The year 2024 is nearing its end, and it has been a relatively good year for the ecosystem. However, what lies in store for the cryptocurrency market in 2025?

This is an important question that investors may have. In this analysis, BeInCrypto discusses insights into next year's outlook from renowned analysts. While some predict a bullish market will gain momentum, others sound a note of caution. Here are the key forecasts and signals from important indicators.

Reasons Behind the 'Bitcoin to Rise After Correction' Outlook

Benjamin Cowen, a cryptocurrency analyst and founder of IntoThecryptoverse, says Bitcoin (BTC) could enter a correction in early 2025. Cowen suggests this could happen because Bitcoin has exhibited similar behavior in January following previous halvings. He advises market participants to be mentally prepared for a potential decline.

"In the last two cycles, BTC has seen a correction in January of the year following the halving. It might be worth mentally preparing for the potential outcome." Cowen wrote on X.

However, this contrasts with several opinions that Bitcoin price could surge to $120,000 in the first month. Currently, BTC is trading at $97,970. Cryptocurrencies have set a new all-time high of $108,268 this year, representing a 112% year-to-date (YTD) increase.

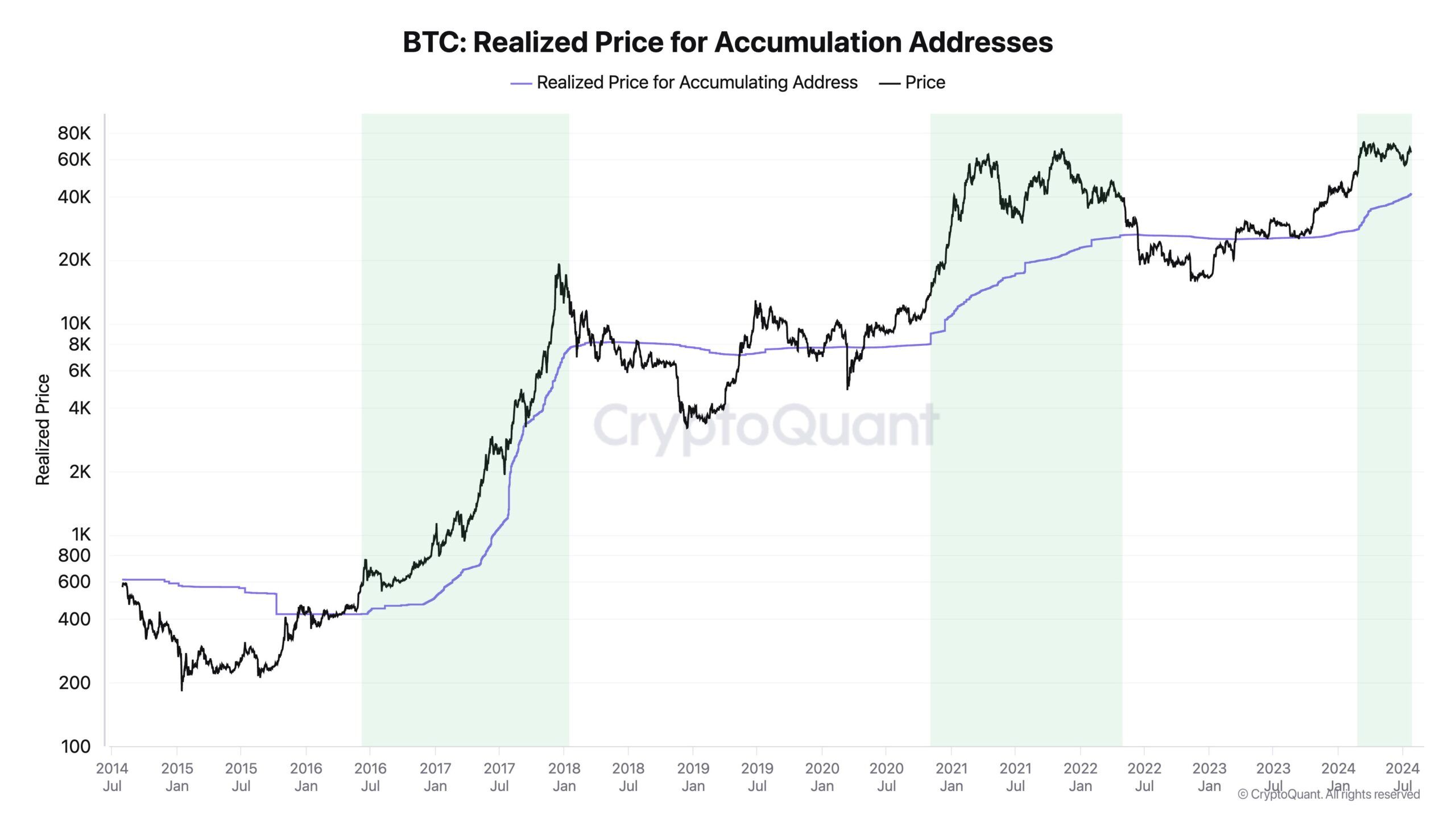

Ki Young Ju, CEO of on-chain analytics platform CryptoQuant, has opined that the Bitcoin bull market could continue until mid-2025. In July, he made this claim, mentioning that BTC could attract new capital and extend the bullish cryptocurrency market until 2025.

However, in November, Ki Young Ju changed his stance. According to him, if Bitcoin price ends 2024 strongly, it could set the stage for a bearish market in 2025.

"The BTC futures market indicators are overbought, and we're entering price discovery, and the market is getting hotter. If we see a correction and establish a bottom, the bull market can extend, but a strong year-end rally can set up a bearish 2025." Ki said on X.

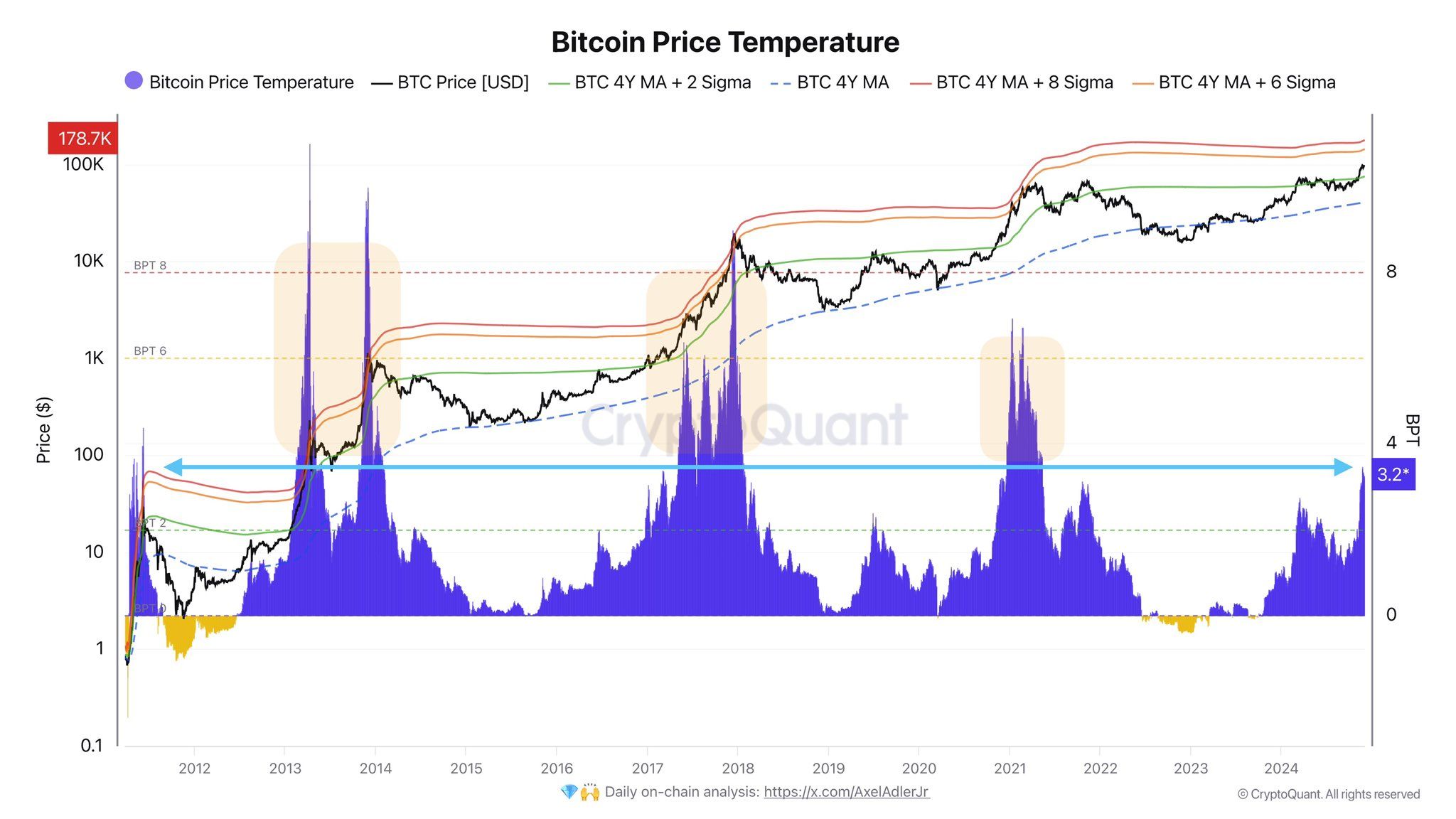

Recently, Axel Adler shared his perspective on the Bitcoin Price Temperature (BPT). This measures the distance between the current Bitcoin price and the 4-year moving average.

Generally, Bitcoin reaches a cycle top when the BPT is between 6 and 8. On December 7th, Adler mentioned the indicator was at 3.2. However, he said if the metric rises to 8, Bitcoin price could reach $178,000.

"At a BPT level of 8, the price can reach $178,000 per BTC. Essentially, this could serve as a target for 2025 if the current spot market demand for the coin persists." Adler mentioned on X.

Altcoins Also in Focus... Solana vs. Ethereum Competition Continues

However, Bitcoin is just a part of the cryptocurrency market. Therefore, it is important to examine the potential macroeconomic outlook for cryptocurrencies in 2025. At the same time, it should be noted that in the 2021 bull run, only a few altcoins were able to reach new all-time highs, besides Bitcoin.

There were still positive signals. For example, BNB and Solana (SOL) reached new peaks, and XRP's price performed strongly last quarter. Relatively new altcoins like Sui (SUI), Mantra (OM), and Bitget Token (BGB) also showed impressive results.

This praise would be incomplete without mentioning memecoins. They have maintained a strong presence in the market during this cycle. This has led experts to predict that memecoins, AI coins, and real-world asset (RWA) tokens can continue to perform well in 2025.

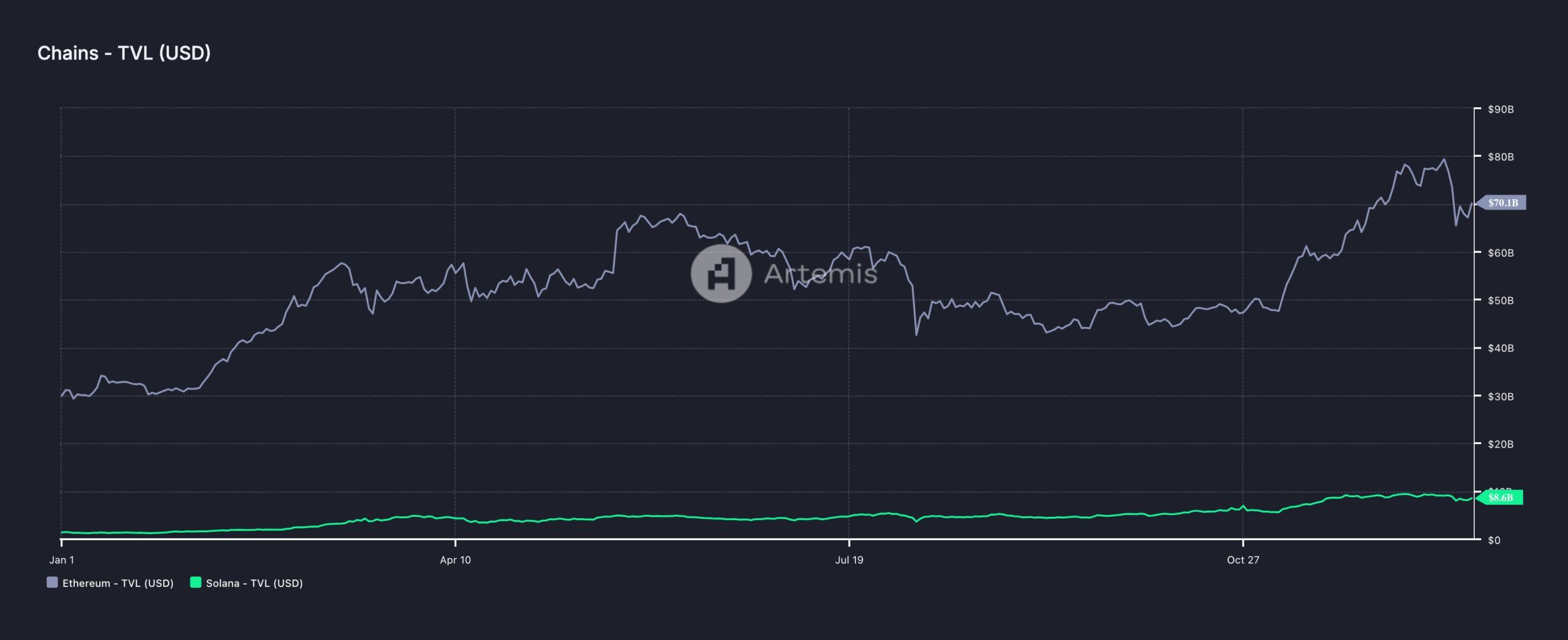

However, Ethereum (ETH) has been somewhat disappointing. As a result, digital asset management firm 21Shares has opined that Solana could continue to erode Ethereum's market share by 2025.

21Shares cited the low fees provided by the Solana blockchain and the adoption integration of the PayPal USD (PYUSD) stablecoin as reasons for this prediction. It also emphasized that this does not mean SOL will flip ETH's market capitalization.

"We don't expect a full 'flippening', but Solana is poised to capture more market share than Ethereum through improved UX and infrastructure," the report stated on X.

Nevertheless, Ethereum's Total Value Locked (TVL) is still higher than Solana's. At the time of writing, Solana's TVL is $8.6 billion, while Ethereum's TVL is $70.1 billion.

If the predictions materialize, the TVL gap could narrow. 21Shares mentioned that the approval of a Solana ETF application could happen within the first three quarters. However, it could also occur towards the end of 2025 or early the following year.

"The expansion of Solana's role in traditional finance is expected to pave the way for traditional finance products such as Solana futures on the CME or a Solana ETF in the US. While the ETF approval may not happen in 2025, the likelihood increases as we approach the end of the year and the first half of 2026." - 21Shares

The Trump Effect... How Will Adoption Unfold?

From a macroeconomic perspective, asset managers expect the approval of a Bitcoin ETF to drive institutional adoption globally. This sentiment may be related to the election of Donald Trump as US President.

Trump consistently promised during his campaign that his administration would provide clear regulations for the cryptocurrency sector. His inauguration is scheduled for January 2025, and the resignation of SEC Chair Gary Gensler could allow the market to experience more freedom.

Beyond the US, South Korea is also considering lifting the ban on cryptocurrency ETFs. If this happens, trading volume in the Asia region could increase significantly in value. The UK is no exception, with speculation that retail investors will be able to access cryptocurrency exchange-traded notes (ETNs).

Based on the above, the cryptocurrency market in 2025 could provide more positive results than this year. Another country may follow in the footsteps of El Salvador and adopt Bitcoin as a strategic reserve asset.

At the time of writing, the countries with that possibility are the US and Argentina led by Javier Milei. If that happens, Bitcoin prices could reach new highs, and the total market value could exceed $5 trillion.

The situation for altcoins remains uncertain. However, if a high level of capital flows into these assets, they could also reach new highs. At the same time, investors should be cautious, as a collapse of cryptocurrency platforms like in 2025 could invalidate this forecast and push the market into a bearish phase.