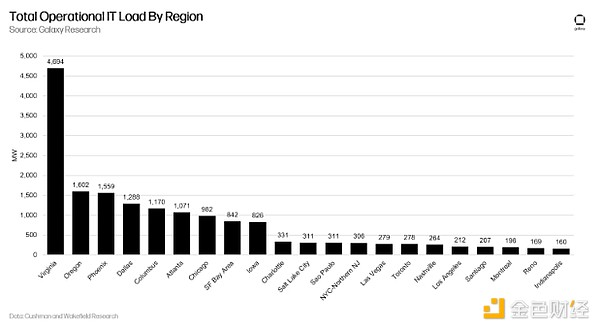

The current data center market consists of multiple public and private companies that collectively manage a large number of data centers. Well-known companies in this field include Digital Realty, Equinix, Vantage, EdgeConnex and QTS, among others. According to CBRE, the largest data center region in the United States is currently located in Northern Virginia, but all regions are growing rapidly, resulting in vacancy rates reaching historical lows.

Data centers are the backbone of several different industries, supporting everything from streaming services like Netflix to cloud computing, artificial intelligence, and a host of other applications. However, not all data centers are the same. Each data center can be customized for a specific function and can be classified into different categories, including hyperscale, edge, cloud, and enterprise data centers. Data centers are getting larger and more power dense. The competition to provide infrastructure for rapidly expanding industries like AI has led to an arms race among hyperscalers to build out data center capacity at an accelerated pace.

Obstacles Traditional Data Centers Face in Meeting the Demands of AI

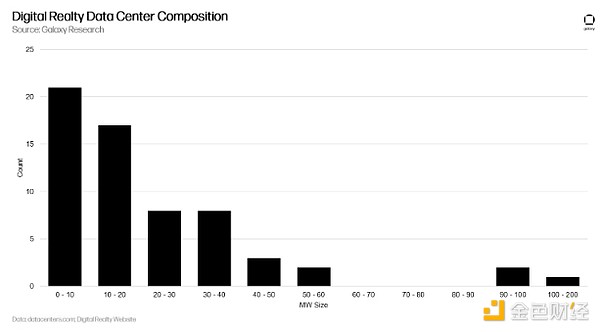

Traditional data center providers serving non-AI industries typically use a portfolio of smaller, geographically dispersed data centers, many of which were originally built for low-density applications. Over the past decade, traditional data centers have operated at relatively low energy consumption. Although Digital Realty ($62 billion market cap) and Equinix ($94 billion market cap) are two of the largest data center companies in the world, they primarily operate smaller data centers. For example, Digital Realty's data centers typically range from 0.5 MW to 40 MW per facility. Similarly, Equinix's xScale initiative consists of a global data center network with a total operating capacity of only 292 MW across 20 facilities (Equinix Q3 2024 Investor Presentation, November 8, 2024). In contrast, some mining operations have access to comparable energy capacity at a single site.

Historically, operators have had little incentive to scale quickly because streaming services, telecommunications, data storage, and many cloud applications have limited compute density. However, with advances in AI and the increasing complexity of these algorithms, data centers now have to use the latest generation of GPUs and run state-of-the-art facilities at scale to optimize training execution.

The increase in scale is due to advances in GPU computing power and the advantages of parallel computing, which enable data centers to build larger clusters with greater computing power. Parallel computing allows workloads to be seamlessly distributed across additional GPUs, allowing for efficient scaling by adding more units. Crucially, large clusters at a single site reduce latency between GPUs, which improves the performance of parallel computing. This advantage makes a single 200MW cluster significantly more efficient for AI training than four geographically distributed 50MW clusters, as low-latency communication between GPUs is critical to maximizing computing efficiency. As a result, hyperscalers prioritize a single location with access to large power capacity to meet the needs of advanced AI workloads.

Currently, this capacity is in short supply, and many traditional facilities struggle to meet the massive energy demands of modern AI/HPC workloads. Older facilities cannot be easily retrofitted due to factors such as differences in network, cooling, and rack density requirements between low- and high-compute use cases.

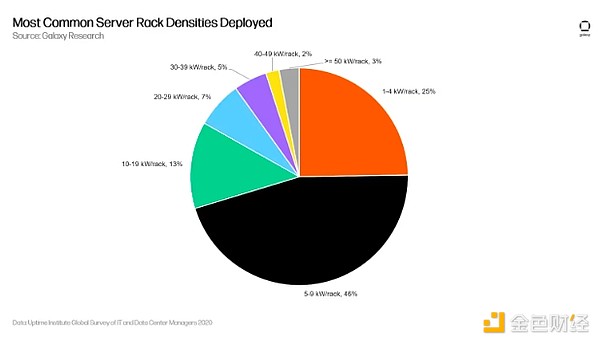

Today, hyperscalers require data centers with higher energy capacity to support the training of their energy-hungry models, such as large language models. According to a December 2020 article from the Uptime Institute, the average rack density that year was 8.4 kW/rack, excluding high-performance outliers of 30+ kW/rack. Server racks in these data centers, which once maxed out at 40 kW per rack, now need to support more than 132 kW per rack, which is the power required for cutting-edge systems like NVIDIA's GB200 NVL72, more than three times the amount in just a few years. Industry experts predict that increased compute density and the growth of Moore's Law could push server rack power requirements to unprecedented levels.

As a result, traditional data center operators have shifted their focus to greenfield development to accommodate the new generation of AI/HPC-specific data centers, which will take years to energy permit and build. According to a recent report by the U.S. Department of Energy, there has been a sharp increase in connection requests for facilities ranging from 300 MW to 1,000 MW or more, which has put a strain on the ability of local grids to deliver power at such a fast rate, resulting in an extension of 2-4 years in interconnection and construction times.

Hyperscale data center operators now aim to build the largest possible GPU clusters to train AI/HPC models, with several companies targeting gigawatt-scale data centers to accommodate hundreds of thousands of next-generation GPUs. While hyperscale data center operators are building their own data centers, they still rely heavily on third-party suppliers with mature power capabilities to speed up the time to power GPUs. However, only a few existing data centers can handle such huge power requirements and high rack energy density. This shortage is largely due to the lack of anticipation of the rapid growth in data center demand.

Why Bitcoin Miners Could Fill a Critical Gap

Bitcoin miners have large-scale, power-ready facilities, so they have the ability to meet the energy needs of hyperscale miners. For years, miners have been looking for locations where energy is abundant and affordable, and securing large amounts of power capacity in a single location, as well as long-term infrastructure projects such as substation components and medium and high voltage equipment. Some mining sites already have power-ready capabilities, which solves one of the biggest constraints facing hyperscale miners: access to reliable, large-scale electricity.

By accessing these power-ready Bitcoin mining sites, hyperscale miners can bypass the lengthy process of ensuring energy availability and focus on retrofitting and customizing infrastructure to meet their specific needs. Many miners control sites of hundreds of megawatts, and few traditional data center operators have access to such scale in a single location. Several large mining operations have established access to industrial-scale power infrastructure, securing energy pipelines with a capacity of over 2 gigawatts (GW), enabling miners to benefit from the growth in power capacity demand. While there are significant differences between traditional Bitcoin mining farms and AI data centers, miners have valuable experience in large-scale building and data center management, often with mature electrical, mechanical, facilities, and security teams. This expertise can further ease the transition for hyperscalers looking to scale quickly.

Only some miners can benefit from AI

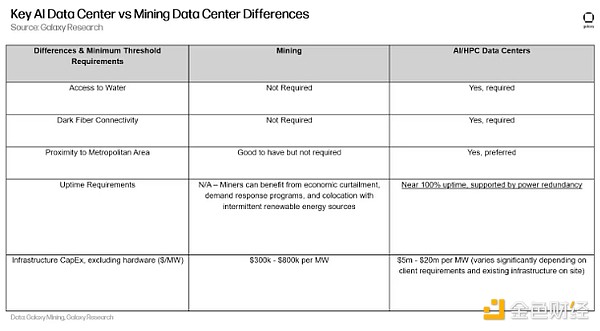

Not all miners are able to take advantage of AI/HPC opportunities. To build a data center suitable for AI/HPC, several key factors must be met, including access to large-scale land, cooling water, dark fiber, reliable electricity, and a skilled workforce. Unfortunately, even if these conditions are met, companies that have not yet obtained the necessary approvals (i.e., power capacity, land, and zoning) or do not yet have key long-term infrastructure components in place will encounter obstacles and delays in the development process.

Another key reason why not all Bitcoin miners are able to take advantage of AI/HPC opportunities is that miners’ existing infrastructure cannot be directly transferred or adapted to AI data centers due to differences in design and operational requirements. While there are some similarities in critical electrical infrastructure, including high-voltage substation components and distribution systems, AI data centers have specific requirements that require meticulous expertise and a skilled workforce.

The complexity of AI data centers increases nearly all aspects of operations, including mechanical, cooling, and networking systems, making the transformation of Bitcoin mining facilities into AI/HPC data centers a daunting task. Below, we outline some of the major upgrades that miners need to transform existing facilities into AI data centers:

1. Network infrastructure:

AI/HPC workloads require high-speed, low-latency connections between GPUs in data centers. Therefore, the internal network structure of AI/HPC workloads is much more complex than mining because GPUs are constantly communicating with each other. The key to successful AI operations is to develop an optimal network backbone to ensure fast execution of workloads. In addition, connections to dark fiber must be established from the site and meet latency requirements, while mining sites do not require these requirements.

2. Cooling system:

Miners use a variety of cooling designs, including air cooling, water cooling, and immersion cooling systems. Cooling is primarily focused on the actual machine itself, with less attention paid to supporting infrastructure. On the other hand, AI data centers will require more advanced cooling solutions, such as direct-to-chip liquid cooling to cool the latest generation of power-intensive NVIDIA servers, combined with additional air cooling systems to support the network and mechanical infrastructure.

3. Redundancy:

Compared to Bitcoin mining data centers, AI data centers have more stringent redundancy requirements. Mining operations are flexible in nature, so powerful backup power generation facilities are not required. On the other hand, AI data centers usually use at least N+1 redundancy throughout the operation, and more mission-critical components such as core network and storage components require a higher degree of redundancy to ensure uninterrupted operation, or at least correct caching and checkpointing of data in the event of equipment failure. This means that for each important infrastructure, such as cooling equipment, there must be a backup (N+1 redundancy). For example, when maintenance is performed on one cooling unit, an additional unit must be available to maintain continuous operation. This level of redundancy is rarely found in mining facilities that do not have such uptime requirements.

4. Redesign of the appearance and dimensions:

AI data centers use rack-mounted servers, which are very different from the shoebox ASICs used in Bitcoin mining. To accommodate AI hardware, the internal physical infrastructure of the facility needs to be completely redesigned to support rack-mounted systems and their specific cooling, networking, and electrical requirements.

5. Other differences:

Taken together, these factors indicate that adapting mining facilities to meet the requirements of AI/HPC data centers is a design and engineering challenge. The enhanced infrastructure requirements also cause AI/HPC data center capital expenditure costs to rise significantly relative to Bitcoin mining construction costs.

Miners that can capitalize on AI data center demand have upside potential

While miners may have the right infrastructure and location, transitioning to AI/HPC operations requires more than just physical assets—it requires expertise, a different technology stack, and new business models. Those with experienced management teams who can successfully build AI/HPC operations have a tremendous opportunity to drive significant incremental value to their companies. Here are some key advantages that can add value to companies that choose to allocate their power and data center resources from Bitcoin mining to AI/HPC:

High cash flow margins and predictability: AI/HPC data center operations, especially the colocation/build-to-order model, have long-term contracts with fixed and recurring cash flows that are typically agreed before data center construction begins. These are predictable and high-margin cash flows, typically with creditworthy counterparties, and data center operators can pass on most costs to tenants, including energy and operating expenses (depending on the lease structure).

Cash flow diversification: Revenue is not only more predictable than Bitcoin mining, but also uncorrelated with the cryptocurrency market, which can balance the revenue profile of companies that are more exposed to risk in volatile cryptocurrency markets. In a Bitcoin bear market, this can enhance financial stability, allowing miners to continue to raise cash through equity or debt without incurring excessive dilution or interest burdens.

Deep capital markets can help expand operations: Although infrastructure is much more expensive than Bitcoin mining, underwriting investments are more straightforward due to the predictability of cash flows, opening up new sources of debt and equity capital for data center projects. Private equity firms, infrastructure investments, pension funds, life insurance companies, and many others are eager to get involved in the data center space to reap the benefits. Data center operators that have signed a lease with a reputable counterparty can assume that lease and raise substantial project financing to build a data center.

According to Newmark’s 2023 Data Center Market Annual Overview Report, term debt financing volumes hit an all-time high in 2023 and the pace is not slowing down, with $18 billion of development financing underwritten in the first quarter of 2024 alone. Interest rates are reasonable, too, with Newmark’s range of rates being around 2.25% – 4.50% SOFR, depending on the lender.

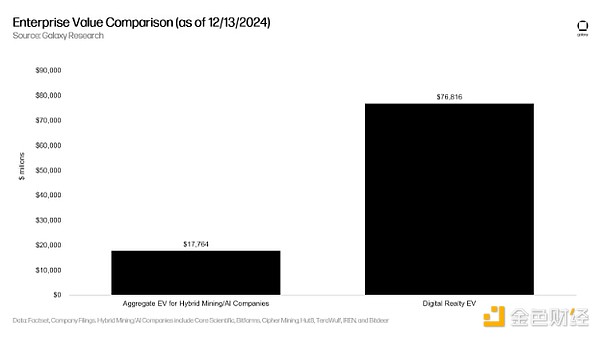

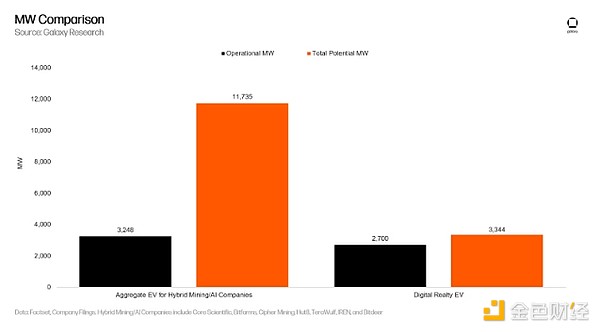

Huge Valuation Appreciation Potential: There is also a huge valuation differential between mining and AI/HPC once the assets are established and stabilized, making AI/HPC a very attractive opportunity. Bitcoin miners have historically traded in the 6-12x EV/EBITDA multiple range, while some of the world’s largest data center operators are valued at 20-25x EV/EBITDA. This is reasonable given the industry’s high margins, growth trajectory, predictable cash flows, and reduced market volatility compared to cryptocurrencies. To further understand the scale of the current differential, the total EV of hybrid mining/AI companies is 23% of Digital Realty’s EV, despite having 3.5x more total potential MW capacity.

Therefore, cash flow predictability, active financing markets, and significant valuation upside make AI/HPC opportunities extremely attractive and value-added for miners with the right assets. These miners are expected to make significant inroads into the traditional data center market and become one of the largest operators in the industry.

The future of Bitcoin mining

AI/HPC has received a lot of attention over the past few months, but we still expect the hash rate and growth of the Bitcoin mining network to continue to rise. The growth of mining has been in sync with the growth of AI/HPC. The rise in Bitcoin prices has increased the profitability of miners, and if the price continues to move higher and outstrips the growth in network difficulty, mining could become even more profitable. But with the rise of Bitcoin and AI/HPC, what will the future mining landscape look like? Below we outline some of the main trends that are likely to emerge in the convergence of AI/HPC and Bitcoin mining in the foreseeable future:

Miners maximize the value of electrons:

Most Bitcoin miners always prioritize maximizing the value of their energy usage. Currently, AI data centers are the most profitable path for those with adaptable sites. Given the growth in value of AI/HPC sites, mining sites that are able to convert to AI/HPC data centers will likely follow this path to maximize shareholder value. However, this does not necessarily mean a disadvantage for Bitcoin miners. We still expect network hash rate to grow, but at a slower rate than if none of the major US miners converted sites to AI/HPC data centers. These conversions benefit miners that remain on the network by eliminating competing hash rate.

Bitcoin mining is a driving force in monetizing idle electricity:

As AI/HPC gain prominence, we expect miners to further focus on deploying their capacity in more remote areas as hyperscalers outbid miners because they have large sites in more developed markets that can be used for AI/HPC. Bitcoin mining is permissionless, location-independent, and flexible, making it one of the best ways to utilize idle power generation capacity.

We expect a larger portion of Bitcoin mining to be pushed out to the border to monetize idle power capacity — especially in remote areas of the United States and international emerging markets such as Ethiopia and Paraguay, which have abundant cheap excess energy.

Bitcoin Mining as a Strategic Bridge between Infrastructure Investment and AI/HPC Optionality

Additionally, as different regions of the U.S. work to build out transmission infrastructure and fiber connections, Bitcoin mining can act as a bridge to underwrite larger capacity energy infrastructure projects, such as substation and power plant construction, even in situations where there are no immediate or clear opportunities to leverage AI/HPC capacity. By leveraging Bitcoin mining for opportunistic real estate and power generation related investments, investors can earn returns while waiting for other long-term energy use cases to materialize, positioning it as an attractive strategy for infrastructure growth and investment.

For miners that are unable to convert to AI/HPC data centers, Bitcoin mining farms can still be operated as long-term profitable businesses. Several miners have purchased large-load facilities without existing AI/HPC tenants and have also invested in sites in various stages of development. As we have previously outlined, some of these sites may not have the optimal characteristics required for AI/HPC but may still be useful for Bitcoin mining. Other miners do not have the team or in-house expertise to contract with a major off-taker and undertake challenging engineering and large construction projects. The hope for miners seeking to maximize value is to lock in an AI customer, but in the event that the AI/HPC opportunity does not materialize, these miners still have the option of building a profitable BTC mining operation.

Emerging synergies between AI/HPC data centers and mining

ASIC manufacturers such as Bitmain have begun developing ASICs with form factors similar to GPUs for data center racks. Further alignment of ASIC form factors with next-generation GPU form factors will allow data centers to monetize their underutilized server racks by installing server-sized miners in the empty rack space, which will help simplify the process of retrofitting data centers for AI/HPC if similar racks are used. Going forward, miners may be more willing to purchase these machines as they maintain flexibility in data center design and can help miners more easily pivot to AI/HPC if higher value opportunities arise.

As AI/HPC data centers grow in capacity, so does their impact on the grid. While these data centers must be online almost all the time, this does not necessarily mean that the total energy consumption is constant. In fact, the load profile for AI/HPC training can be very volatile, as more power is consumed during intensive computational execution and less power is consumed during checkpoints. The frequency of checkpoints varies, and the process can take from a few minutes to tens of minutes, depending on the deployed infrastructure and the size of the model. As the model size increases, more data needs to be stored, increasing the time required to save all the data.

Similarly, for AI/HPC inference workloads, load profiles are expected to be closely aligned with customer demand, as each model query is processed directly within the data center. Initially, these profiles may exhibit a lot of volatility as model demand fluctuates. However, over time, as a particular model becomes more widely adopted, the load may become more predictable, with demand peaking during the day and falling at night. This daily load cycle presents an ideal opportunity for Bitcoin mining, as mining operations can dynamically scale up or down to compensate for the fluctuating energy demands of the AI inference process.

Therefore, in the future Bitcoin mining could be used as a load balancing mechanism, increasing when load is low and decreasing when AI load recovers. Tenants may not yet need to use full GPU capacity, allowing miners to speed up.

For data center operators, the benefits are clear, as they are able to extract more value from the capacity that can be brought online, while for tenants, this provides a degree of load stability for the data center and the entire grid. As data center clusters grow in size, power consumption and the impact on the grid will come under increasing scrutiny, and ensuring load stability will be critical.

Shifting MW to AI/HPC should slow the growth rate of hash rate

Miners entering AI/HPC operations are actively diverting capacity that would otherwise be available for Bitcoin mining, which should slow the rate of growth in the network hash rate. This is particularly important given Bitcoin's potential bull run, as increases in Bitcoin price will not be accompanied by equal and offsetting increases in network hash rate, pushing the hash rate higher. That being said, we still expect the network hash rate to rise as more efficient mining machines come online, either to replace older generation machines or as net new commissions are made at sites that are not conducive to AI/HPC operations.

Summarize

Data center demand in the U.S. is likely to surge at an unprecedented rate, with a projected 31% year-over-year growth through 2024 alone. These forecasts also indicate that U.S. data center capacity will more than double over the next five years, jumping from 21 GW of data center capacity today to a projected 45 GW. This explosive growth, coupled with hundreds of billions of dollars in investments committed by hyperscale providers over the next 5-10 years, creates an attractive opportunity for companies that can provide two key resources: abundant, cheap energy and robust infrastructure capable of supporting AI and HPC operations.

The current AI and HPC boom has exposed a key weakness of traditional data centers, namely their inability to retrofit existing facilities to meet the intense power demands of modern AI workloads. This gap in the market has created a significant opportunity for Bitcoin mining operations, which already have something AI/HPC companies desperately need: large sites with accelerated power-up plans. Hyperscale providers have limited options and are unable to scale their operations in time to meet the explosive demand of AI/HPC businesses. Bitcoin miners are becoming a reasonably viable option for hyperscalers to scale their operations and remain competitive in the growing market. However, this generational opportunity for Bitcoin miners remains selective. Only a small fraction of Bitcoin mining operations have the necessary infrastructure and capabilities to successfully support the demanding requirements of modern AI/HPC workloads. Those miners who own these scarce assets and seek to maximize their value will turn to AI/HPC data centers.

While some critics have argued that Bitcoin miners’ diversification into AI/HPC services could weaken network security by reducing the amount of computing power dedicated to mining blocks, the shift could actually benefit the broader mining ecosystem. Miners that are unable to meet the needs of AI/HPC sites could benefit from higher profitability from increased hash prices. As more miners go offline and Bitcoin prices rise, the increase in hash prices will significantly increase profitability for all Bitcoin miners. With Bitcoin prices up a whopping 143% year-to-date and a new pro-Bitcoin president in the White House, Bitcoin mining in the United States is poised to enter its strongest era yet.

The intersection of crypto and AI is arguably one of the hottest crypto sectors in 2024. The total market cap of crypto projects building AI projects using liquid tokens is approximately $33 billion as of December 2024. Additionally, Galaxy Research estimates that over $382 million in venture capital has been allocated to early-stage crypto AI startups in 2024. While most crypto AI projects lack product-market fit, the intersection of Bitcoin mining and the growth of AI/HPC businesses is clear. Bitcoin mining’s entry into AI stands out from other overlapping sectors of the two sectors because of its potential to massively supply the most important component of AI/HPC businesses – energy. As a result, Bitcoin miners holding AI/HPC convertible assets may be one of the only pure and scalable crypto x AI investments in the industry today.