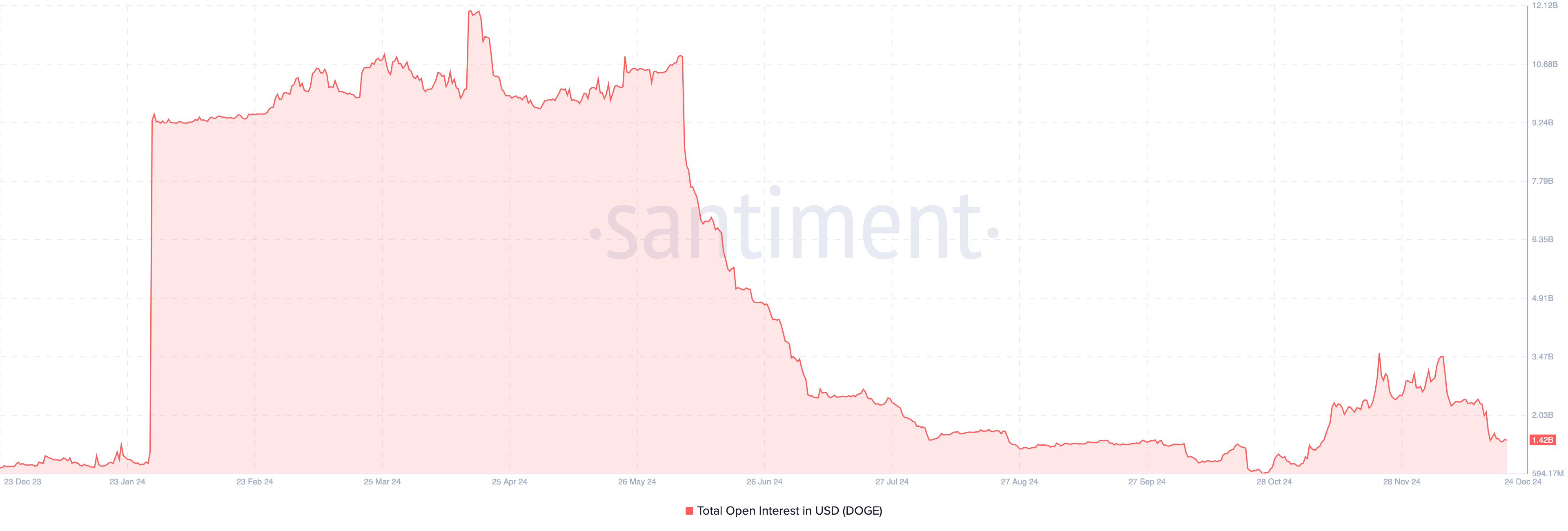

In April, Dogecoin (DOGE) open interest reached an annual high of $12 billion, but it has since dropped significantly between that peak and October. While it has risen again in early November, it is now at risk of falling to its lowest level since November 10th.

Generally, a decrease in open interest, also known as OI, corresponds with DOGE's price movement, and it has declined by 20% over the past 7 days. So what's next for the cryptocurrency?

Decrease in Dogecoin trader exposure...investors cautious

Dogecoin's current open interest has decreased to $1.42 billion. OI represents the total number of open contracts in the futures or options market at a given point in time. An increase in OI indicates that new positions are being added, reflecting greater participation and confidence in the cryptocurrency's price movement.

Conversely, a decrease in the indicator reflects the closing of positions, suggesting a decline in trader confidence or a neutral outlook on the asset. Therefore, the significant drop in DOGE's open interest implies that traders are not expecting large gains from short-term price movements.

If this trend continues and Dogecoin's price falls to $0.32, the cryptocurrency's value may undergo a long-term correction.

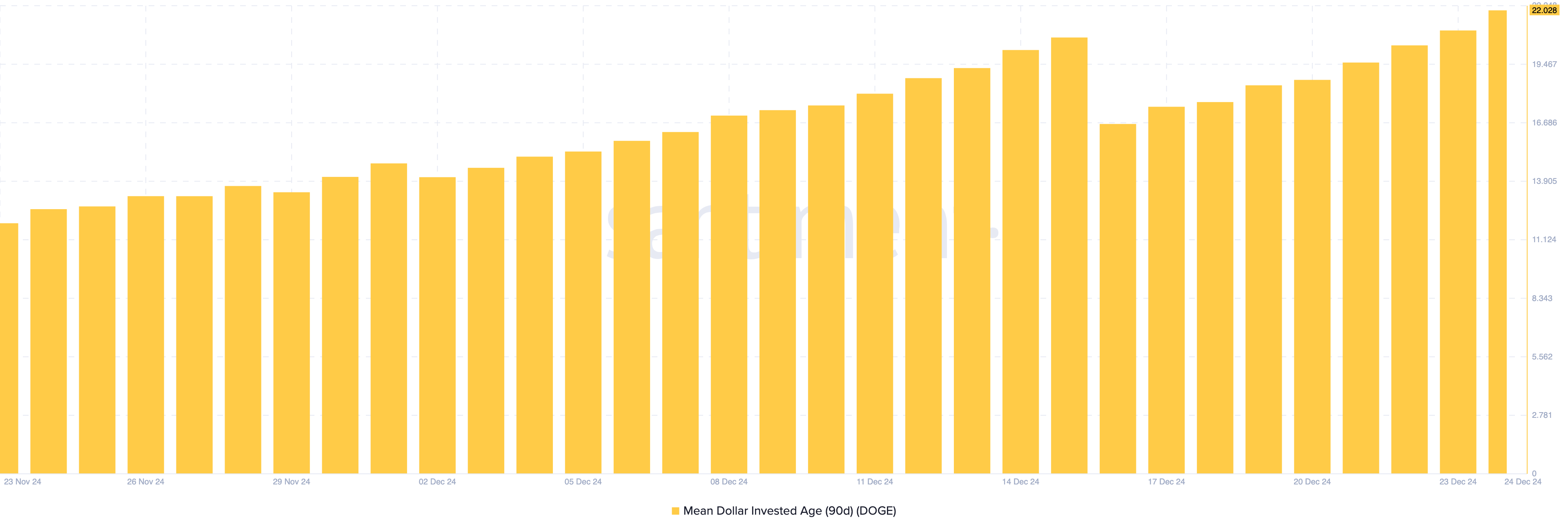

The Mean Dollar Invested Age (MDIA) is another indicator suggesting that Dogecoin's price could decline further. As the name implies, MDIA is the average age of all coins on the blockchain, weighted by their purchase price.

An increase in MDIA indicates that holders are keeping their coins in their wallets and not actively trading them. This signifies stagnation and is generally considered bearish. A decrease in MDIA suggests that previously inactive coins are moving, implying increased activity or trading. This is generally considered bullish, as it can indicate new interest and liquidity.

According to Santiment, Dogecoin's 90-day MDIA has increased, indicating that holders are primarily keeping their coins in a stagnant state. If this continues, it would support a bearish outlook on the cryptocurrency.

DOGE Price Prediction: Correction Still Ongoing

On the daily chart, DOGE continues to lose key support levels. Specifically, the coin has fallen below the $0.35 support area, and the bulls have failed to defend this zone. The Moving Average Convergence Divergence (MACD) also supports this decline.

MACD measures momentum. A positive reading indicates bullish momentum, while a negative reading suggests bearish momentum. As can be seen below, the MACD reading is in the negative territory. If this continues, Dogecoin's price could drop to $0.27.

However, if the bulls manage to reclaim and successfully defend the $0.35 support, the trend could reverse. In that case, DOGE could rebound to $0.48.