Written by: TechFlow

Recently, Messari, a top crypto research institution, released its annual report "The Crypto Theses 2025", expressing a positive attitude towards the prospects of Bitcoin in 2025: BTC will mature as a global asset.

BTCFi has become a clear and popular narrative in 2025.

When talking about the current BTCFi landscape, liquidity staking, which is committed to bringing more capital-efficient native returns to BTC Holders, is an important sector that cannot be ignored.

With the launch of the latest BTC LRT product brBTC and the approaching token TGE, the multi-chain and multi-asset liquid staking protocol Bedrock has further come into the public eye.

It is reported that in the latest round of financing in May this year, Bedrock attracted support from well-known institutions and industry leaders such as OKX Ventures, LongHash Ventures, Comma3 Ventures and Babylon co-founder Fisher Yu.

On this important occasion, we had an in-depth conversation with Zhuling, a core contributor of Bedrock.

Thanks for reading TechFlow TechFlow! Subscribe for free to receive new posts and support my work.

During the conversation, Zhuling, who is very good at taking a global perspective, introduced us to Bedrock’s overall product planning in the BTCFi field:

uniBTC is a groundbreaking BTC LRT asset based on the Babylon narrative in the BTCFi 1.0 era; uniBTC Vaults, which is committed to providing users with a simple and intuitive channel for earning income, is our strategic upgrade to BTCFi 1.0; the newly launched brBTC, as a groundbreaking product in the BTCFi 2.0 era, represents our deep thinking on the future of finance.

When talking about the outlook for 2025, Zhuling made no secret of his optimism about BTCFi:

After witnessing Bitcoin breaking through the $100,000 mark, we believe this is an important signal that the bull market has truly begun, and BTCFi will soon enter a new stage, which we define as BTCFi 2.0.

As for brBTC, Zhuling also introduced in detail its important position in the overall planning of Bedrock BTCFi 2.0:

True income diversification is the core advantage of brBTC. Through intelligent dynamic asset allocation strategies, it can not only bring better returns to users, but also lower the threshold for participation, helping BTCFi achieve large-scale development.

Read the full article to learn more about the conversation.

TechFlow: I am very happy to have the opportunity to have an in-depth exchange with you. First of all, please introduce yourself (you can share some of your past educational background, work/entrepreneurship experience, your encounter with Bedrock, etc.).

Zhuling:

Hello everyone, I am Zhuling, a core contributor of Bedrock. I am very happy to have this opportunity to have in-depth exchanges with you.

As a technical expert with an overseas engineering background, I have been deeply involved in the innovation projects of multiple central banks and financial institutions as a consultant. Based on my strong interest in cutting-edge technologies and innovative business opportunities, I joined an overseas blockchain startup team and continuously participated in the design and development of a hardcore public chain.

My first encounter with staking income originated from the birth of the first generation of PoS public chains. I saw a unique and innovative income model in the blockchain. The staking income model is similar to public debt and is the most native income of the blockchain.

In the past five years, I have been deeply involved in the staking services of mainstream public chains such as Ethereum, and have witnessed the historic transformation of Ethereum from PoW to PoS. I believe that in the current blockchain ecosystem, financial applications dominate, and staking income, a pure on-chain native income, has become the core pillar of DeFi.

Therefore, at the beginning of this year, I joined the Bedrock project as an early contributor. The project is committed to integrating the three most promising asset classes in the blockchain field: Bitcoin (BTC), Ethereum (ETH) and DePIN (IOTEX), and releasing their intrinsic value through an innovative liquidity pledge mechanism.

TechFlow: The liquidity staking track is crowded, but Bedrock is still at the forefront. So can you share with us the outstanding achievements and key data that Bedrock has achieved in the past?

Zhuling:

In general, the current TVL of Bedrock is about 508 million US dollars, and there are more than 114,000 staking users. Specifically, since it is a multi-chain and multi-asset liquid staking protocol, Bedrock’s past achievements can be sorted out from different ecological dimensions.

First, let’s talk about the Ethereum ecosystem. One year ago, Bedrock launched uniETH. As an institutional-level liquidity re-staking token based on EigenLayer, uniETH is the only protocol in ETH that only supports native ETH and implements full-process smart contracts. UniETH supports unstaking from the first day of its launch, and all smart contracts have undergone multiple security audits to help users choose the best verification nodes and obtain the best returns. Currently, uniETH has a stake of over 29,010 ETH and has nearly 10,000 staking users.

Since then, Bedrock has also launched uniIOTX, and in a short period of time it has developed into the largest staking portal on IOTX. Currently, the uniIOTX staked volume is nearly 450 million IOTX, and there are nearly 15,000 staking users.

This summer, the emergence of Babylon made us see the value of BTCFi, and the liquid pledged Bitcoin uniBTC launched in technical cooperation with Babylon is Bedrock’s key layout for the Bitcoin ecosystem.

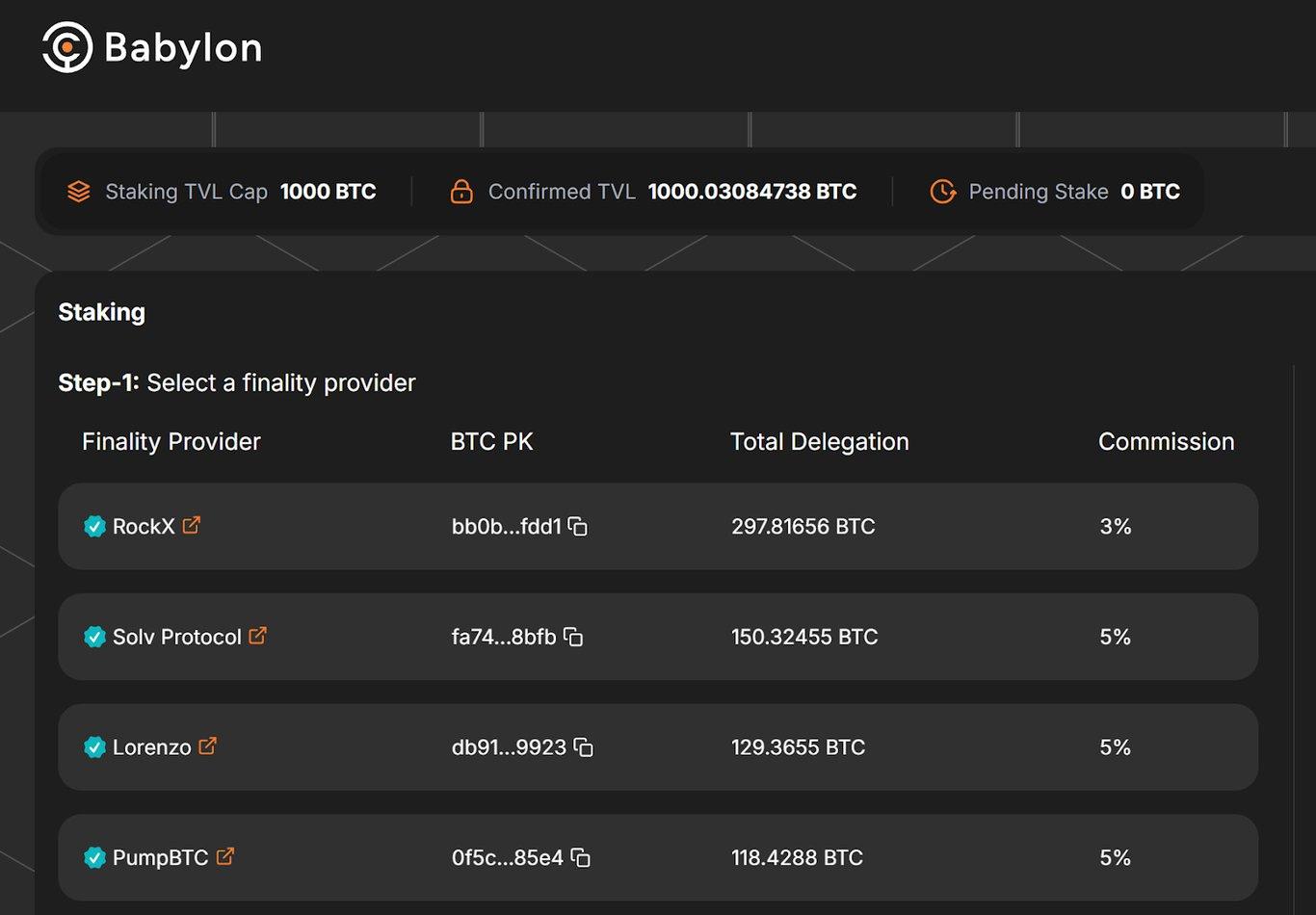

When talking about Bedrock's impressive data in the past, the in-depth cooperation with the Babylon ecosystem is an unavoidable topic. Currently, Babylon staking has gone through three stages. In the Babylon staking Cap-1 stage, Bedrock (ROCKX) appeared in the market as a dark horse in this battle for quotas, staking the most BTC, accounting for nearly 30% of Babylon's initial staking amount.

The success of Cap-1 did not stop us from thinking. Instead, we observed many pain points at the user level, such as the problem of severe compression of the points income of users participating in Babylon staking. Therefore, in the Cap-2 stage of Babylon staking, Bedrcok did a lot of work to ensure that BTC pledgers obtained the highest Babylon points . Of course, it finally achieved very good results. Bedrock pledgers obtained and distributed a total of 5,854 Babylon points in this stage, ranking first among all Bitcoin staking protocols. This strategy based on safeguarding the vital interests of users has also received widespread positive feedback from the community.

In the Cap-3 stage of Babylon staking that just ended, Bedrock still has a strong performance in terms of TVL and Holder data. However, with the development of the Bitcoin ecosystem, we gradually realized that BTCFi should have more possibilities for in-depth development in addition to Babylon, and under a series of market catalysts such as Bitcoin breaking through the $100,000 mark, we feel that BTCFi 2.0 is accelerating, and there is still a lot we can do. Therefore, while participating in Cap-3 staking, Bedrock's work focus is more on the new LRT product brBTC, aiming to bring better income strategies to BTC users.

TechFlow: What unique advantages do you think Bedrock has compared to other competitors in the industry that have led to its success?

Zhuling:

First of all, I believe that the biggest differentiating advantage of Bedrock from other liquidity staking projects lies in its special positioning . As the industry's leading multi-asset restaking protocol, Bedrock is committed to providing users with a full range of staking solutions, aiming to redefine the future of digital asset staking.

Secondly, the impressive data Bedrock has achieved today is inseparable from the resource support brought by our project background , including in-depth cooperation with ROCKX and Babylon.

As we all know, Bedrock was born out of RockX. As a blockchain platform that has been deeply involved in the staking track since 2019, RockX has a total staking value of over US$2 billion and over 150,000 registered users.

As one of the first projects to enter the BTC Restaking track and a pioneer in the Babylon ecosystem, Bedrock has excellent endorsements and resource support. In May this year, Bedrock received investment support from well-known institutions and industry leaders such as OKX Ventures, LongHash Ventures, Comma3 Ventures and Babylon co-founder Fisher Yu, and subsequently reached a technical cooperation with Babylon, developing rapidly in the Babylon ecosystem.

Positioning and resource support are important, and the hard power of the product itself is also very important. The core concept of Bedrock's product design is to put users first, understand user needs to iterate products in more detail, and continuously explore product and technology development. We oppose BTCFi being a 100% big player game, and have been committed to allowing more users to enter BTCFi, promote the large-scale adoption of BTCFi, and provide them with a more convenient entry, diverse usage scenarios, and simplified and optimized income strategies. Take uniBTC as an example. uniBTC is the BTC LRT with the widest and most comprehensive DeFi user scenarios. It not only supports 13 chains and 30+ DeFi scenarios, but also can provide users with up to three-digit APY returns. It is also well received by the community in the market.

The last but also very important point is that Bedrock is committed to building a complete ecosystem through a diversified product portfolio, including uniETH, uniIOTX, uniBTC, uniBTC vaults and brBTC, etc., and continuously building a more open and efficient digital asset staking ecosystem to provide users with better staking services and richer application scenarios.

TechFlow: In 2023, when the Bitcoin ecosystem narrative was just beginning to gain popularity, Bedrock had already started to focus on BTCFi. How did you and your team keenly perceive this trend? What do you personally think of the current situation and future prospects of BTCFi?

Zhuling:

Although the Bitcoin ecosystem narrative has just emerged in 2023, we believe that 2024 is the real first year of BTFCi. In this year, we will truly see many ideas of the Bitcoin ecosystem begin to take shape, such as Ordinal and the rune craze.

By the second half of 2024, the market will see the full blossoming of BTCFi, with sub-narratives such as Restaking/Ledning/BTC L2/BTC Stables emerging. The Babylon ecosystem will lead everyone to achieve success in the first phase of BTCFi. At this stage, I believe that no one will ever say that Bitcoin does not need an ecosystem again.

At the same time, we also believe that after witnessing Bitcoin breaking through the $100,000 mark, we believe this is an important signal that the bull market has truly begun, and BTCFi will soon enter a new stage, which we define as BTCFi 2.0.

After entering 2025, BTCFi will have more surprising performances, and according to our observations, the relevant trends of BTCFi are becoming obvious:

On the one hand, BTC holders can have more sustainable, stable and diverse income strategies;

On the other hand, the entry threshold of BTCFi will be lower, not only will the participation process be more simplified, but users will also have greater flexibility in participating;

The most important thing is that in the future, the competition in the BTCFi track will no longer be dominated by one company alone, but rather everyone will further optimize and develop while cooperating more closely and integrating resources.

This is our judgment on the market, and Bedrock will continue to work hard on these aspects in the future.

TechFlow: Based on the deep cultivation of the staking track and observation of the Bitcoin ecosystem, what is Bedrock's overall vision and product plan for BTCFi?

Zhuling:

In the current market environment, we have observed that users' demands for BTCFi products are undergoing profound changes, from the initial pursuit of simple returns to the current comprehensive consideration of BTCFi products in terms of sustainability, innovation and ecological value. This transformation indicates that the entire industry is moving towards a more mature stage of development.

BTCFi is not only an emerging track, but also an inevitable choice for the evolution of Bitcoin ecology. It will become an important link between traditional Bitcoin holders and the next generation of financial innovation, opening a new era of Bitcoin value release.

Looking ahead to 2025, we firmly believe that BTCFi will usher in a qualitative leap and officially enter the 2.0 era. This will not only redefine the development trajectory of BTC L2, but will also inject revolutionary innovation power into the stablecoin system and pledge economy, and ultimately build a more inclusive and scalable Bitcoin financial ecosystem.

As a pioneer and developer in the BTCFi field, Bedrock has always adhered to the core concept of "connection, innovation, and empowerment" and is committed to building a bridge connecting the native value of Bitcoin and future financial innovation. We must not only accurately grasp user needs, but also stand at the commanding heights of industry development and lead the future direction of BTCFi.

Based on this vision, we have built a comprehensive product matrix:

It can be said that our strategic layout for BTCFi is already very clear, and what we need to do next is to present higher-quality products and continuously optimize products based on community feedback.

TechFlow: According to your introduction, brBTC is the key layout of Bedrock BTCFi 2.0. Can you tell us more about brBTC and its planning? What are its unique advantages? In the overall planning of Bedrock BTCFi, how will brBTC be linked with uniBTC and the broader ecosystem?

Zhuling:

From the perspective of product evolution, uniBTC and uniBTC Vaults, as the core products of our BTCFi 1.0 era, have successfully built the first bridge for users to enter the world of Bitcoin finance. The launch of brBTC marks our official entry into the BTCFi 2.0 era. In the first phase, brBTC will be launched on Ethereum and BNB Chain. In the second phase, more chains will be supported to further expand the coverage and accessibility of brBTC.

True income diversification is the core advantage of brBTC. Through intelligent dynamic asset allocation strategies, it can not only bring better returns to users, but also lower the threshold for participation, helping BTCFi achieve large-scale development.

Specifically, brBTC's revenue structure mainly includes two core sections.

The first is a diversified re-staking income system:

The most distinctive source of income for brBTC is its innovative multi-protocol restaking mechanism. We have reached strategic cooperation with the most powerful restaking protocols in the industry, including Babylon, Kernel, Symbiotic, Mellow, Pell and SatLayer. This not only ensures the diversity and stability of income, but more importantly, lays a solid foundation for the subsequent introduction of more high-quality restaking protocols, allowing brBTC holders to continue to enjoy the income dividends brought by the ecological expansion.

Secondly, brBTC’s diversified income comes from innovative DeFi income strategies:

brBTC has pioneered a flexible combination strategy for on-chain DeFi returns. Continuing the mature return logic of uniTokens, we have created a comprehensive DeFi ecosystem. Users can freely combine various DeFi protocols (such as DEX, lending, etc.) according to their personal risk preferences to achieve personalized customization of returns. This innovative strategy design not only guarantees basic returns, but also provides more possibilities for users who pursue high returns.

Looking ahead, we are actively developing off-chain revenue, including cooperation with traditional financial institutions, developing innovative revenue models, etc. These groundbreaking plans will be announced to the community at an appropriate time to further enrich brBTC's revenue sources.

Of course, from a global perspective, brBTC is not a separate product, but can effectively link with the major sections of the Bedrock BTCFi product matrix to form an ecological effect: brBTC will form a complete product matrix with uniBTC and uniBTC Vaults to meet the investment needs of different users. Users can use uniBTC as a deposit asset for brBTC, and the intelligent linkage between the three products will create the most comprehensive Bitcoin financial application scenario for users. This innovative ecological linkage mechanism not only improves the liquidity of the entire Bitcoin decentralized ecosystem, but also provides a solid guarantee for ecological security.

TechFlow: From the user's perspective, fund security is the most important thing. How does Bedrock ensure fund security and protect user rights?

Zhuling:

Bedrock has multiple measures to effectively protect the security of user assets and provide users with a trustworthy blockchain ecosystem. In today's complex blockchain environment, security is always one of the core elements we value most, so we have built a comprehensive security system from multiple levels to strive to provide the greatest protection for user assets.

First of all, the contract audit report is one of the basic measures to ensure security. Bedrock has established cooperation with many well-known auditing companies in the industry, and has passed comprehensive audits by authoritative security auditing agencies in the industry, including Peckshield and Blocksec, striving to escort the security of funds from the lowest level of the code.

Secondly, Bedrock has successfully integrated Chainlink to further ensure the security and reliability of data and enhance the platform's risk resistance. In addition, we have also taken a series of strict security measures, including a 24/7 real-time monitoring mechanism to respond to potential threats at any time, a bug bounty program to encourage global security experts to discover and fix potential security risks, and we have also set up a special security fund to quickly respond to and resolve sudden security issues.

Through these multi-level security measures, Bedrock not only provides users with a feature-rich blockchain platform, but also builds a solid line of defense for the security of users' assets. In the future, we will continue to invest resources and continuously optimize security strategies to ensure that users can safely participate in the innovation and development of the blockchain ecosystem on the Bedrock platform.

TechFlow: The community is currently discussing Bedrock TGE very actively. Can you share more details with us?

Zhuling:

First of all, I would like to thank the community for their continued attention to Bedrock TGE. Currently, the community is very enthusiastic about our Diamonds and TGE.

Although more information about TGE has not been released yet, we can be sure that the Diamonds currently accumulated by users will be converted into future BR tokens according to a specific mechanism. Bedrock takes community-based operations as its basic rule, and we will never ignore the efforts of early contributors.

Bedrock's TGE design will fully reflect the long-term value of the project. Our goal is to establish a sustainable token economic model. In the future, BR token will not only be a value carrier, but also an important governance tool in the ecosystem. Token holders will have the opportunity to participate in important decisions of the project and jointly promote the healthy development of the ecosystem.

The specific conversion ratio and details will be announced to the community at an appropriate time, so please stay tuned.

TechFlow: For current users, how can they participate in Bedrock more effectively?

Zhuling:

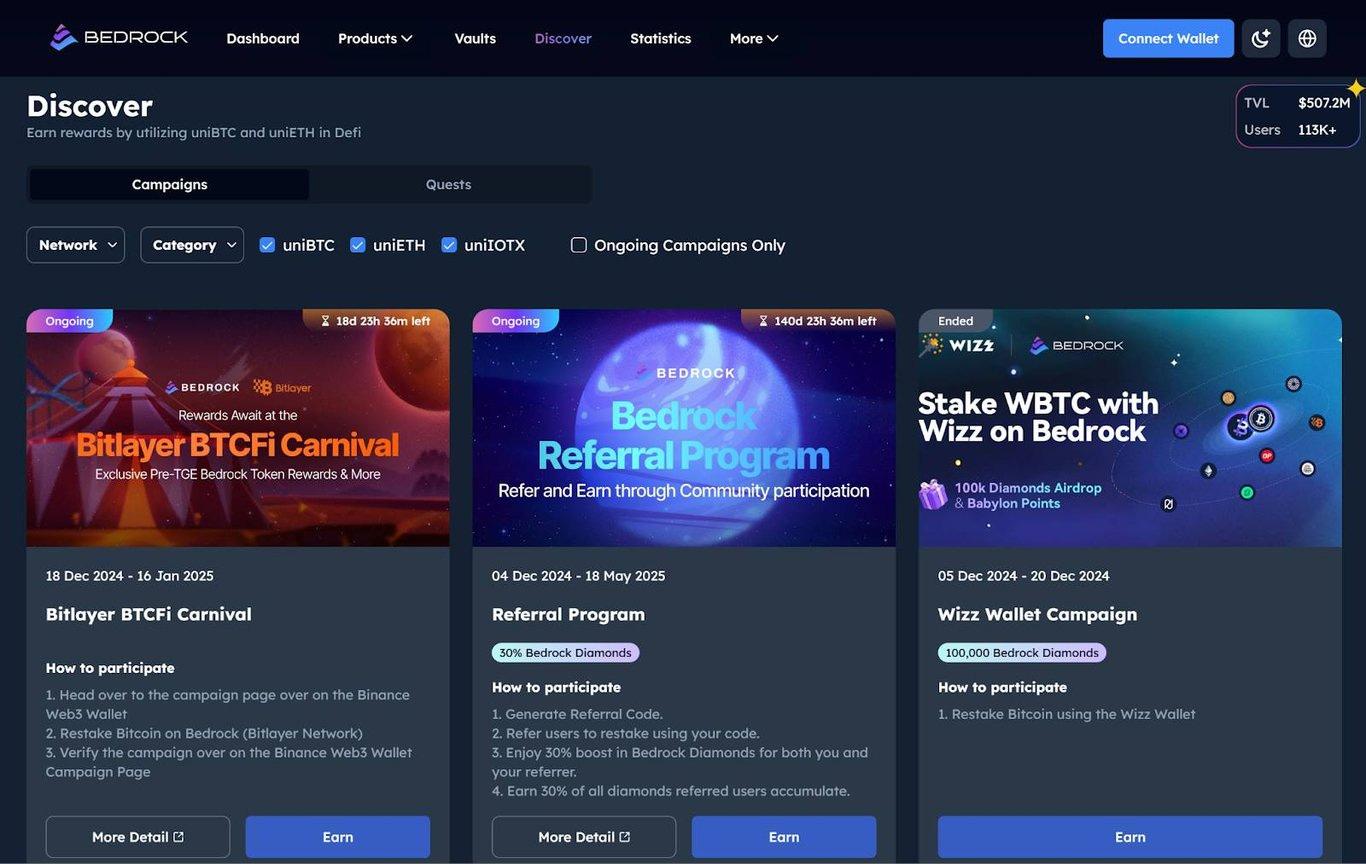

As the TGE promised just now: Diamonds accumulated by users currently will be converted into BR tokens according to a specific mechanism in the future. Therefore, now is the golden period for users to interact with Bedrock and accumulate Diamonds by participating in unitoken activities.

Since our product planning is very clear, the way to participate in our ecosystem is also very clear to users:

First of all, users who participate in staking and minting uniBTC can get multiple Diamonds rewards. Bedrock supports assets from Ethereum (wBTC/FBTC/cbBTC), Optimism (wBTC), Merlin (BTC/MBTC), Bitlayer (BTC/wBTC), B² Network (BTC/wBTC) and other ecosystems to mint uniBTC. In the future, as the pace of ecological cooperation accelerates, Bedrock will continue to support a wider range of assets. At the same time, users can enter the Discover page of Bedrock's official website to participate in multiple ecological income activities to get Diamonds bonus. Participating in the minting of uniBTC will receive multiple rewards including Bedrock Diamonds rewards, Babylon staking income, Babylon points, and DeFi ecological participation income.

Secondly, participating in uniBTC Vaults is also an efficient choice to accumulate Diamonds chips and optimize returns: Bedrock has reached cooperation with DeFi protocols CIAN and Veda to jointly launch two Vault products: uniBTC Corn Vault and Cian uniBTC Yield Layer. Users only need to deposit assets such as uniBTC, FBTC, cbBTC or WBTC to participate in the yield optimization strategy with one click, and at the same time receive points rewards from multiple platforms such as CORN, BABYLON, CIAN, VEDA, FBTC, etc.

Of course, brBTC is a core product recently launched focusing on BTCFi 2.0. Participating in the minting of brBTC will also receive considerable Diamonds rewards. In order to further integrate BTC liquidity between different DeFi platforms, brBTC currently accepts WBTC, FBTC, mBTC, cbBTC, BTCB and uniBTC as collateral. In the future, more assets will be introduced as the ecosystem expands. Everyone is welcome to participate and experience it.

TechFlow: Last question, as the market becomes active again, more people are looking forward to the innovation of staking and re-staking. What do you think will be the next trend of liquidity staking? In the face of the trend, can you share with us Bedrock's work focus in 2025?

Zhuling:

We believe that 2025 will be a year of vigorous development for the cryptocurrency industry, and innovation in liquidity staking will usher in a new round of breakthrough developments.

Judging from the trend, the next stage of liquidity pledge may present the following characteristics:

In the face of these trends, Bedrock's work focus in 2025 will revolve around the following points.

First, Bedrock will continue to deepen the core staking product ecosystem:

In 2024, through our two core products, uniETH and uniBTC, we will help users earn returns in leading re-staking protocols such as Eigenlayer and Babylon while maintaining asset liquidity. On this basis, in 2025 we will continue to improve the uniTokens series and provide users with more high-quality staking and liquidity management solutions.

Secondly, Bedrock will focus on BTCFi 2.0 in the future and strive to lead this narrative trend.

brBTC will serve as the core tool of the BTCFi 2.0 narrative, bringing safe, efficient and lasting benefits to users. We will be committed to expanding the ecological application scenarios of brBTC, promoting the value release of Bitcoin in the fields of DeFi and re-staking, and ensuring that brBTC holders can interact freely on multiple chains and protocols.

Most importantly, Bedrock will continue to explore new revenue scenarios.

In addition to on-chain revenue, we will also explore the possibility of off-chain revenue and further expand users’ revenue space by combining with traditional finance, institutional investors and other innovative revenue models.

Finally, Bedrock will drive the industry's continued progress toward standardization and security.

In the face of the rapid development trend of the industry, Bedrock will continue to make efforts in protocol security, revenue transparency and user education to set new standards for the industry while promoting the healthy development of the liquidity staking track.

In summary, Bedrock will continue to maintain its leading position in industry innovation in 2025, creating more value for users and helping the liquidity staking track reach new heights through the optimization of core products, the expansion of the multi-chain ecosystem, and the narrative construction of BTCFi 2.0.

TechFlow is a community-driven in- TechFlow content platform dedicated to providing valuable information and thoughtful thinking.

Community:

TechFlow account: TechFlow

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join the WeChat group and add assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A