Author: Kyle, Crypto Researcher; Compiled by: Felix, PANews

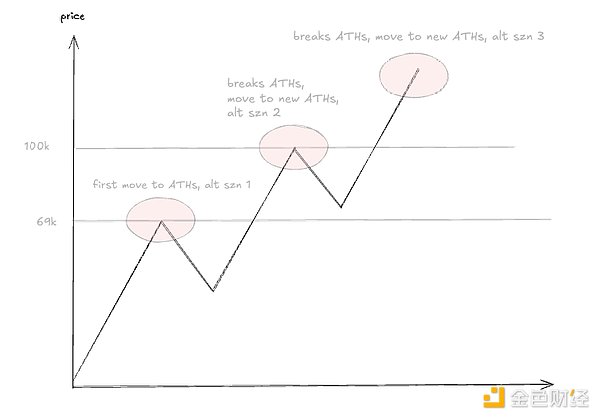

Since the current bull market cycle began in 2024, the cycle so far has been: January 10th, BTC ETF launch → until Bitcoin reaches a new all-time high, fueling the Altcoin season, entering a volatile Q2/Q3 2024, with Bitcoin continuing to break through $50,000 and $60,000, currently hovering around $90,000.

It is worth noting that the Altcoin season began when BTC reached its peak, the first round was BTC approaching $69,000 but failing to break through properly, the next round was approaching $100,000.

The next Altcoin season is likely to be when Bitcoin stabilizes at $100,000, which is hoped to happen in Q1 2025. But it may replay the story of Q2/Q3 2024 in the coming months. Here are all the possible scenarios:

Scenario 1: BTC + Altcoins generally rise. Rises all the way through 2025, then enters another Altcoin season, as BTC continues to rise, all tokens perform well, repeating the past 2 months (30-40% chance).

Strategy: Select outperforming Altcoins and buy on dips.

Scenario 2: BTC rises, fewer Altcoins rise; Replay of 2024 story, fluctuating up and down in the coming months, but more bullish than 2024 (because BTC is rising); so select well-performing tokens (50-60% chance).

Strategy: Buy selected Altcoins on dips. Avoid high-profile tracks, find the next "moonshot".

Scenario 3: BTC rises, Altcoins generally fall (20-30% chance).

Strategy: Sell all Altcoins. Reduce Altcoin investment; if the Altcoins held have not risen in the long run, may have to sell them all.

Scenario 4: BTC falls, Altcoins generally fall. Everything has reached its peak (10-20% chance).

Due to macroeconomic tailwinds, the new BTC ATH breakthrough may not take as long as in 2024. In this hellish summer, the ETF has just been launched, and TradFi is still struggling to sell the BTC story to clients. Most importantly, the outside world does not generally believe in the importance of Bitcoin.

Now with Trump's victory, discussions about strategic Bitcoin reserves are underway, although the likelihood of establishing a strategic Bitcoin reserve is low, but Bitcoin's reputation has already changed.

The narrative is important - in fact, the new regime currently in place has brought new attention to the digital asset space, and the fact that the next US president is now talking about Bitcoin so frequently makes it much easier to convince people to buy Bitcoin.

This regime change is extremely important. Therefore, BTC will continue to maintain a bullish trend in 2025. For Altcoins, the situation is similar but different.

Total3 (the total market cap of all Altcoins) hit a new all-time high in Q1 2024, then reached a cycle high in Q4 2024. It more or less follows the same pattern (Scenario 1 and Scenario 2 above are not too different).

The key is positioning and timing. While bullish on 2025, it's unclear how long it will take. Although the 2025 rally may come earlier than 2024, Altcoins will still see significant declines in periods without catalysts.

As long as the cycle hasn't ended, stay long on both Bitcoin and Altcoins. 2025 won't see the same situation as the summer of 2024, although there may be periods like the current one (just a consolidation period), but prices will still remain quite good.

The on-chain situation is different, when the tide goes out, on-chain can easily see 70% declines. Altcoins are not expected to peak at this time, as it is not clear how BTC can continue to rise when Altcoins "die", nor how BTC can peak here.

Conclusion:

BTC rises, with a higher gain than 2024

Altcoins are in an uptrend, although there will be declines, but less severe than 2024

Risks

Cycle Top

We are still far from the cycle top, but must constantly re-evaluate it weekly. The cycle top may not be a "event", but more of a range that gradually approaches over time.

Bitcoin Reserve Plan Risk

With the start of the new presidential term, all eyes will be on Trump's actions. While the Bitcoin tailwinds exist, if Trump completely ignores the reserve plan, that would be quite pessimistic. More likely is that the reserve plan does not happen/is delayed by some events.

In the latter case: it is initially bearish, but ultimately a bullish event as long as it benefits Bitcoin.

TLDR: Bullish signal = cycle continues. Bearish signal = plan needs to be revised. Cycle may continue, but chances are lower.

Supply Risk

The summer of 2024 experienced a crazy macroeconomic environment, with the stock market hitting new highs. However, due to repeated blows from supply whales like Gox, Grayscale GBTC, etc., there was no benefit, only harm.

Supply risk can never be mitigated. There will always be someone holding a large amount of Bitcoin - the UK government, Silk Road, FTX distribution, etc. This is just something you have to keep a close eye on, but if everything goes well, these are good buy-the-dip events.

Macro Risk

Expected smaller rate cuts, while not as optimistic, the fact is that as long as rates continue to decline, liquidity will improve. Similarly, bullish signal = cycle continues. Unless there are rate hikes/no rate cuts, macro should be favorable for digital assets.

The bearish signal is if inflation rears its head again, the Fed may have to raise rates to curb inflation.

Token Recommendations

1. AI

Has already experienced several waves. The next wave is expected to come soon. Buy and hold will not yield good results. Goat, the token that spawned all this, has already fallen 60% from its high and may continue to underperform.

Top Picks: Applied Tech / Swarms / Gaming / Consumer-Centric AI

ALCH (game development), Griffain (helps control wallet proxies), Digimon, Ai16z, etc. are top picks.

2. DeFi

DeFi will continue to be a great narrative, however it is very difficult to invest in, as very few tokens can benefit from it, and even if they do, they may not see a big rally.

To be frank, DeFi is not the top choice in terms of risk-reward.

Top Picks: AAVE / ENA / Morpho / Euler / USUAL

Secondary: Stablecoins / Payment-related tokens

3. L1

L1 will make a comeback. The obvious one is Hype. L1 itself is one of the areas the market has always ignored - it's one of the untapped areas, but it holds huge opportunities (just as Hype grew 10x).

Top Picks: SUI / Hype

Secondary: Abstract

4. NFT Tokens and Gaming Tokens

The NFT token space is worth watching. PENGU is slowly recovering, Azuki has the ANIME token, Doodles has... whatever. NFTs are not expected to revive, but their tokens will. Also, it's interesting to dig deeper and find interesting upcoming game tokens.

Top Picks: Pengu / Anime (Azuki) / Spellborne / Treeverse

Secondary: Prime / Off the grid (if the token is launched) / Overworld

5. Other Narratives

Data Tokens: Kaito / Arkm

Meme: PEPE

DePIN: PEAQ / HNT

Ordinals

Old DeFi: CRV / CVX

2025 Predictions

DePIN will be implemented in some way by a company, perhaps through an acquisition.

Binance will lose market share as the largest exchange. Not from Hyperliquid, but from Bybit / OKX.

As VR makes new progress, altcoin tokens gain new life

ICO is great again

There will be no Altcoin season on the ETH chain

Sui reaches double digits (at least $10)

The Ethereum ETF staking is approved, which in turn spawns more yield products for staking other tokens, as well as yield aggregators

A top-tier artist uses Non-Fungible Tokens and tokens to maintain fan relationships and provide rewards

Bitcoin reaches $200,000

More L1 institution CEOs/founders leave their original companies after seeing the Aptos Labs CEO depart (PANews note: On December 20, Aptos Labs co-founder Mo Shaikh resigned as CEO, and co-founder Avery Ching will take over)

Base fails in the competition with L1s, and another L1 takes its place. Solana continues to hold