Author: arndxt

Compiled by: TechFlow

The following is a detailed guide based on my personal experience, providing a clear and actionable framework.

It aims to help you better navigate the complexities of high-volume markets.

By summarizing the lessons learned from "Trench Warfare" trading, this blueprint will guide you on how to trade MEME, capitalize on AI-driven trends, and stand out in high-risk, high-return opportunities.

(TechFlow note: "Trench Warfare" trading is derived from "trench warfare" tactics, where soldiers dug trenches to protect themselves during war, while also seeking breakthrough opportunities in extreme pressure and danger. Here, "Trench Warfare" trading is used to describe the need for investors to be well-prepared, including research, strategy, and discipline, to address the opportunities and risks that may arise in highly volatile and competitive market environments.)

(The original English table is from @arndxt_xo, compiled by TechFlow)

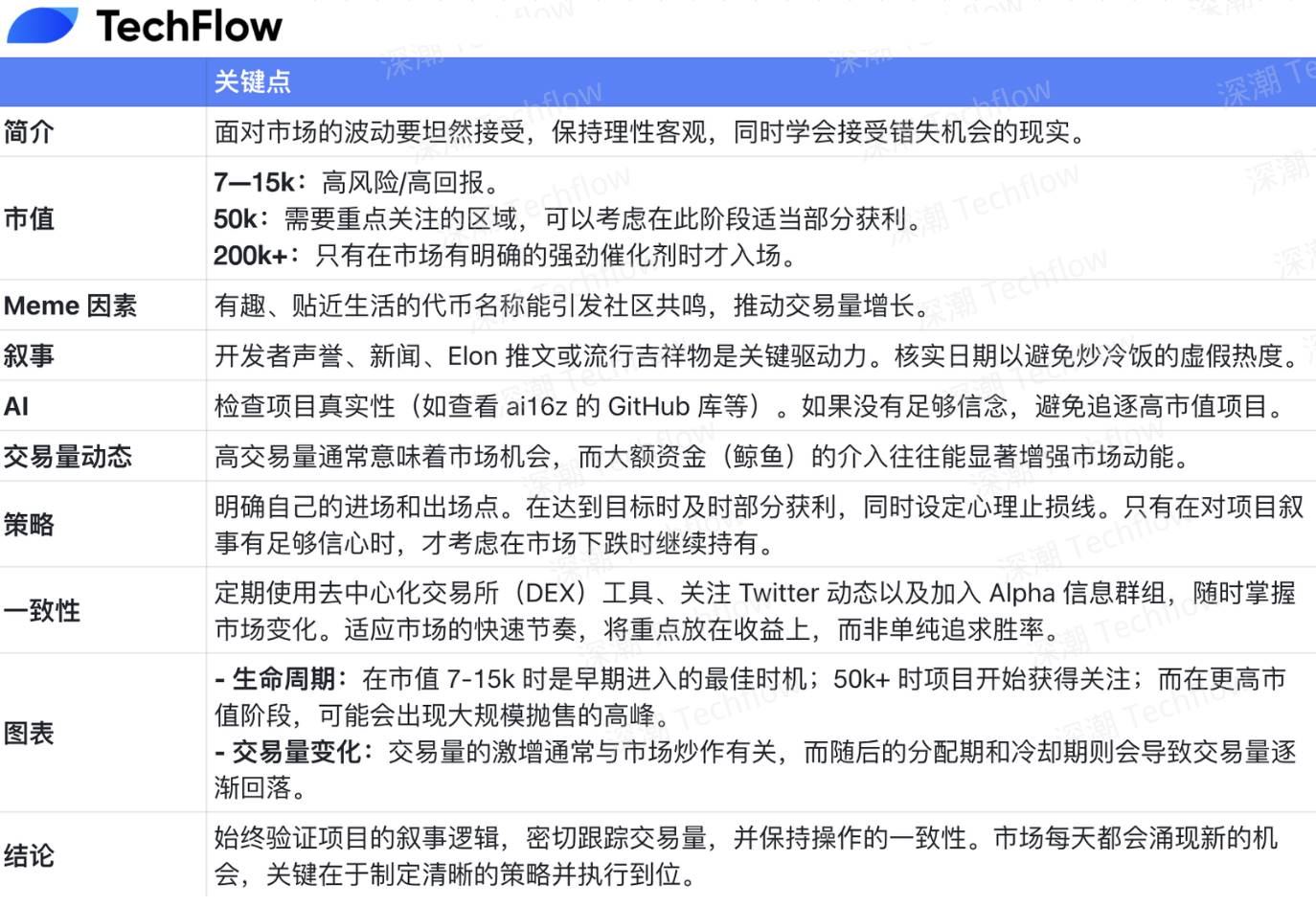

1. Introduction and Mindset

The "Trench Warfare" trading strategy is a high-risk, high-return investment approach. In this mode, you will face microcaps, MEME narratives, AI-related topics, and breaking news. These factors can potentially push a token's market cap from $15k to $10 million or more within a few hours.

Key Mindset Shifts

Embrace Volatility: The assets you trade are not stable large-cap assets, so your gains or losses can fluctuate dramatically overnight.

Maintain Rationality: Even in the frenzy of MEME coins, you need to keep a cool judgment.

Seize the Next Opportunity: Missed a big move? Don't worry, the market often provides new opportunities in a short time.

2. Understanding Market Cap Psychology

In a highly volatile market, the most important thing is to know when to buy decisively and when to observe cautiously.

$7–15k: Initial Stage

This is the entry point for extremely low market caps. If you find a new project that fits your narrative (e.g., MEME, AI, or Elon tweets), this is the stage with the greatest potential upside, but also the highest risk.

$50k: Psychological Barrier

When a MEME coin's market cap breaks $50k, it often attracts more attention on social media (e.g., Crypto Twitter and Telegram). Many early investors may take partial profits at this stage. If you have confidence in the project's narrative or development team, you can choose to hold or even increase your position.

$200k+: Overheated Zone

When a token's market cap exceeds $200k, it may indicate you are paying a premium, unless there is a clear project narrative or developer transparency. Only consider entering at this stage if there are strong catalysts or sustained high trading volume.

3. MEME Factors

When trading MEME coins, the token's explosion may depend solely on humor, community enthusiasm, or a viral tweet.

Example Ticker: For instance, a MEME coin called "Girlfriend = Money Drainer" could skyrocket overnight due to its humorous and relatable theme, resonating strongly with the community.

Community Dynamics: Monitor popular topics on Twitter (now X) or Telegram. If a MEME starts gaining traction, this seemingly "absurd" concept may turn into a real profit opportunity.

4. Narratives and Trends

Narratives are the core driver of trading volume.

When the market believes in a trend or story, investors often flock to it.

Common MEME Narratives

Developer Background: If the developers have a track record of successful projects, this is usually a positive signal.

News-Driven: For example, a new partnership announcement, especially when it becomes a Twitter trend.

Elon Musk's Tweets: If Elon posts about a MEME or AI concept, it often triggers a surge in trading volume, such as $KEKIUS or $PNUT.

Mascot Effect: New dog breeds or random cartoon characters can also become market hotspots.

Before participating, be sure to verify the timing of the news. If old news is being recycled, be wary of the risk of buying at the top.

5. Considerations for AI

AI is one of the core drivers of the current market hype, but not all projects claiming to be "AI" are trustworthy. Here are some points to consider:

Assess Project Value through ai16z GitHub Open-Source Code: If a project references legitimate open-source code or repositories (e.g., from renowned tech companies or top AI labs), it usually indicates the project has more real value. ai16z is the abbreviation for the well-known venture capital firm Andreessen Horowitz, and its GitHub open-source resources are often seen as industry benchmarks.

Beware of "AI Girl" Token Scams: Some so-called "AI Girl" tokens may be just chatbot projects disguised as AI, lacking real technical support. These projects often experience rapid price spikes followed by significant sell-offs, and investors need to be extremely cautious.

Strategic Advice: For brand-new projects, if the developers have a good track record, consider entering early (market cap $10–15k). However, if the market cap has already exceeded $200k, do not blindly chase the price unless there are solid reasons to support its continued growth.

6. Trading Volume Dynamics

Trading volume is a core indicator for fast-paced trading. When trading volume surges, prices can skyrocket, but they can also plummet quickly.

High Trading Volume Means Opportunity

If the project narrative is credible and trading volume has increased significantly (e.g., large buy orders flowing in), you can consider increasing your position.

Observe the Order Book

Large buy walls usually indicate strong market interest, while large sell walls may exert pressure on the price.

Whale Effect

If known whales or popular on-chain wallets start buying, it may attract followers and further boost market sentiment.

7. Strategies and Risk Management

7.1 Entry and Exit Plan

This is a PVP (player-versus-player) market, and trading is like a game. When you buy, someone may be selling.

1. Set Targets

Establish a rough exit market cap target, such as achieving 2x, 3x, or even higher returns.

2. Partial Profit-Taking

At key profit milestones (e.g., 2x or 5x), take back your initial investment or realize partial gains to reduce risk.

3. Look for Confirmation Signals

Closely monitor the chart's performance around key market attention levels (e.g., $50k, $100k, $1M) to assess whether there are further upside signals.

7.2 Stop-Loss Strategy

Due to the high volatility of the market, traditional stop-loss methods may not be effective. To reduce the risk of loss, you can try to set a psychological stop-loss point (a loss range based on your own risk tolerance), or place a limit order below the key support level.

7.3 When to Hold Long-Term

If you are confident in the prospects or narrative of a project (e.g., strong technical capabilities or support from renowned figures), you can choose to continue holding when the price experiences a significant pullback. However, this strategy should be used with caution to avoid significant losses due to a decline in market hype.

8. Consistency and Adaptability

Keep up with market dynamics: Use tools (such as DEX filters), join Telegram groups, or follow Twitter trends to quickly capture information on new project releases.

Adapt to the market rhythm: When there is a large influx of new projects and the market sentiment is active, you can increase your trading frequency; when the market is relatively calm, you should focus more on screening for quality opportunities.

Balance win rate and returns: Even if your win rate is only 40-65%, as long as you can quickly cut losses and let your profitable trades continue to grow, you still have the opportunity to achieve a substantial overall return.

9. Example Charts and Visual Aids

Chart 1: The "Life Cycle" of a Meme Coin

Early Stage (0-15k): Lack of liquidity, with both risks and rewards.

Mid-Stage (50k-100k): Begins to gain attention on Crypto Twitter, and investors gradually cash in their initial gains.

Late Stage (100k-1M+): If there is hype or influence from key figures (such as a tweet from Elon Musk), the price can skyrocket quickly.

Price Peaks: As profit-taking accelerates, the price may drop rapidly.

Chart 2: Dynamics of Surging Trading Volume

Release of Hot News (e.g., news or tweets): Driven by the news, the market trading volume surges quickly.

Price Surge: As trading volume increases, the price rises in tandem.

Profit-Taking Stage: During this stage, whales or early buyers begin to sell their assets, and although the trading volume is still relatively high, it gradually becomes seller-dominated, and price volatility may intensify.

Cooling Period: If the market lacks new news or hype, the trading volume will gradually decrease, and the market heat will also decline.

Conclusion

The "Trench Warfare Strategy" can be built through strong risk management, in-depth research, and strict discipline.

Find new projects and uncover early opportunities (market cap $7-15k): When entering a project in its early stages, focus on its potential and growth space.

Verify project information: Confirm whether the project is genuinely related to artificial intelligence, whether there is an actual development team behind it, and whether it is truly associated with renowned figures like Elon Musk.

Focus on trading volume and market sentiment: Closely monitor changes in trading volume, observe whether there is large-scale capital (whales) involvement, and pay attention to the market's positive feedback and hype.

Develop a clear trading strategy: Plan your exit points, staggered profit-taking levels, and psychological stop-loss lines in advance to cope with market fluctuations.

Persist in executing the plan: In the Meme micro-cap space, new opportunities emerge every hour, so maintaining stability and patience is crucial.

Continuous learning and tracking: Constantly click, refresh, and analyze data to maintain a keen observation of the market, so that you can stay ahead of the curve.

It's important to note that trading in these small-cap areas carries extremely high risks. Always manage your position size reasonably and do not act rashly out of fear of missing out. This market sees new million-dollar-level surge projects every day, so there is no need to rush.

May 2025 (and the future) be good to you!

Seize the opportunities, but please approach them with a strategic and calm mindset. You have the potential to succeed in these highly volatile "trench warfare markets".

Good luck!