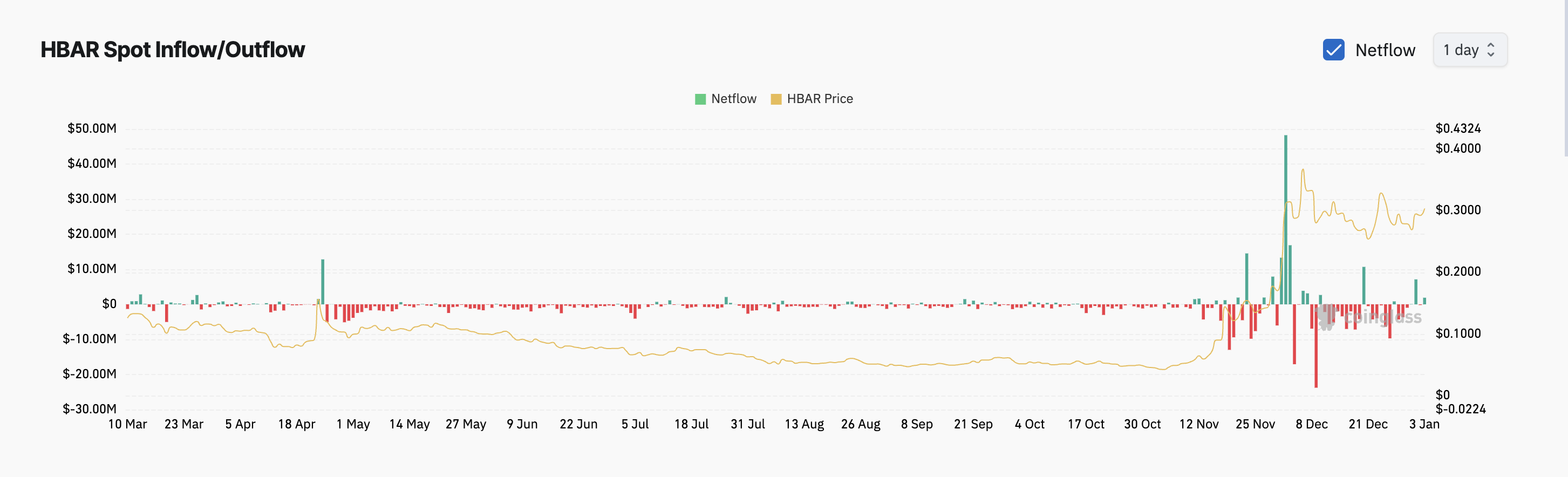

The native token of the Hedera Hashgraph, HBAR, has seen a price increase of about 10% in the last 24 hours. This rally was triggered by a significant increase in inflows to the spot market during that period.

Strong buying pressure has put the HBAR token in a position to expand its gains in the short term. The reasons are as follows.

HBAR, Increased Spot Inflows

According to data from the cryptocurrency derivatives data platform Coinglass, an on-chain analytics platform, $2 million flowed into the HBAR spot market on Friday. This suggests that confidence in the future price performance of the altcoin is increasing.

When investors increase their spot inflows into an asset, they are directly investing at the current market price in the spot market. This indicates that more participants are directly purchasing the asset, reflecting increased investor confidence. Such inflows can often increase demand and put upward pressure on the asset's price.

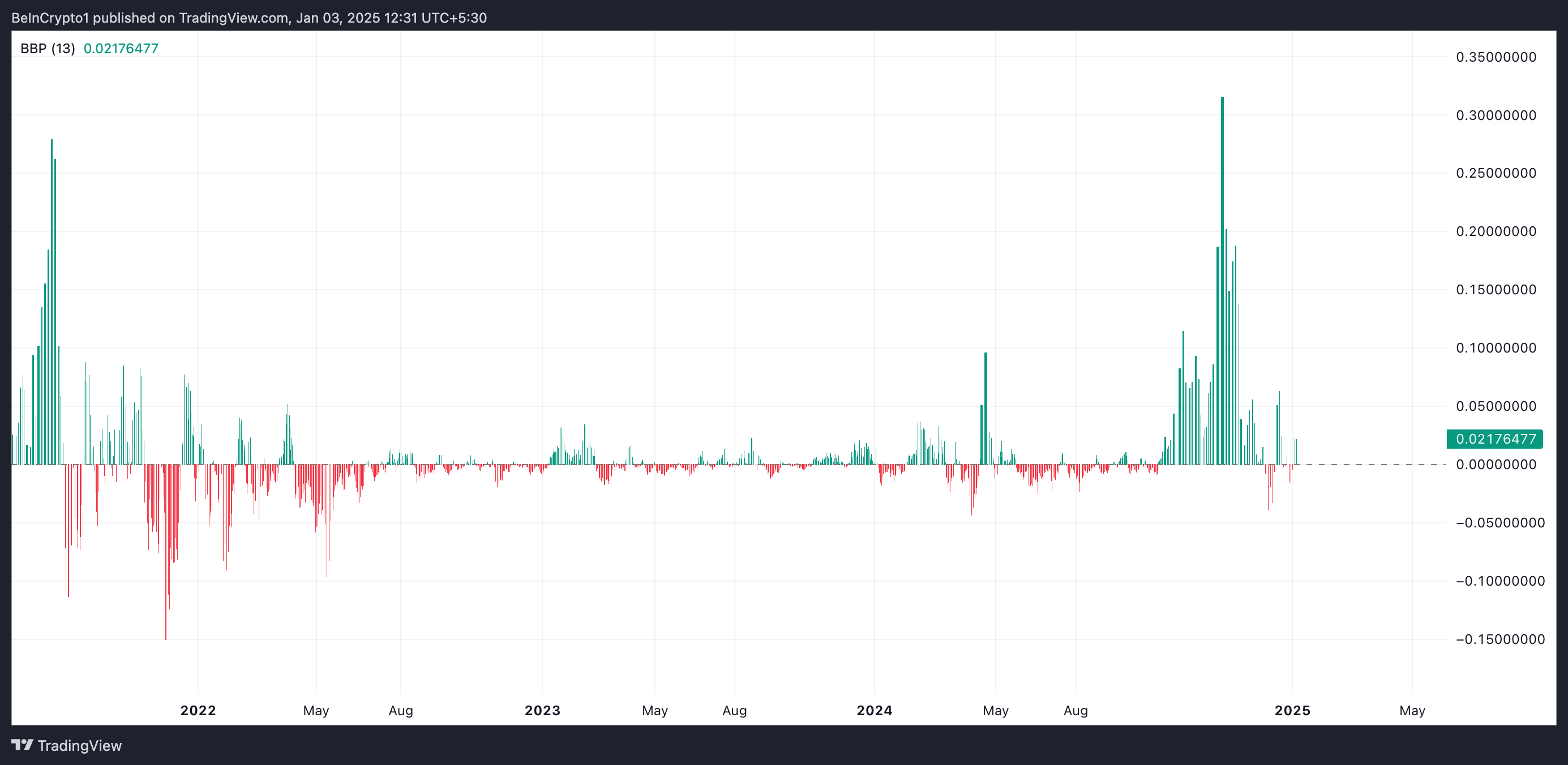

Furthermore, positive technical indicators for HBAR further support this increase in demand. For example, the value of the Elder-Ray Index indicates that the bullish forces are strengthening. Currently, this value is 0.021.

The Elder-Ray Index measures the strength of the buyers (bullish) and sellers (bearish) of an asset. For HBAR, a positive value indicates that the bullish side is dominant, suggesting price upside momentum and potential buying opportunities.

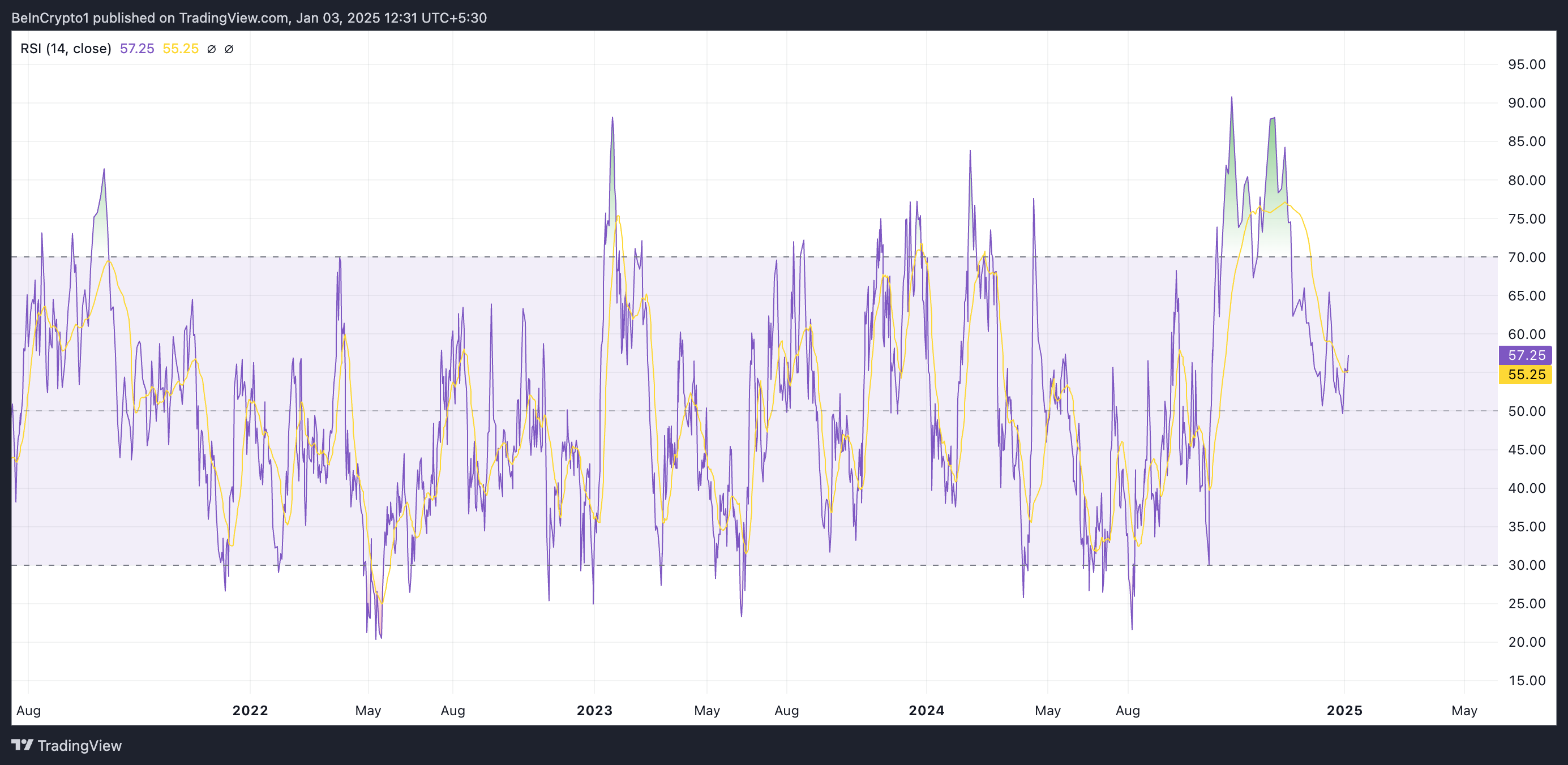

Specifically, HBAR's rising Relative Strength Index (RSI) confirms that traders are capitalizing on this buying opportunity. Currently, this indicator is at 57.25 and in an uptrend, indicating that demand for the altcoin is steadily increasing.

RSI measures the overbought and oversold market conditions of an asset. It ranges from 0 to 100, with values above 70 indicating the asset is in an overbought state and a price decline is expected. Conversely, values below 30 suggest the asset is in an oversold state and may be due for a rebound.

HBAR's RSI of 57.25 indicates a mid-strength bullish trend, suggesting the altcoin is gaining strength but is not yet in an overbought state. This implies there is room for further price appreciation.

HBAR Price Prediction: 100% Upside Left to All-Time High

HBAR is currently trading at $0.29. If the buying pressure strengthens, the token's price could revisit the $0.38 multi-year high last reached on December 3rd. Successfully breaking above this key resistance could open the door for HBAR to recover its all-time high of $0.58.

However, if attempts to break above the $0.38 resistance level fail, it could lead to a downtrend. In that case, HBAR's price could plummet to $0.20.