XRP has been consolidating below major resistance for over a month, and altcoins have failed to gain upward momentum, disappointing investors.

This prolonged stagnation is affecting traders' confidence, and many are retreating as meaningful price appreciation remains elusive.

XRP traders seem to lack conviction in the upside

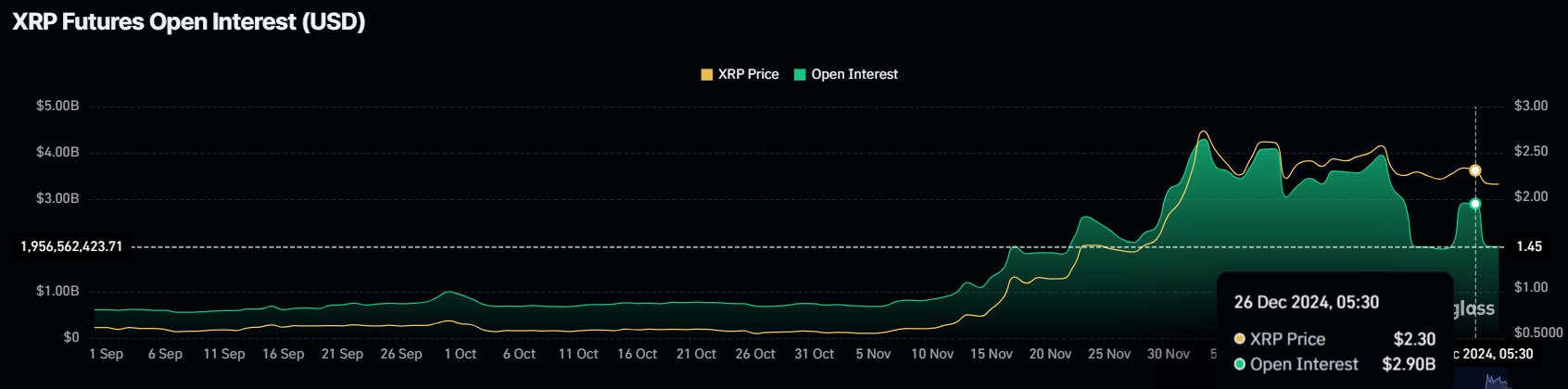

The open interest (OI) of XRP futures has decreased by $1 billion in the past 24 hours, indicating a decline in traders' conviction. Just a day earlier, the OI had surged to $2.9 billion on the back of price appreciation expectations, but as these expectations failed to materialize, traders have started to unwind their positions.

This sudden unwinding reflects a growing bearish sentiment among XRP enthusiasts. The decrease in OI emphasizes the increasing doubts about XRP's ability to break above the current resistance levels, and this could further dampen short-term market activity.

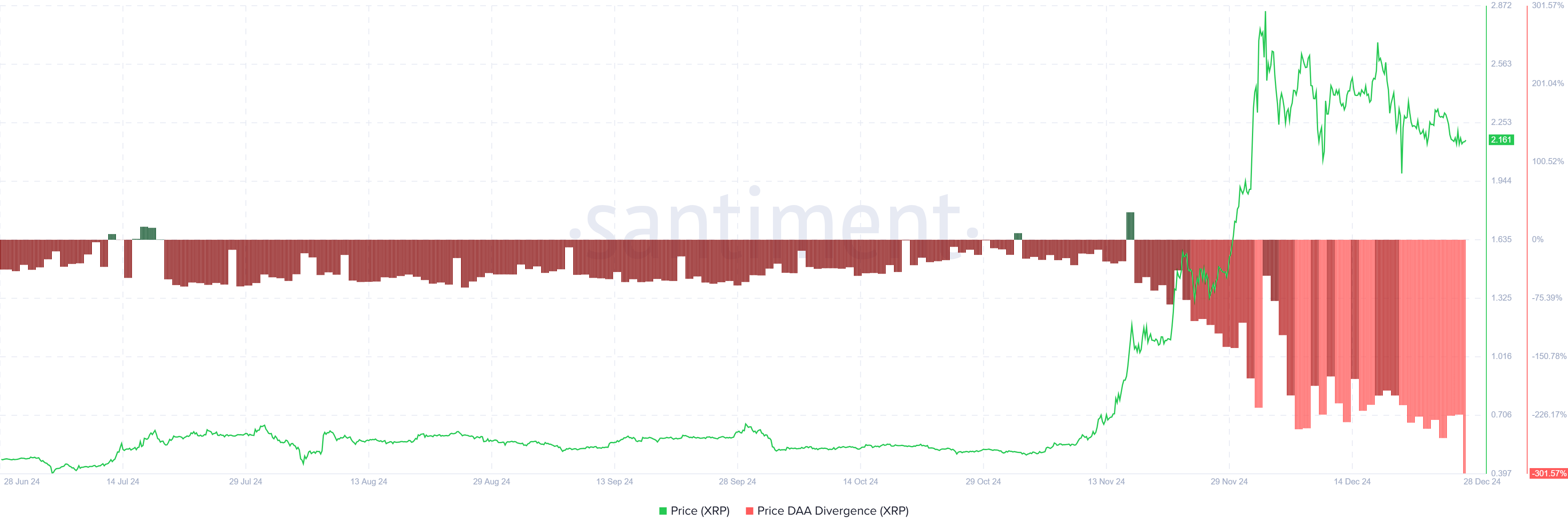

The macro momentum for XRP is also showing weakness. The price DAA divergence is currently signaling a sell signal, reflecting the decline in participation and stagnant price movement. This bearish indicator suggests that traders may start to take profits, which could lead to further price declines.

If the selling pressure intensifies, XRP may face additional challenges. The combination of decreased participation and hesitant investors could delay the altcoin's recovery, and it may enter a correction phase until a strong market signal emerges.

XRP Price Prediction: Needs to Rally Above $2.00 Support

The price of XRP has declined by 20% over the past month, but it has maintained the $2.00 support level. However, the altcoin is currently in a correction phase below the crucial $2.73 resistance, failing to initiate a rally.

If the bearish factors persist, XRP risks losing the $2.00 support level and entering a deeper correction. This scenario could further weaken investor confidence and exert additional downward pressure on the price, prolonging the current stagnation.

Conversely, if the overall market conditions shift to a bullish stance, XRP could break above the $2.73 resistance and target its all-time high of $3.31. Reaching this level would invalidate the bearish narrative and initiate a new uptrend, attracting more investors back into the market.