Author: Daniel Ramirez-Escudero, CoinTelegraph; Translated by: Bai Shui, Jinse Finance

Driven by the growing institutional adoption and bullish sentiment in the United States, the cryptocurrency market is firmly in a bull market cycle. Bitcoin, once viewed as a fringe asset, is now being embraced by major financial institutions.

Women have played a core role in this transformation, leading startups, shaping policies, creating educational content, and writing research reports to help drive mainstream adoption of cryptocurrencies.

Given its roots in the traditionally male-dominated tech and finance sectors, the cryptocurrency industry has long been male-dominated. However, the novel industry represents a fresh and innovative evolution of these fields. Cryptocurrencies are now attracting more women, providing a unique opportunity to address the gender imbalance in tech and finance.

Cryptocurrencies have long been criticized for their "bro" culture, but as the industry matures, it has become more balanced, with women increasingly taking the lead, even surpassing men in some areas.

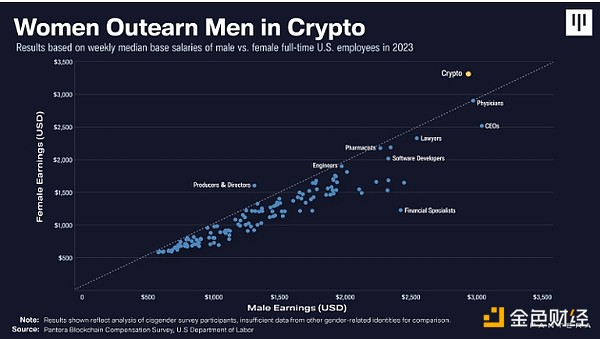

On July 29, a report from the cryptocurrency hedge fund Pantera Capital showed that the earnings of women in the industry have started to exceed those of men, which is clearly an exception to trends in other industries.

The report noted: "The relatively equitable pay in the cryptocurrency space suggests that gender equality is moving in a more positive direction, marking a progressive trend in this relatively new field."

In the cryptocurrency field, women's earnings exceed those of men. Source: Pantera

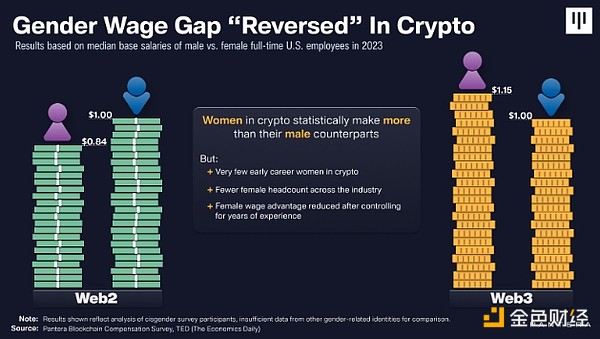

While the gender pay gap in the crypto industry may have reversed, women are still underrepresented in senior positions, highlighting the persistent glass ceiling in the industry.

The gender pay gap in the cryptocurrency field has reversed. Source: Pantera

Nevertheless, women have seized the opportunity to jump into the cryptocurrency gold rush, and their efforts have borne fruit, making significant contributions across various disciplines and achieving success in the crypto industry.

Senator Cynthia Lummis: A Legislator Supporting Bitcoin

U.S. Senator Cynthia Lummis from Wyoming has become a key figure in the crypto industry, primarily due to her advocacy for clear, balanced crypto regulations.

Lummis invested in BTC in 2013. Her deep understanding of digital assets and her background as Wyoming's state treasurer have made her a leading advocate for innovation and regulatory clarity in the U.S. Senate.

Lummis has strongly criticized the current anti-crypto regulatory approach, particularly the enforcement-driven stance of the U.S. Securities and Exchange Commission (SEC). This has helped her gain the trust of many in the crypto community.

Her advocacy includes pushing for the classification of BTC and ETH as commodities, under the jurisdiction of the Commodity Futures Trading Commission (CFTC), rather than the SEC.

On July 27, 2024, she introduced the 2024 Bitcoin Bill at the Bitcoin Nashville Conference. The bill would require the U.S. government to establish a Bitcoin strategic reserve, purchasing around 5% of the total 21 million BTC supply and holding it for at least 20 years. Lummis hopes to have the U.S. treat BTC as a reserve asset to hedge against currency devaluation. Lummis said:

"We now have money, but we will no longer hold it in dollars and assets intended to depreciate at least 2% per year. We will hold it as an asset that will appreciate."

After the 2024 federal elections, with the Republicans controlling both the Senate and the House, she doubled down on her commitment to passing the bill.

Source: Senator Cynthia Lummis

Lummis has even gone further, suggesting that the U.S. could exchange its gold reserves for cryptocurrencies instead of waiting to purchase BTC.

The "Bitcoin Bill" is seen by many as one of the most bullish factors in the current BTC cycle and remains a source of excitement for the crypto community.

Blockstream co-founder and CEO, Hashcash inventor Adam Back, predicted that if implemented, the BTC valuation could exceed $1 million.

Source: Adam Back

Blockcircle CEO Basel Ismail pointed out that if the bill is passed in the U.S., it will "signal to most G20 countries" to follow suit, triggering a domino effect.

Maya Parbhoe: Creating a New Bitcoin Nation

Suriname presidential candidate Maya Parbhoe has an ambitious vision: to create a Bitcoin nation deeply integrated with cryptocurrencies.

Her plan for Suriname is not just to make BTC a legal tender - she wants to dissolve the central bank, cut taxes, privatize public services, issue national BTC bonds, and implement widespread deregulation.

In 2023, she collaborated with Jan3 CEO Samson Mow, playing a crucial role in El Salvador's BTC transformation. She nearly achieved her goal of making BTC Suriname's legal tender, but she says corruption derailed her efforts, prompting her to seek change through politics.

In October 2024, she announced her candidacy for the May 2025 elections, promising to adopt the BTC standard in Suriname within a year if elected.

From left: Suriname President Chan Santokhi, Maya Parbhoe, and Ben van Hul.

While many politicians have only recently embraced cryptocurrencies, Parbhoe has been involved with BTC for the past decade and is a firm believer in Satoshi Nakamoto's values.

In 2014, her curiosity led her to explore BTC, and she found her life's calling, as she shared:

"I fell down the rabbit hole completely and decided to dedicate the rest of my life to it. If there's a reason worth dying on this hill, it's Bitcoin."

Parbhoe's vision and her efforts to root out corruption have garnered the support of many in the BTC community. However, only time will tell if the momentum she is building is sufficient to take power and reshape the nation's future.

Perianne Boring: The Tireless Bitcoin Lobbyist

While President-elect Donald Trump made several promises that, if fulfilled, could have overwhelmingly supported cryptocurrencies in the country, U.S. regulators and policymakers have not always been so crypto-friendly.

Perianne Boring, the founder and CEO of the blockchain advocacy organization the Digital Chamber, has long been tirelessly advocating for pro-crypto policies on the frontlines.

The crypto voting bloc has made its voice heard, and we now have a once-in-a-lifetime opportunity to make America the world capital of cryptocurrencies.

-- Perianne (@PerianneDC), November 13, 2024

In 2018, Forbes named Boring one of the "50 Leading Women in Tech" in America, reflecting her strong influence in the U.S. in this field.

Boring is an early adopter, having learned about BTC while working on Capitol Hill in 2011. Her political experience and understanding of BTC led her to take on her current role.

She is a staunch defender of clear crypto policies and has criticized the U.S. Securities and Exchange Commission, as many in the crypto industry believe this is "enforcement regulation." She believes the CFTC should regulate cryptocurrencies because "cryptocurrencies are commodities".

According to Fox Business, her positive attitude may have put her on the list of candidates for CFTC chair, and if she is nominated and confirmed, she could develop crypto-friendly regulations.

She may become a key figure in the field of crypto regulation, especially if the Financial Innovation and Technology Act of the 21st Century (FIT21) is enacted. FIT21 will clarify the roles of the CFTC and SEC, and determine that most digital assets that fail the SEC's securities "Howey test" will fall under CFTC jurisdiction, particularly in the spot market.

Natalie Brunell: Educating the Public on Crypto

Natalie Brunell is a prominent figure in the cryptocurrency space, known as a Bitcoin advocate and educator.

Brunell hosts Coin Stories, a highly popular Bitcoin-centric podcast where she interviews key figures in the Bitcoin and economics fields. Her work helps to connect complex financial concepts with personal stories, making Bitcoin accessible to a wide audience.

Brunell's career began in traditional media, where she spent over a decade as an investigative reporter and television journalist. After witnessing her family's financial struggles during the 2008 financial crisis, she began to turn to Bitcoin, which led her to question the systemic problems of the traditional financial system.

Since then, her show has featured guests related to cryptocurrencies, such as Michael Saylor, Peter Schiff, PlanB, Anthony Pompliano, Willy Woo, Raoul Pal, Dan Held, Peter McCormack, and Jimmy Song.

Her journey from traditional media to a full-time Bitcoin advocate highlights her commitment to reshaping the public's understanding of money and technology.

Lyn Alden: Bitcoin Researcher

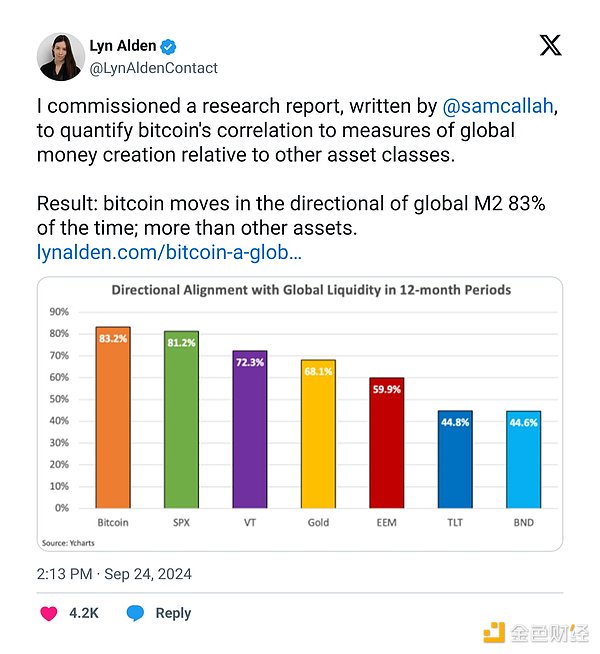

Investor and stock analyst Lyn Alden has become a prominent figure in the field of macroeconomic analysis and investment strategy. She actively participates in the activities of crypto thought leaders, providing her insights and understanding of the crypto markets.

Alden excels at making complex analysis simple for the average person. In 2024, she commissioned a research report titled "Bitcoin: A Global Liquidity Barometer," exploring the strong correlation between Bitcoin price trends and global liquidity, particularly measuring the M2 money supply of cash, checking deposits, and other monetary assets.

The research showed that Bitcoin has been aligned with global liquidity trends around 83% of the time, a higher proportion than other major asset classes like gold and stocks.

This perspective highlights Bitcoin's potential to benefit from favorable liquidity conditions, while acknowledging its volatility and dependence on broader macroeconomic changes.

Margot Paez: Combating Environmental Misinformation

One of the most common criticisms of cryptocurrencies is the negative environmental impact of crypto mining. However, this narrative is starting to shift.

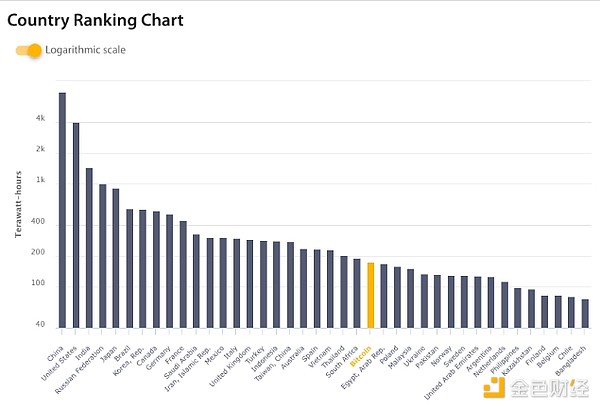

Bitcoin uses Proof-of-Work (PoW) as its consensus mechanism, which requires significant computing power to generate new blocks on the blockchain. According to data from the Cambridge Centre for Alternative Finance (CCAF), as of December 17, Bitcoin consumes around 185 TWh per year, more than Egypt and Poland.

Comparison of Bitcoin energy consumption by country. Source: CCAF

Margot Paez, a researcher at the Bitcoin Policy Institute and an environmental sustainability consultant, has conducted research that challenges the view of Bitcoin as harmful to the environment. She believes that, contrary to intuition, Bitcoin's mining flexibility and location-agnostic nature may actually accelerate the global transition to renewable energy, while also helping to balance the energy grid.

She has played an active role in data-driven advocacy campaigns to better understand Bitcoin mining.

Ophelia Snyder: Crypto ETF Expert

The 2024 Bitcoin price surge was closely linked to the approval of spot Bitcoin exchange-traded funds (ETFs). BlackRock's BTC ETF has become the most successful ETF it has ever launched, reversing its gold ETF through record capital inflows.

Ophelia Snyder, co-founder and president of 21.co, has been a key figure in the launch of multiple ETFs, including serving as a sponsor and sub-advisor for ARK Invest's spot Bitcoin and Ethereum ETFs.

On November 1, 2018, she launched the world's first crypto index exchange-traded product through 21.co's subsidiary 21Shares in Switzerland.

One of Snyder's major achievements is collaborating with Cathie Wood's ARK Invest to launch a spot Bitcoin ETF in the U.S. Her efforts have played a crucial role in the legitimization of crypto assets for traditional investors by providing simple, secure market access.