Bit (BTC) is unable to recover the $100,000 support level due to its sideways movement.

In the midst of this price movement, veteran trader Peter Brandt has emphasized the similarity between Bit's 2018 pattern and the current situation, sparking speculation about the next move of the king of cryptocurrencies.

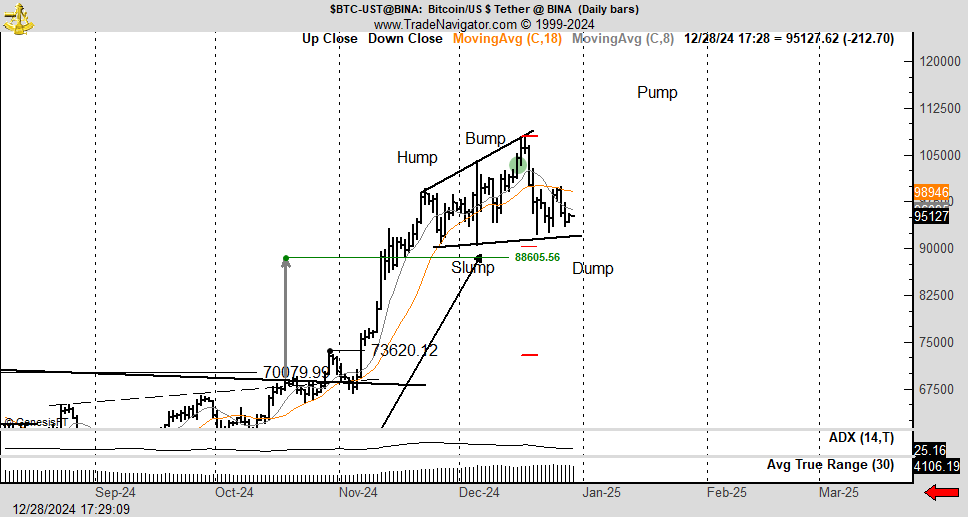

Bump-Rump-Hump-Dump...and Pump?

Peter Brandt mentioned that Bit is similar to the old pattern from 2018, which occurred before BTC broke out of its parabolic rise. This pattern, known as BHLD (Bump, Lump, Hump, Dump), means that the chart progresses in a sequence of small and gradual ascent-consolidation or compression-small but steep ascent-steep correction. The characteristic of this pattern is that a sharp and large ascent, known as the Pump, comes at the end of the Dump.

This pattern has a derivative form called Hump-Slump-Pump-Dump, which aligns with Bit's current trajectory and may become the next trajectory.

"If you're a Bit investor, go back and look at this post from a few years ago. It explains the famous Hump Slump Bump Dump Pump chart pattern for $BTC. It could be happening again." - Brandt said.

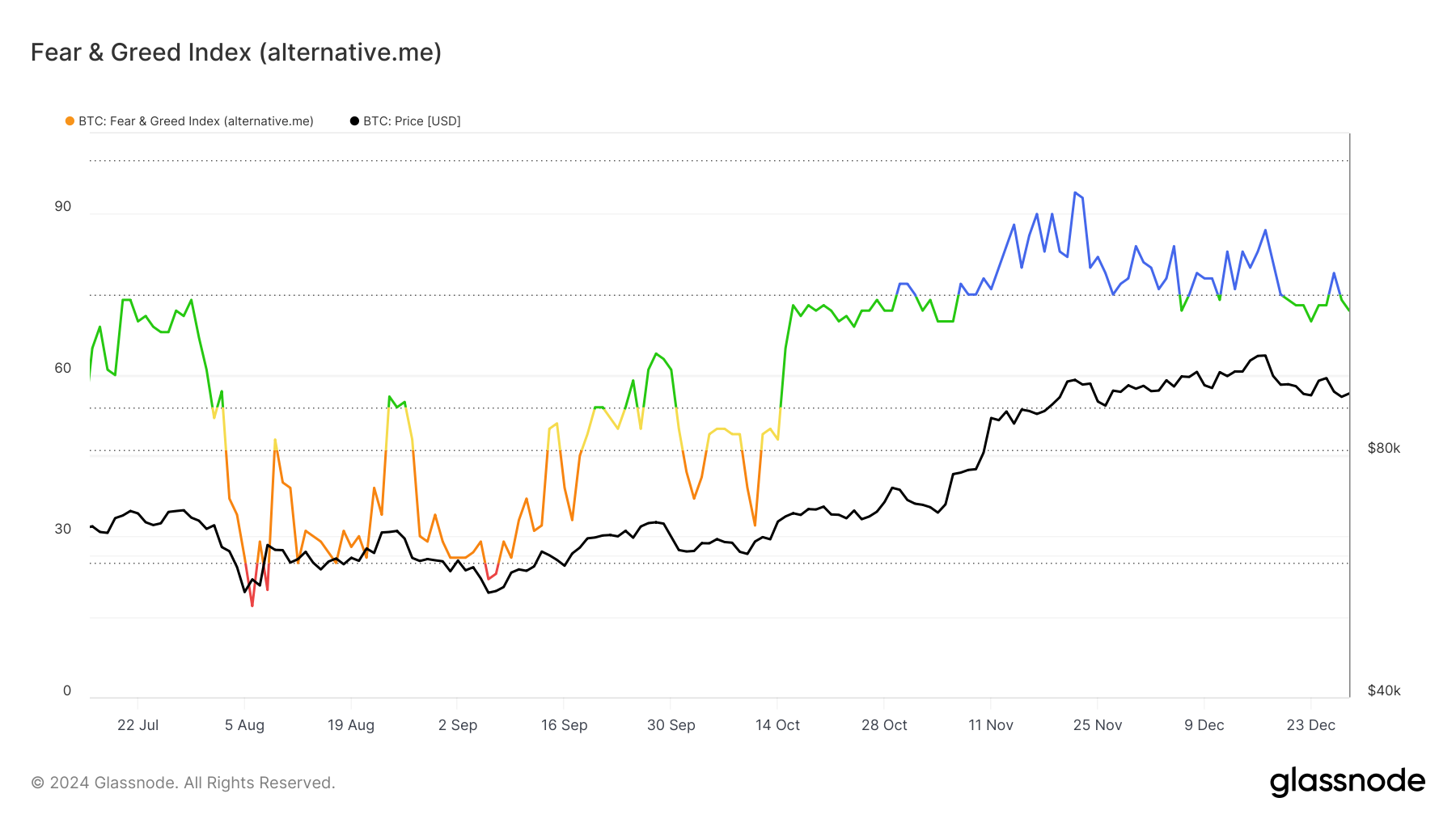

Bit's macroeconomic momentum is transitioning from extreme greed to low greed on the Fear and Greed Index. Historically, BTC has experienced sharp corrections from the extreme greed stage, which is a positive signal for price stabilization.

The current greed level indicates the potential for recovery, as long as it does not lead to excessive selling pressure. Selling is still possible, but the easing of market sentiment could provide opportunities for short-term gains in Bit.

BTC Price Prediction, Support Consolidation

Bit is trading at $94,224 and is attempting to consolidate the $95,668 support level. Investors need to refrain from profit-taking to allow BTC to stabilize and regain its lost momentum.

If Bit recovers the $100,000 support level, it could indicate a short-term bullish trend. This would help BTC recover its recent losses, resume its upward trajectory, and strengthen investor confidence.

Conversely, if it fails to maintain the $95,668 level, Bit could test the $89,800 support and decline further. Such a drop would invalidate the bullish outlook and extend the recovery timeline for BTC to January 2025, creating uncertainty for investors.