Bit(BTC) fell 7% last week. This decline was due not only to the overall weakness in the cryptocurrency market, but was also driven primarily by a decrease in buying activity by large investors, known as "whales".

As these major coin holders continue to remain on the sidelines, BTC is at risk of further decline. The reasons are as follows.

Bitcoin Whales Reduce Buying Activity

According to the on-chain data platform IntoTheBlock, the net inflow of large Bitcoin holders decreased by 116% over the past 7 days. Large holders are addresses that hold more than 0.1% of the circulating supply of the asset.

Their net inflow measures the difference between the amount of cryptocurrency flowing into (inflow) and out of (outflow) these large holder addresses. For Bit(BTC), this indicator decreasing suggests that the outflow from whales is exceeding the inflow, indicating that these large investors are selling their coins to realize profits.

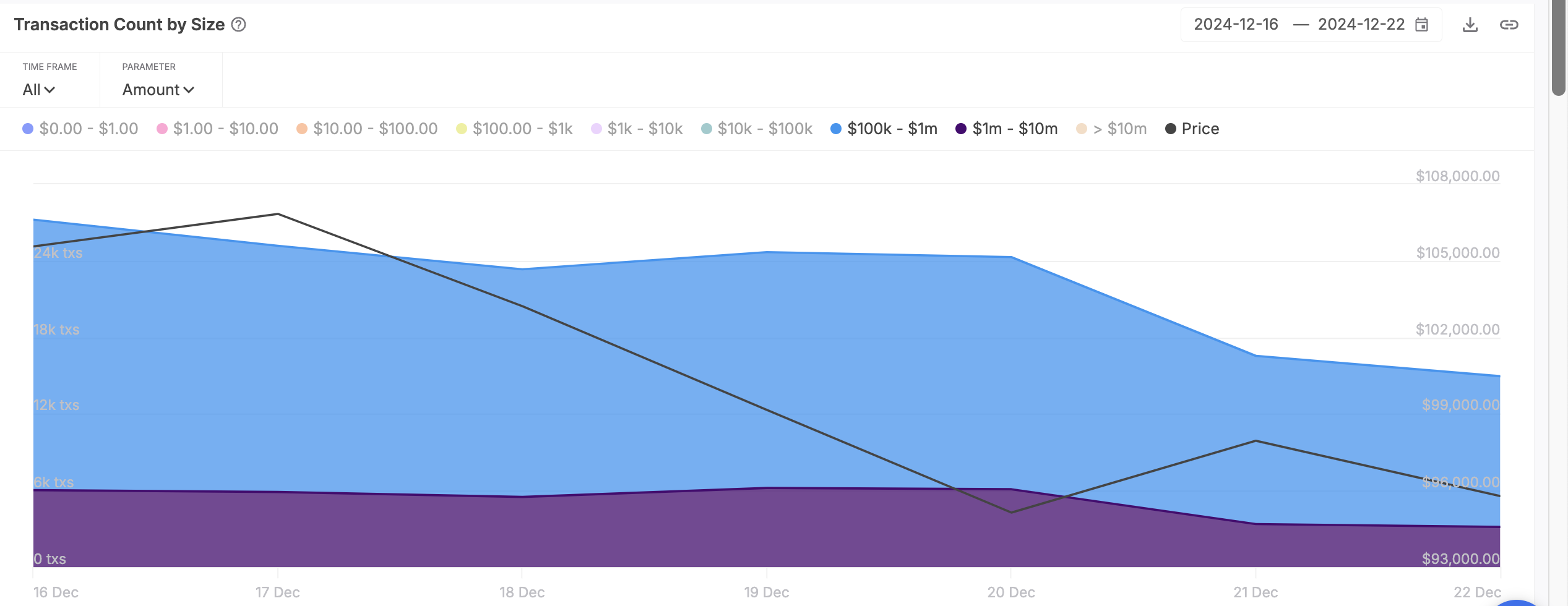

Furthermore, a decrease in the daily count of large Bit(BTC) transactions confirms the reduction in whale activity. According to IntoTheBlock, the number of Bit(BTC) transactions between $100,000 and $1 million decreased by 48% last week.

Similarly, the count of even larger Bit(BTC) transactions between $1 million and $10 million decreased by 50% over the same period.

The reduction in Bit(BTC) whale activity is noteworthy. The decrease in buying pressure from large investors can weaken price support and increase the likelihood of further price declines.

Bit(BTC) Price Forecast: Staying Below $95,690 Could See It Reach $85,000

On the daily chart, Bit(BTC) is hovering slightly above the support level of $95,690. As whale activity diminishes, this crucial level may not hold. In that case, the price of Bit(BTC) could drop below $90,000 and trade at $85,721.

Conversely, if market sentiment changes and Bitcoin whales resume coin accumulation, it could trigger a rally to the all-time high of $108,388 for the coin.